China Price Index: Why Chinese Crop Protection Companies Seek Mutual Prosperity with LATAM Trading Partners

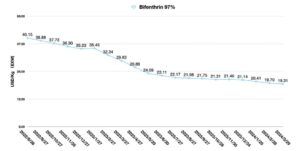

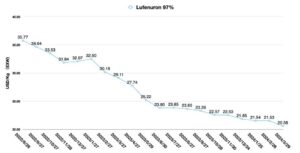

Editor’s note: Contributing writer David Li offers a snapshot of current price trends for key herbicides, fungicides, and insecticides in the Chinese agrochemical market in his monthly China Price Index. Below he also provides insight into why there is great potential for cooperation between China and Latin American countries.

In Principles of Political Economy and Taxation (1817), David Ricardo (1772-1823) put forward the famous Law of Comparative Advantage. The core of the Law of Comparative Advantage is that a country that specializes in the production of products in which it has a large comparative advantage and exchanges them for products in which it does not have through international trade, can reap the benefits.

Trade: The Basis for National Economic Prosperity

China’s trade with Latin American countries has grown at a high rate in recent years. In Brazil, for example, its exports to China reached USD $105.75 billion in 2023, making China its first trading partner with an export value of more than USD $100 billion.

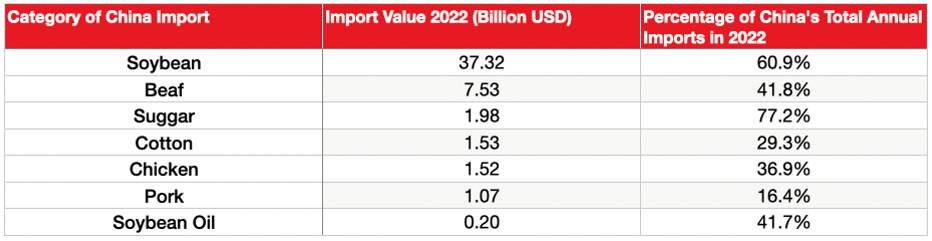

For China, Brazil is also becoming increasingly important. Brazil is China’s ninth-largest trading partner country and largest trading partner in Latin America. Especially in the field of agricultural trade, Brazil is the top source of China’s imports of soybeans, soybean oil, beef, chicken, and sugar, and the second largest source of imports of cotton and pork.

Chart 1: China Import Value of Brazil Agriculture Commodities in 2022. Data Source: China Ministry of Commerce

Argentina is the third largest economy in Latin America. The country is also one of China’s important sources of agricultural imports. Starting from 2019, China’s grain imports from Argentina have been growing rapidly, from 206 thousand Mt in 2019 to 4.377 million Mt in 2022, an average annual growth of 1.8 times. Among China’s grain imports from Argentina, 2.389 million Mt of barley and 1.988 million Mt of sorghum were imported. Among the sources of China’s grain imports, Argentina has risen from the 12th place in 2018 to fourth place in 2022 and has become the largest source of barley and the second largest source of sorghum imports.

Moreover, China’s diplomatic relations with the Southern Cone countries have been further strengthened. In November 2023, Uruguay’s President Luis Lacalle Pou visited China. And the two countries announced the establishment of a comprehensive strategic partnership. According to information from China’s Ministry of Foreign Affairs, China’s bilateral trade with Uruguay amounted to USD $5.317 billion in 2023, of which China’s exports amounted to $2.969 billion and China’s imports amounted to $2.348 billion. China is Uruguay’s number one trading partner, and largest importer of Uruguayan beef, soybeans, and wool. Uruguay is the third largest source of beef imports and the fourth largest source of soybean imports for China.

At the end of the 2023, to promote Uruguay’s agricultural imports, the General Administration of Customs of the People’s Republic of China (GACP) and the Ministry of Agriculture, Fisheries and Forestry of the Eastern Republic of Uruguay (MAPAF) signed a series of protocols and memorandums related to inspection and quarantine of agricultural products. The strengthening of bilateral relations and the implementation of policies will greatly contribute to the continued growth of bilateral trade between China and Uruguay.

Investment: The Latecomer’s Advantages

The acceptance of overseas investment is not new to Latin America. Large Japanese trading companies have been pioneers in Latin American investment. Japanese trading companies, such as Mitsubishi Corporation and Sumitomo Corporation, gained opportunities to cooperate with Latin American countries by investing in key local companies and participating in local projects. These trading firms earned returns through trade as return of investment. From a business perspective, such a business strategy is successful.

However, the Chinese model is completely different. China, as the world’s largest single market, opens its doors to the agricultural products in which Latin American countries have a comparative advantage, and by exporting products in which China has a comparative advantage, achieves mutual prosperity for both countries, not only to make a profit during the cooperation.

The agricultural sector is the most important investment area for Chinese investment. China’s agriculture has limited arable land area, while China has a population of 1.4 billion. In the process of urbanization, China’s middle class continues to have a strong demand for protein. This has led to gaps in China’s supply of some key agricultural products.

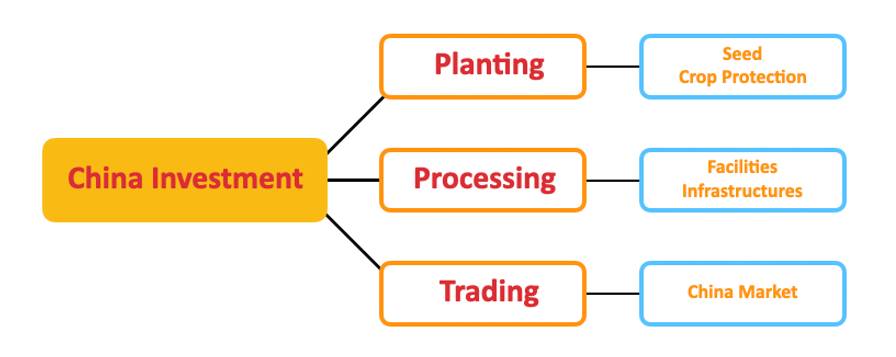

Latin America’s agriculture is growing faster, with rapid growth in acreage. Therefore, there is a good match between the Chinese market and the supply of agricultural products from Latin America. However, the agricultural cultivation sector requires agricultural inputs such as seeds and crop protection products. And the processing of agricultural products requires infrastructure development and investment in fixed assets. The trade in agricultural products requires agreements between the two countries, as well as the development of mutually recognized and sound customs inspection and quarantine laws and regulations. These are all areas that will require a great deal of communication and work between China and Latin American governments in the future.

Although China’s cooperation with Latin American countries faces challenges. We have now seen that Chinese companies, together with entrepreneurs from Latin American countries, are making firm progress toward their goals.

In the field of China’s investment in the soybean industry chain, Brazil is undoubtedly the biggest beneficiary. The strong demand for Brazilian soybeans in the Chinese market is the main underlying logic for Chinese companies to invest in Brazil due to the huge planting and low price of Brazil soybeans. As China has high quality requirements for soybeans, standardized planting to ensure standardized quality is the key demand of Chinese agricultural importers. As a result, local Chinese plantation companies have become the main force investing in Brazil in the plantation sector which can help Chinese importers to have standardized crop management.

On the China side, in addition to industrialized mass production, China’s economic development has benefited from a highly efficient warehousing and logistics network, advanced port facilities and management systems. Investment in logistics infrastructure in Latin America will be also a key focus for Chinese investors. Agricultural products, unlike other industrial products, cannot be stored for long periods of time. The most critical bottleneck in the agricultural trade is the efficient delivery of goods to their destinations, thus minimizing the loss of agricultural products in the logistics process can save trade costs.

Chart 2: China Investment in LATAM

While agriculture is a key area for Chinese investment in Latin American countries, Latin America’s prosperity cannot be limited to agricultural exports. Chinese investment should also benefit a broader area of economic development in Latin American countries. According to the report “Inversiones de China en el Cono Sur de América Latina” published by Fundación SOL, Chile has become the South Cone country that has benefited the most from Chinese outward foreign direct investment in energy, mining, food, telecommunications, infrastructure, and other sectors of the economy. Between 2000 and 2020, Chinese investment in Chile’s energy sector was total $9.593 billion. In second place was the mining sector, with a total investment of $6.726 billion.

It is worth noting that China is now a key global source of production and manufacturing of crop protection products. China has comparative advantage in the production of crop protection products. Not only is the quality of key AIs excellent, but they are also low price. This has resulted in significant input cost savings for Latin American growers. Moreover, Chinese seed companies are also active in seed R&D. There are already Chinese seed companies in Latin America that have been granted commercial licenses for China GM seeds. In the future, China’s chemical synthesis technology, pesticide formulation technology, adjuvant technology and biotechnology in agriculture will be combined with China’s investment in the region’s cultivation sector, which will eventually form a healthy ecology favorable to bilateral trade and political relations.

Overcapacity & Bilateral Trade

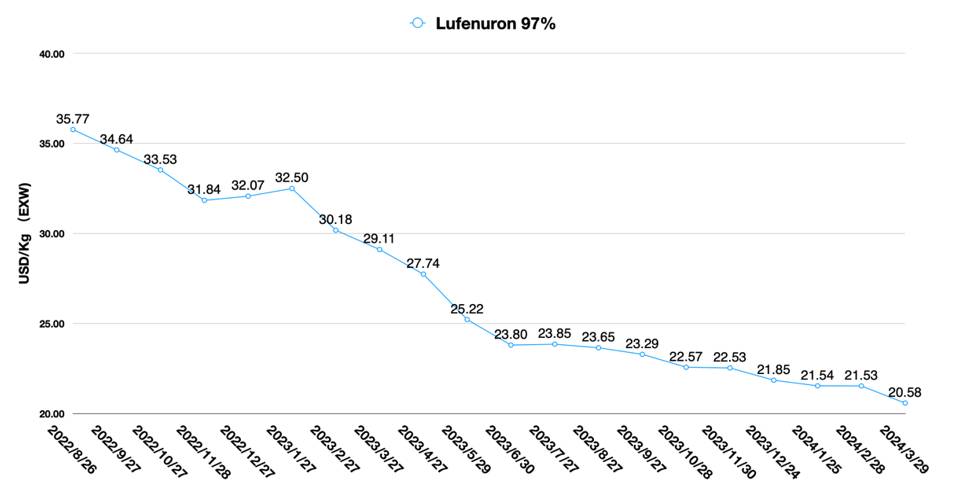

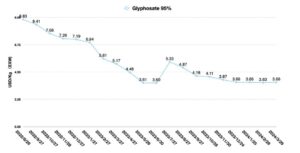

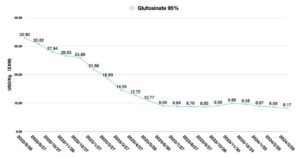

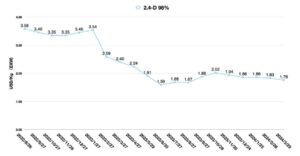

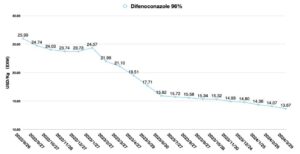

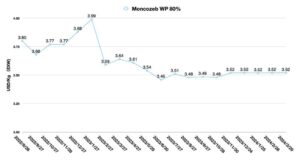

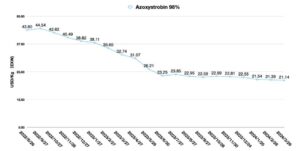

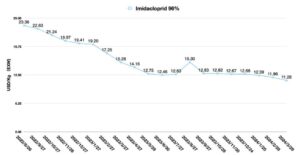

At present, China’s supply of AI products is in the stage of overcapacity. If we understand the theory of “Flying Geese Paradigm,” overcapacity is the inevitable result of the development of a country’s capital good production to a certain stage. In the future, China’s crop protection products will go global. And Latin America will be the key destination that Chinese pesticide companies will inevitably choose.

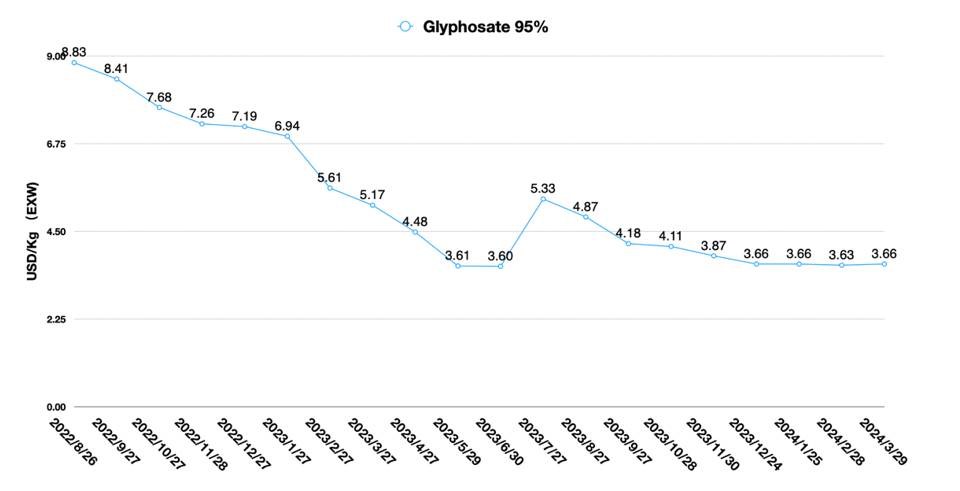

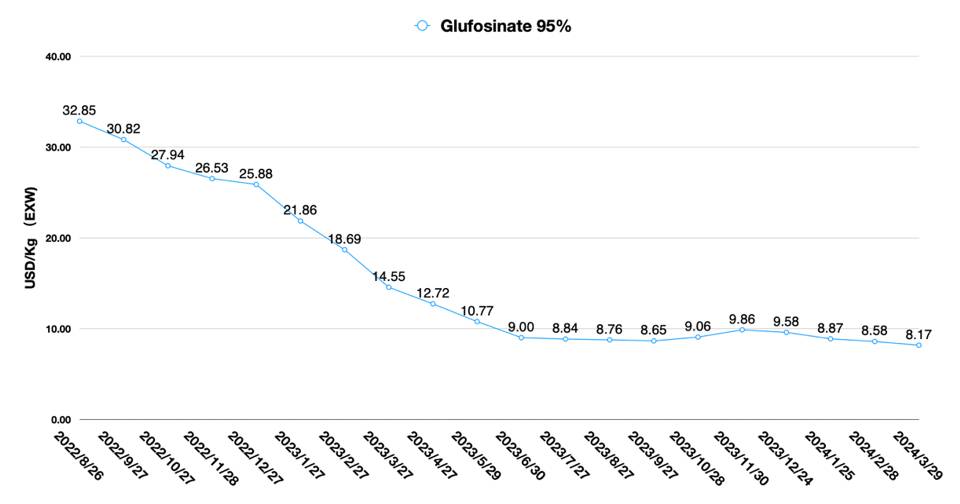

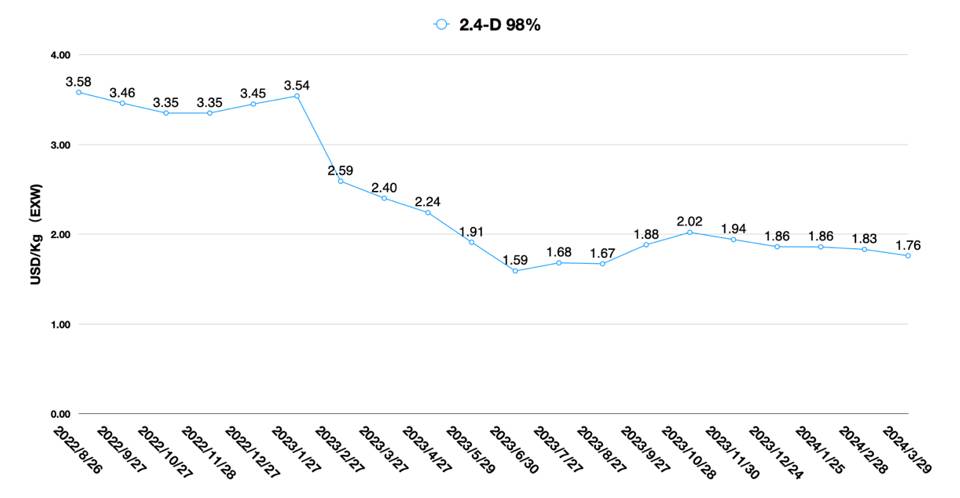

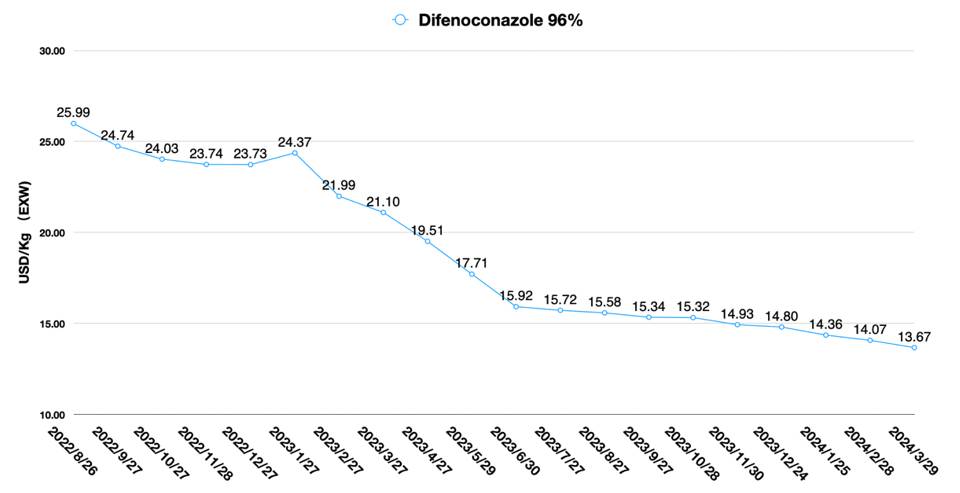

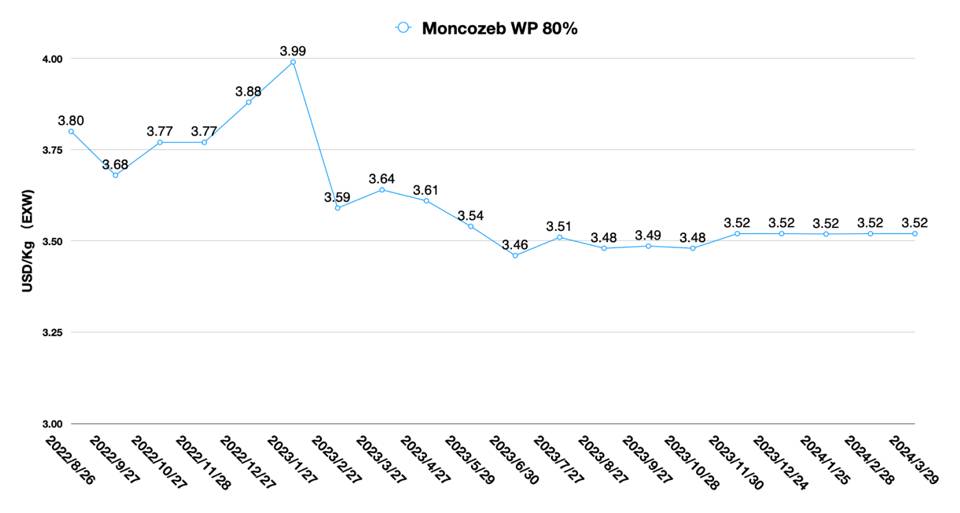

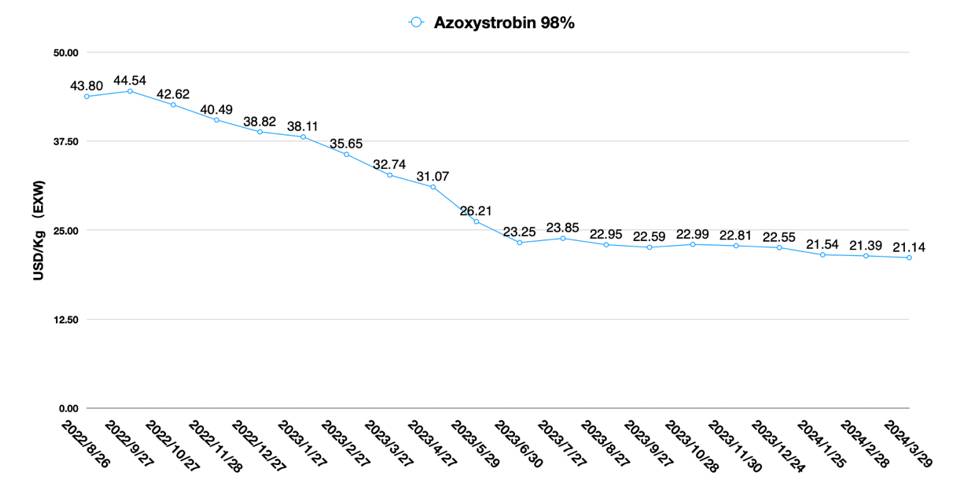

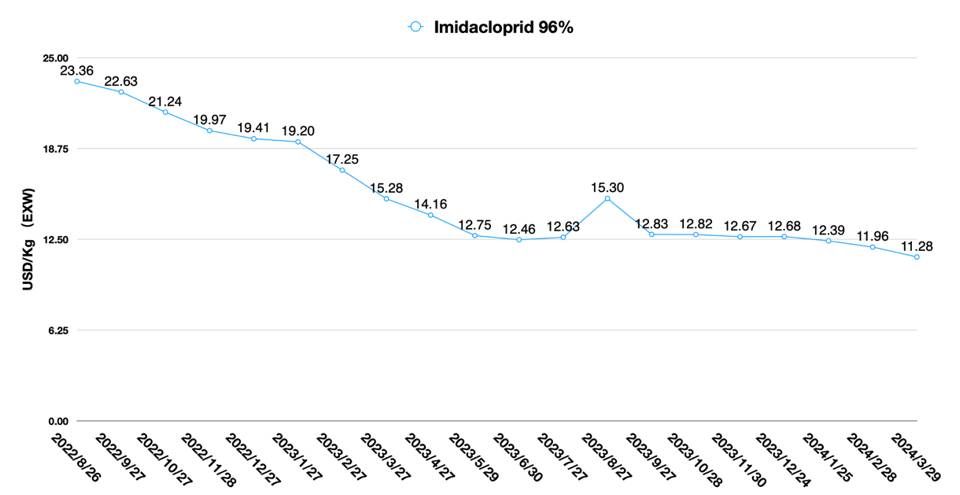

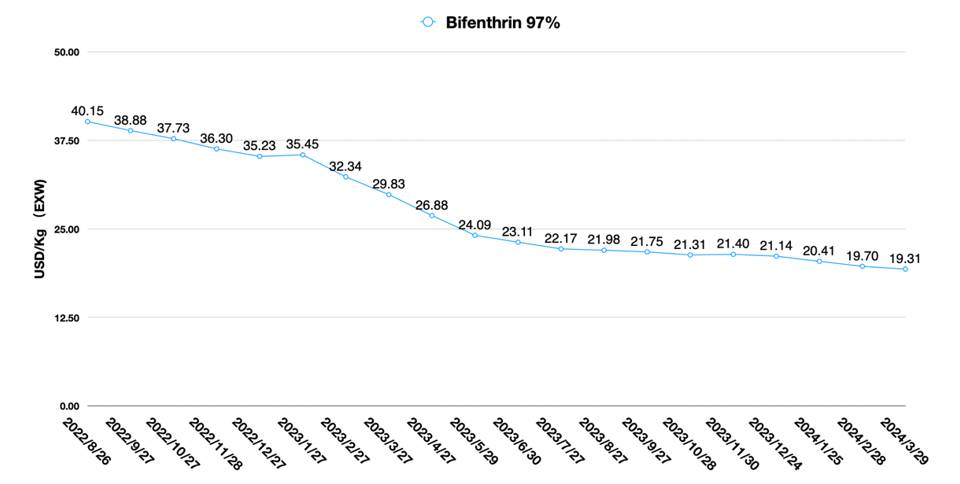

But China’s overcapacity has also brought some anxiety to Latin American distributors, whether China’s low-cost products will have an impact on the region’s crop protection market. Against the backdrop of slowing global economic growth, channel inventories of crop protection products have increased in different regions. Waning farmer demand for global agricultural inputs is the key influence factor. The lower end-market prices can be attributed to a combination of reasons. This situation will continue for some time and the price slump will not change much, at least until the end of 2024.

This leads to a critical question: How will the crop protection market in Latin America be reshaped by various factors in the future?

During a time when Chinese supply prices for AIs are hovering low, so the crop protection market in Latin America will become more competitive at the farmer’s end. In the short term, more traditional national distributors will opt for lower-cost Chinese formulation products due to higher formulation production costs. For some new compounds, finished formulations from Chinese companies will have a greater advantage. This is mainly due to the fact that Chinese formulation R&D is more familiar with new compounds and can conduct recipe and production more efficiently.

Closed-loop business thinking may be a good choice for Chinese and Latin American companies. Simply competing in the crop protection market is no longer enough to meet the business growth expectations of Latin American distributors. Collaborating with Chinese planting companies and Chinese seed companies in LATAM to ensure standardized quality through standardized cultivation will benefit the LATAM agricultural commodities exporting to China market. Only standardized quality of commodity can guarantee long-term sustainable purchases from Chinese agricultural companies. Therefore, the formation of an efficient standardized business closed loop will be necessary across the different hemisphere.

Of course, we can’t rule out the possibility of Chinese companies investing in Latin American crop protection channels. But the internationality of Chinese crop protection companies still need time and “globalization education.” At least, Chinese companies’ top management is not ready yet. First step of business globalization shall be the globalization of human resources, which needs to start from Chinese education right now.

Finally, let’s return to the Law of Comparative Advantage mentioned at the beginning of this article: China has a high degree of complementarity with the countries of Latin America. Latin America is based on agriculture and resources as the basis for the country’s economic growth. China’s strengths are large-scale flexible manufacturing and a single market with the world’s largest population. There is great potential for cooperation between China and Latin American countries. We already see steaks and cherries from Latin America readily available in Chinese supermarkets. We also hope that in the near future we will be able to enjoy the beautiful landscapes of the southern hemisphere and meet friends on the other side of the globe who traveled by taking the high-speed railroad in Latin America. As a Chinese, I am looking forward to this future scenario.