China Price Index: What Is the Right Supply Chain Strategy for Your Agrochemicals in 2024?

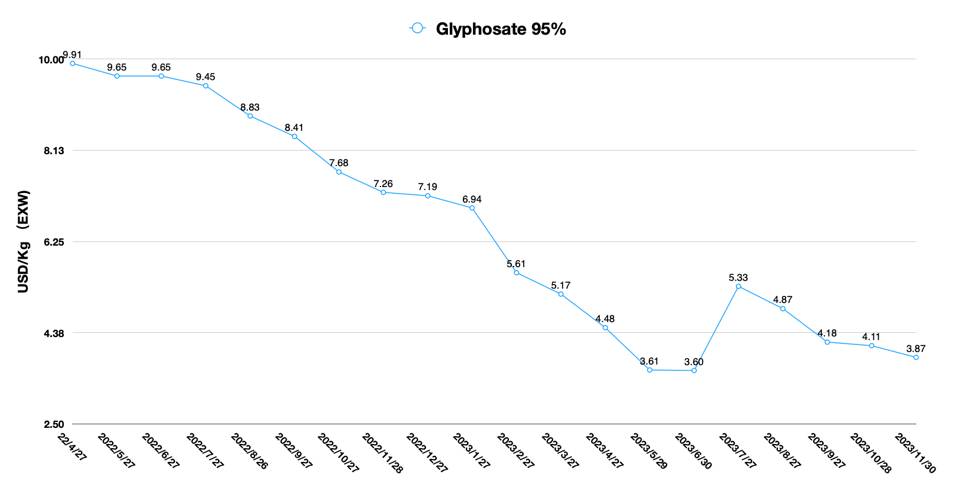

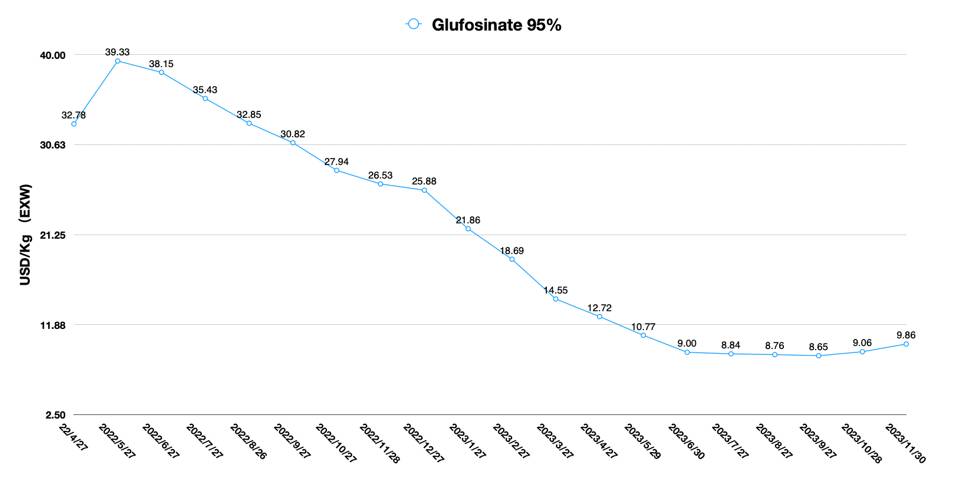

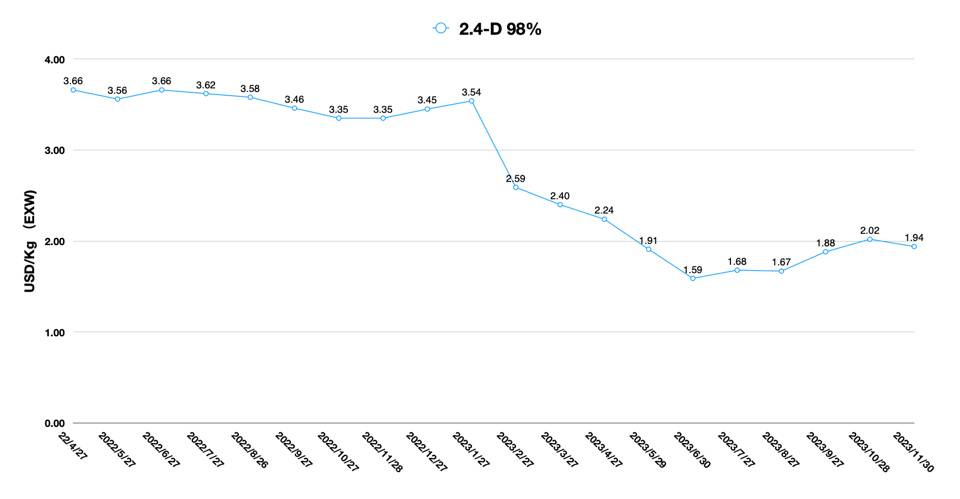

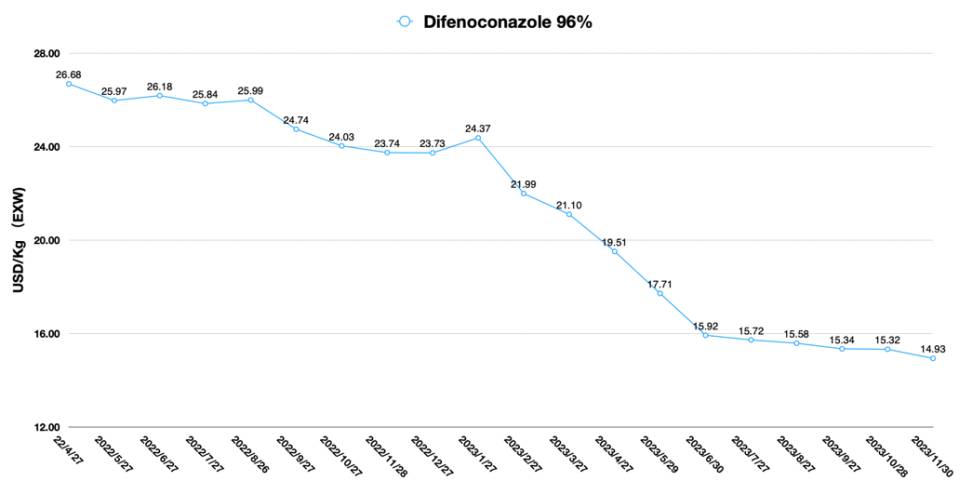

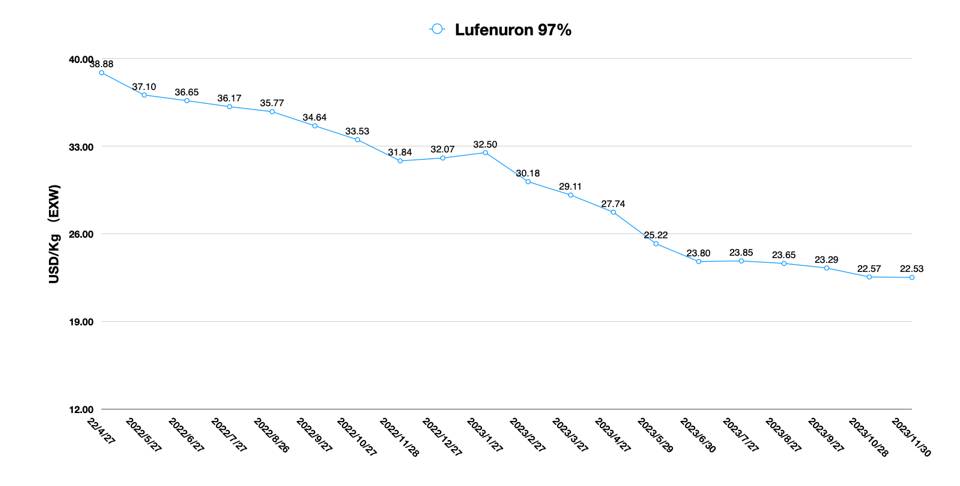

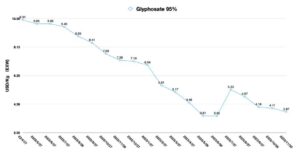

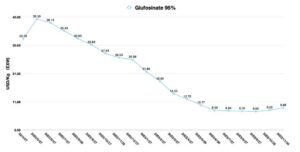

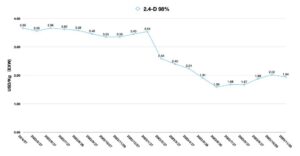

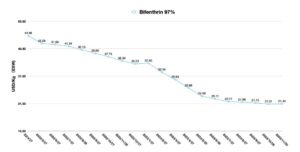

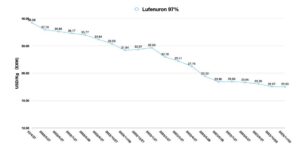

Editor’s note: Contributing writer David Li offers a snapshot of current price trends for key herbicides, fungicides, and insecticides in the Chinese agrochemical market in his monthly China Price Index. Below he also provides key insight into the importance of matching the right supply chain strategy with the right products in 2024.

In the last month of 2023, a cold wave unexpectedly brought a long overdue chill to China from north to south. “Snow is an omen of a good year.” Chinese farmers believe that the sight of snow in winter means a good harvest in the coming year. Fresh snow fills people’s hearts with hope in the winter.

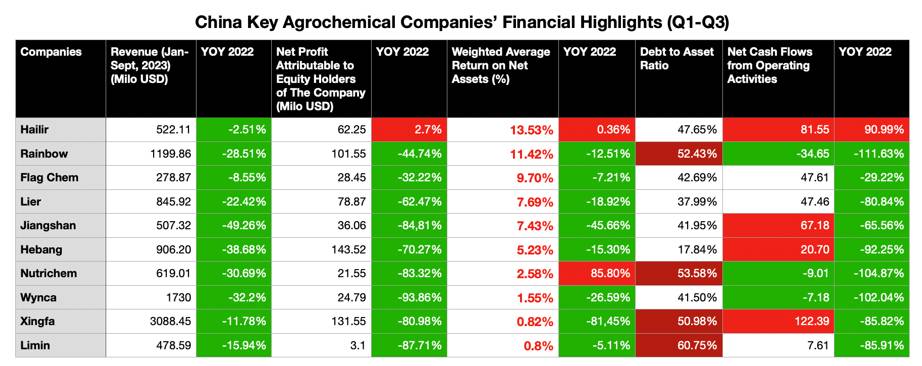

As one of the practitioners in China’s pesticide industry, I have never experienced such a difficult winter in my 15 years working experience. According to the first three quarters of the financial reports of Chinese pesticide listed companies, almost 90% of the performances have shown different degrees of decline compared with the same period last year. We use Weighted Average Return on Net Assets as a hard indicator to evaluate the operating level of a company. Manufacturing companies rarely show double-digit growth in Weighted Average Return on Net Assets.

These companies in China’s pesticide industry are not doing well. At the same time, the Debt-to-Asset Ratio of some companies is above 50%, which indicates that the companies are also facing the possibility of a debt crisis at the same time. There are two main reasons for the high Debt-to-Asset Ratio. One is that the companies are continuing to invest in their production facilities and expanding their production. The second is that some companies continue to expand product inventories in overseas subsidiaries. In a fully competitive market like China’s pesticide supply market, it is difficult for companies to rationally scrutinize the sustainability of their operations. It’s the law of the jungle as the “survival of the fittest” era has arrived. Especially in such a “bitter winter” market background, the term “survival of the fittest” seems even more cruel.

Traditional leading manufacturers are utilizing their financial strengths to expand existing product capacity as well as build new capacity. Xingfa is building 50,000 Mtpa (million tons per annum) of new 2,4-D capacity to move into another herbicide category. Nutrichem and Chang Qing continue to add capacity for S-metolachlor in the hope of capturing a larger share of customers’ purchases. Lier continues to invest in capacity for L-glufosinate supporting raw materials. Hebang focuses on PMIDA (N-[Phosphonomethyl] iminodiacetic acid) production capacity expansion and overseas production capacity construction of glyphosate. Rainbow is investing in pyroxasulfone capacity. And CAC Nantong’s new prothioconazole capacity will put pressure on Hailir.

Not only are leading producers moving on, new players are also utilizing capacity investments to try to overthrow the existing Chinese supply chain. Hebei Shanli (Hebei Chengxin) is building 10,000 Mtpa of prothioconazole, 5,000 Mtpa of trifloxystrobin, and 1,000 Mtpa of kresoxim-methyl. Such a product line is obviously prepared for the supply to Bayer CropScience. Hebei Nongbiwei invested in a new project with an annual production capacity of 5,400 Mtpa of tebuthiuron, 1,800 Mtpa imazapyr, 6,300 Mtpa of clethodim, and 3,000 Mtpa of mesotrione. The company’s product line setup is very similar to Nutrichem existing portfolios. In the Chinese supply market, the new investment is ignoring the existing supply pattern and directly competing in the future market with super capacity.

Money never sleeps. Under downward economic pressure, local capital in China is entering the agrochemical industry with undifferentiated fighting. In 2024-2026, most suppliers in China will not be able to guarantee reasonable profit margins. Overcapacity will continue to drive down the overall value of China’s pesticide supply market. In such a future supply market, product prices will fail to regulate supply and demand.

Changes in the upstream supply chain landscape of China’s pesticide industry are also creating new challenges for agrochemical distributors and multinational companies in various countries. An important question is: What is the right supply chain for your product?

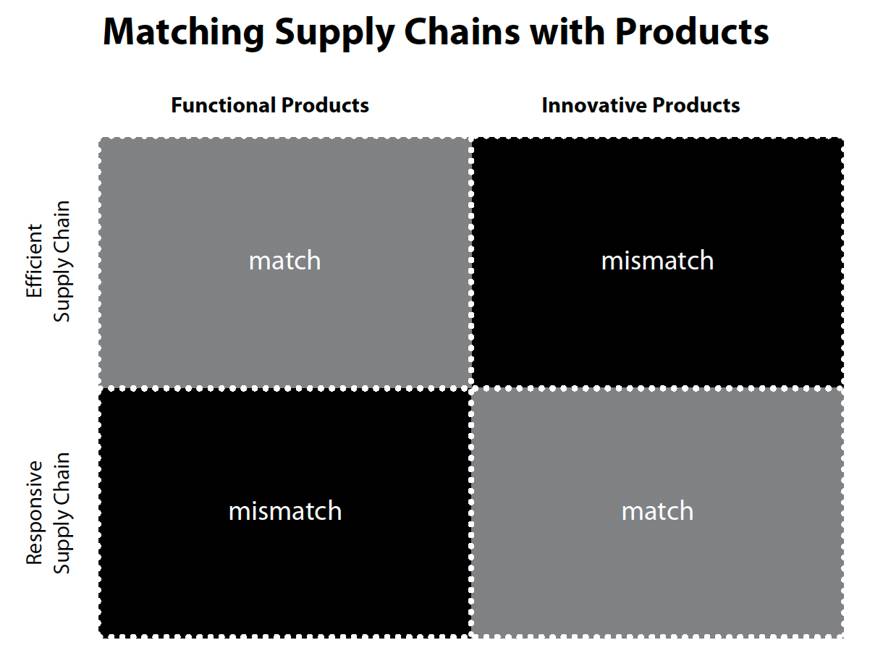

In 1997, Marshall Fisher published an article titled: “What’s the Right Supply Chain for Your Product” in Harvard Business Review, which focused on the match between product strategy and supply chain strategy. Marshall utilized the dichotomy to classify products into functional products and innovative products. As for functional products, the core is the low cost of the supply chain, and we should adopt a more efficient supply chain for the category. For innovative products, quick response is the critical factor, and flexibility of the supply chain is more important.

Source: What’s the Right Supply Chain for Your Product, Marshall Fisher, Harvard Business Review, March-April 1997.

Some agrochemical products, like glyphosate, glufosinate, 2,4-D, chlorantraniliprole, and mesotrione, which have super capacity in China’s supply market at present, belong to the category of functional products. For these AIs, manufacturers need to fully utilize their own production capacity (formulation line) for quick inventory turnover, so that the supply chain cost per unit of product can be lower. At the same time, the enterprise can reasonably use the supplier’s capacity of the elastic space to achieve their own supply flexibility. Moreover, functional products are easier to predict demand than innovative products. High quality and low cost are essential success factors for a functional product supply chain strategy.

In the case of some “new” molecules, such as prothioconazole, pyroxasulfon, saflufenaci, fluopyram, and other near-off-patented compounds, they clearly fit into the innovative product category. Due to the close relationship between these products and the company’s competitive strategy in the end market, as well as the unpredictable nature of new product demand in potentially competitive markets, suppliers of these products need to be flexible and responsive to customer needs quickly. Supply shortages are not acceptable. Therefore, for these products, customers need to organize a separate sourcing team to confirm that the supplier is a real producer and not just a simple registration holder. The instability of the source of goods from a trading supplier will be absolutely unacceptable in such categories. For innovative products, it may be more important for the supply chain team to utilize its own warehousing facilities to hold a certain amount of inventory to ensure flexibility of supply in the future. While cost is also a consideration for the supply chain team, the speed, flexibility, and quality of product supply from the supplier are more important.

Of course, the line between functional product and innovative product is not always clear. Innovative products can slip into the realm of functional products as competition in the marketplace intensifies. Product attributes are easy to change. It is much harder to change the supply chain to match. At the end of 2023, it is worthwhile to think deeply about supply chain solutions especially China’s intense supply chain fluctuations. There are three tips for 2024 supply chain management:

- First, future supply chain teams need to be more diverse. For the teams that have been handling demand for functional products for a long time, it’s hard for them to make innovative product supply layouts without thinking more about price. With the price factor in mind, it is difficult for teams to make decisions that have long-term value for the supply chain. Strategic sourcing headcount settings are worthwhile in an environment of rapid supply chain change.

- Second, supply chain strategy needs to be set based on product strategy. For a crop protection business targeting the field market, it would be wise to choose suppliers with scale effects such as Xingfa, Wynca, Lier, and Hebei Chengxin. For core compounds such as prothioconazole and pyroxasulfon, which need to gain a beachhead in the competitive market and develop a brand, CAC Nantong may be a more appropriate upstream supply partner. Product strategy determines supplier selection early in the competitive market. Price is not the most important factor in determining suppliers in the early adoption phase.

- Finally, less is more. In the downward phase of the global economy, goods are not flowing well in the global crop protection market. The best option for distribution companies is to subtract. Companies should be bold enough to remove less profitable, chicken-scratch product lines at the end of their product life cycle. The best direction is to go to market segments with potentially high marginal benefits. In the global agrochemicals market, a gradual shift from low price competition to a “membership” model could bring unexpected opportunities for companies. Farmers, like consumers, are always interested in innovation and open to unique solutions. Of course, before we enter the blue ocean market, we need to address an important question: Why would farmers choose us? How can we better link with farmers?

In 2024, we will see some unexpected events in the global crop protection landscape. As a general practitioner, all we can do is to protect ourselves as much as possible. Survival may already be the optimal solution for Chinese pesticide companies, overseas agrochemical distributors, and Chinese pesticide practitioners in short perspectives.