China Price Index: How Agrochemical Companies Can Thrive During Disruption

Editor’s note: Contributing writer David Li offers a snapshot of current price trends for key herbicides, fungicides, and insecticides in the Chinese agrochemical market in his monthly China Price Index. He also provides insight on how global challenges are forcing companies to rethink their supply chains and business operations.

One of my favorite books is “Up the Organization” written by Robert C. Townsend. His timeless wisdom continues to remind us not to get mired in sacred organizational routines that strangle profits and profitability. During the disruptive noises around the world, some different principles can help stakeholders in ag-input market take a leading role in protecting enterprise margin and growth. The key is how we free up high-value talent for the most strategic activities.

Currently, the global buyers are facing internal and external influences when dealing with agrochemical sourcing from China.

The external issues include geopolitical instability and conflicts that result in unstable supply chains and unpredictable timelines for international transportation. The global shortages of potash and some key fertilizers are the consequences of those issues. And the disruption of supply chain like lockdown of Shanghai brought high-level risk to the procurement leaders around world. The sudden lockdown shook the confidence of global supply chains on the availability of Chinese supply. The most worrying thing is the risk of supply chain volatility with so much of the industry centered in China.

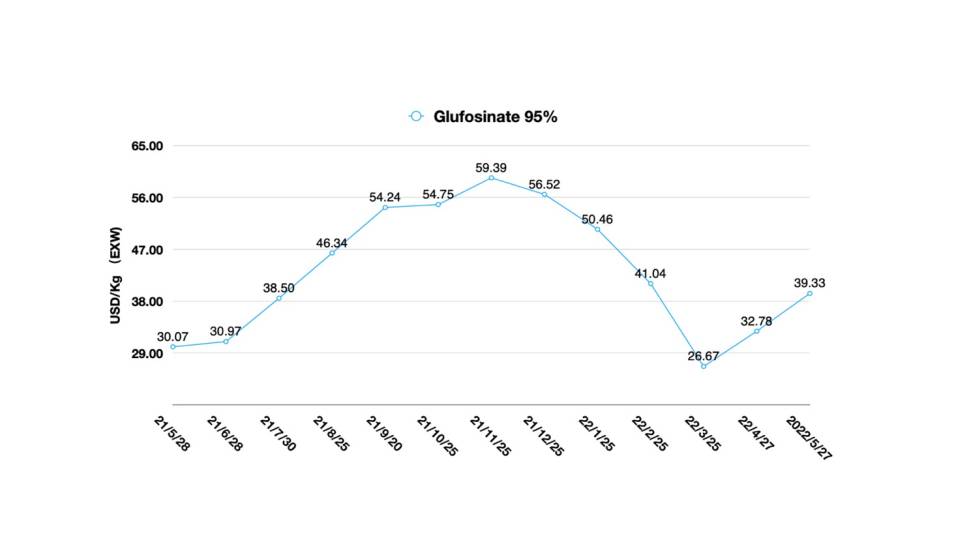

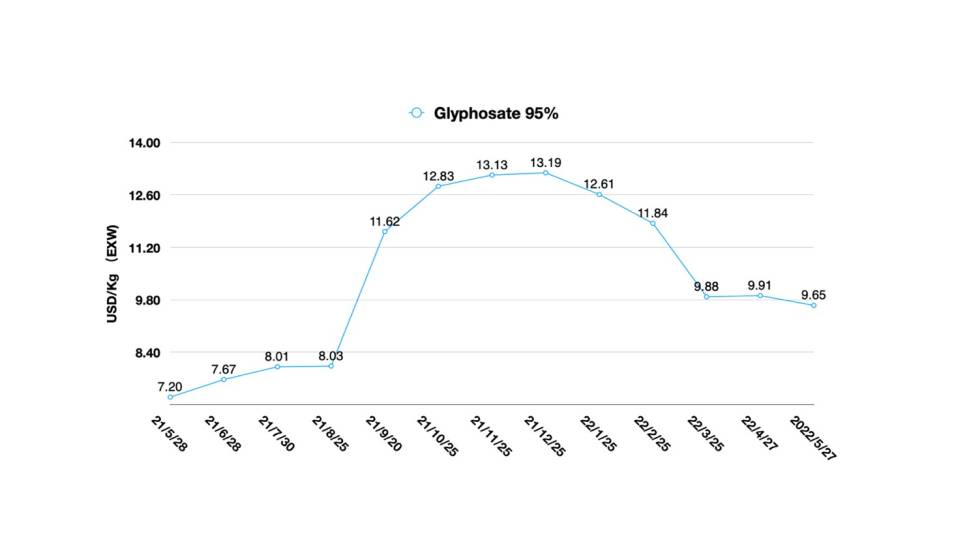

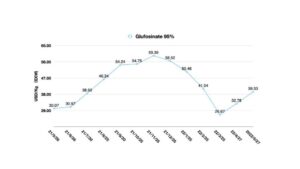

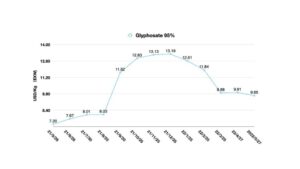

Internally, companies’ portfolios need to change along with the volatility of the supply chain. Mature and long-tail products can be supplied continuously and allowed to have flexibility through the offshore supply chain. For a company’s strategic product lines or newly launched product lines, timely supply must be ensured. Is the future of China’s supply going to be in the direction of only bulk portfolio supply like glyphosate and glufosinate? This is still a question that needs to be weighed.

According to China’s customs statistics, from January to March 2022, China exported 532,500 tons of products under 3808, down 8.79% YOY, with an export value of $2.834 billion, up 63.86% YOY. The average unit price increased 79.73% YOY.

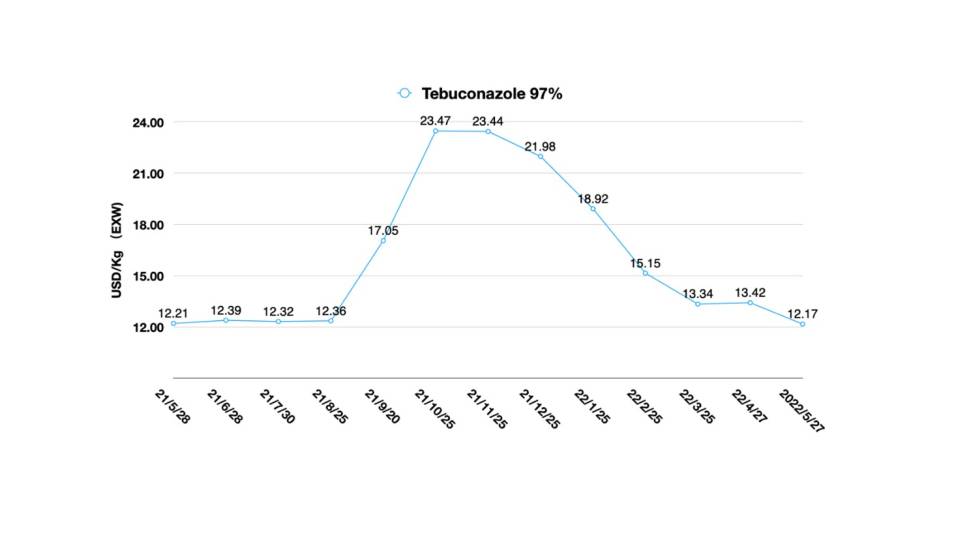

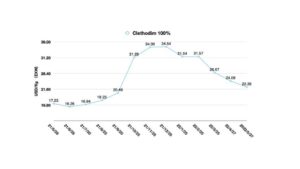

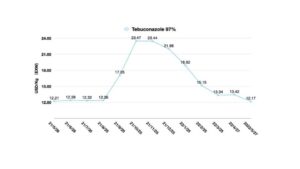

In terms of specific commodities, herbicides were the most exported with 372,700 tons leaving the country, down 0.12% YOY. The value of those exports amounted to $2.068 billion, an increase of 107.74%. Among the main export markets for herbicides were Brazil, Australia, the United States, Nigeria, and Ukraine. The second exported products were insecticides. The export volume of 80,900 tons was down 3.7%, while the value amounted to $418 million, an increase of 16.21%. The main export markets for those products included Brazil, Thailand, Indonesia, Vietnam, Bangladesh, and Peru. For fungicides, the export quantity of 29,700 tons was down 6.32%, but the value for those exports was up 21.34% at $221 million. The main export markets for fungicides include Australia, Ukraine, Indonesia, Brazil, Vietnam, and Kenya.

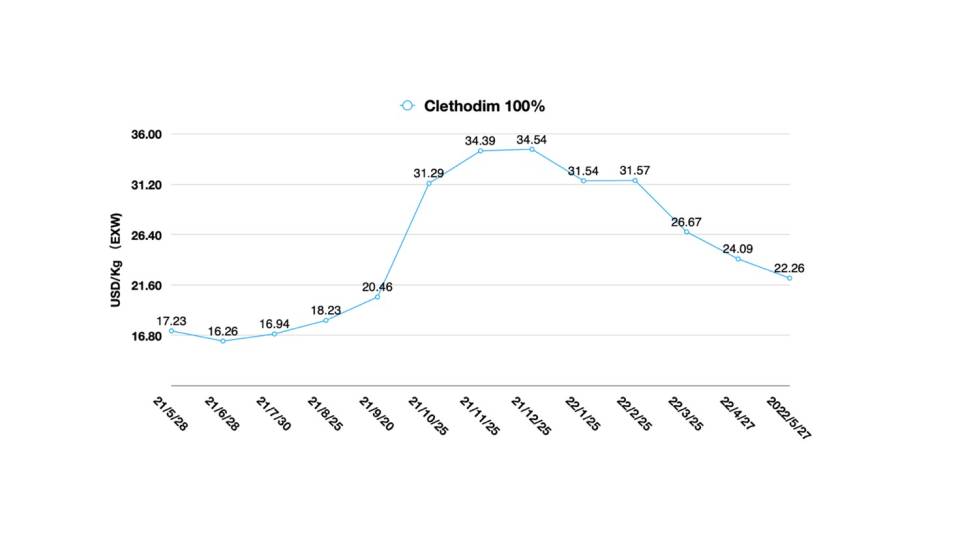

The cost of goods sold (COGS) of key agrochemicals from China seems strong for stocks at the beginning of 2022. The risk to corporate capital is then elevated. In June and July of 2022, the Federal Reserve has worked to control inflation by raising interest rates twice by 50 basis points (with at the time of this article the possibility of more increases). This will make the agrochemical distribution companies, especially in emerging market countries, riskier to operate. Capital itself has a cost, and the cost of capital has become more expensive along with the total COGS. The total COGS may go up even more after the rate hike. This produces two possibilities: One is that companies need to increase supply chain flexibility, save inventory costs, and thus reduce capital possession. The other possibility is that promotions may become more intense in the 2023 sales season. The return of funds might be a future issue for companies to face.

In times of change, it is very difficult to make the right decision at the right point in time ― not only for companies without a branch office in China, but also for multinational companies even with independent intelligence teams may have very different insights about the market based on the almost similar database.

In times of change, it is very difficult to make the right decision at the right point in time ― not only for companies without a branch office in China, but also for multinational companies even with independent intelligence teams may have very different insights about the market based on the almost similar database.

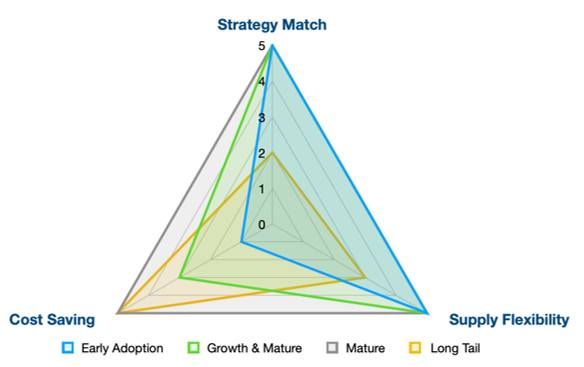

Enterprise decisions will always be based on internal strategies designed to achieve a long-term market goal. Normally three key weights come to mind: Strategy Match, Supply Flexibility, and Cost Saving. Depending on the lifecycle from cradle to grave, the sourcing strategies adopted for the different stages of product launch are completely different. During the early adoption period, strategy importance and on-time supply are top priorities. When brand portfolios became mature, the sourcing team starts to add alternative sources to leverage the price and risk of supply. Long-tail generics are always facing strong competition from Chinese suppliers, so the license-out or asset trade to generic companies might be the best options.

These three key factors are specific to different product lines and may involve dozens of active ingredients (AIs), as well as dozens of co-formulations. Each AI is faced with at least two manufacturers from China or India. The need to make all the right decision for every permutation is almost a “mission impossible,” especially for non-multinational companies. Even with a branch in China, it is never easy to achieve success without a team of talents.

A McKinsey & Company article ― “Full-Potential Procurement: Lessons Amid Inflation and Volatility” ― stated the internal transformation is needed to protect the margin by the talent up the organization. The action plan of beyond the expectation of the company will be critical for company to get through the future economic recession. McKinsey listed the five points for talent resource to think:

- Take a leading role in protecting enterprise margin and growth;

- Step into the center of cross-functional value creation to apply a broad range of levers that put “everything in play” based on TCO (total cost of ownership) and life-cycle views of spend;

- Build deep expertise in supply market dynamics and supplier economics to become thought partners and innovation engines that optimize their operations through insight;

- Invest in proven technology and process automation to free up high-value talent for the most strategic activities; and

- If necessary, acquire talent who understand suppliers’ markets and industries and are strong category managers, negotiators, and relationship builders.

Cross-functional value creation and free up high-value talent for the most strategic activities are two of my favorites. Talented individuals take a lead when they feel they would be needed. However, the organizational structure and the improvement of the process may be the constraint of strategy transformation.

The real market is dynamic. Structuralism is definitely insufficient for strategy adaptability. When there is a fluctuation of price of glufosinate, is it because of shortage of supply? Disruption of supply chain? Sudden strong demand? Or just a tactical way to attract panic buying? Sometimes, the conclusion could come from naturalism analysis by verifications from a different angle of industry. Such capability of naturalism analysis can be recognized as “catalyst,” which can improve the efficiency of value creation and avoid mirage in internal system.

The future between China and the world will need countless successful builders who need to have such capability as a catalyst. However, since China’s reform and opening up in 1978, the cultural gap between the world and China has exceeded the economic gap between them, and this phenomenon shows no sign of improving, especially with the COVID-19 pandemic’s global impact. What I want to highlight here is that I am referring to traditional Chinese culture, the wisdom that has been imprinted in the genes of ordinary Chinese people and handed down in ancient Chinese books for thousands of years.

Countless individual decisions were used to educate the leaders on how to govern the bureaucracy with excellence throughout China’s history. The key to the success of any organization should be more than just the system. People, as a core variable, are also something that must be thought about deeply. The ability to predict human behavioral decisions is probably the highest level of strategic adaptability. In game theory, behaviors that are competitive or adversarial in nature are called game behaviors. In this type of behavior, the parties involved in the struggle or competition each have different goals or interests. In order to achieve their goals and interests, each party must consider the various possible courses of action of the opponent and try to choose the most favorable or reasonable option for themselves. Game theory on agrochemical industry is an interesting way of application.

I believe that both the Chinese manufacturers and the global buyers need the growth mindset proposed by Professor Carol Dweck of Harvard University. The future relationship between China and world is not just purchasing cargo by lowest price and making profit. The future would be an art of “investment,” View the sustainability of a company’s earnings from a long-term point of view and value investment perspective can look beyond the organizational structure to lead role in protecting enterprise margin and growth, by which the most favorable or reasonable option for both sides would rise up the organization.