China Price Index: 2024 Reorganization of the Pesticide Supply Chain in China

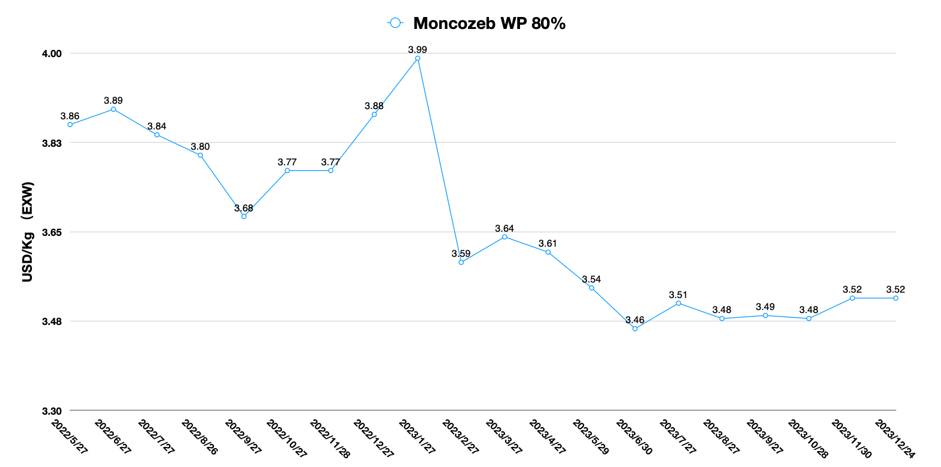

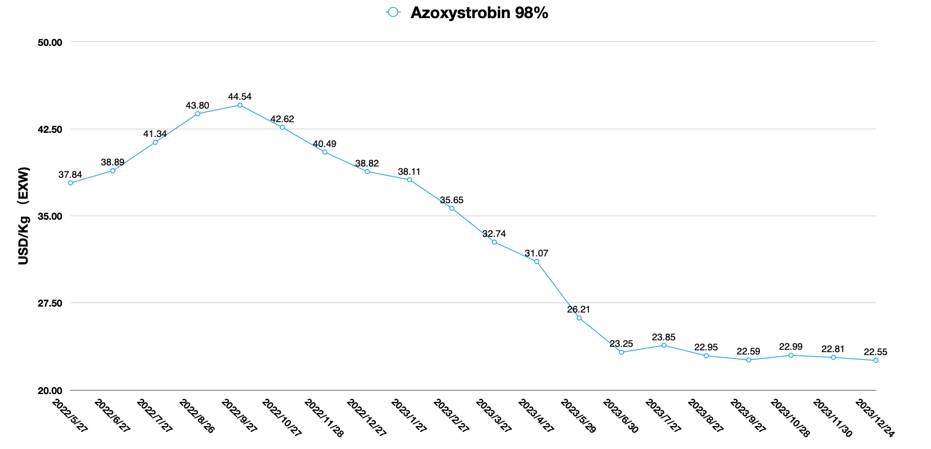

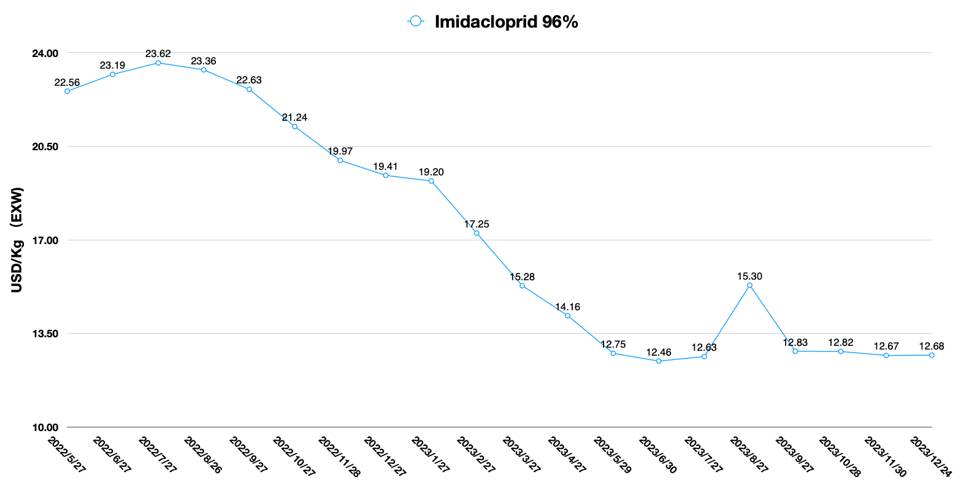

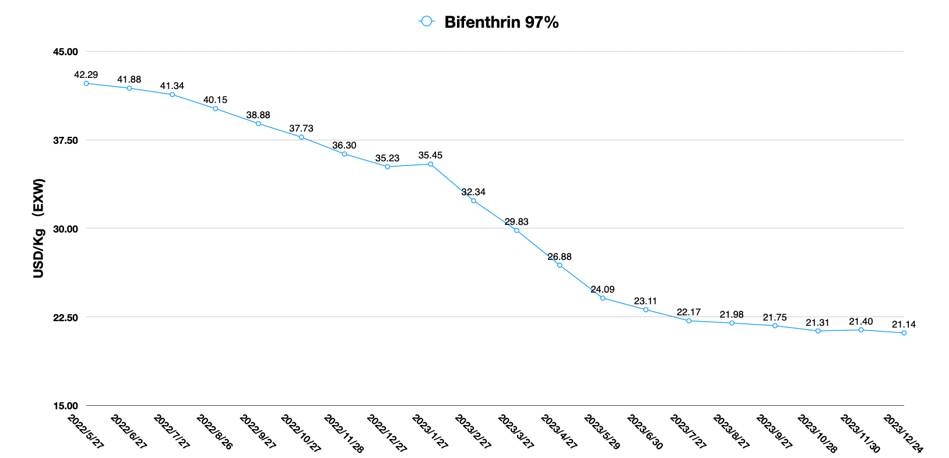

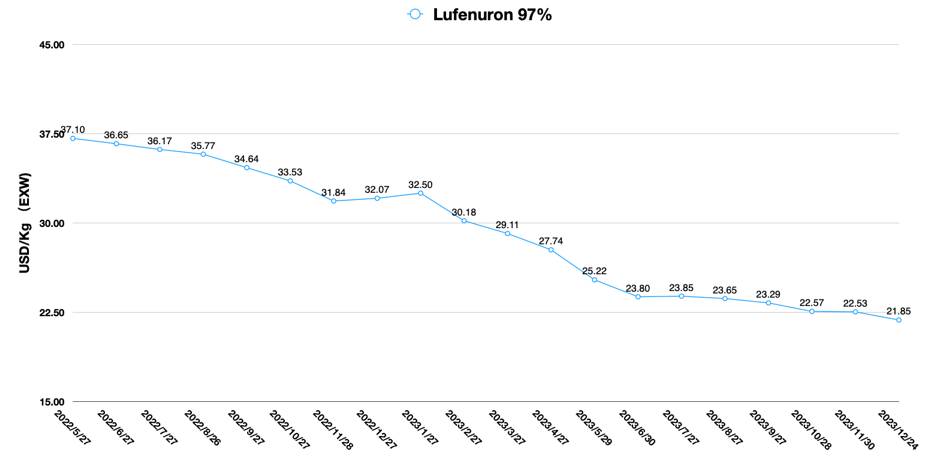

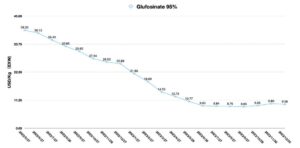

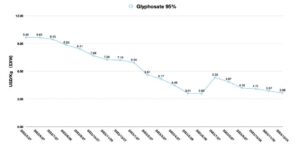

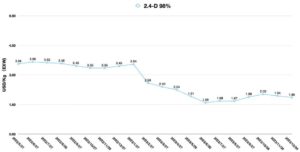

Editor’s note: Contributing writer David Li offers a snapshot of current price trends for key herbicides, fungicides, and insecticides in the Chinese agrochemical market in his monthly China Price Index. Below he also provides insight into how global crop protection companies will need to adjust their supply chain strategy in 2024.

The Year of the Dragon, the Chinese New Year, is fast approaching. In the Chinese mind, the Year of the Dragon will have dramatic change. It also signals that 2024 is likely to face many opportunities. For crop protection practitioners, it could be a year of beginnings for a new era.

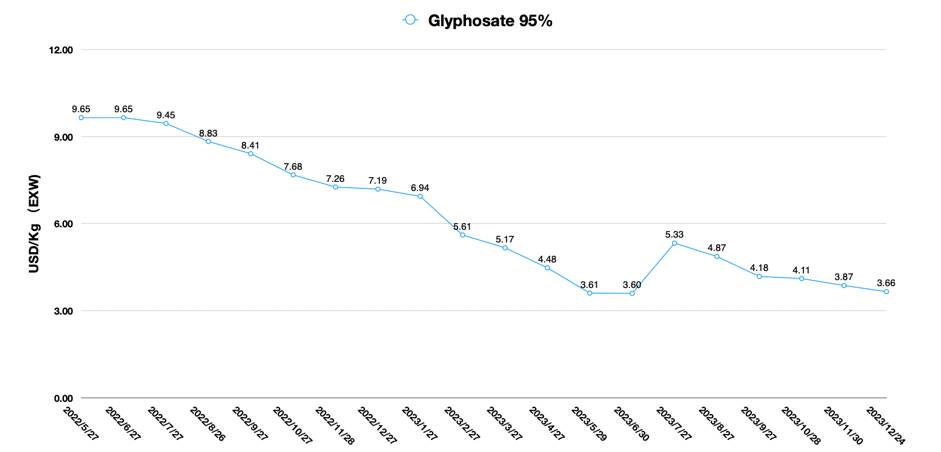

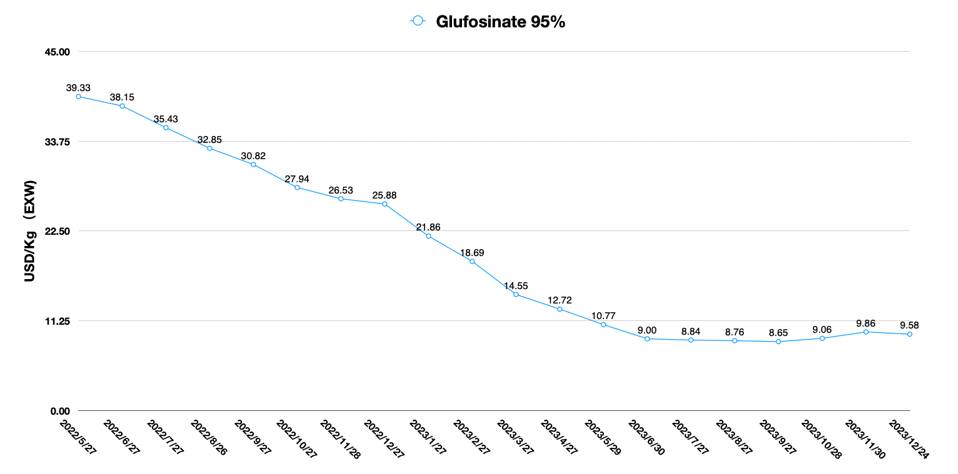

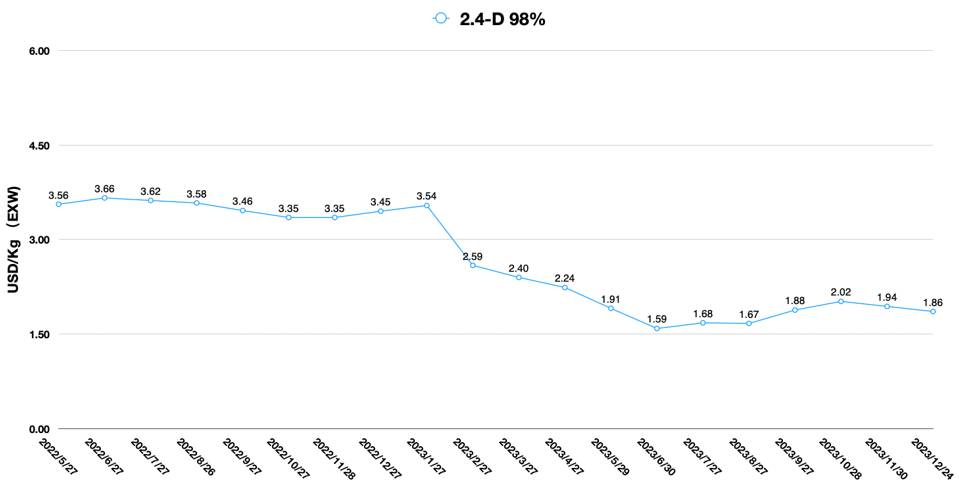

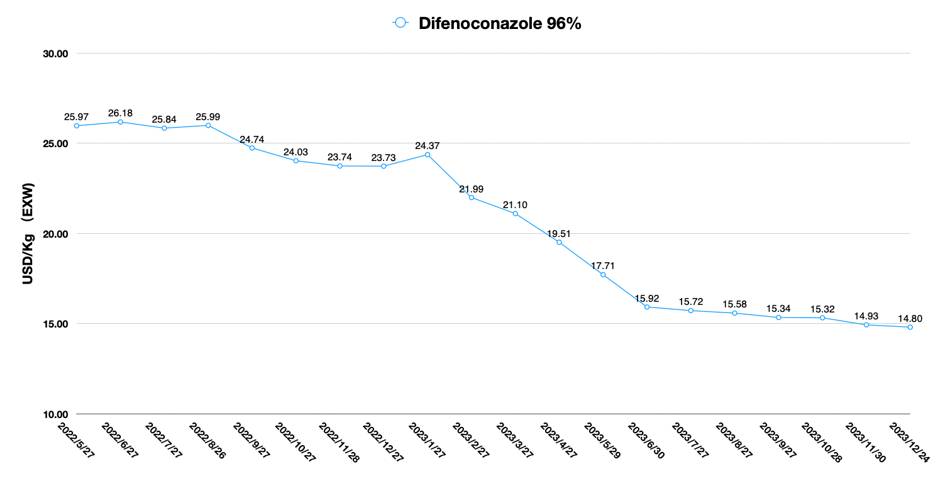

In 2023, China’s pesticide industry can be summarized by two words: overcapacity and price collapse. Faced with a complete competition market, global supply chain teams may be facing one of the toughest questions of all: how to re-organize their China supply chain strategy?

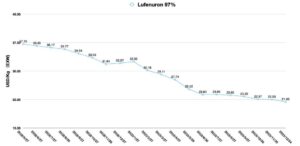

The overall supply chain framework for overseas crop protection companies consists of three main components: First, the market dimension. This includes the establishment and management of standardized corporate processes, the management of product categories, and the setting of reasonable supplier tiers.

Chart 1: Three Dimensions of Supply Chain Framework

The second is the enterprise dimension. This includes more accurate forecasting of sales demand, more accurate grasp of the future supply trends of key raw materials while controlling the supply risk. Inventory planning is the most important, as it directly affects the execution of product supply and sales. Accordingly, proper inventory planning will have a greater impact on profitability. Moreover, risk variables had to be managed during the execution of supply chain strategies, such as the release of new capacity from suppliers, the emergence of new suppliers from China, fluctuations in raw material prices, fluctuations in freight cost, and the long-term impact of geopolitics on supply.

The third part is the supply dimension. This includes category management of raw materials. Based on market demand, crop protection companies need to adjust the weighting of category volume and category importance. In order to minimize the business risk of a crop protection company, rationally assessing the capital investment would be necessary. In the environment of global climate change and uncertainty in market demand, there is a shift from asset-heavy to asset-light for optimizing supply chain. How do you utilize the capital investment of Chinese companies and nest them into the competitive advantages of crop protection companies? This is a question to be considered deeply.

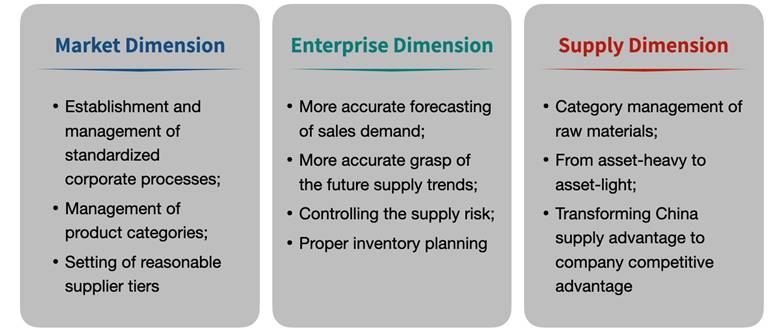

From 2022 to 2023, the crop protection market shifts from high inventory to de-inventory. Availability of goods is becoming increasingly important in supply chain strategies. An important initiative to stimulate channel consumption is to provide farmers with the products they need. The shift in demand is forcing adjustments in channel distribution strategies. If we make a quadrant of inventory levels and availability of goods, the crop protection market in 2024 is moving from the “High Inventory + High Cargo Availability” to the “Low Inventory + High Cargo Availability” quadrant.

Chart 2: Quadrant Diagram of Stock & Goods Availability

De-stocking takes place over a certain period of time. For crop protection companies, the de-stocking strategy is based on three main aspects: First, it is to speed up the turnover cycle of the supply chain. From the Chinese pesticide supply market, we can easily see that crop protection companies, including multinationals, are decentralizing their long-term purchase orders into smaller batch orders. This is on the one hand used to cope with the continued low prices of pesticides in China together with the uncertainty of market prices after the expansion of new production capacity. On the other hand, it can also speed up the turnover of goods in the supply chain of enterprises, thus reducing the overall cost of the supply chain.

Second, crop protection companies need to manage uncertainty in the supply chain. The first step is to improve the accuracy of sales forecasts. Although it is difficult to achieve 100% accuracy, this strategic direction at least puts pressure on the sales team. In addition, sourcing and procurement teams are stepping up to monitor changes in the Chinese market. The competition between traditional and new suppliers in China is pushing the rearrangement of supply chain resources in China. To sustainably gain the advantage of China’s supply chain is the key to determine the break-out from the fierce competition in the market in 2024. The recent increase in uncertainty in the Red Sea region has led to a 200% increase in freight rates on European routes compared to the same period last month. Freight rates on the China to North America route also increased by around 140%. The uncertainty of shipping cost globally is increasing.

Chart 3: Freightos Baltic Index (FBX)

In addition, some overseas distributors are actively strengthening their China supply chain teams in terms of human resources. For example, some North American distributors are willing to expand into the South American market and therefore need to increase their diversity of product categories. It requires more senior China supply chain teams and sourcing teams to join them. At the same time, the supply market intelligence team is becoming more and more critical in the overall supply chain system. Inside of today’s international crop protection companies, the sourcing team and the supply market intelligence team are two indispensable cornerstones of success. Correspondingly, the introduction of new teams will bring about changes in organizational behavior. Decision-making mechanisms will be influenced. The accuracy of the organization’s predictive analytics for the future will be invaluable for supply chain decision making and supply chain cost savings.

In 2024, the timing of global demand is likely to be in the Q3 to Q4. In addition to controlling inventories, the timing of purchases also needs to be evaluated. As prices bottom out in the Chinese supply market, many manufacturers are adjusting their operation rates in response. Due to the bullwhip effect in the supply chain, the prices of upstream raw materials and intermediates are moving inversely to the downstream AI market. After experiencing lower demand in 2023, raw material and intermediate manufacturers will see their operation rates decrease accordingly with sluggish downstream demand.

Therefore, in the early stage of overseas demand release in 2024, China’s raw material supply market is likely to experience a process of price hikes. However, with the full release of supply capacity in the market, the supply price will still return to the reasonable range of supply-demand balance. Timely supply and procurement cost savings will become a trade-off for crop protection companies.

In terms of sales regions, the European market is likely to see an early arrival of demand due to the Red Sea crisis. The North American market is likely to see more optimistic demand than expected after getting back on track. South American demand and Asian demand will be released smoothly. The price advantage and scale effect of Chinese pesticides will save more cost for global farmers for the 2024 planting season. In addition to AIs, the capacity of near-off patented AIs will be released centrally in 2025-2026. In the long run, the adjustment and change of layout of global crop protection companies in China’s supply chain remains inevitable.