China Price Index: Strong Demand and Low Inventories Continue to Drive Prices for Major Pesticides

Strong demand from China becomes a new reality for global agriculture product exporters when China’s import of meat from overseas reached around 9.91 million Mt in 2020. China’s meat import accumulation YOY 2019 was 60.4%. The USDA anticipates the China demand will surpass 10 million Mt in the next projection.

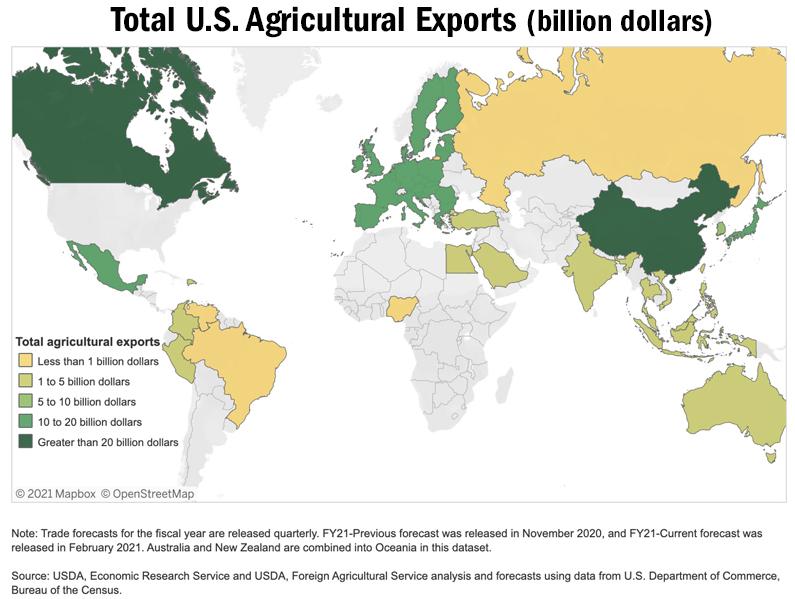

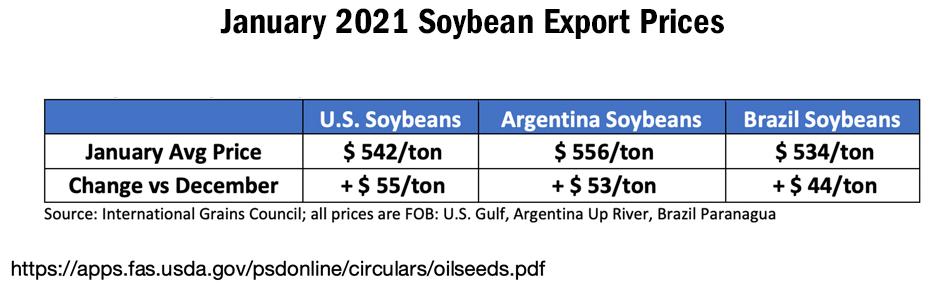

As the key vegetable protein, China imported 100.33 million Mt of soybeans with 13.3% growth YOY compared to 2019. According to the Outlook for U.S. Agricultural Trade, the projection for total U.S. soybean exports is up $5.9 billion to a record $26.3 billion due to higher unit values, strong demand from China, and record volumes.

For the U.S., agricultural exports to China are forecast at a record $27 billion, an increase of $8.5 billion, largely due to strong soybean and corn demand. China is expected to once again become the largest U.S. agricultural market, a position it last held in FY 2017.

On March 5, Premier Li Keqiang delivered the Government Work Report at the opening of this year’s session of the 13th National People’s Congress in Beijing. China sets its GDP growth target for 2021 at above 6%. Since its resilience after COVID-19, China leads the world’s major economies in projected growth rates.

As the world’s second-largest economy, China is aiming to cut energy consumption, control environmental pollution, accelerate energy trading, and reduce carbon-emissions. During the 14th Five-Year Plan from 2021 to 2025, China is prioritizing Sino-U.S. trade as the first partnership to be promoted and ties strengthened on basis of mutual respect.

The highlights of China’s Government Work Report provide a profile of China future plan. Along with the economy growth, China wants to satisfy the China’s demand for protein, which will deeply influence the global agribusiness in 2021. Not only for U.S., China’s demand for Ag imports already has benefited global producers and is expected to continue growing.

In the U.S., the soybean price rose to its highest point since record prices in 2012. U.S. soybean acreage in 2021-22 is expected to be at 90 million acres, up 8.5% YOY. And U.S. farmers sold 90% of 2020-21 projected exports. Since the status of low inventory, the soybean farmers would benefit from the high price of soybean to gain better margin in coming season. Brazilian farmers also have good cash margins under healthy growth. Production in Brazil is currently forecast at 131 million tons, up around 5 million from last year. The strong demand from China will drive favorable exports and encourage the U.S. and Brazil to invest full capacity on soybean and other profitable crops in 2021-2022 season.

Even though the unexpected weather due to La Nina could affect the trend of acreage growth, the global distribution channel of ag input and multinational companies are optimistic on sales in 2021 season. Post COVID-19, resilience on global agriculture market is stable. Field crops like soybean and corn are becoming more significant for marketing meanwhile vegetable market was affected by the pandemic. Along with the lower budget of multinationals in 2020, the inventory in the distribution channel is healthy for organic growth in 2021.

- Related: China Price Index Archive

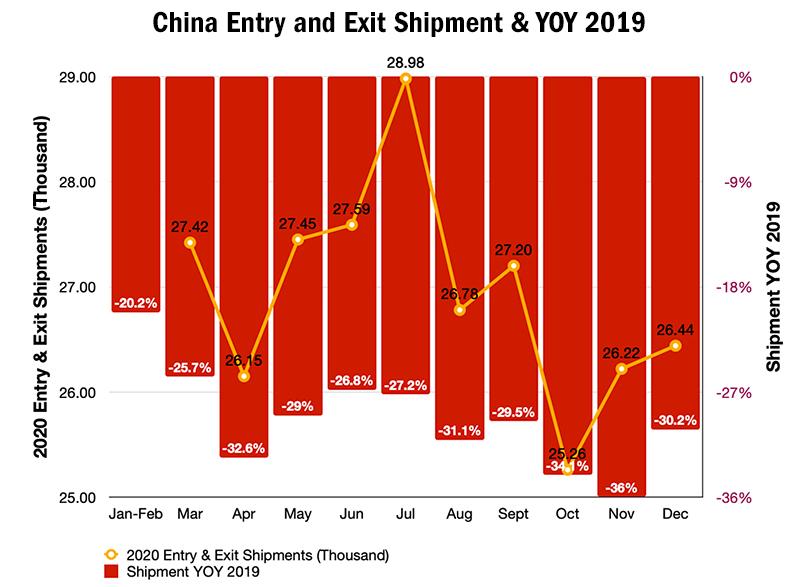

The predictable challenge in 2021 season could be the supply chain management for global demand of ag input sourcing from China. According to the China Custom report, there was around 30% shortage of Exit & Entry Shipments in China. When the Exit & Entry Shipment reach 35,000 per month, the global logistic can be back to normal. The signal can guide the supply chain management to adjust the lead time and safe inventory level. However, the freight cost in first half of 2021 will still be high.

The challenge of supply chain management is to bolster the safe inventory for agrochemical companies around the world. The demand in local farmers like in the U.S. and Brazil could not be missed due to shortage of portfolio supply. To avoid the shortage risk, multinational companies were preparing safe inventory of AIs from 3Q 2020. Based on the exporting data from China ICAMA, much of this product was amassed during buying in August and September.

The good news is consumption of agrochemical portfolios would be strong due to the demand from farmers based on the previous analysis of global demand logic. The EBITDA of organic growth for multinational crop protection companies would be rising along with the double-digit growth in Asia Pacific, North America, and South America.

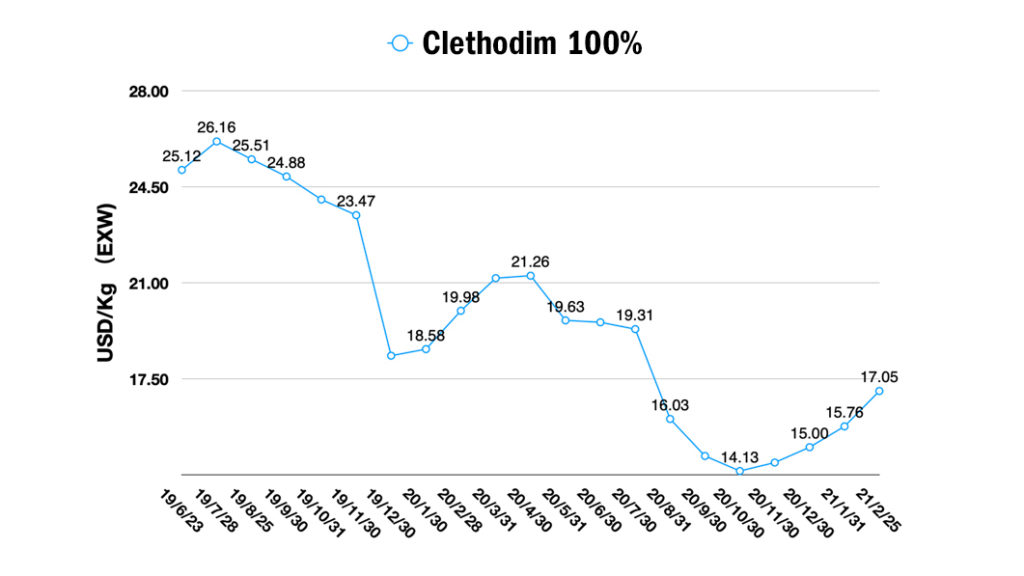

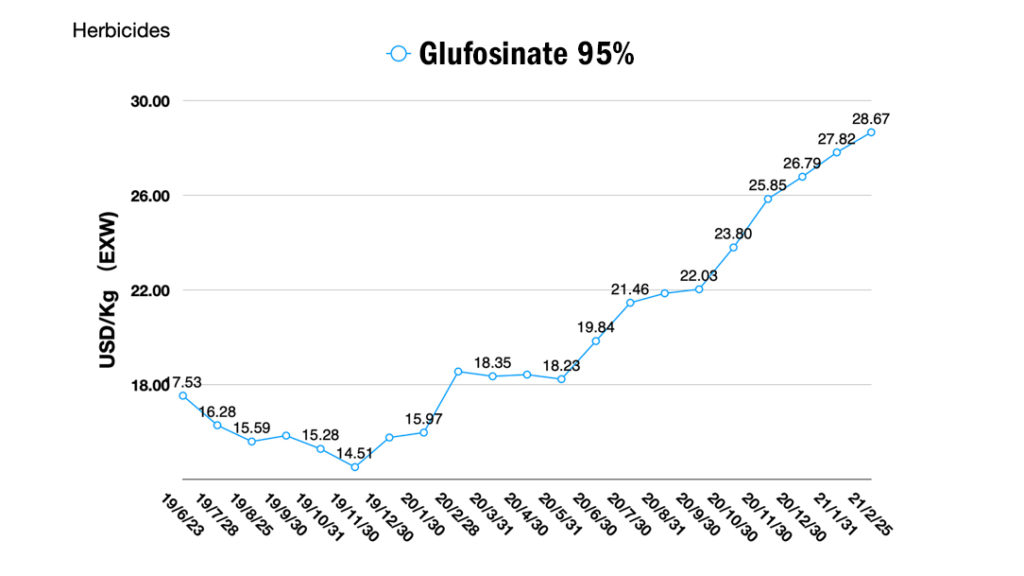

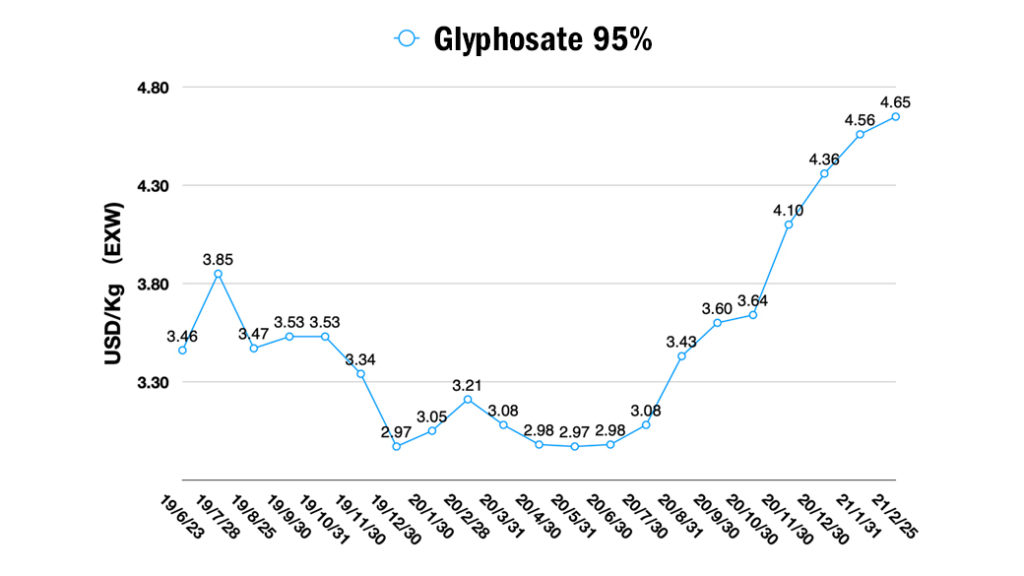

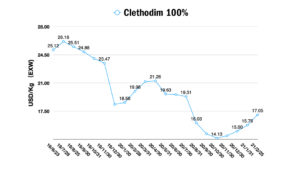

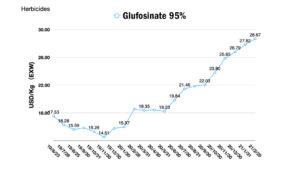

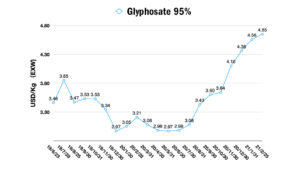

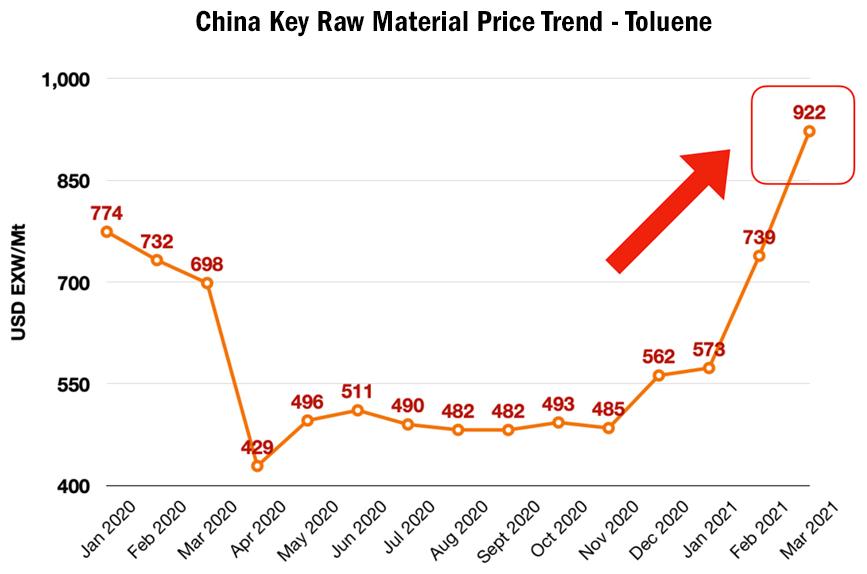

In March 2021, the fundamental raw material prices rose significantly, which brought huge pressure on agrochemical production in China. Clethodim price continues to rise due to the high pricing level of raw material and low inventory in the market. Since Chinese Spring Holiday, the operation rate of glyphosate was low in February 2021. The COVID-19 pandemic in Hebei Province brought uncertainty of PMIDA supply. So the glyphosate price went up in February.

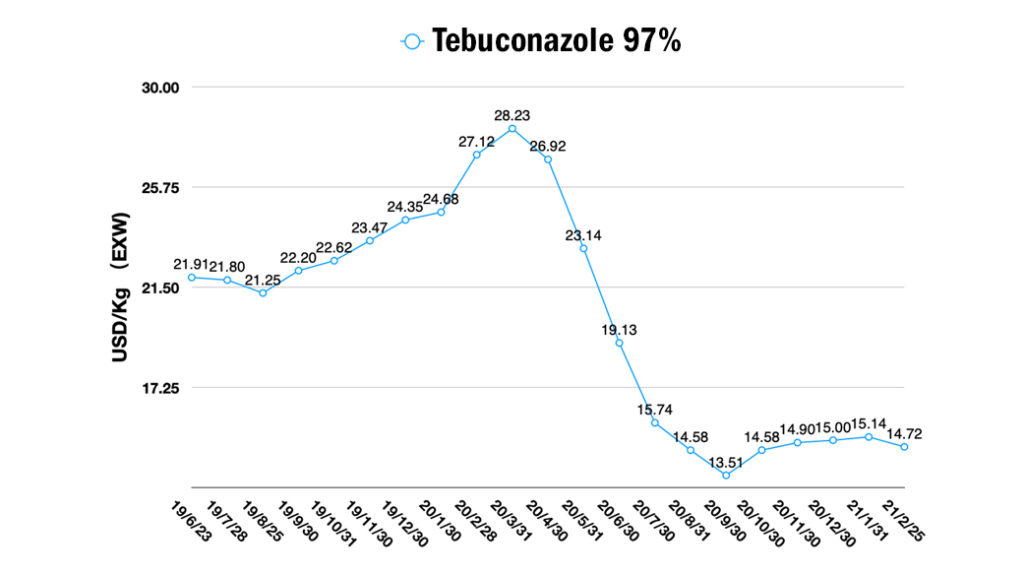

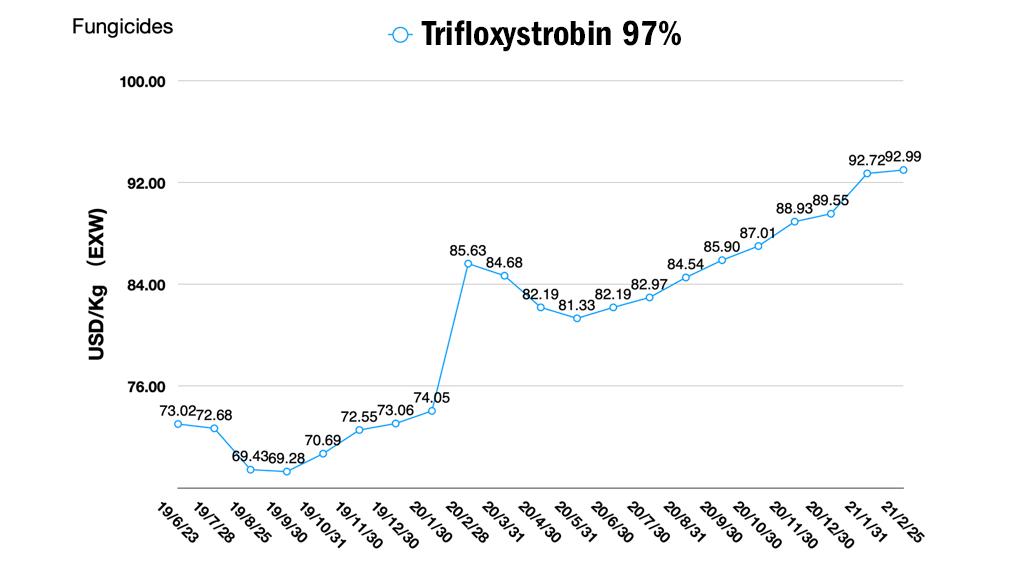

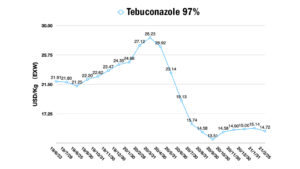

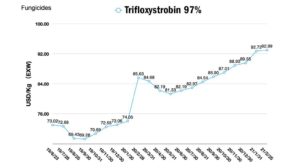

As for the fungicide supply, tebuconazole is still in low price position. As one leading triazole fungicide in controlling Asian Soybean Rust in the Brazil market, the price of tebuconazole could have room to boom when LATAM demand release in the second half of 2021. Trifloxystrobin will have new capacity in the coming two years. Low inventory and operation rate result a high price in 2021.

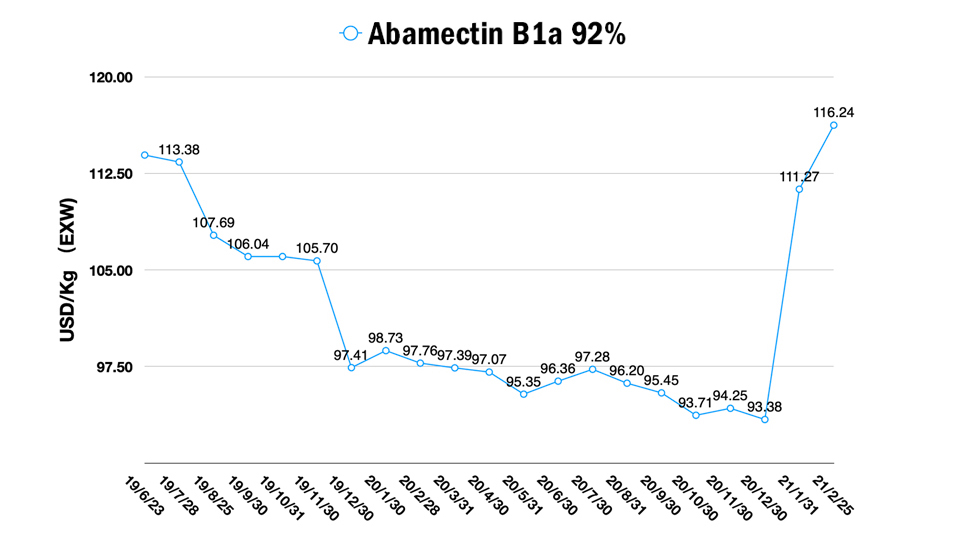

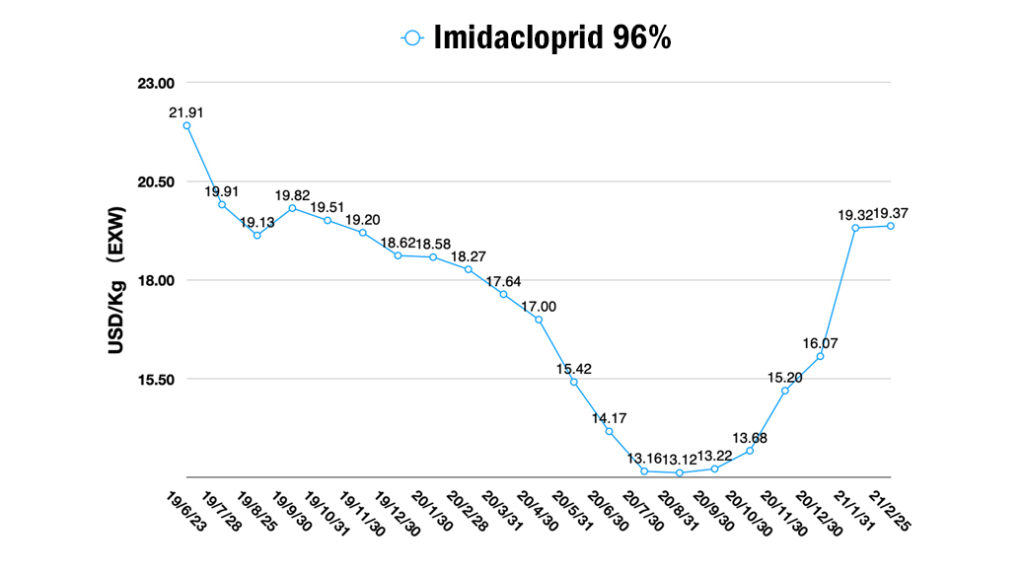

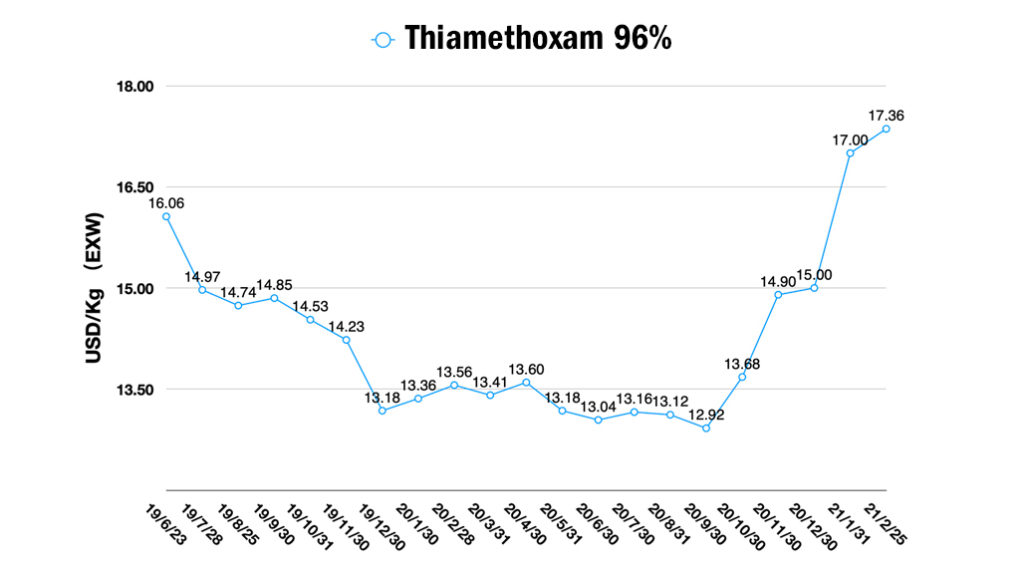

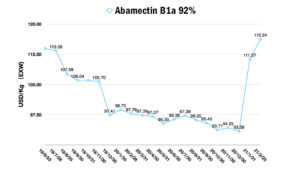

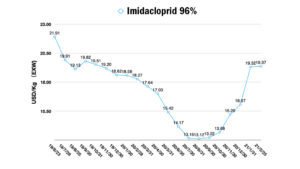

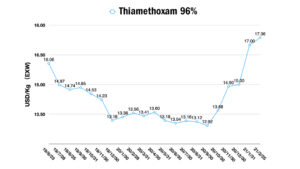

The price of CCMP is increasing stably which causes the imidaclopird prices to rise slowly. Prices of thiamethoxam and abamectin B1a were also increasing due to the low inventory.