With Prices Rising, Agrochemical Factories Take Measures to Resolve Supply Shortages

Many companies globalized their sourcing and production of materials in the 1990s. This accelerated after 2001 once China was included in the World Trade Organization.

And, as a result, global trade increased from 39% of GDP in 1990 to 58% in 2019.

While this shift, along with lean manufacturing strategies, helped reduce costs, it also opened companies to more supply chain risks – everything from extreme weather occurrences to cyberattacks to labor issues.

Enter COVID-19. While it’s not the first epidemic to disrupt supply chains (swine flu, Ebola, etc.), many experts agree it has been the most disruptive.

It “revealed the fragility of the modern supply chain,” explains Eleftherios Iakovou, the Harvey Hubbell Professor of Industrial Distribution at Texas A&M University, and Chelsea White III, the Schneider National Chair in transportation and logistics and a professor at the H. Milton Steward School of Industrial and Systems Engineering at Georgia Tech, in a Brookings report. “Companies and governments alike are realizing that efficiency at the expense of resilience cannot be the sole criterion around which supply chains are designed.”

While some things may be changing in how factories conduct business daily to maintain this productivity, other things may never change, such as a customer’s desire for low prices. Increased costs can’t always be passed on to the customer when competition remains cut-throat.

As such, factories are taking measures – from simple to complex – to try and limit their vulnerabilities and maintain efficiency.

Diversify Suppliers

“The pandemic has been a wake-up call to many businesses about the importance of being able to mobilize rapidly, set up crisis management mechanisms and build the supply chain resilience that will see them to the other side,” a Baker McKenzie report says.

This “other side” is the rebound as pent-up demand is released in line with recovery, making up for previously lost output. The Baker McKenzie report predicts this happening in the first quarter of 2021. “Global manufacturing value-added output will rebound in 2021 with a 6 percent value-add in manufacturing output compared to 2019,” the report specified. “In 2021, for Asia-Pacific (excluding China), this value is set to hit 4 percent, while the U.S. may see up to 6 percent value-add and the pick-up in Europe is currently estimated at 5 percent.”

However, as many are realizing, this won’t be a resumption of business as usual.

After the start of COVID-19, raw materials, mainly from COVID-19-impacted areas, were insufficient for many factories, including Hailir Pesticides and Chemicals Group, an agricultural technology company located in the Chengyang District of Qingdao, China, says Tang Zhiming, the company’s chief safety officer.

The solution has been to actively seek out alternative suppliers.

In most areas, manufacturers have relied on suppliers with a singular focus, which means they have the advantage of incorporating the most modern technology. “But you’re left vulnerable when you depend on a single supplier somewhere deep in your network for a crucial component or material,” explains Willy Shih, the Robert and Jane Cizik Professor of Management Practice in Business Administration at Harvard Business School in Harvard Business Review. “If that supplier produces the item at only one plant or one country, your disruption risks are higher.”

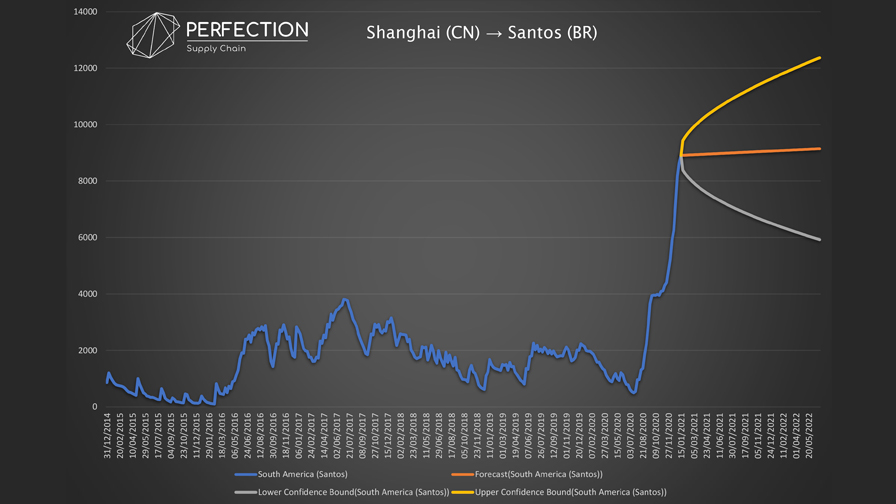

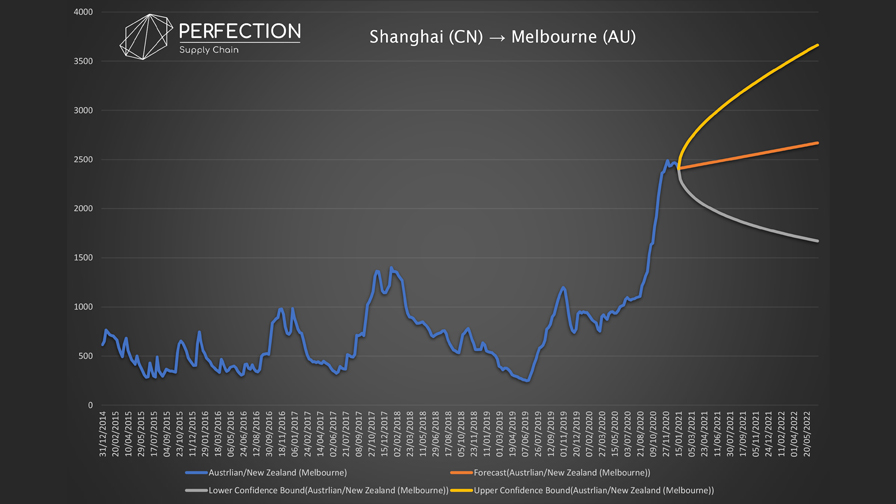

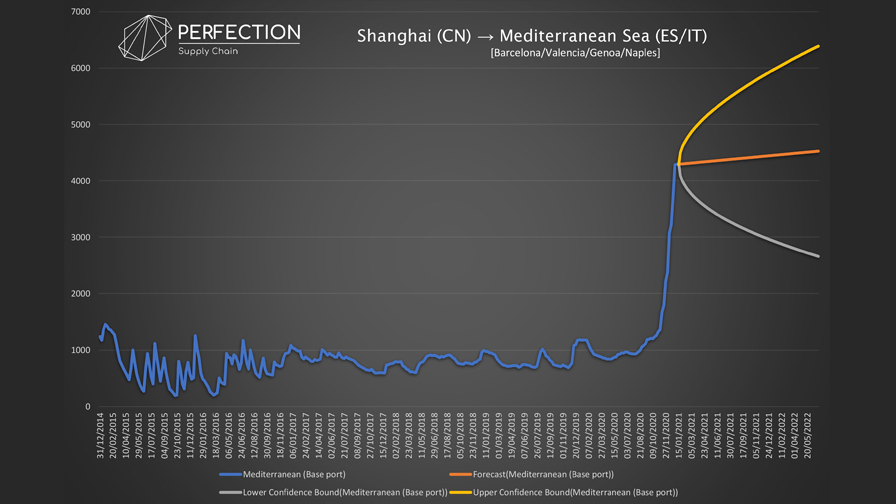

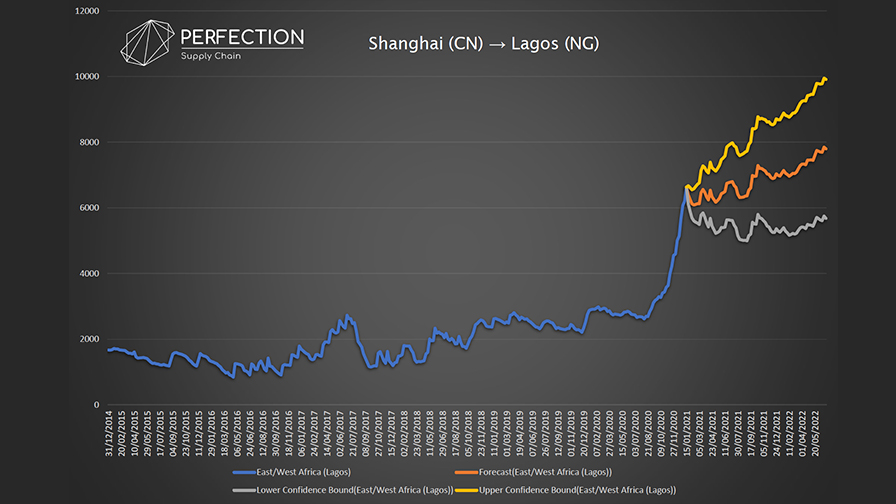

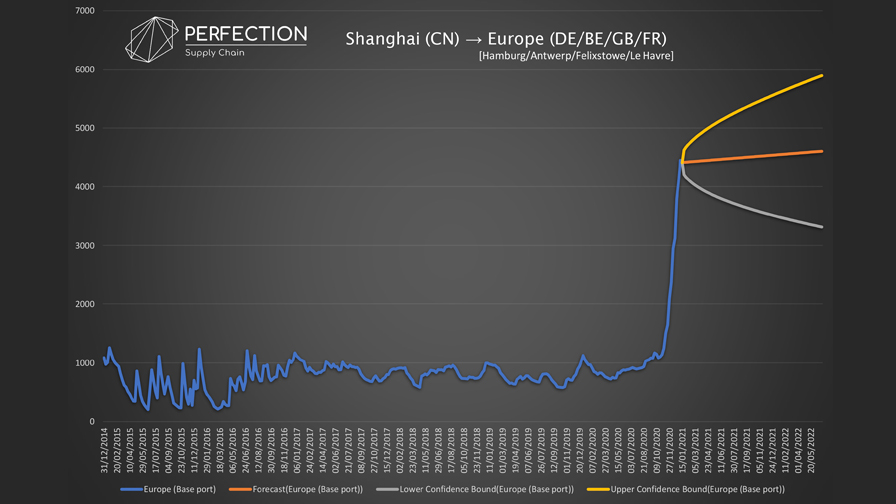

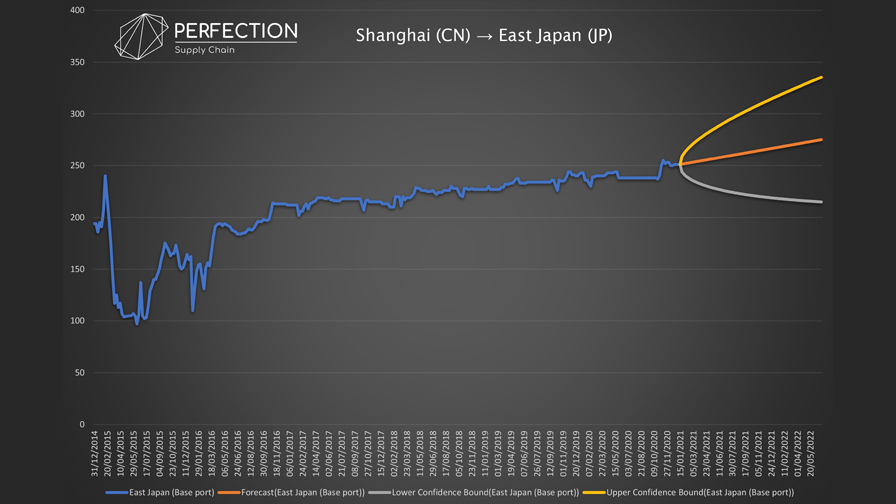

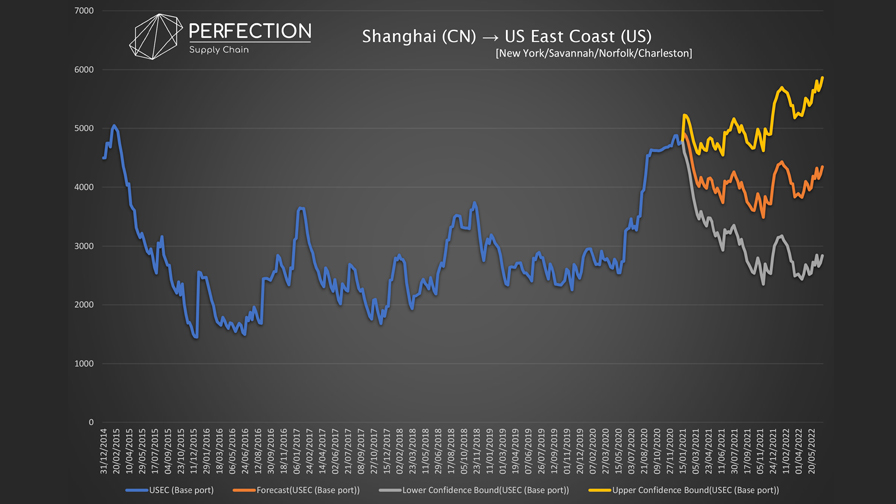

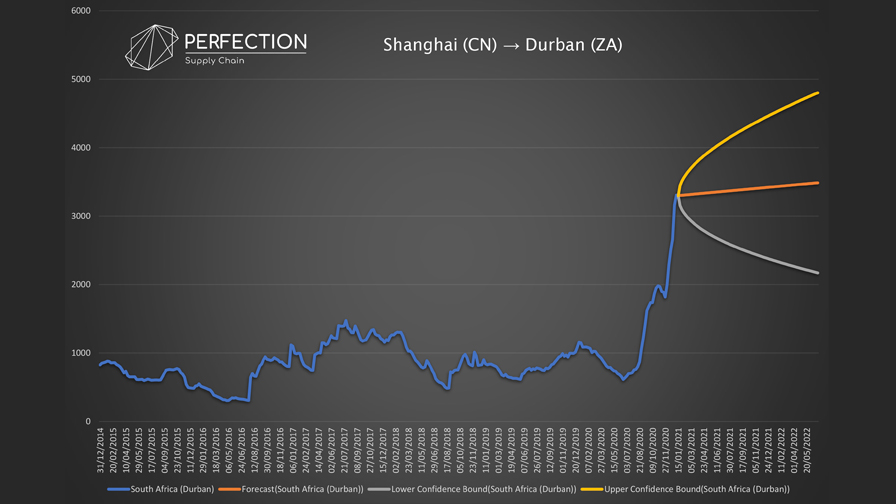

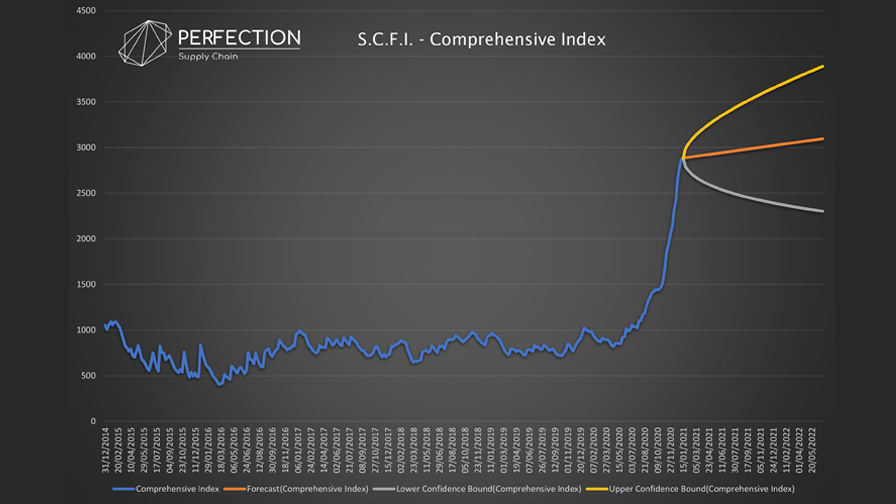

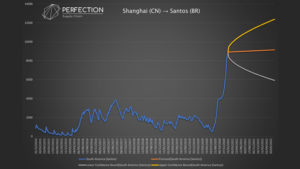

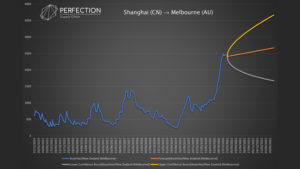

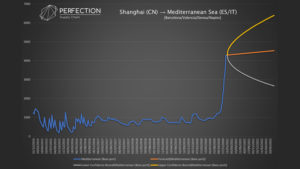

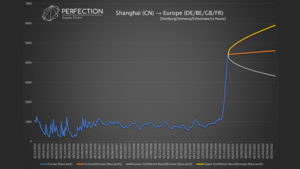

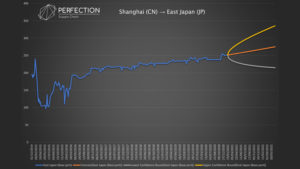

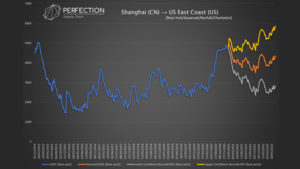

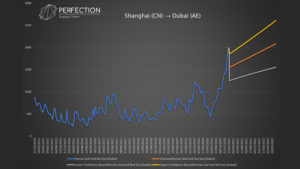

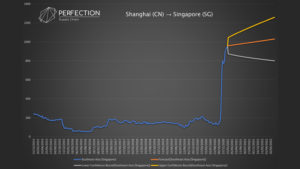

COVID definitely drove one agenda item to the top of many to-do lists: figuring out how to mitigate risk with multiple sourcing, says Keith Holdsworth, a senior supply chain consultant with Perfection Limited, based in West Oxfordshire, England. “You’re trying to figure out what the right amount of sources are and how to diversify this by country and continent so that you can survive everything from fires to port closures,” he explains.

Operations Adjustments

Factory operations adjustments to lessen virus spread has also added to their challenges, but at a lesser extent than shipping and sourcing issues, as they quickly adapted to necessary modifications.

These include strictly controlling entrances and exits of personnel and goods, mandating masks, enforcing safe distancing during breaks and lunches, as well as checking employees’ temperatures and disinfecting gathering places daily.

Other companies like pesticide manufacturer and distributor Jiangsu Institute of Ecomones Co., located in Jintan in southern Jiangsu, China, also cancelled unnecessary face-to-face meetings, and ensured migrant workers returning from infect zones served two-week quarantines prior to coming back to work. Hailir also implemented a WeChat group to help increase and ease communication with its contractors.

Ramping up to full capacity after the Chinese New Year has always presented some challenges, but experts predict this will take longer this year. “They need to consider how to restart business operations amid ongoing epidemic prevention and control measures, and ensure they can return to a normal, healthy work rhythm as soon as possible,” a Deloitte report advises.

Automation is the Way Forward

Long-term improvement will require automation to limit dependence on human error, as well as labor delays and risks, supply chain experts say.

“COVID-19 has put a renewed urgency behind automation and the use of robotics to mitigate against the disruptive impact on supply chains through the restrictions of the movement of people,” the Baker McKenzie report explains, adding remote monitoring technology to that list of automation ideas that could help mitigate supply chain disruptions.

Hailir is keeping automation top-of-mind as it moves forward. “We mainly adopt DCS and SIS operating procedures for the liquid circulation process,” Zhiming says, pointing to the advantages: more stable operations, avoiding best practice fluctuations between personnel, and limiting accidents.