Keys to Agrochemical Sourcing in China in 2020 and Beyond

Editor’s note: David Li is Business Manager with Beijing-based SPM Biosciences Inc. He is an editorial advisor and regular columnist for AgriBusiness Global and an innovator in UAV application technologies and specialized formulations. He sat down with AgriBusiness Global in mid-July to share insight on the status and outlook for China’s agchem industry, as well as sourcing considerations.

What is the status of China’s agrochemical industry in July 2020?

China’s agrochemical supply is stable. As I mentioned in a previous article, the entire Chinese agrochemical industry is moving from east to north and west. So we can see there will be hundreds of thousands of Mt capacity coming in the near future. However, the early demand in Q1 from the market led multinationals on early supply since COVID-19 is concerning. Demand from overseas currently is still weak. Weak demand combined with stable or oversupply are causing the price index to go down quickly.

Can you comment on the China-India border conflict, with respect to agrochemical imports being held up in India?

China’s agrochemical industry has deep cooperation with Indian partners such as in the intermediates business. The leading Indian agrochemical company, UPL, also invested in their first Chinese plant in Hebei Province. The countries’ agrochemical industries are highly complementary.

I think the border issue is an occassional case. Both India and China’s governments can handle the issue properly. We only see some delay of cargo custom clearance in the Indian port, and I believe the issue will be fixed soon.

Broadly speaking, how are the flow of goods, demand, and prices still being impacted by the coronavirus pandemic, and how long might a recovery take?

- Impact to show up in Q3

The challenge of COVID-19 could be a consistent issue globally until the end of 2021. The pandemic’s impact takes time to show up. We can feel pressure in our economics. Some industries could have planned layoffs from Q3, not only for private companies but also for multinational companies globally. Since the pandemic in US/EU/LATAM occurred later than in China, the tough period for economics will be delayed by a few months.

- Agriculture outlook

However, the pandemic has a different impact on agriculture. COVID-19 did not affect China’s spring planting of field crops. There is an impact on small farmers or fruit companies that provide fresh produce, such as lemons from Chile, to restaurants. The biggest impact on agriculture was still adverse weather like frost and hail. Fresh produce prices are stable in China, but pork price is increasing. Regarding the strong Chinese demand for protein, soybean globally has more growth potential. This provides a positive outlook for the world’s soybean growers.

Can you offer an update on production and pricing of some of the key active ingredients, and the drivers behind those trends?

Agrochemical portfolios were pulled into the channel from March to April. There are a few shortages of agriculture inputs for Chinese distributors and farmers. During Q1, some companies were concerned that China might face a logistics block due to the lockdown of transportation for an uncertain time period. For now, China’s supply is stable.

Manufacturers need to regain full operations to make up for the lost production during the COVID-19 period. The local market is in a period of slack sales. Global demand is weak due to the early demand, and also because of the pandemic, which is one or two months later than in China. So, we did not see aggressive transactions from June to July.

Moreover, there are new capacities arising from western China, including Inner Mongolia, Ning Xia, and Gan Su. Supply would be much bigger than demand, which is one of the reasons for falling prices.

Up to now, China’s agrochemical industry is investigating the global status of the COVID-19 impact. The world is consuming a large inventory based on the rule of “First-in, first-out.” Multinationals pushed the distribution channel to pay cash by a discount strategy.

For next season, the industry might face a big challenge on consumption. That could be the reason that multinationals are promoting precision ag and digital farming in 2020. They need to help distributors persuade farmers to consume their brand more than others. Meanwhile, China is suffering adverse weather, with heavy rain hitting growers in central China, affecting payment from local farmers.

Glyphosate consumption is rising fast in China’s domestic market, as a new balance between supply and demand is formed. We see the price becoming stable.

For 2,4-D, the situation is similar. However, India banned 2,4-D recently, and we need to check other countries’ consideration of the AI. 2,4-D is important for multinational GMO seed program, such as Corteva’s Enlist system. Glufosinate prices are stronger than in previous months due to tight supplies.

Insecticide and fungicide prices continue to decline in July.

In your recent article for AgriBusiness Global, you discussed growing competition on synthesis of certain off-patent actives over the next five years. As some countries move to ban AIs, such as the recent cases of India banning mancozeb and 2,4-D and Thailand doing the same for chlorpyrifos and paraquat, how do you see market share playing out?

Off-patent agrochemical companies are growing in China. We see capacities expanding on some products. Global demand is stable. The key advantage when producers compete is lowering of production costs by process enhancement . Recently, there are many “long-tail” molecules facing bans. This will drive producers to focus on future off-patent molecules.

India has good experience on API and key intermediates synthesis as one of global sources. From 2008 to 2010, multinationals invested heavily in Indian production, such as Deccan by Mitsubishi Corp. The leading Indian chemical companies are becoming more important to multinationals’ global sourcing, which helps the latter mitigate risk of AI shortages in China.

As for the banning of insecticides order in 2020, they are all old AIs in the “long tail” period of their life value. Most are low priced and widely applied, and as such, we call them a “cash cow.” Multinationals normally sell off the long-tail portfolios to generic companies in order to focus on higher profit business. For example, the mancozeb asset was acquired by UPL from Dow.

The banning order from India will surely affect mancozeb supplies from India, which currently has around 220,000 Mt in total capacity. India’s mancozeb capacity from UPL, Coromandel, and Indofil accounts for about 70% of the global supply. By comparison, Limin in China had around 40,000 Mt in capacity. From my point of view, the ban will force UPL to take mancozeb production elsewhere worldwide, using US or China’s facilities. If UPL wants to keep a high return of investment for the AI, there is a possibility it will cooperate with a Chinese source or invest further outside of India.

Moreover, banning of long-tail molecules will create global regulation challenges for the food industry. Countries may further review banned pesticide residue limits for food exports and imports.

Another important aspect is alternative choices for farmers. Cost-to-performance ratio will be the important factor for farmers’ choice. In Asia, we have lots of small farmers earning low incomes in agriculture. Long-tail portfolios could help them to minimize growing costs if molecules are safe to humans and the environment.

However, it is not easy to recommend alternative AIs. We need to consider mechanism model, safety, resistant status and cost savings for farmers. To control insect pressure, there will be more market potential for resistance management for Coragen (chlorantraniliprole), indoxacarb, emamectin benzoate, and lambda-cyhalothrin. The herbicides quizalofop-ethyl, metolachlor, fenoxaprop-p-ethyl, and glufosinate can be other options for farmers.

For fungicides, copper agents, propineb, boscalid, fludioxonil, cyprodinil, prochloraz, dimethomorph, fluopyram, and pyraclostrobin could be good options for farmers in the future.

Can you discuss development of new formulations for precision farming and how off-patent players take advantage? Which markets will be most competitive?

There is more challenges ahead for the crop protection industry. China has a national objective to prevent the increase of use of agrochemicals and fertilizers beyond 2020. Resistance to weeds, fall armyworm, and soybean rust are increasing sharply.

According to Dr. Aaron Hager, Weed Science Professor at the University of Illinois, some weed internal mechanisms are able to metabolize herbicides into non-toxic products, rendering them ineffective. The mechanism is similar to GMO crops that are able to sustain being sprayed by herbicides like glyphosate.

The sustainable business is the only way for crop protection industry growth. The challenges require that portfolios have innovative characteristics with lower costs to farmers. Efficacy and application efficiency need to be improved.

The novel Formulation Delivery System (FDS) will be very critical for portfolio branding and launching into market. As Dr. Xuemin Wu, Chief Scientist of China Pesticide Formulation & Adjuvant Laboratory, crop protection is an organic ecosystem to crops, so we need to consider the molecule, formulation, adjuvant, and application system together.

Precision farming will utilize agrochemical formulations for maximum efficacy. Combined with digital farming, artificial intelligence could help to find novel molecules and help farmers to make timely decisions for applications. We also want to utilize Cryo-EM technology to find out new target point on weeds or fungi, so that we can make it possible to discover new protein biopesticides for Integrated Pest Management (IPM) and organic agriculture in the coming decades.

What are the keys to successful agrochemical sourcing from China?

Successful sourcing from China requires more deeply understanding China’s agrochemical industry, history, and key advantages. Different teams have different comparative advantages to guide a global sourcing team to make the right decision at the right time.

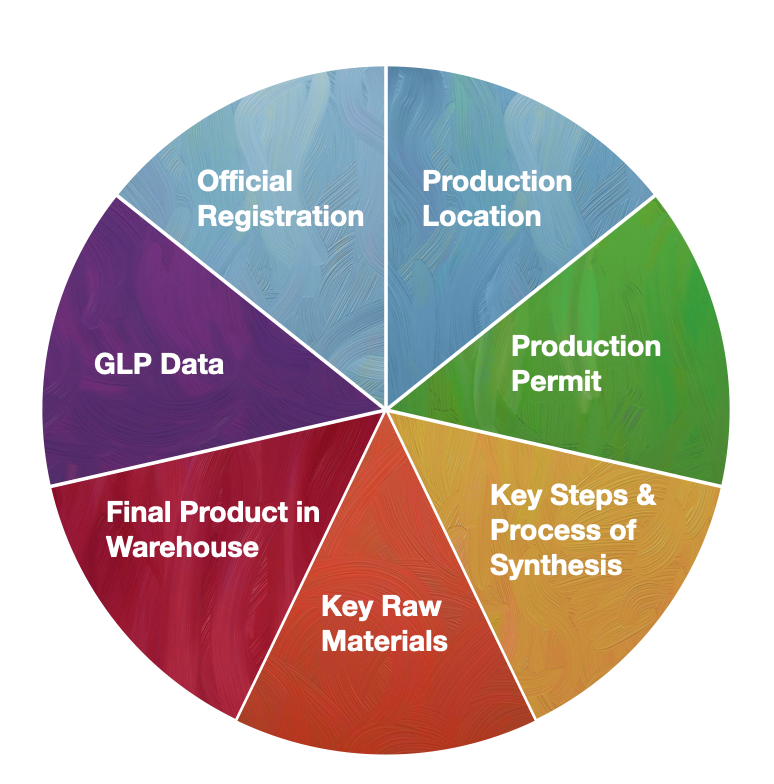

In the pie chart, I have listed the key factors.

Regulation is first since it decides if the production is legal or not. The official registration is the most important information. Currently there are two kinds of registration in China, one is PD registration as official registration; the other one is export-only registration starting with EX.

The production location is related to GLP consistency. That information also indicates where the cargo comes from. When a sourcing team visits the location, the full facility, raw materials, and key final product should be checked at the same time.

Along with the production location, it is important to have the production permit. This can help the sourcing manager to manage the risk of environment issue about the production and potential risk of production suspension. Fortunately, Chinese manufacturers already have moved into industry parks with high-level environment protection guided by CCPIA. The new production line is advanced to meet efficient operation and environment protection regulations.

GLP data need to be complete and related to the production location. The sponsor and manufacturers must be clearly explained by the supplier. The key steps and process shall be identified by the sourcing manager with background of chemical synthesis. The raw materials and final product must be reviewed.

Besides these factors, the manufacturer’s decision maker possessing a solid reputation is important in my personal experience. The team’s behavior is the reflection of their leader’s thinking model, and a critical indicator is how the boss handles quality complaint issues. It can show us if the company has a growth mindset and wisdom to contribute to the supply relationship.