Thailand, Vietnam Dominate Southeast Asian Crop Protection Market

Southeast Asia is a sub-region of Asia; consisting of the regions that are south of China, east of India and north-west of Australia. The region is the only part of Asia that lies partly within the Southern Hemisphere with the equator running through a large part of Indonesia. To the North East lies the Pacific Ocean and to the South West the Indian Ocean.

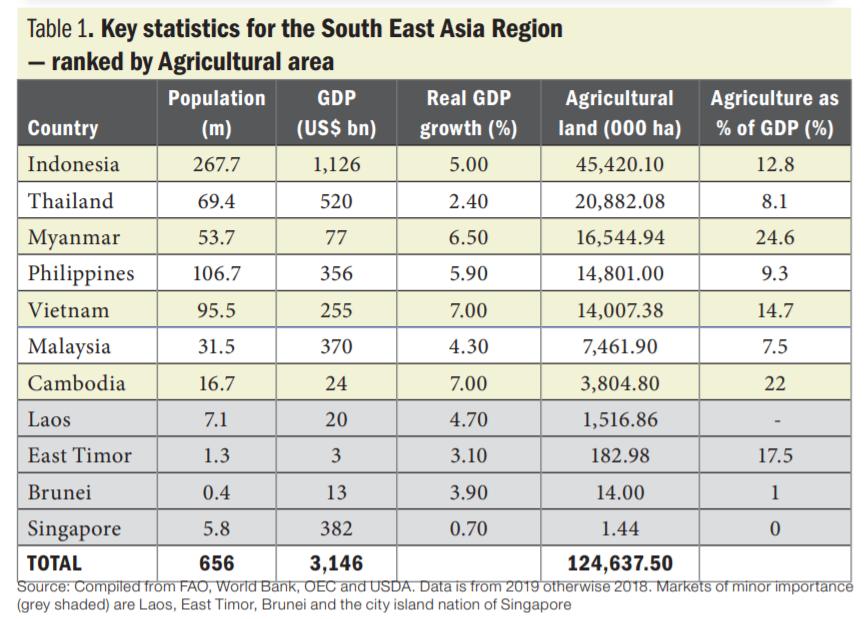

Southeast Asia is composed of 11 countries Brunei, Cambodia, Timor-Leste, Indonesia, Laos, Malaysia, Myanmar the Philippines, Singapore, Thailand, and Vietnam. As indicated in Table 1 from the point of view of agriculture then really only seven of the 11 countries are of significance. Those seven are also quite different in terms of the types of agriculture practiced. In Malaysia, for example, the plantation crops of oil palm and rubber dominate; Indonesia is a much more diverse with corn and rice important as well as the plantation crops. Rice tends to dominate in other markets, especially Cambodia, Philippines, Vietnam, and Thailand. Myanmar is different again in that although rice dominates, the fruit and vegetable crops are especially important and in particular the legume crops of beans and peas as well as various nuts.

The size of the overall economy of Indonesia and the importance of agriculture in that economy, however, makes it the largest agricultural economy in the region by a significant margin (Table 1). At the same time while agricultural is important in Indonesia, heavy industries dominate the export market with coal and various forms of petroleum being of highest value. Palm-oil and rubber do feature as leading exports but of significantly lower importance as compared to the energy based commodities.

Likewise Thailand, Philippines, Vietnam, and Malaysia also have exports which are dominated by textiles and “technology” rather than by agricultural products. Myanmar is the only country in the region which has a significant proportion of its GDP from agriculture and also that has key raw agricultural commodities (in this case raw sugar) as its most significant exports.

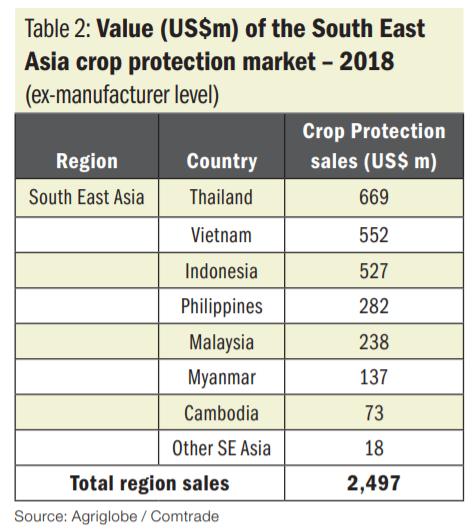

That dominance in crop area and economy in the case of Indonesia (as in Table 1) does, not, however, equate to the largest market for crop protection; it in fact being less than that of either Thailand or Vietnam.

Comparison of agricultural land area as in Table 1 and the value of the market for Crop Protection sales in Table 2 indicates that the relative intensity (or average spend per hectare overall) of Thailand, Vietnam, and Malaysia is high as compared to the region as a whole. Conversely, Indonesia and Myanmar are the least developed markets in terms of average spend. Crop type variation between the countries will explain a lot of the variation in spend, in that plantation crops are generally very extensive, however, it is also clear that Myanmar in particular is a market that to-date is relatively undeveloped Southeast Asia – overtime a significant growth market for crop protection products, continuing into 2019.

Comparison of agricultural land area as in Table 1 and the value of the market for Crop Protection sales in Table 2 indicates that the relative intensity (or average spend per hectare overall) of Thailand, Vietnam, and Malaysia is high as compared to the region as a whole. Conversely, Indonesia and Myanmar are the least developed markets in terms of average spend. Crop type variation between the countries will explain a lot of the variation in spend, in that plantation crops are generally very extensive, however, it is also clear that Myanmar in particular is a market that to-date is relatively undeveloped Southeast Asia – overtime a significant growth market for crop protection products, continuing into 2019.

As published in July 2019 the global crop protection market in 2018 increased at a rate of 2% in nominal terms over that of 2017. As a comparative figure the Southeast Asian Market saw a significant increase of some 8% in 2018 as compared to 2017. The region has also considerably outperformed the global market with a CAGR of 7% per annum over the time period 2008 to 2018 as compared to a more modest CAGR of 2.3% per annum for the global market. Detailed data on 2019 was not available at the time of writing; but all indications as of early June 2020 are that the increase seen in 2018 will have continued into 2019.

The region overall has with very few exceptions, seen a year-on-year increase in overall value over the last 10 years. Overall there has also been little change in the relative importance of the individual countries within the region; with the exception of Indonesia growing and the Philippines declining in importance.

The region overall has with very few exceptions, seen a year-on-year increase in overall value over the last 10 years. Overall there has also been little change in the relative importance of the individual countries within the region; with the exception of Indonesia growing and the Philippines declining in importance.

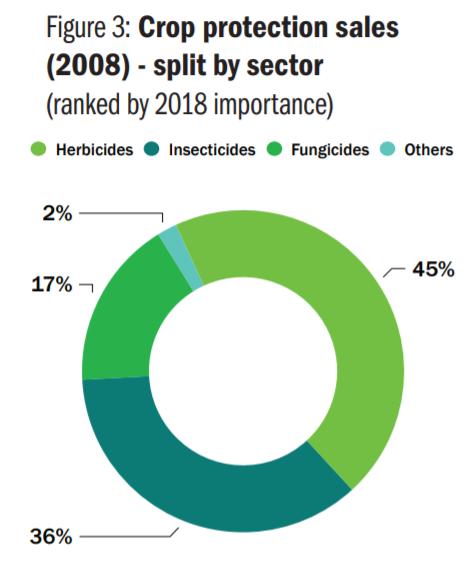

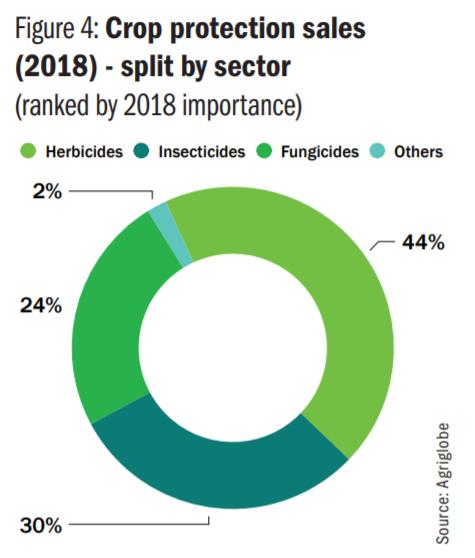

This relative stability in the country markets has also fed through to a relative stability in the different sectors. Herbicides remains the dominant sector with only a slight increase in fungicides at some expense to the insecticide market (Figures 3 & 4). Given the increasing importance of insect pests in the region as a whole this is a trend likely to have been reversed in 2019 and in to 2020.

This relative stability in the country markets has also fed through to a relative stability in the different sectors. Herbicides remains the dominant sector with only a slight increase in fungicides at some expense to the insecticide market (Figures 3 & 4). Given the increasing importance of insect pests in the region as a whole this is a trend likely to have been reversed in 2019 and in to 2020.

As with sectors the relative split between the different crop groups has remained relatively stable over the time frame covered here although there has been a shift towards rice; when comparing 2008 with 2018. Maize has also remained a constant at 5%. Such a chart, however hides much detail and in general rice as a percentage of the total value peaked in around 2013/14 and has slowly been in decline since then. This is in-line with the various government-backed rice reductions programs operated in several Southeast Asian markets. Another detail that is hidden is a decline in soybean area over that time; another trend that might see a reversal over the coming years as soybean markets globally open up to different pressures.

Outlook for 2020

At the time of writing the outlook for the global market for crop protection products is heavily influenced by the progression of COVID-19. At the end of 2019 the Kleffmann Agriglobe forecast for 2020 was for a global growth of just over 2.5% in 2020 as compared to 2019. That rate has since been cut by a clear percentage point over concerns of COVID-19 on the global economy as well as the direct impact on the agricultural sector and in-turn crop protection use.

Various economic stimuli packages introduced around the world (for instance the CARES package in the U.S.) have done much to reduce the overall negative impact that the pandemic and subsequent “global” shutdown would have caused to agriculture and in turn the crop protection industry. Despite this, however, one area that is likely to see a significant decline in crop protection usage globally will be the fruit and vegetable sector; as the availability of labor required for the crop will likely be restricted out to Q2 and possible Q3 in many regions. This dynamic is unlikely to significantly impact crop protection usage in Southeast Asia, however, the severe drop in global palm oil demand both as biodiesel feedstock and as edible oils will have been a serious impact in the first half of 2020.

With a recovery in crude oil prices and indications that competing soy-oil prices are becoming “bullish” there is some indications that that impact might be in-part recovered in the 2nd half of 2020. The global supply and demand dynamics of rubber have also been severely impacted by COVID-19 during the first half of 2020 although again there are indications that this situation will reverse in Q3 and Q4 as demand increases for among other requirements that of PPE.