Global Crop Protection: 5 Key Factors Influencing the Market So Far in 2019

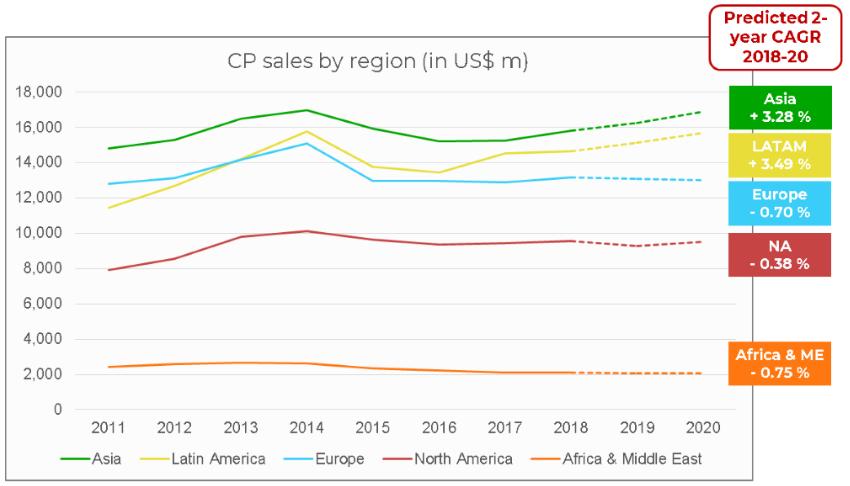

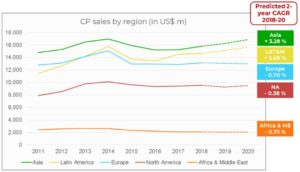

One key observation in review of the 2018 global crop protection market is that it remained positive despite challenging times. Initial estimates for the 2018 markets (posted December 2018) had been for a much flatter market. One of the key surprises as the data was processed throughout the year was the strength of the Eastern European markets, which offset the decline in the Western European markets.

That changed the global picture over the year from a flat market to one of modest overall growth. One other significant change factor, aside from the real growth of the Eastern European markets, was currency movements. When you consider that the Euro gained close to 5% in value against the U.S. dollar in 2018 as compared to 2017, then even a flat EU market would have shown positive U.S. dollar results.

Now in October 2019 the questions become: What will be the final result from the 2019 campaign? Will we be able to say once again that the market remained positive despite challenging times? Or will the phrase be somewhat less optimistic?

At this point, aside from results from the 2019 Kleffmann Harvest Year Panels, there are few fixed data points on which to draw a comprehensive overview of 2019 (see charts in slideshow above). As such, we need to review from a top-down perspective (rather than a bottom-up perspective) some of the key market influences so far in 2019 and look at their probable impact on the final year-end 2019 campaign:

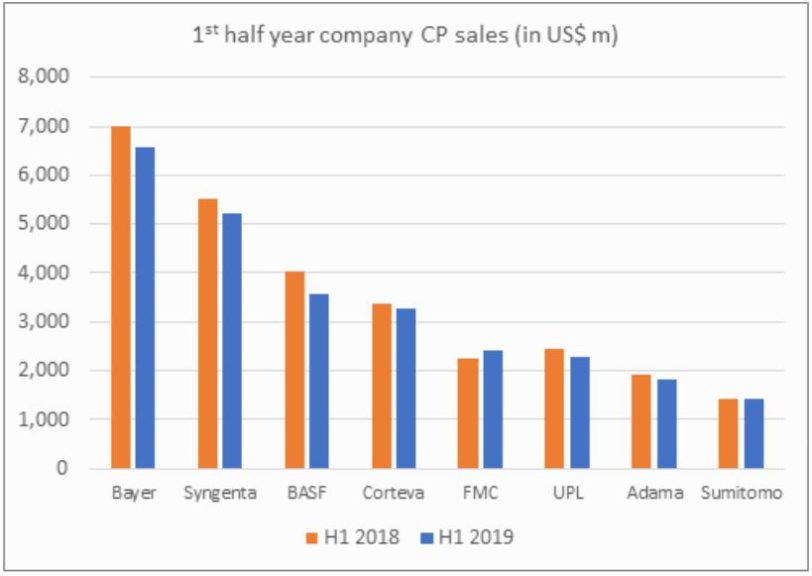

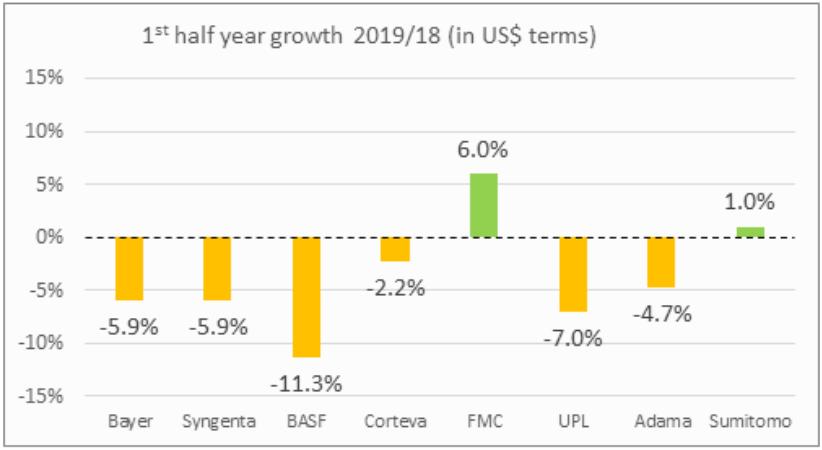

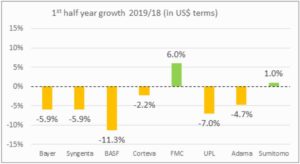

- Company sales performance: Half-year sales performance of the leading companies is an indication of how the year so far has developed. Despite being down in 2018, quarterly sales are notoriously fickle, and a poor first half-year does not necessarily mean that the full-year results will be poor. The year 2018 was a good example of this in that the fourth quarter was a barn breaker that turned around the year-end results for many companies.

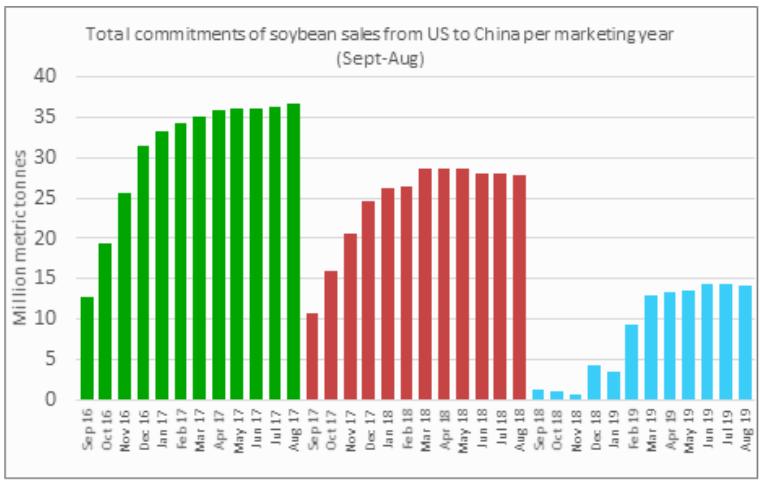

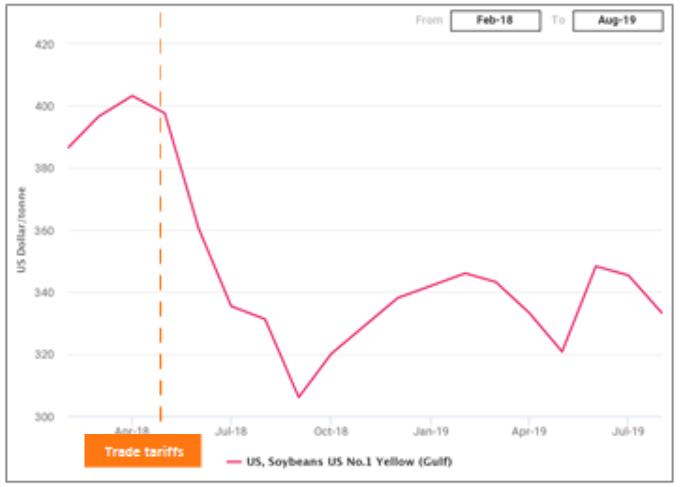

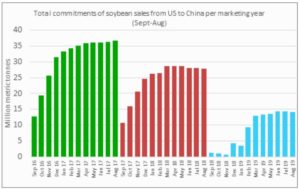

- Trade wars: Undoubtedly this has been a key driver in 2019 as growers in the U.S. modified practices to take into account the ongoing trade wars and in particular how they have impacted the purchase of U.S. soybeans by China. Predictably, growers in Brazil and Argentina are expected to plant more soybeans in the current crop year 2019-20 to take advantage of any U.S. export difficulties. The trade wars are far from over, but indications are that China is once again buying soybeans from the U.S., with the run-up to the U.S. 2020 election likely to be a very important pivotal point.

- FX rates: A significant impact on the 2018 U.S. dollar result was currency movement, in that the Brazilian Real lost against the U.S. dollar whereas the Euro appreciated some 5% against the U.S. dollar. The situation in 2019 (so far) seems more uniform in that most currencies show a depreciation against what is a strengthening U.S. dollar, with the Euro and Brazilian Real, for instance, both down on average by some 6% in the first nine months of 2019 as compared to 2018. However, a lot can change in the next three months as the dollar wobbles amid political impeachment discussions and a cooling U.S. economy.

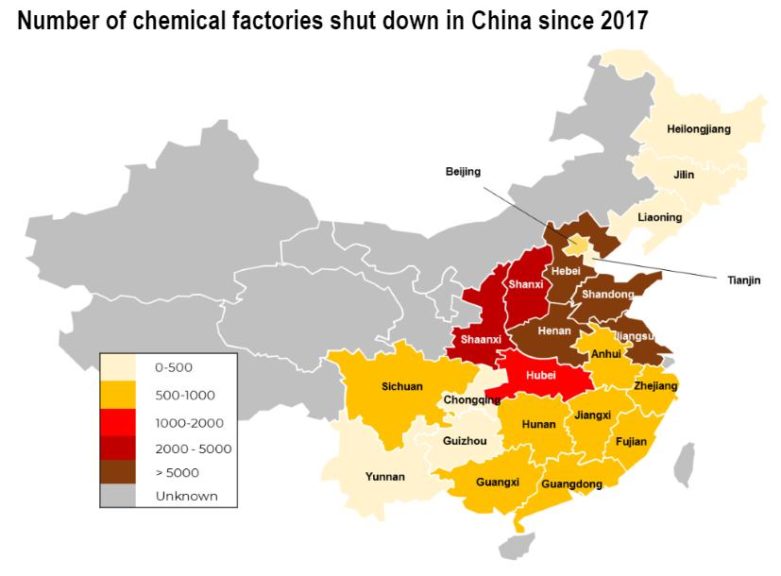

- Supply chain issues: A significant driver now for this year and 2020 and beyond is supply chain issues felt throughout the industry as China significantly reduces the number of chemical factories under the Blue Sky Programme. India is clearly making up some of the deficit, but the shortage of supply for some active ingredients — already felt in 2018 — became a significant influencer in 2019.

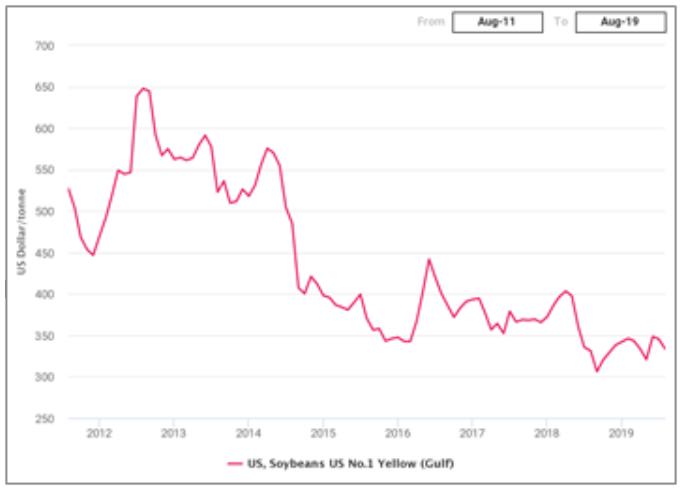

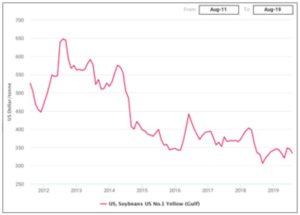

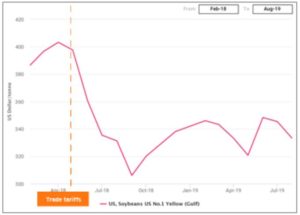

- Commodity prices: This is one of the key drivers influencing what growers spend on crop protection products. Commodity prices had been tracking downward for a number of years. At the point of the tariffs being brought in (May 2018), commodity prices fell across the board, proving to be a negative factor throughout most of 2018 and 2019 so far.

Aside from these top five influences on the market, we can include several additional key drivers on the list for the 2019 season. Pest and disease development (Asian swine flu impacting on the demand for commodities) and the spread of fall armyworm in Asia have influenced pesticide use. Disruptive technologies continued to erode the traditional markets with, for instance, evolving distribution chains in the U.S. and commercial drone use in parts of Asia. Regulatory issues, always a big driver in the EU market, are now seen increasingly as an issue on older chemistries in Asia with, for instance, Thailand taking action on paraquat, chlorpyrifos, and glyphosate, and Vietnam banning glyphosate, all in 2019. These bans, in turn, lead to opportunities for alternative chemistries, although they are often the more expensive ones. However, the initial impact of any bans or restrictions tends to be negative.

Government policy in 2019 has also had a direct impact on the crop protection markets globally. The U.S. July 2019 aid package to compensate farmers for the trade war went some way to pay them back for lower prices. Other policies around the world (for example, in Russia, India, and Mexico) tended to increase support for agriculture and, in turn, generally led to positive impact on pesticide spend. The strengthening of the EcoPhyto plan in France is, however, one very strong exception to this rule. A final key driver of 2019 was a series of extreme weather events, most notably in the U.S. According to the USDA September report, the U.S. spring floods of 2019, in effect, reduced soybean-planted area by some 14% to 76.7 million acres; and although corn remained stable at 90 million acres planted, the proportion of that crop reaching harvest will be just 82 million acres, per USDA.

So, back to the question of will the 2019 market remain positive despite challenging times? Unfortunately it remains too soon to be sure. We entered the first quarter 2019 on a positive note, only to have that washed away by the U.S. spring floods and, to a lesser extent, the July floods in India. Most other factors, including policy, were largely already accounted for. Now, in the final quarter of 2019, eyes are on the Southern Hemisphere, in particular Brazil, which is in the midst of slowly planting a delayed soybean crop and first corn crop in what remains very dry conditions. In Argentina, while the view was for 5% more corn at planting, the uncertainty over the October presidential elections among other factors is now pushing Argentine farmers to plant more soybeans rather than corn. With two months of 2019 still to go, there is all to play for in this market.

The bottom line is that, as of November 2019, there is still some opportunity for what is now a much-reduced positive outcome to 2019.