China Price Index: Production Costs Fuel Higher Agrochemical Prices in December

In the short term, the best strategy to managing supply of agrochemicals is to analyze pricing trends of individual products. The cost savings can enhance our profit margin as a key KPI of sourcing strategy. During such procurement action, managers might need to analyze environment factors, for example, the trend of global agriculture, logic of downstream demand like protein and animal feed, global trends in chemical raw material supply and behavior analysis of suppliers. If we have all the information we need, is it possible to precisely predict price trends of agrochemicals? Is a price-only mentality the best way to approach global supply chain management?

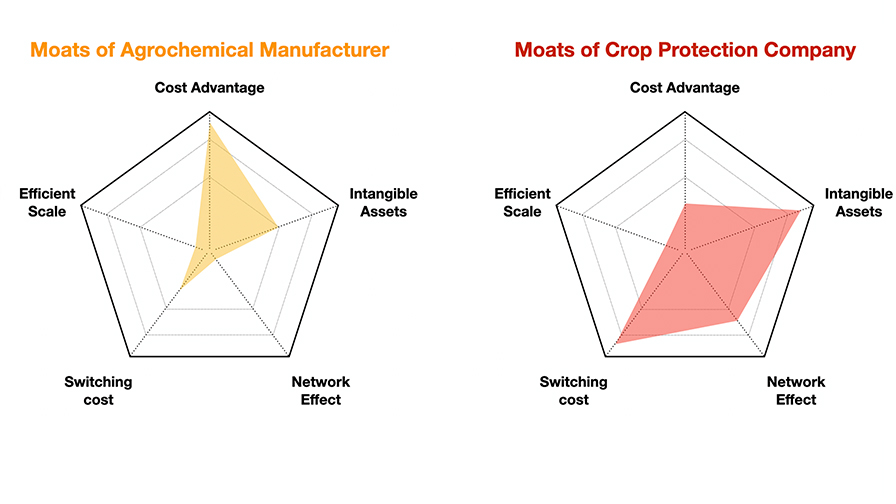

The agrochemical industry is a commodity-based business. Global suppliers are the raw material providers to distributors around world. The commodity-based business is unable to be differentiated. Moats in agrochemical production are rare to see. The law of supply and demand set the price of agrochemical products. The game of balance is the most complicated part for every player.

It is almost impossible to build a moat for agrochemical suppliers that mainly produce off-patent agrochemicals. They focus on the cost advantages. That’s the reason why some China manufacturers were trying to run 100% operation rate for re-production in 2020. All the action with one clear goal is saving cost.

The status for multinational crop protection companies is different from agrochemical suppliers. Most multinational crop protection companies were built by the intangible assets on genetically modified (GMO) seeds and patented molecules. Innovation allows multinationals to switch or embed costs, for example, using GMO seed and companion chemistries to establish an integrated program. The digital farming and precision agriculture are strengthening such network effects as well (Figure 1).

Figure 1.

The moats make us think about the model of supply and demand between agrochemical manufacturers and multinational crop protection companies. Purchasing has already been transferred into supply management more deeply than ever. In 1983, author and purchasing strategist Peter Kraljic argued such topic and established the Kraljic Matrix in an article for Harvard Business Review. Segmentation of suppliers and strategical thinking about supply are hallmarks of sustainable supply relationship.

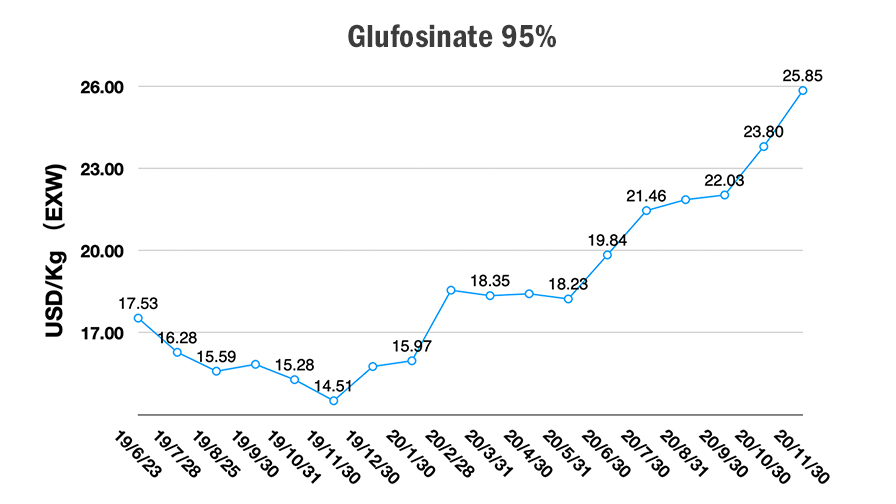

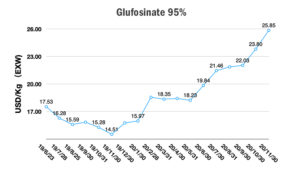

Chinese suppliers are material providers as part of customer’s multiple sourcing strategy. The price and supply timing are the critical factors to manage. When there are fewer suppliers in the market, there is potential for a bottleneck. In glufosinate and L-glufosinate supply, for example, it is difficult for vendors to control availability. The relatively few suppliers of glufosinate force distributors to secure comparatively high inventory as a precaution because few backup plans are available. Only strategic demand insight and precise sales forecasting can minimize the risk of supply.

Obviously, COVID-19 challenged the global supply chain, and a new order is emerging.

From March 2020, the supply of raw chemicals was in a challenging situation. The pandemic brought heightened demand on sterilization products and materials for the medical industry. The need to control COVID-19 occupied upstream around 30% of acetone supply following the strong demand on isopropanol. A similar situation happened on the chloride chemicals as well. This situation persists as COVID-19 and its variants continue to spread around the word and strains global supply chain management.

On the other hand, there are four new key factors which are influencing China supply by the end of 2020:

- Exchange rate: The exchange rate of USD to CNY was changing 8.7% from 7.1617% on May 27 to 6.5411% on December 11. The changing of EX rate squeezed profit margin for China exporting suppliers.

- Global supply risk on international transportation: The pandemic continues to bring challenges to international transportation. Limitation of shipments is driving the costs of freight more than 10 times higher than pre-pandemic levels in some ocean transportation lines. Air transportation is being affected, too, because of limitations on lead times. For global buyers, the uncertainty of shipment increases the complicity of lead-time management and DSI (Days of Safe Inventory) management. The DSI affects cashflow on a company’s balance sheet, which means additional cost of capital.

- Domestic demand is booming: China domestic chemical market is showing its resilience. The local market demand is strong in different chemical industries, which encourages local suppliers to adjust their customer structure. The strong inquiry from other advanced chemical industries also took up some portion of chemical raw material supply to the agrochemical industry.

- Supply chains are becoming more diverse and increasingly localized when possible.

According to the “Designing Resilience into Global Supply Chains” by Boston Consulting Group, many global enterprises have been moving toward regional manufacturing and sourcing footprints in order to be closer to end markets. China factories serve the China domestic demand. And global production sites can balance the risk of global transportation and tariff between U.S. and China.

This near-shoring had already begun before the pandemic. Since 2017, China’s environmental protection audit prompted some companies to look for new sources while capacity was being rebuilt. The multinational companies had already prepared for risky fluctuation of global supply more than three years before.

So while China supply will continue to be an important part for global supply chain, regionalized supply chain will be the new balance for global business. COVID-19 could be an enzyme to accelerate this new dynamic.

In China ancestry dating back about 5,000 years, 2020 is a year of Gengzi, which appears every 60 years. Gengzi brings change and uncertainty, which is cyclical. It definitely lived up to its prediction, and 2021 will be the year of Xin Chou (metal ox cow), which promises ample spring and summer rains and good harvests.

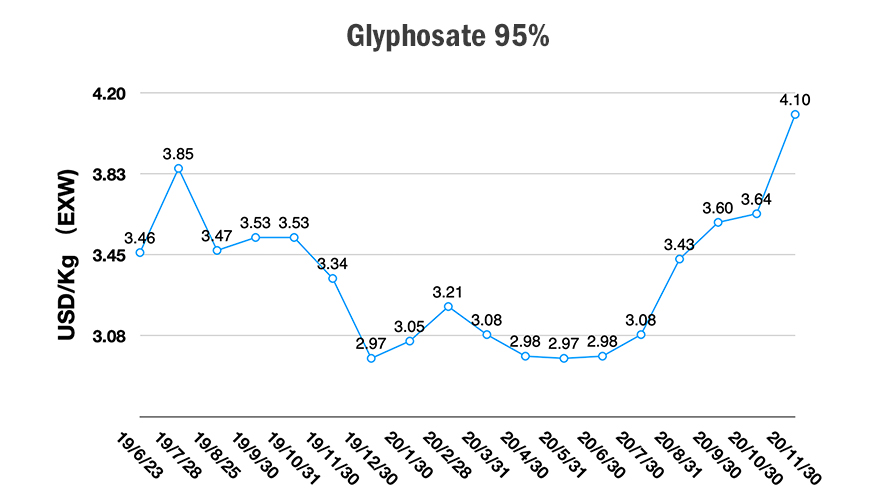

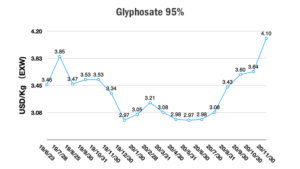

With the Chinese Spring Holiday approaching, formulators and traders in the China domestic market are preparing to have ample and well-priced inventory available for next season. Raw material prices are increasing, and the prices of many agrochemicals from China are heading up. Glyphosate prices, for example, are being driven up by price increases in PIMIDA, which will be reflected in higher prices in the next couple months. Considering the existing inventory in the global market, international traders still hold some low-cost glyphosate in the channel, so it could take some time for prices to be felt downstream.

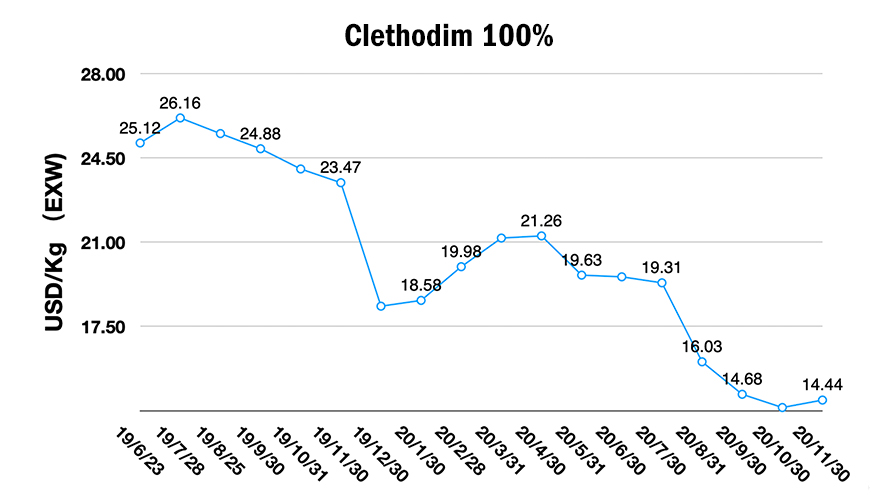

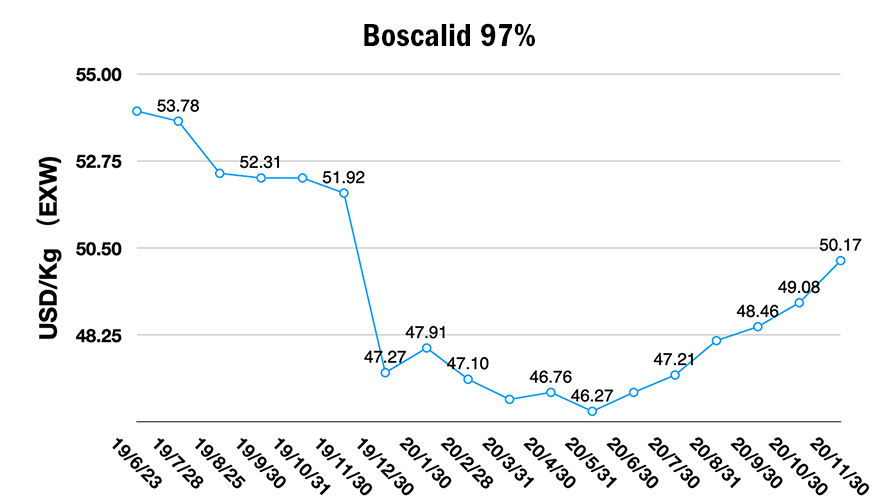

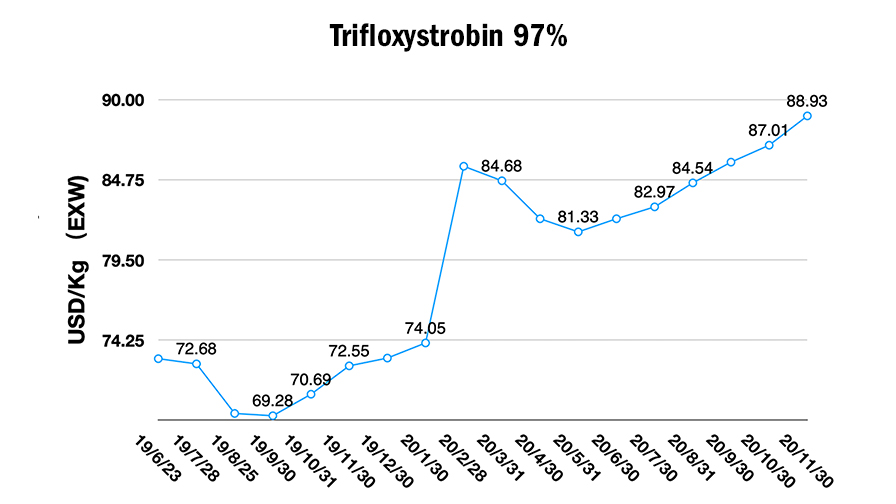

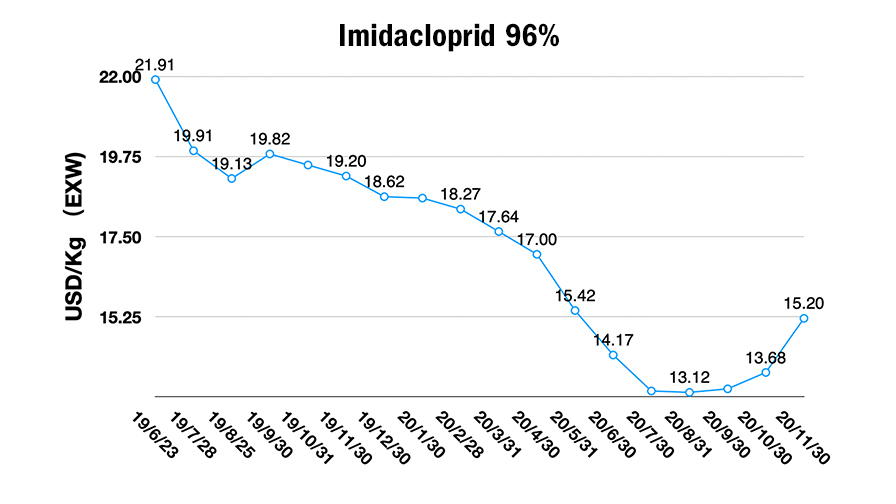

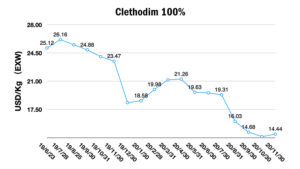

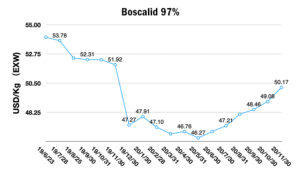

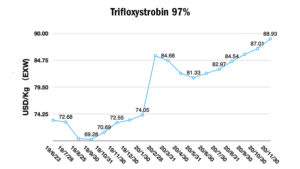

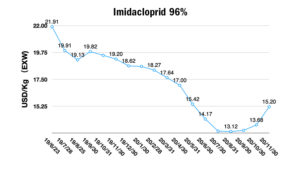

Additionally, clethodim’s raw materials are rising, but despite higher cost of production, high competition in this space could keep margins and prices low. Triazole fungicide prices are expected to climb, too. Kresoxim-methyl and trifloxystrobin are under low production rate. The price of CCMP, the key intermediate of imidacloprid, has been on the uptick for some time, and neonicotinoid insecticides has been trending up since September 2020.