5 Factors Propelling Growth in the Global Crop Protection Market in 2021

As 2020 drew to a close, few in the industry were sorry to see the end of it. The disruptions caused by COVID-19 are too many to mention, and the impact on the overall growth dynamics of the sector are significant. At the beginning of 2020, much like the start of 2019, the year ahead looked to be very positive. A strong recovery in the North American crop protection market was anticipated, and any negative impact of COVID-19 at that point was restricted to mainland China. By March 2020 that outlook had changed with the WHO declaring the coronavirus outbreak a pandemic.

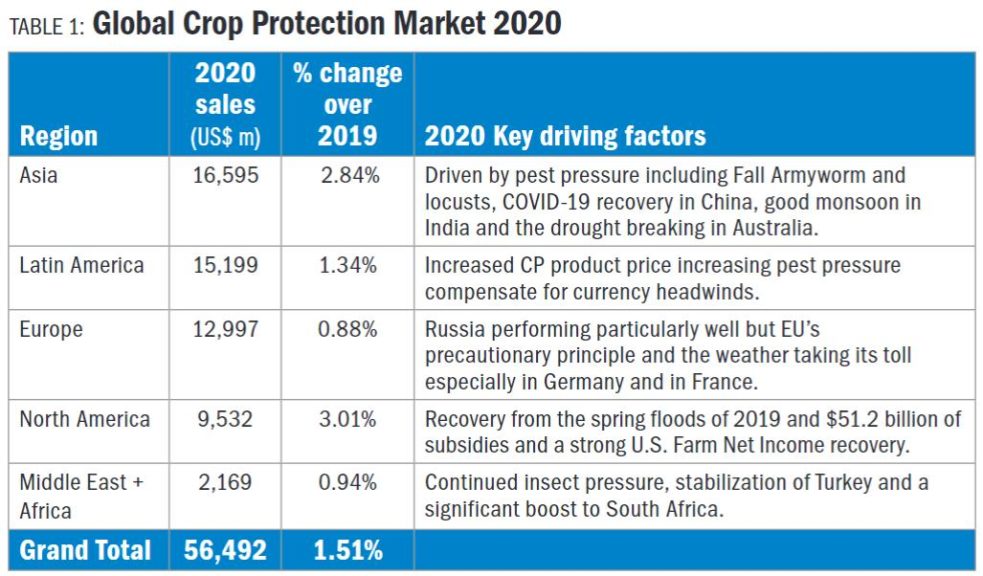

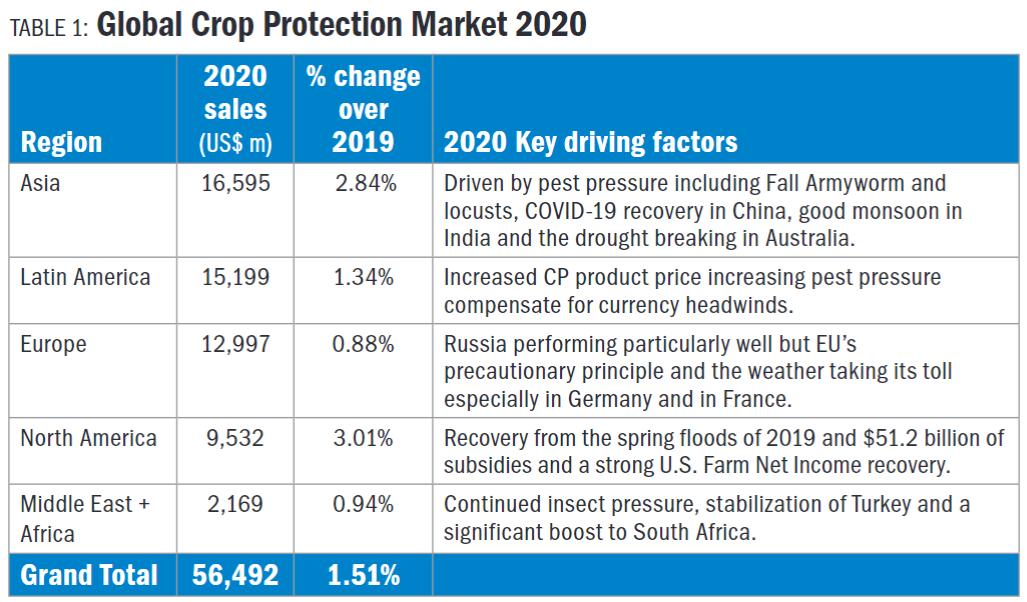

Despite COVID-19, however, the global crop protection market still registered a modest growth of some 1.5% in 2020 to reach just under $56.5 billion. The growth areas (Table 1) were broad with the exception of Europe. While generally favorable weather and increased pest pressure were key drivers for that growth, the range of COVID-19 fiscal responses from governments globally was also key in offsetting pandemic related losses.

Measured at ex-company level and using average-year exchange rates; preliminary market estimates as of October 2020. Source: Kynetec – AgMarket Insights Division

By example, latest estimates indicate that some $51 billion of subsidies were provided to U.S. growers in 2020 along with the European Union, China, and India were also among nations providing significant immediate fiscal support for growers. Despite this, and despite the fact that most countries excluded farming activity from any lock-down restrictions, there was still an impact on the agricultural economy, largely due to logistics.

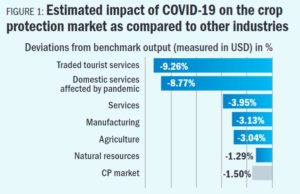

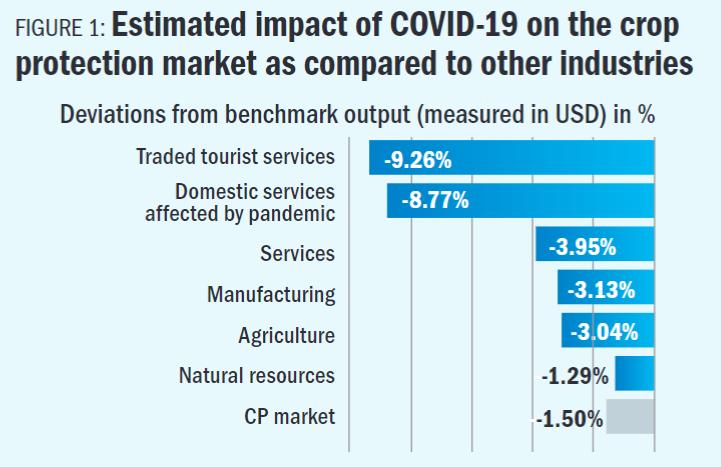

Source: World Bank research study – “The potential impact of COVID-19 on GDP and trade-2020.” Impact (over and above anticipated 2020 growth/decline). Crop protection (CP) market estimates by AgriGlobe on various key assumptions.

Estimates early in 2020 by the World Bank (Figure 1) indicated that COVID-19 would decrease the global output of agriculture by about 3% over-and-above that which would otherwise have occurred. The knock-on effect for crop protection is estimated at in the range of -1% to -1.5% and felt mainly in the treatments for perishable fruit and vegetables.

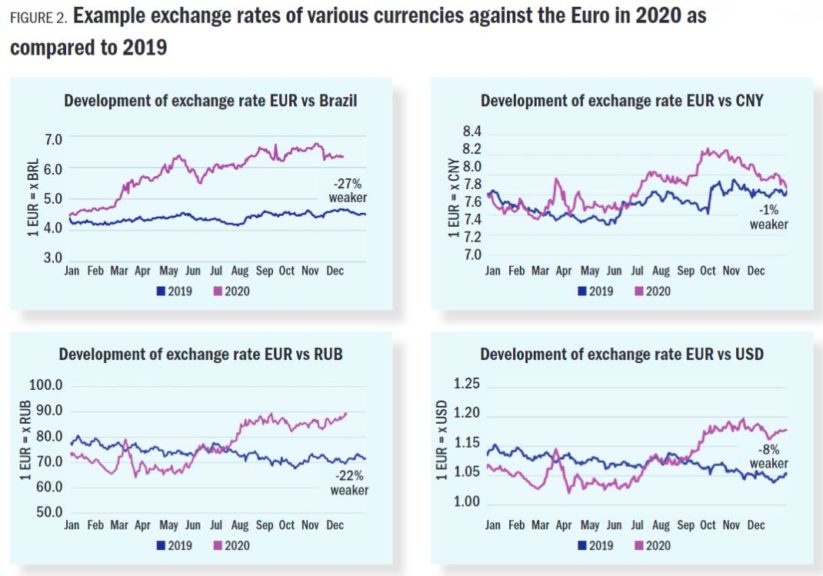

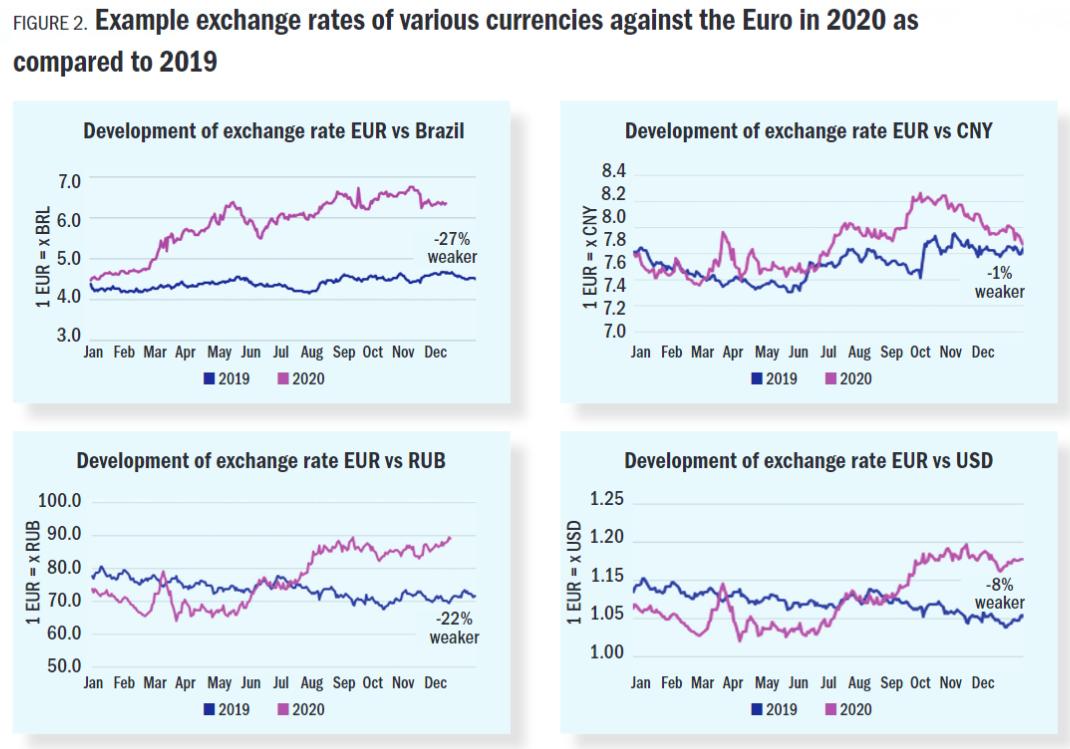

COVID-19 was not, however, the main financial headwind for 2020 for crop protection businesses. More significant than the pandemic was the continual erosion of global market value through currency devaluation. Currency fluctuation is nothing new, especially in Latin America. However, the scale of it in 2020 was especially significant. Another unusual feature in 2020 is that rather than the U.S. dollar, it was the Euro that gained most against other currencies; especially since July. The net effect, for example, being that for a Euro reporting company the value of sales in Brazil when converted to Euros would have been some 15% to 20% less in 2020 as compared to 2019; all other things being equal (Figure 2).

Clearly companies mitigate some of this potential loss via a range of financial and non-financial mechanisms, including hedging, payment terms, pricing, locking in, portfolio, and retail management. However, the impact of currency devaluation and the weakening of the safe-haven status of the U.S. dollar continues to impact the reported sales of all the multinational companies.

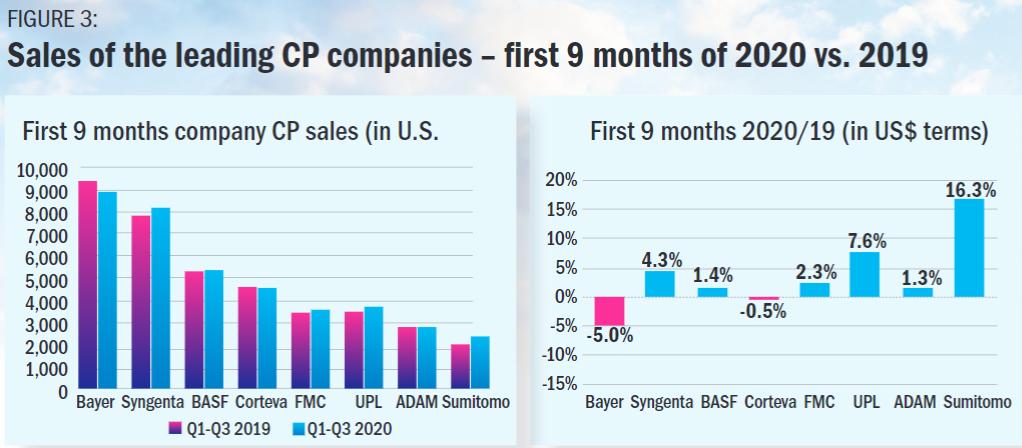

As of the time of writing, there remains limited time for additional 2020 sales by companies with full-year results still pending those final sales. The latest comparable set of results are up to Q3 representing the first 9 months.

While the combined sales growth of the leading companies (Figure 3) at just under 1% is less than the estimated 2020 growth of 1.5% (as in Table 1 above) the relationship is complicated by numerous factors including intercompany selling and distribution loading. In addition, the smaller companies on the whole are growing significantly faster than the multinationals. For example, ICAMA reported that the nine-month pesticide export value through September 2020 out of China rose 14% in U.S. dollar terms compared to 2019.

Source: Kynetec – AgMarket Insights Division estimates, Company reports. Data is presented in nominal terms and expressed on a pro-forma basis where possible with the exception of Sumitomo where pro-forma estimates following the acquisition of the Nufarm LATAM business are not available.

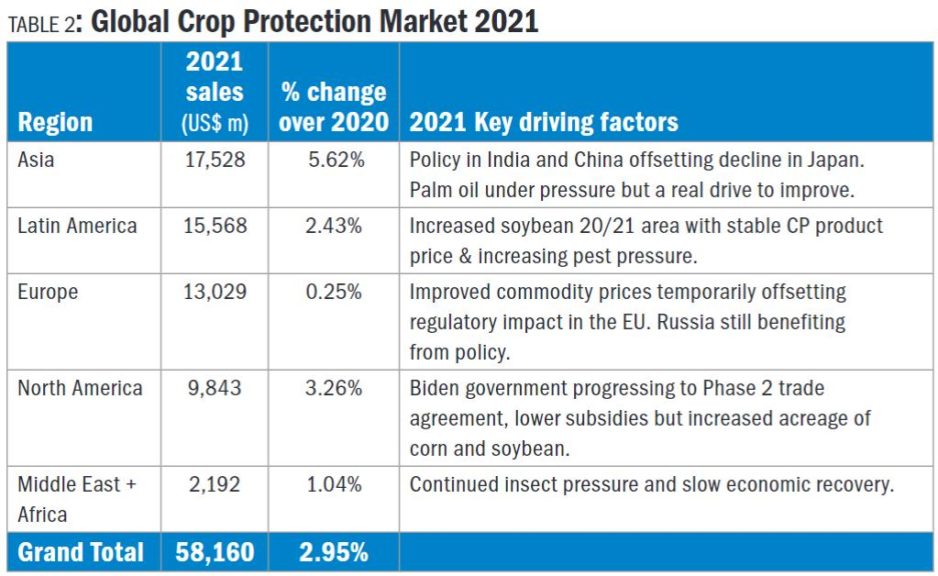

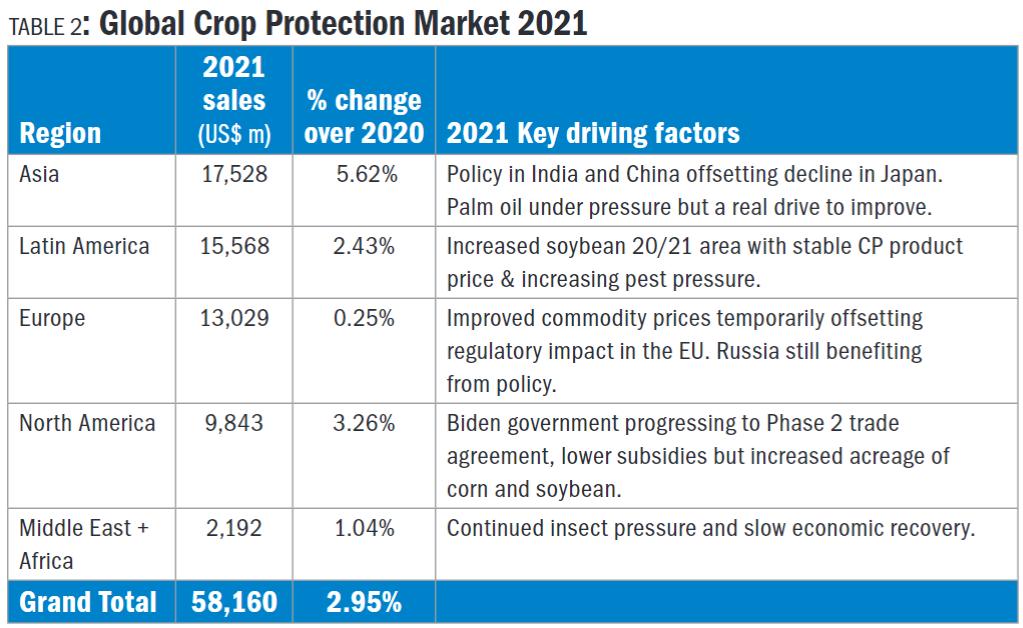

With a turbulent 2020 finished, focus turns to “What will the 2021 campaign look like?” Fearful of jinxing the result and bearing in mind the change in fortunes of both 2019 and 2020, the outlook for 2021 at this point in time looks robust. While actual data on the 2021 market is still some months off, many of the fundamentals for growth are in place as referenced in Table 2.

Measured at ex-company level and using average-year exchange rates. Estimates made at the end of October 2020. Source: Kynetec – AgMarket Insights Division

Giving those fundamentals some relative importance, the Top 5 would include:

1. Continual improvement in commodity prices is anticipated as prices firm on tight stocks. This will be driven by corn and soybeans. Chinese demand, depleted stock levels, and a marginal reductions in 2020 output levels are set to reverse the situation as seen over the last five years of global surpluses and often extreme market price volatility.

2. Global Crop Area will continue to develop in-line with predictions. In Brazil CONAB’s November 2020 estimated area of the 20/21 soybean crop is now 38.3 million ha, close to 4% up on the 19/20 plantings. Corn acreage is stable at 18.4 million ha. In India all indications are for an increase in area of the 2020/21 Rabi season with the latest USDA estimates indicating that U.S. growers will plant 90 million acres of corn (down slightly on 2020) but close to 89 million acres of soybean some 6 million acres more than in 2020. In the EU then the latest estimates by COCERAL indicate that the EU wheat production will rebound as areas recover.

3. The Global Economy will rebound by +5.2% as forecast by the IMF in the latest October 2020 update. Though reduced from previous estimates, the current rebound of the Chinese economy from the COVID-19 pandemic is evidence of economies starting to rebuild. The roll-out of the different COVID-19 vaccine across the globe and starting in Europe will help build economic recovery and the €1.8 trillion seven-year budget and coronavirus recovery fund finally unblocked after Hungary and Poland lifted their objections.

4. In 2021 agricultural policy should remain on the whole positive. A key assumption will be that the Phase 1 Trade Agreement between China and the U.S. holds and that a Biden government moves substantially toward a Phase 2. The reinstatement of GSP to India is assumed probable. “Greening Policy,” however, within the EU remaining negative as is the over-regulation of the EU re-registration process with several key active ingredients set to face non-renewal in 2021. A Brexit trade agreement now considered likely as both sides slowly resolve outstanding differences.

5. ENSO neutral conditions now developing into a strong La Niña which is expected to continue into the 2nd quarter of 2021 (c. 60% chance). La Niña conditions typically reduce rainfall the southern U.S., India, southern Brazil, northern Argentina, eastern China, the Korean Peninsula, and southern Japan. Conversely La Niña conditions typically increase rainfall in Southeast Asia, Southern Africa, southern Central America, northern South America, in southernmost India, Australia, and Indonesia. While a La Niña can on-balance be positive it does carry an extra degree of weather related risk and uncertainty.