China Price Index: Why Chinese Companies Need to Reinvent Themselves and What It Means for Glyphosate, Other Key Agrochemicals

Editor’s note: Contributing writer David Li offers a snapshot of current price trends for key herbicides, fungicides, and insecticides in the Chinese agrochemical market in his monthly China Price Index. Below he also provides insight into how Chinese agrochemical companies are exploring various market strategies, and why their future path must be internationalization.

An ancient Chinese book, The I Ching, opens with the state of the dragon to describe the human condition. The dragon exceeding the proper limits; the dragon lying hid (in the deep); the dragon appearing in the field; and the dragon on the wing in the sky. These four idioms mean that the dragon descends from a high position to a low one, so that it can reflect on its behavior and virtues, get rid of its bad character, develop its strengths, and start afresh.

The ancient Chinese were very interesting in that they incorporated the laws of nature into their philosophy of life. Like the changing of the seasons, the Chinese visualized the human state as a cycle. For thousands of years, the Chinese have perpetuated this culture of continuous upgrades in a structure similar to the double helix of DNA. The Chinese are probably one of the most optimistic people in the world. No matter what kind of crisis the Chinese face, they are always determined to find a way out and actively try to solve the problem.

At the beginning of the Year of the Dragon, China’s leading pesticide companies had released company earnings forecasts of 2023. Among the companies that released their earnings forecasts, 40% of listed pesticide companies were in the red in 2023. Almost all pesticide companies had experienced a decline in performance compared to 2022.

Among the many Chinese pesticide companies, only glyphosate companies with advantages in mineral resources could maintain considerable profits. Hebang and Xingfa are undoubtedly far ahead of other companies in terms of net profit contribution. Lier, with cluster advantage and process upgrading ability, also still maintains a profit of USD $85 million to USD $89 million. This fully demonstrates that the control of mineral resources, the whole industry chain, and the regional cluster development mode are the keys to reducing costs and improving profitability.

Forecast of net profit attributable to equity holders of the Chinese agrochemical companies. Click image to enlarge.

For companies with strong R&D capabilities, competition is fierce due to the overcapacity in China’s supply and low-market prices for AIs, which has led to a decline in profitability. Process improvement alone is difficult to sustain cost reductions during the maturity of an AI product’s life cycle. It must be supported by upstream controlling of raw material costs. Therefore, in China’s pesticide industry, the era of the strongest is coming.

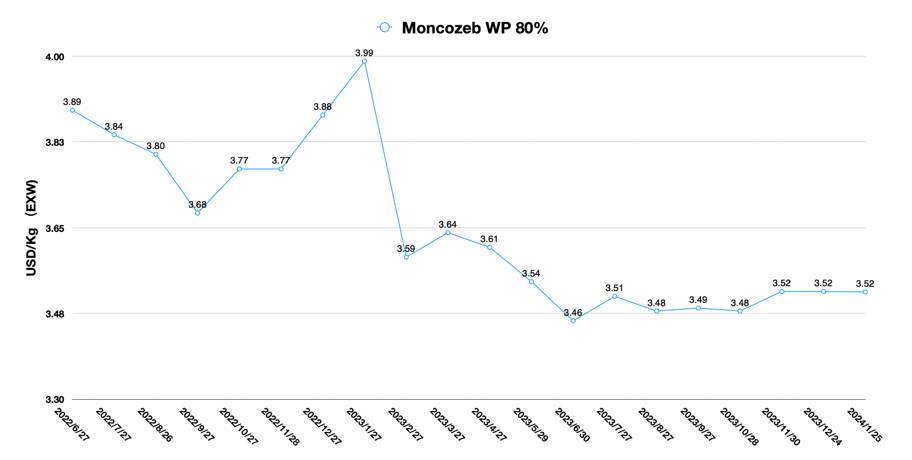

If we summarize the key factors of Chinese pesticide companies on poor performance, the following areas are most often mentioned in the list: low prices, reduced sales volume, de-stocking, fierce competition, and heavy asset investment in new products.

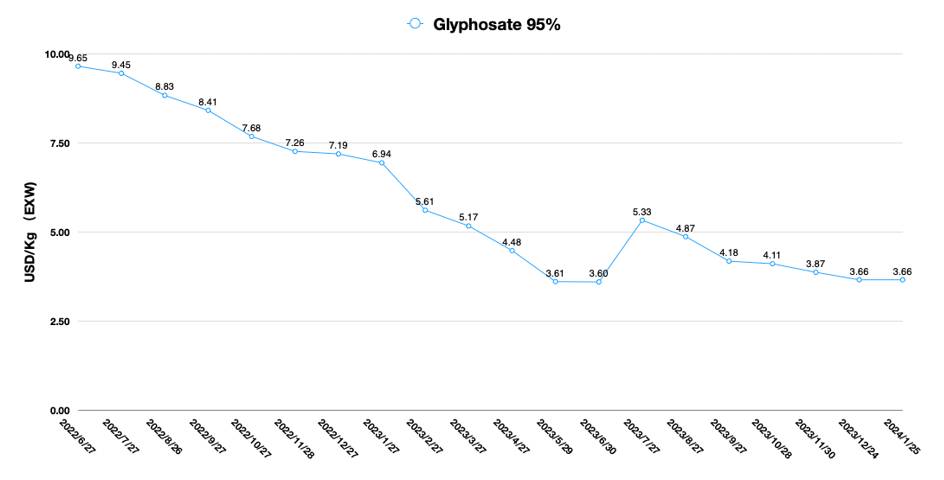

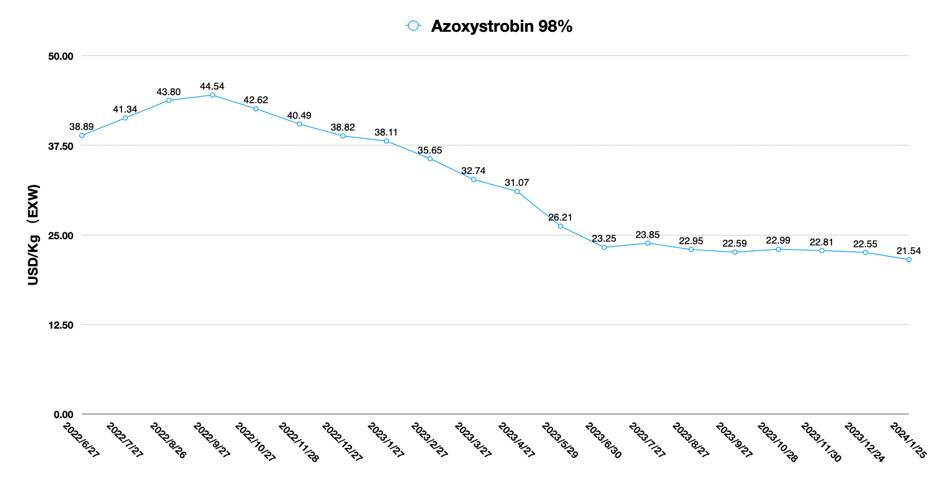

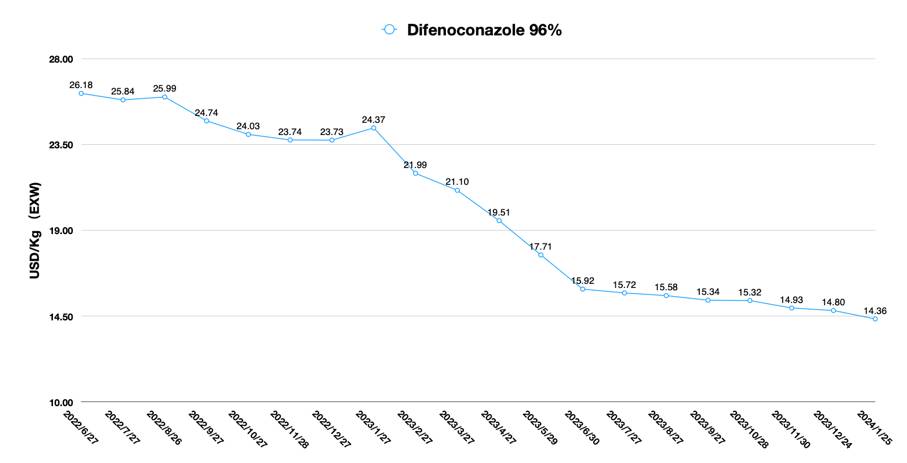

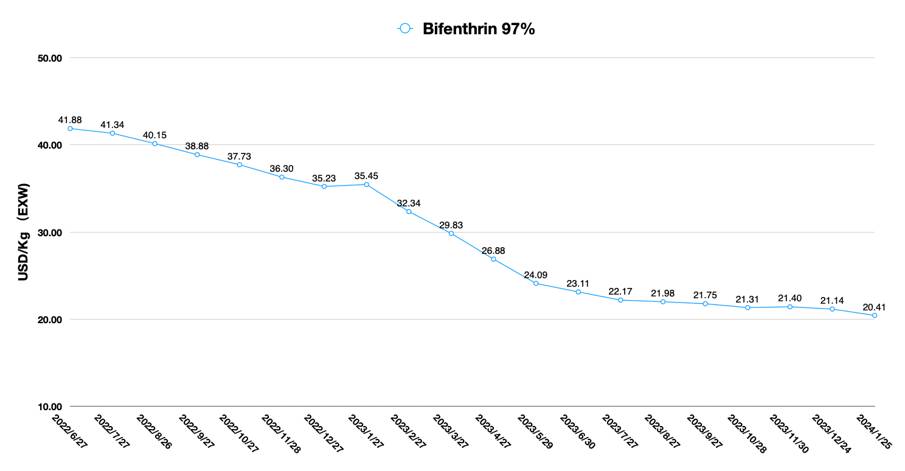

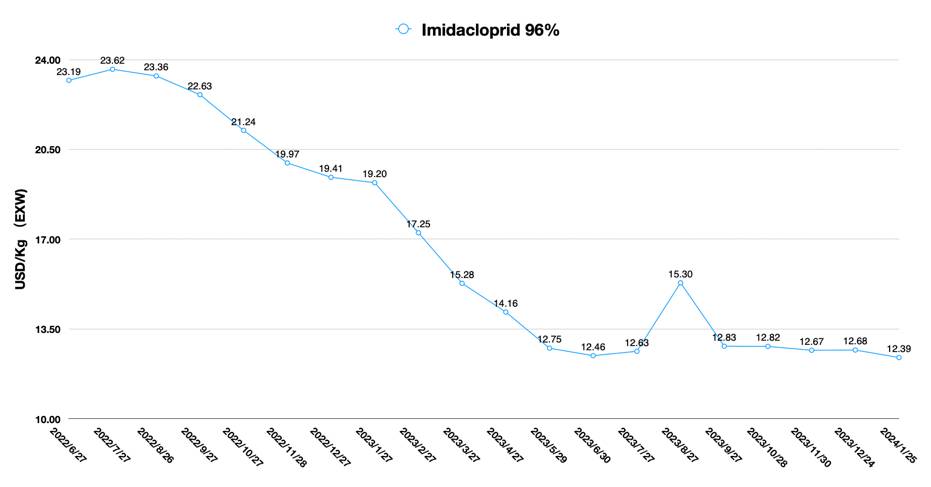

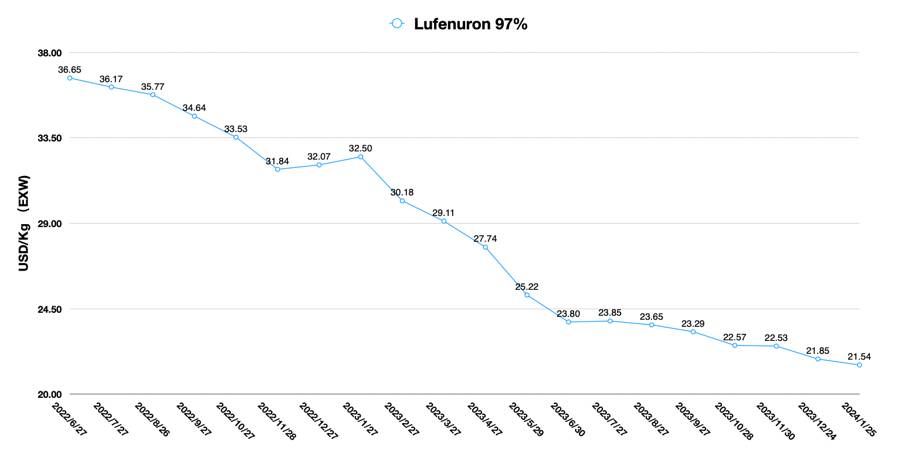

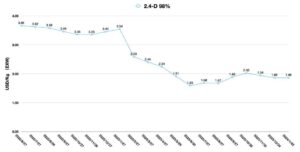

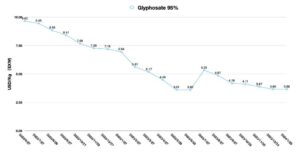

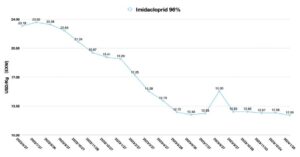

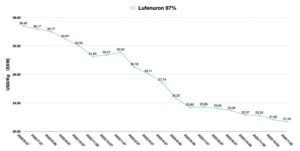

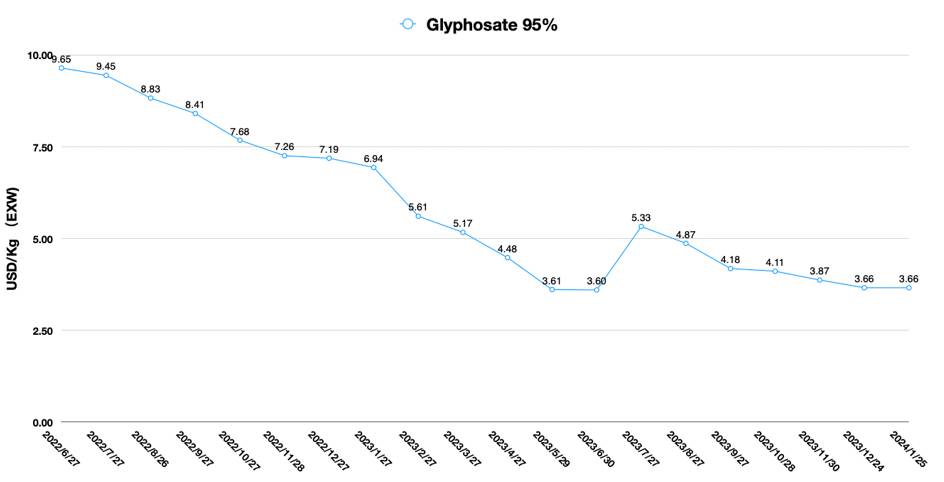

The trend of lower prices for pesticide products in China continued into the Chinese New Year of Dragon. Taking glyphosate AI as an example, the EXW price of glyphosate AI was relatively stable during the period when the exchange rate between the USD and CNY was relatively stable in the 7.1-7.2 range. On the supply side, although some companies have adjusted their plant start-up rates during this period of weak demand, there is sufficient glyphosate raw material in the supply market. Glyphosate prices will maintain a stable and slightly stronger price trend in the coming months.

EXW Price Trend of Glyphosate AI

It can be expected that overseas demand will continue to be dominated by fragmented orders in the first half of 2024. Although affected by the El Niño climate, the weather conditions in North America and Argentina will have some favorable impact on crop cultivation. However, the dry climate in Brazil will bring great uncertainty to procurement from China. Therefore, it may be difficult to see a large-scale release of overseas demand in the first half of 2024.

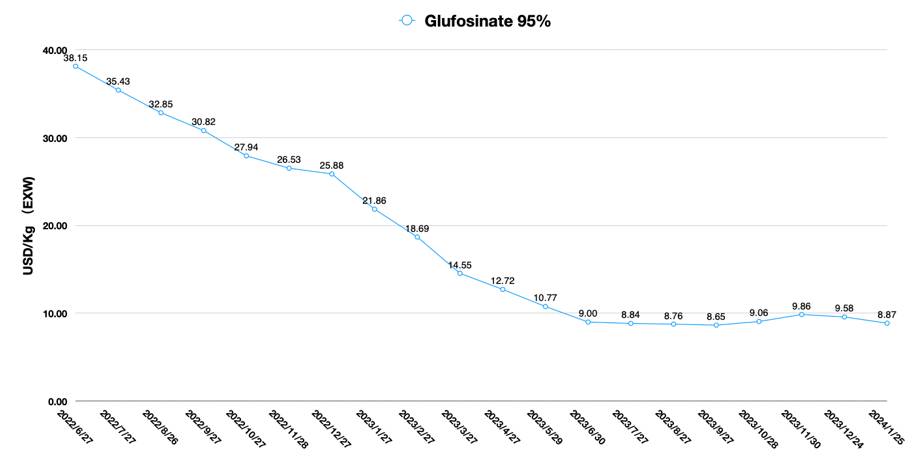

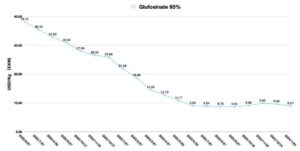

In 2023, demand in the North American market was weak. In 2024, the restart of the North American market (B2B level) will be very important for Chinese companies, especially glyphosate and glufosinate companies. However, according to the comments of Terry Kippley, President of the Council of Producers and Distributors of Agrotechnology (CPDA), the purchasing of Chinese AIs by North American distributors would restart gradually from the second quarter of 2024.

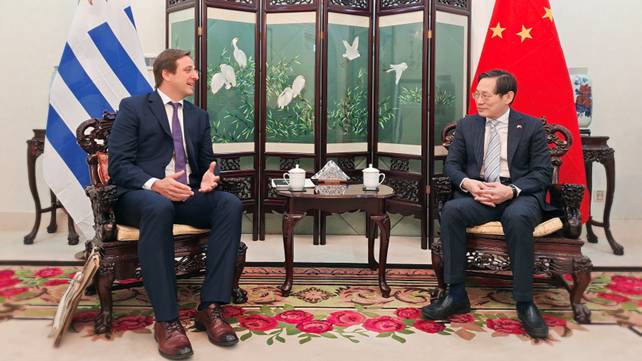

TARIFEL’s Dr. Nicholas Potrie with Huang Yazhong, China Ambassador to Uruguay. Photo credit: China Embassy.

Dr. Nicolas Potrie, Director of TAFIREL, spends a lot of time on the front lines of agriculture working with farmers. His judgment on demand in Latin America is compelling.

After three years of drought, MERCOSUR members, mainly Uruguay and Argentina, are on the verge of an optimistic harvest year. Potrie expects increased production to offset the negative impact of lower grain and soybean prices.

Of note, the 2023 winter planting season was in good shape. This has favored agricultural production in the region and farmer payments. Although farmers are active in application, stocks of goods in the channel remain adequate. Brazil, the world’s most important agricultural exporter, has seen an increase in the country’s planted acreage. Combined with Argentina’s exposure to El Niño weather, agricultural production in 2024 is expected to be better than in previous years. These two factors could drive soybean prices lower.

In terms of channel demand for Chinese AIs, Potrie believes that growth is likely to lack momentum going forward. This is mainly due to a combination of inventory levels in the overseas channels and lower prices for Chinese AIs.

Potrie, who is also currently president of the Uruguay-China Chamber of Commerce, emphasized that the agricultural economy is a global closed-loop. China’s demand for meat and dairy products, although recently weakened, still has a stronger growth potential than the rest of the world. Therefore, China’s demand for agricultural products in Latin America will, to some extent, drive Latin American farmers’ demand for Chinese ag inputs. The most important thing now is the free trade agreement between China and Latin America. Potrie is confident about the future of bilateral trade between Latin American countries such as Uruguay and China.

It is worth mentioning that Potrie shared TAFIREL’s core values. TAFIREL cooperates with local farmers in each market to make business tangible. The company’s goal is to help farmers experience high-quality, eco-friendly products for increasing the yield and production of food.

This is a very important revelation for Chinese companies. In the face of a difficult industry, companies should also look at the reasons why they set up their business by the First Principle. What value does the company need to bring to local farmers, local agriculture, and local communities?

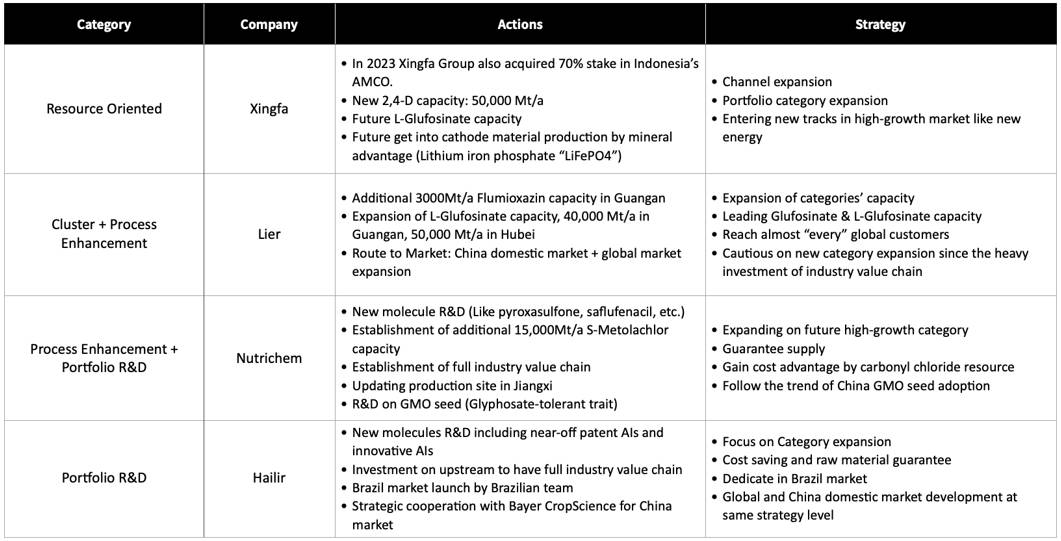

Competition and investment in new capacity are all over the news in the Chinese supply marketplace these days. For different types of Chinese pesticide companies, the strategic paths they have chosen to vary.

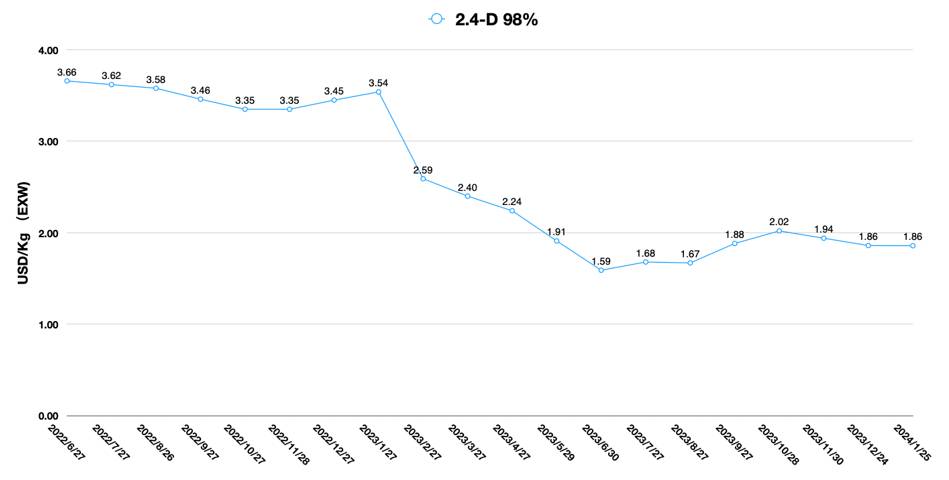

For companies that use resources as a competitive advantage, such as Xingfa, they are moving from glyphosate production into other herbicide categories like 2,4-D. At the same time, glyphosate companies are also seeking to more deeply utilize their phosphate resources. Xingfa is therefore preparing for its future L-glufosinate capacity.

In addition, for listed glyphosate companies, their mineral resources and capital management capabilities allow them to get involved in the new energy track. There are limited new energy sectors in which Chinese chemical companies can participate. Because the new energy field mainly includes three segments, one is power battery positive and negative electrode. The second is the battery diaphragm. The third is electrolyte. The production of positive and negative electrodes for power batteries requires heavy asset investment and upstream mineral resources. This is precisely Xingfa’s advantage. Another Chinese glyphosate company, Wynca, is also laying out on the future business of power battery electrodes.

Moreover, it’s worth noting that Chinese agrochemical companies are exploring channel expansion possibilities in increasing depth. In 2023, Chinese glyphosate companies are under great pressure of declining performance. This has also made more companies realize the importance of route to market (RTM) for sustainable development and detecting growth margins in promising markets. In 2023, Xingfa’s acquisition of Indonesian agrochemical company AMCO was a typical attempt.

Unlike Xingfa, companies with Cluster model and full industry chain as their core competence focus on the scale effect of their own products. Lier is a typical case. The improvement of scale can make the enterprise has the possibility to reduce the cost. At the same time for the market, the enterprise can dominate the market price. Generally speaking, in a complete competitive market, the company with the largest capacity has a pricing advantage. For example, Bayer’s 300,000 tons of glyphosate capacity could affect the price of the 700,000 tons of glyphosate capacity held by Chinese companies.

In addition, with the cost advantage of scale, these companies will choose a market entry strategy that reaches as wide a range of customers as possible. The companies’ channel layout in such category could be their weak point. They choose to focus more on serving key customers. Another weakness of this type of firm is the development of new products. The opportunity cost of making strategic choices is huge due to the firm’s investment in scale. Once the decision is made to choose a particular product, then the firm needs to make a sustained investment in scale. Slow or even no strategic turnaround is a common problem for this type of firm. In the Cluster model, the out-of-house upstream suppliers to the firm are more willing to provide a steady supply of non-diversified products. This is an external resistance to the firm’s strategic shift.

For R&D-focused companies, the problem they face is pacing. Nutrichem has continued to invest over the past five years to make up for its supply capacity shortfall. This was mainly due to Nutrichem losing key production infrastructure in Jiangsu province, Yancheng South, during the environmental storm. This left Nutrichem short of supply for key customers. External co-production would be bound to bring higher supply costs. The price competitiveness of the company’s products is further missing in China’s overcapacity environment.

In addition, Nutrichem could also face a challenge in their pricing mechanism. In a complete competitive market, prices are determined by the market. More precisely, it is determined by competitors in the market. What an enterprise should do is to make process improvements and R&D according to the market price so as to save production costs. This is the key to ensure the profitability of the enterprise sustained. Nutrichem was production pricing for a long time. This obviously could not bring competitive prices to sales to attract orders from key customers in future competition.

Furthermore, such kind of companies’ R&D cadence for new compounds over the past few years has been behind the rest of the industry. Multinationals have many choices of partners in China. Some SMEs in China used to find it difficult to invest in their own data package and reach overseas customers. But now, due to the increasing penetration of MNCs’ sourcing intelligence tentacles in China, MNCs as key customers can take the lead in cultivating new suppliers themselves. Traditional R&D-based AI companies are no longer necessarily the first choice.

Of course, Nutrichem is also actively engaged in internal change management. For example, it has heavily invested in building new capacity of S-metolachlor to meet the demand of multinationals. At the same time, the company has upstream carbonyl chloride resources. Upgrades to existing production facilities are also underway. However, in the long run, there is still much room for improvement for Nutrichem deeper integration with the global crop protection company’s demand.

Hailir has the best category management among all Chinese companies. The global launch of the company’s prothioconazole was the milestone of the performance growth. For Hailir, deeper penetration in the global market is the key to its success, especially since Hailir has a top-notch B2B business team in Brazil. This is a case study to learn from for Chinese pesticide companies that commonly set up subsidiaries and hold registrations in Brazil. A globalized team can develop business efficiently with globalized operations combined with cultural identity.

In terms of product lines, Hailir is also actively laying out new compounds. Continuous R&D investment and innovation are the key drivers for Hailir to be able to excel among prothioconazole suppliers. On top of the successful B2B Route to Market experience, Hailir will have an easier time with new products launch experience.

On the other side, new compounds and new categories require companies to reorganize their upstream raw materials. This will be a challenge for Hailir’s product category management in the future. Compared with the layout of the whole industry chain, Hailir pays more attention to technological innovation and market integration. In 2023, Hailir and Bayer CropScience signed a strategic cooperation agreement, and both sides reached a consensus on product development and market cooperation. This also confirms the strategic principle of “integration of AIs and formulations, integration of Chinese market and overseas market” put forward by Yaolun Ge, Chairman of Hailir.

In short, Chinese pesticide companies are currently in a trough. However, if you are familiar with the “Flying Geese Paradigm,” you can understand that this is an inevitable issue when a country’s industrial development comes to a mature stage. Overcapacity is a result, but not the end. The future path of Chinese pesticide enterprises will be and must be internationalization.

Just as Zheng He led his fleet of ships on one oceanic exploration after hundreds of years ago, Chinese companies today must also choose to go international. Today’s Chinese companies must also choose to go out and explore new markets across the ocean. This reminds me of Chinese ancestors’ use of the dragon as a metaphor for the human condition. The Chinese dragon is not the same creature as the Western perception of the dragon. The Chinese dragon is most importantly virtuous, a metaphor for people who are upright, friendly, and courageous enough to take on social responsibilities. I believe that starting from the Chinese Year of the Dragon, the Chinese Dragon will sow compassion in the world’s farmlands and help the world’s agricultural development.