Spain, Italy: Tracking the EU Powers in Crop Protection

Three months into 2018, many of results of the Kleffmann end-user panels for 2017 are finalized. They confirm our view from December that the global crop protection market did indeed turn a corner in 2017.

Although not earth shattering, this represents an increase of close to 1.8% from the relatively low base of $53.12 billion in 2016. On that basis the global crop protection market in 2017, when measured at ex-company level, and using average-year exchange rates, will come in at close to $54.08 billion.

While we cannot yet put out the bunting, this does bring to an end, quite abruptly, the period of decline seen in 2015 and 2016. Of course, the devil is always in the details. We still need to align the global market as measured in terms of overall usage from the panels with the global market in terms of sales ex-company. Generally the two match quite closely, although account must always be made for inter-company selling among other factors.

In that respect 2017 was not a “normal year.” While the overall crop protection market increased, the two largest companies in the industry (Syngenta and Bayer) posted declines in sales.

In the case of Bayer this apparent contradiction was due to the situation in Brazil, where overstocking of the distribution chain forced the company to make provisions in the second quarter of 2017 to normalize the situation. Aside from that Brazil situation, the reverse was true. Bayer saw sales of its crop science division increase by an amount greater than the 1.8% pegged here. The bottom line is that the market performed better than did the companies in 2017 — a detail that can only be seen with access to original market research data.

Europe did not see the same inventory and buy-back problems that were experienced in Brazil, although high levels of channel inventories were a notable problem in Spain and Italy in 2017. The cause of this was quite different as compared to Brazil and was largely the result of what proved to be lower than anticipated demand. Overall the southern European market was severely impacted by a dry summer season that reduced the demand for fungicides and insecticides in particular. The summer drought in Spain continued into the fourth quarter and resulted in late plantings of winter cereals, therefore reducing the autumn cereals’ herbicide campaign. Italy also suffered from extreme drought despite beneficial rains at the end of September. According to the Italian Institute of Atmospheric Sciences and Climate, between December 2016 and November 2017 Italy saw its lowest total rainfall since the year 1800. Italy also saw unusually late frosts in the spring of 2017, which delayed the season even before the drought had set in.

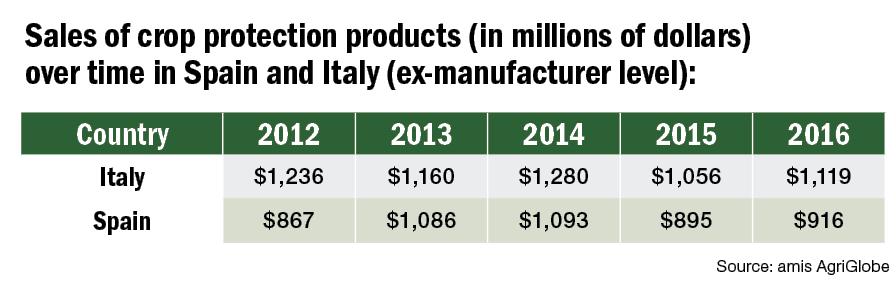

While the final market sizes for 2017 were not available at the time of this writing, the indications are that, despite other positive drivers (the GDP growth of Spain, for instance, outstripped that of any other major EU country, including Germany), the negative impact of the drought in 2017 will reverse the trend of the previous year. In 2016, for instance, both the Spanish and Italian markets outperformed the global market by registering growth of some 2% and 6%, respectively, in a global market that otherwise declined by 2.6%.

In terms of pesticide registration and the process of “mutual recognition,” Spain and Italy are both part of the European Southern Zone, which includes six other member states: Bulgaria, Greece, France, Cyprus, Malta, and Portugal. Within this zone, in terms of total market size, France clearly dominates (being the largest EU market overall), but Italy and Spain are ranked by some margin a close second and third.

Historically — for example, in the removal of many of the organophosphate insecticides from the market — EU regulations have tended to impact the Southern Zone markets, in particular Spain and Italy, to a greater extent than the Northern or Central Zone markets. This will also be the case for glyphosate when the five-year license currently in place runs out.

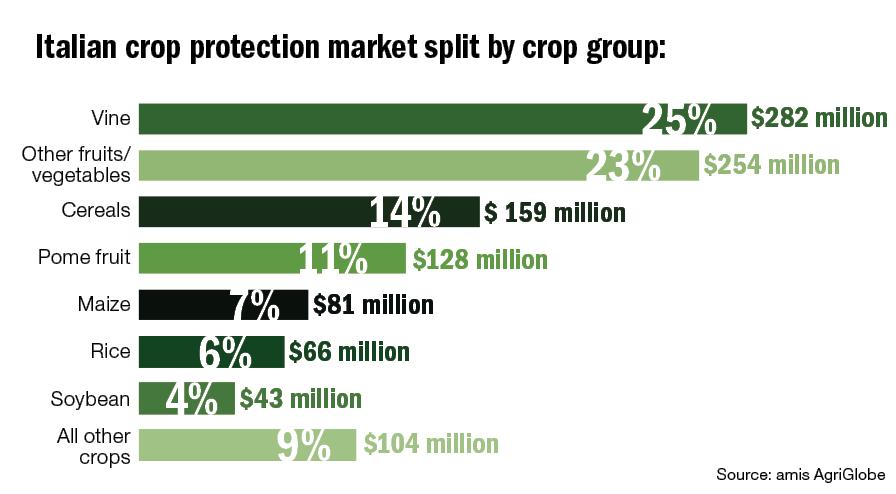

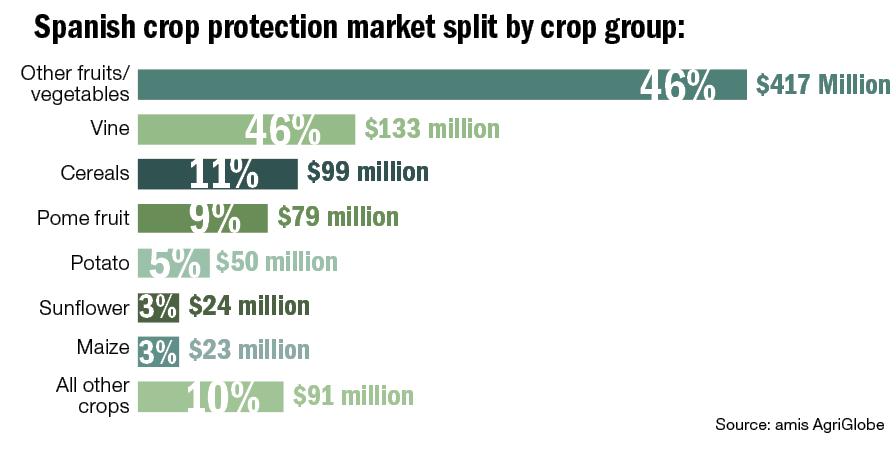

Mostly affected by this will be Spain, which relies heavily on the use of glyphosate for the development of conservation agriculture. Conservation agriculture is an important farming technique aimed at reducing the impact of soil erosion, which remains a significant problem in the country. In addition to glyphosate, any further measures that are taken by the EU Commission (anticipated in May) on the use of the neonicotinoids (clothianidin, imidacloprid, and thiamethoxam) will have the most significant impact throughout the EU in Spain, followed by Italy. The fact that the use of the neonicotinoids is important in these Southern Zone markets reflects the high share of specialty crops in these markets as compared to Northern Zone markets, which are dominated by cereals.

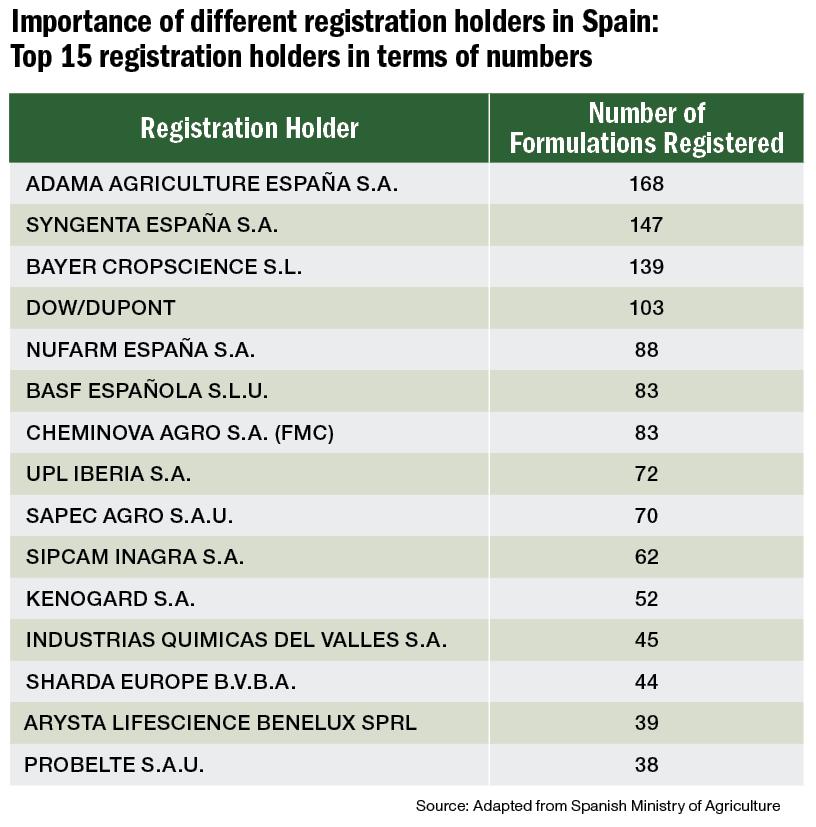

Despite the challenges of the Spanish and Italian markets, both offer good opportunities for the generic industry as well as continued growth for the proprietary sector of the market in the long term. In Spain, for example, more than 2,100 formulations are currently registered. These are held by close to 100 different companies, many of which have only one or two formulations on

the market.

Although the number of registrations does not reflect a company’s market share, the above table is a good indication of the relative importance of the generic companies in the market — now and in the future. The expiration of existing registrations will also create new value-added opportunities in a market that can generally be considered less sophisticated than many others within the EU.

Editor’s note: Analysis provided by Kleffmann Group is based on data collected from farmer surveys, interviews with distributors in emerging markets, proprietary market trend studies, subject matter experts, and open-source information. The farmer surveys continue to provide the bulk of the data for the analysis, although the group’s program of “trend studies” is becoming more significant. Dr. Bob Fairclough is the team leader for amis AgriGlobe, Kleffmann Group’s agricultural input market trend information and consulting unit. He is an editorial advisor to AgriBusiness Global™. For more information, visit kleffmann.com.