China Price Index: January Prices Climb, Plus Three Trends That Define Agrochemical Sourcing in 2021

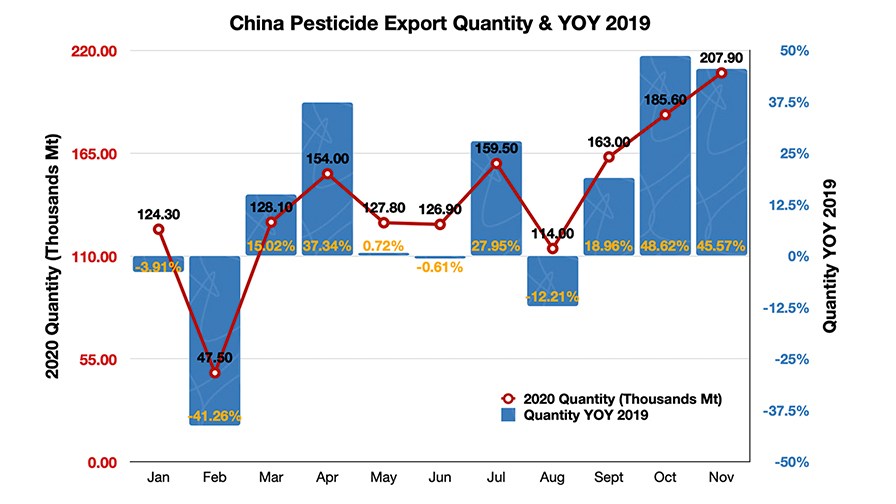

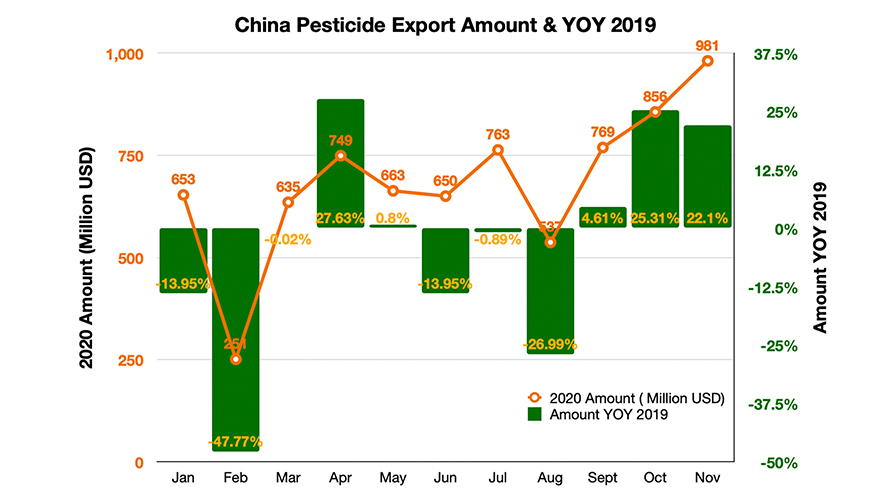

According to ICAMA’s public report, the data shows there was a significant jump in export volumes in November 2020. Due to the second wave of the pandemic overseas, multinational companies were pushing the delivery of the cargo in their supply chain from China toward the end of 2020. The “sudden transactions” during October of 2020 and November 2020 of agrochemical souring from China absorbed market inventory of active ingredients sharply.

Along with the global supply chain disruption by COVID-19, global crop protection distributors have been more cautious on lead times and have secured safe inventory to meet the demand of the approaching 2021 growing season. With many countries facing waves of infections and unpredictable lockdown scenarios following Christmas, supply chain teams have been trying to secure 2021 product needs since September 2020, when we saw an uptick in Chinese exports.

China’s production capacity has proved to be resilient, and production from China has run smoothly since Mar 2020 when its factories and labor emerged from its only widespread lockdown. The portion of China’s trading rose 4% to 20% of global trade. The fluctuation is creating a new balance between the demand for China’s trading and the capacity of vessels and containers.

Based on the data from the General Administration of Customs China, the accumulative volume of import & export cargo from January to November 2020 increased 7.2% YOY 2019. However, the accumulative inbound & outbound vessels from January to November were reduced 28.5% YOY 2019. The shortage of shipment and container capacity are the key reasons for freight cost heading up sharply.

The sudden resilience of China’s supply brought huge pressure to global ports with shipments jammed in key overseas ports. Moreover, the situation will become tougher along with the huge number of empty containers laying idle in overseas ports, including in the US and Australia. The ongoing pandemic and lockdowns in 2021 will create significant challenges for the global carriers.

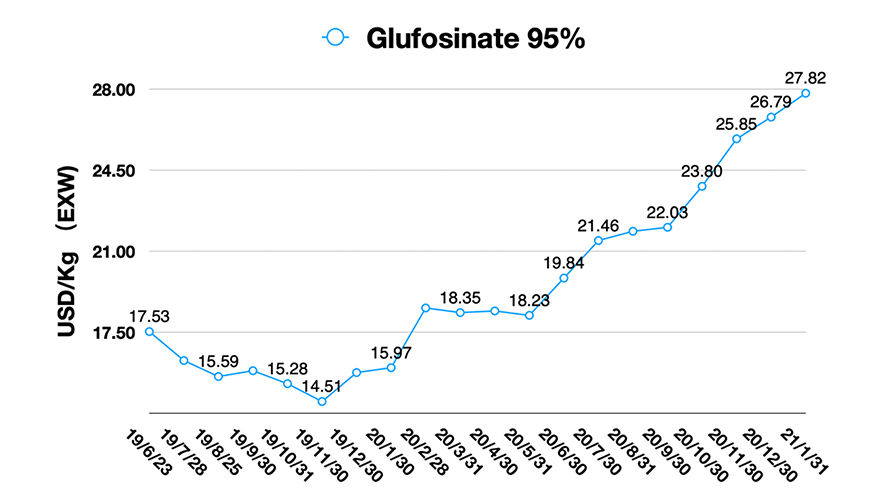

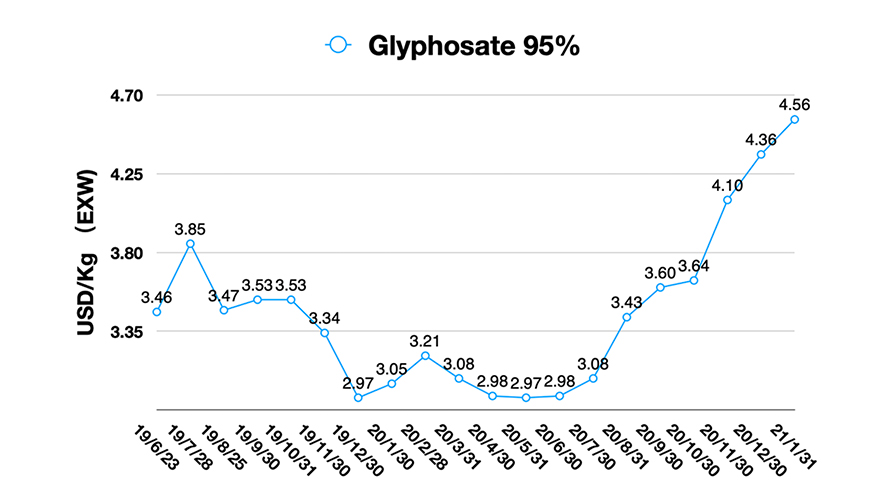

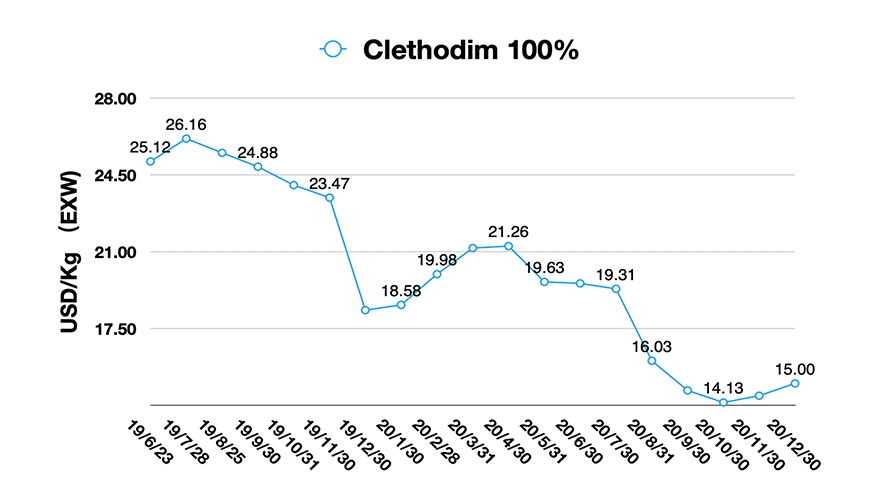

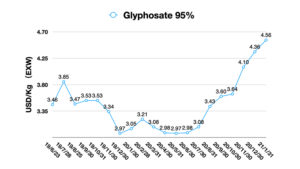

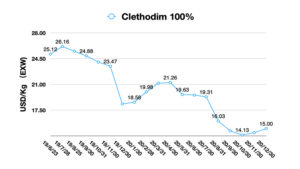

China’s agrochemical supply is relatively stable pushed by increasing the price of the critical raw materials. The price index was affected by shortage of raw material and extreme cold weather together recently. If the price of the product relies on raw materials, for glyphosate and clethodim, for example, then long-term increases are more likely to happen as a result of continued high demand for sterilization products that rely on some of the same raw materials, creating a shortage for an unpredictable duration. The infections of COVID-19 and its variants around the world and subsequent lockdowns will continue to exacerbate competition for raw materials.

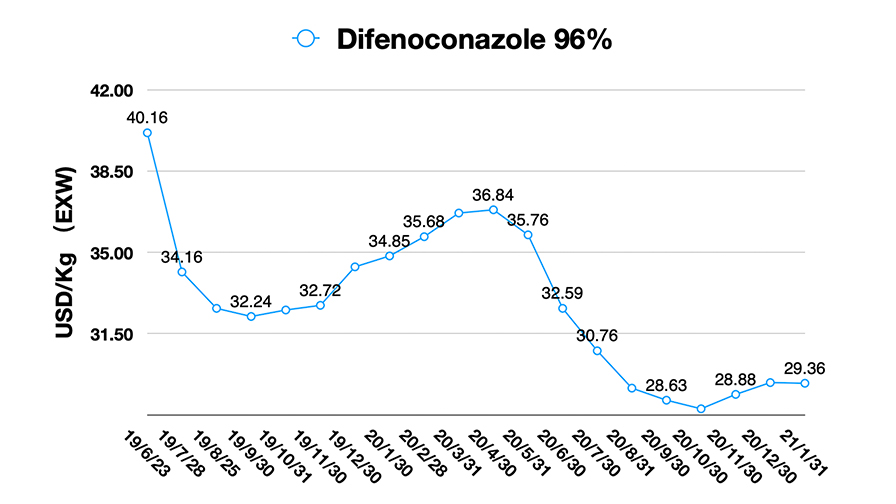

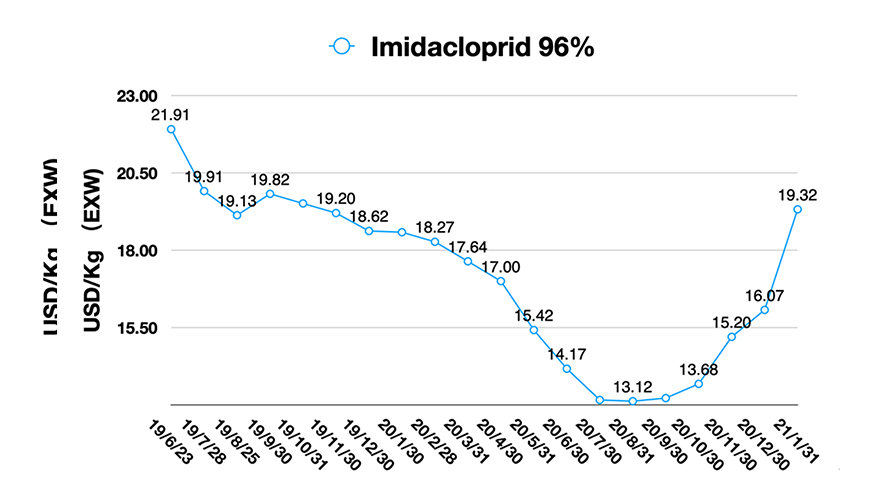

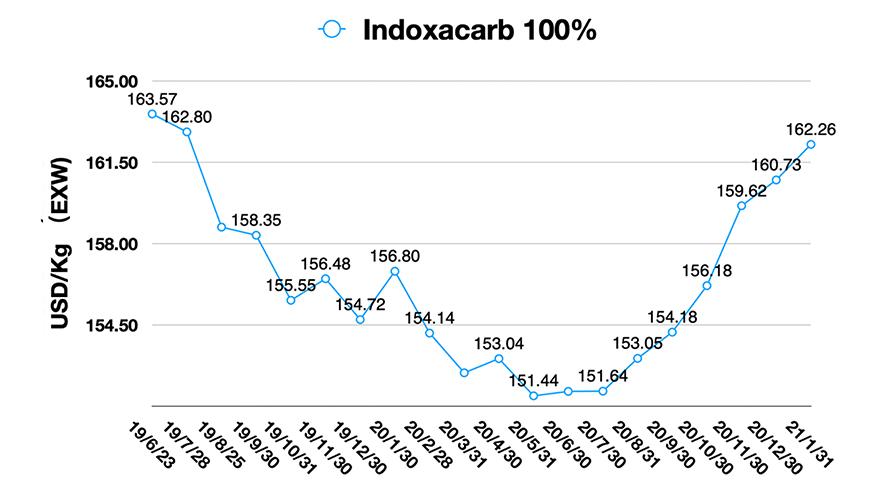

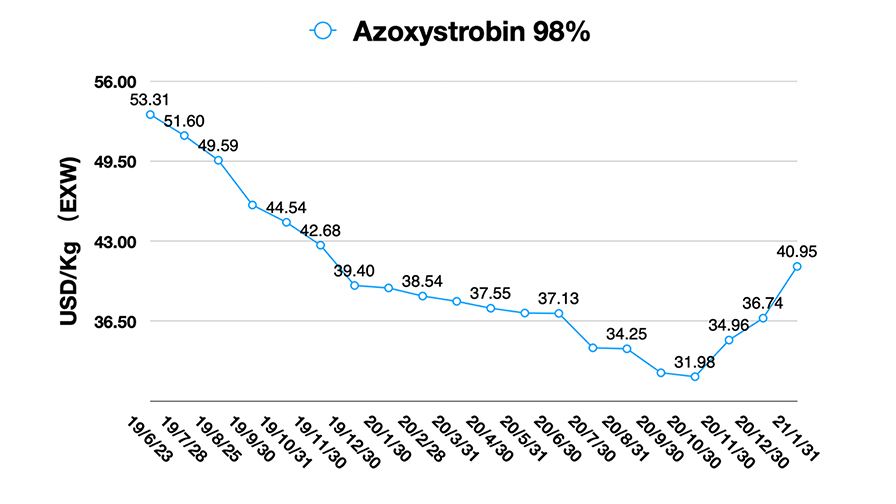

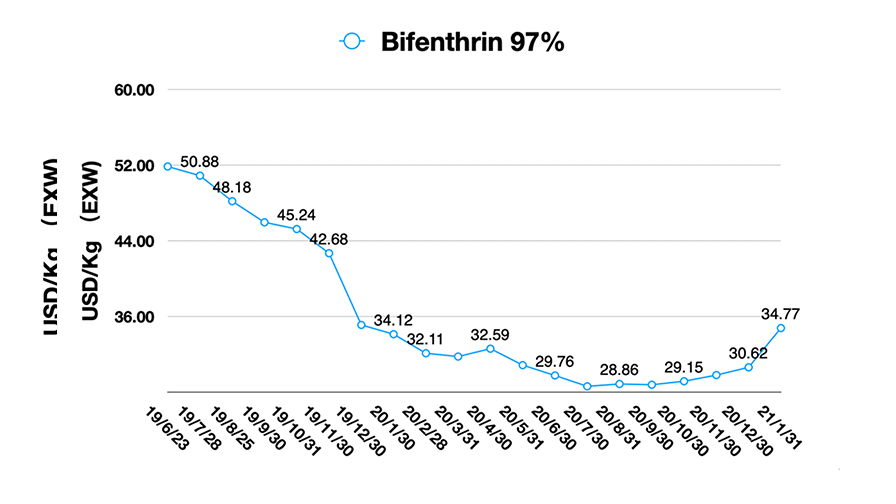

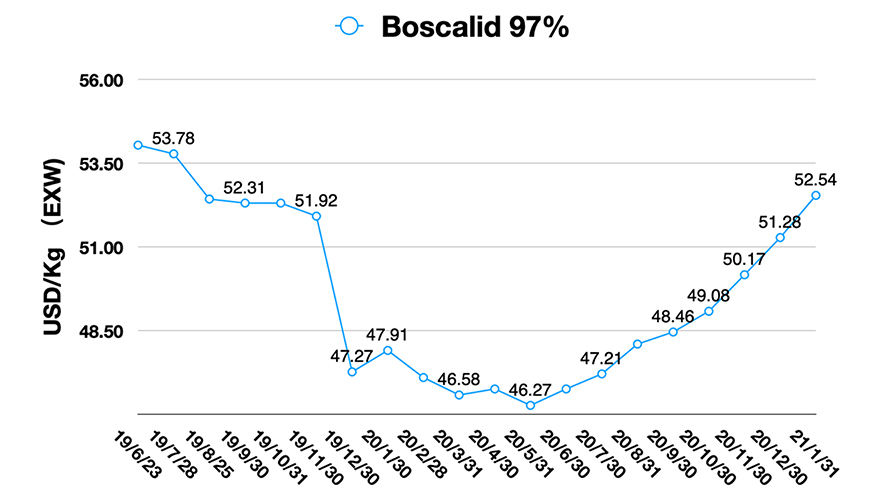

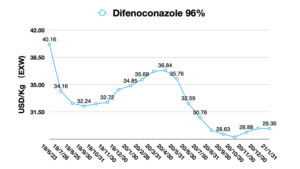

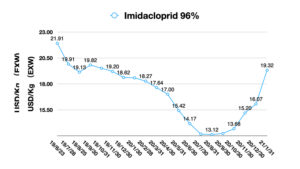

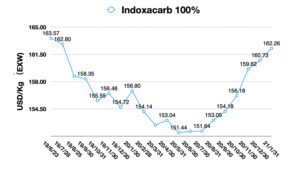

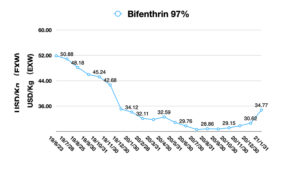

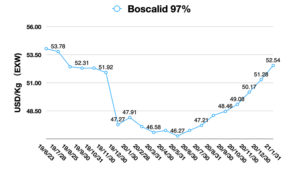

Overall, the fungicide outlook is positive. Triazole fungicides are still in high demand from the global crop protection market. The popular triazole fungicides prices are increasing due to rising raw material cost and rigid supply/demand dynamics. However, insecticide prices are relatively stable.

Another factor is the USD-CNY exchange rate, which reached 6.47 in Jan. 10, 2021. The exchange rate was 7.05 in May 2020. The fluctuation of currency will also result in the higher prices of agrochemical products in USD for global buyers. Along with the resilience of the US from COVID-19, the high level of USD-CNY could be lasting for longer in 2021 which would come out with strong price trends on China agrochemical EXW price as well. US President Joe Biden said Jan. 8 that he will prioritize emergency aid delivery to small businesses. He is assembling a multitrillion-dollar relief package. Such factor would also give expectations of a CNY appreciation starting to accumulate.

From the end of 2020 to the beginning of 2021, China’s supply has risen for key industries. The chemical industry is the basic industry for downstream consumption, such as petrol, fabric, sterilization, and medical, etc. The demand for raw materials from other key industries can affect the agrochemical industry profoundly. The upstream management of supply and access to ingredients has become an important and prioritized consideration for Chinese suppliers.

A group of leading manufacturers in China are evaluating global supply and demand trends to be more responsive new dynamics shaping their businesses. These top-level companies set their production volumes to fix the market price of key active ingredients. Since the strict regulation on environment protection, medium or small-scale manufacturers can only execute the “defense strategy” to quote to global buyers. The cost level of China sourcing will be surely related to Chinese manufacturers’ ability to secure and manage relationships with suppliers.

Trends for Chinese Suppliers

1) Agrochemical industry resources will consolidate into leading manufacturing groups:

In November 2020, Zhejiang Corechem announced a strategic cooperation with Zhejiang Lonshen Group. The cooperation enhanced Corechem’s agrochemical production and control on raw material and intermediates resources with strong financial support and integration between the two manufacturers.

Lier Chemical invested in 20,000 Mt L-Glufosinate capacity in Mianyang production basement which will release for the 2022 season. At the beginning of 2020, Lier Chemical invested 440 million in a joint venture with Corteva Agriscience Shanghai with strategical cooperation on pyridine upstream control.

The China agrochemical industry is integrated by leading groups. Integrated competitiveness is becoming more important than ever since the uncertainty of the global economy. In 2021, there might be more cases on the new mergers and acquisitions in China agrochemical industry that aim for strategic cooperation.

2) Enhancement of production and new capacity:

During the past two years, the new capacity of Active Ingredients (AI) in Inner Mongolia Province reached 93,000 Mt, and there was around 130,000 Mt new capacity of AI in Ningxia Province. Such huge capacity will be released step by step in the coming 10 years. The new facilities in the new production site will have high levels of environment protection and new, more efficient production processes. These innovations could lower the cost of production.

The new capacity means the positive investment philosophy for global agrochemical demand. USDA projects 2021 soybean acreage will increase by about 6 million acres (7%) to 89 million acres planted. It is because of low inventory and higher prices along with strong export demand of soybean from the US. Brazil is projected to harvest 132.6 million Mt of soybeans in 2021, but potential drought could impact output. As for exports, Brazil is anticipated to export 83.5 million Mt of soybean in 2021. The protein demand of China will drive the global growth of soybean in long term.

However, there might be some negative impacts on agrochemical consumption globally. Editing seed genomes through novel methods like CRISPR-Cas9 can let seed have drought-resistance without affecting agrochemical demand. The new sustainable agrochemical formulations will also minimize the input of pesticides with the same level of efficacy. The biological solution for sustainable farming will also focus on Integrated Pest Management (IPM) together with distinguished nutrient efficiency to crops. The pandemic is also a kind of enzyme toward the booming demand for indoor farming and organic growing. Such factors could lead to the gradual erosion of traditional demand for agrochemicals in the coming decades.

3) Strategical transformation to modulized innovation on contract R&D and manufacturing:

On the back of the basic chemical industry, China agrochemical manufacturers could have a chance to change their strategy from simple manufacturing of long-tail, off-patent active ingredients into innovation with global partners.

Although the agrochemical industry is a commodity business, the key molecules going off-patent will bring more margin of profit during the limited time gap before other competitors’ entrance into such market.

The Contract Development Manufacturing Organization (CDMO) is very common in the pharmaceutical industry. In China agrochemical Active Ingredient manufacturing, ABA Chem is a typical intermediate and AI manufacturer with a strategic alliance of FMC. As the only novel “Black Light Formulation Factory”, Huizhou Yin Nong is the strategic cooperator of formulation products with BASF in China.

The strategy with production development would need a deep alliance with multinational companies and their supply chain team. The asset managers from customers will also be involved in the projects. Modulized innovation requests buyers to participate in R&D and manufacturing with suppliers on the same page of portfolio development. The field performance of sustainable agrochemical formulation desires the early cooperation on impurity control, crystallization research, process performance enhancement, packaging technology, and agronomy R&D, etc. The ones who have a systematic understanding of the global crop protection business will benefit in the future.