China Price Index: Value Creation Will Lead Sustainability of the Crop Protection Industry in 2022

Editor’s note: Contributing writer David Li offers a snapshot of current price trends for key herbicides, fungicides, and insecticides in the Chinese agrochemical market in his monthly China Price Index. He also provides insight into why value creation in the global crop protection industry needs contributions from both multinational companies and Chinese agrochemical suppliers.

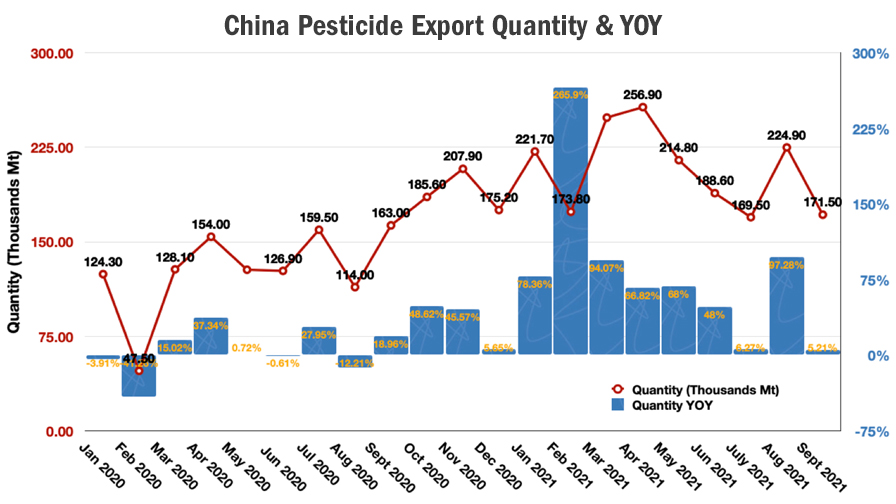

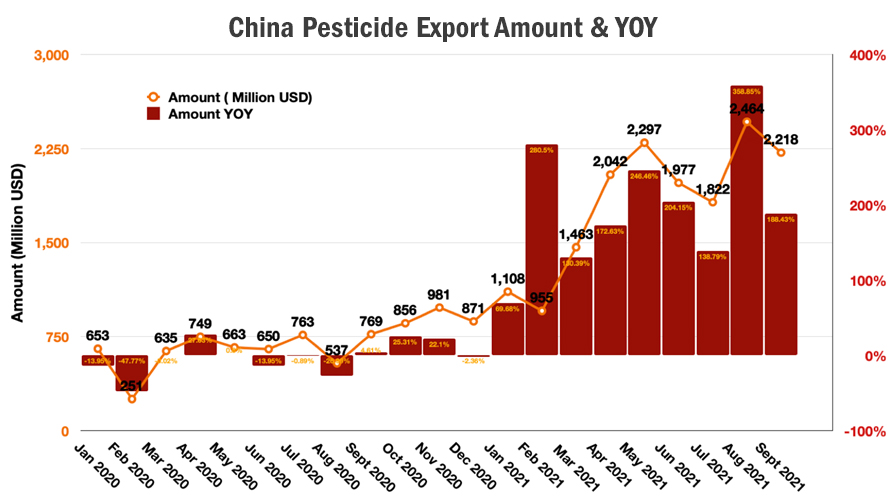

According to the National Bureau of Statistics (NBS) of China, China’s 2020 pesticide exports were 2.5 million Mt, an increase of 71.2% YOY 2019. When the COVID-19 pandemic hit globally in 2020, distributors and multinational companies started to increase their safety inventory to meet the lead time, especially during Q4 2020. High safety stock, plus channel inventory, was the key reason why purchasing increased sharply.

In 2021, China exported around 1.87 million Mt agrochemicals overseas from January to September, a 63.3% increase year to date 2020. The strong demand for overseas purchasing occurred from January to May. The strong export volume once again injected new final products into the pipeline.

According to 2021 Q3 and half-year financing reports of some multinational companies, the sales growth rate reached double digits, which was outstanding. The anxiety of future high pricing portfolios stimulated the consistent purchasing at farm level. But the farmer’s true demand and consumption will have the potential to come to the surface in the next growing season.

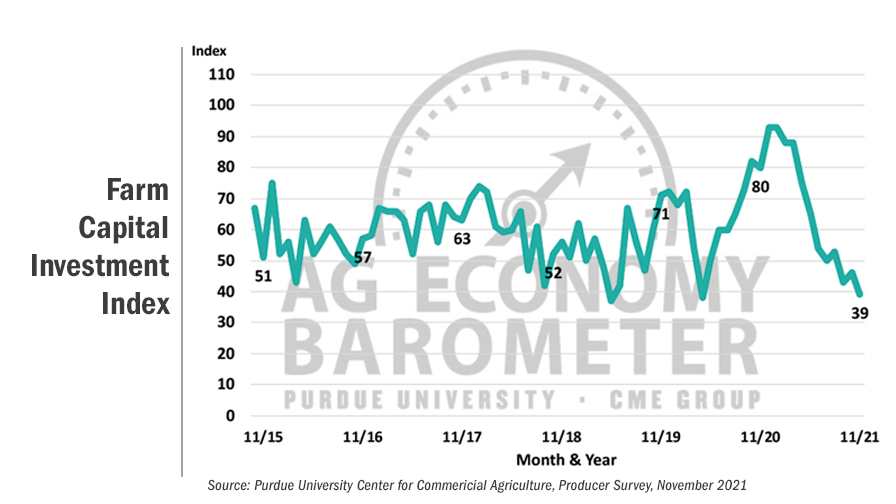

The Ag Economy Barometer (a measure of the health of the U.S. agricultural economy) slipped to a reading of 116 in November, down 5 points from October and 30% lower than in November 2020, when the barometer stood at 167. U.S. farmers’ concerns about sharp rises in production costs coincided with concerns about a host of other issues, ranging from prices for crops and livestock to environmental and tax policy, as well as COVID. The Farm Capital Investment Index declined 7 points to a reading of 39, the index’s lowest reading since April 2020. Weakness in the investment index seems to be a function of supply chain problems, along with concerns about rapidly rising input costs, according to the report from Purdue University.

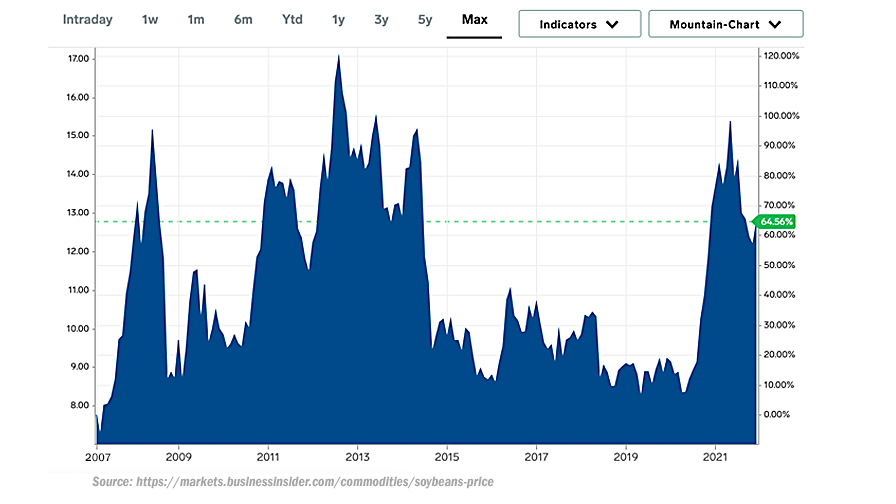

Compared with the gradual decline in the investment willingness of farmers, the timing of this investment reduction is worthy of more in-depth analysis. Quick resilience along with high inflation risk would bring more uncertainty for agribusiness in 2022, even though the agribusiness economic background looks positive due to key food commodity prices at historically high levels.

The 2022 situation could be very similar to 2014. At that time, the U.S. Federal Reserve just finished QE3 in October 2014. After the financial crisis of 2007-08, a series of economic recovery policies of the Federal Reserve made the U.S. become the first country among Western nations to get out of the economic crisis. In 2022, global inflation caused by the quantitative easing of monetary policy and shortage of cargo supply will be consistent across the new year.

Inflation is a “workable tool” for economy resilience. However, when the world faces the new variants of COVID-19, a typical black swan event, the economic hits experienced from 2020 to 2021 will continue to increase the instability of global growth, whereby inflation could go hand in hand with stagnation. The recovery time for the current global economy would be shorter compared to the last recovery from the 2007-08 global financial crisis. As for the crop protection industry, the key problem in the future would be lower value creation due to the high inventory in the pipeline, high cost of ag inputs, and low consumption at the farm level.

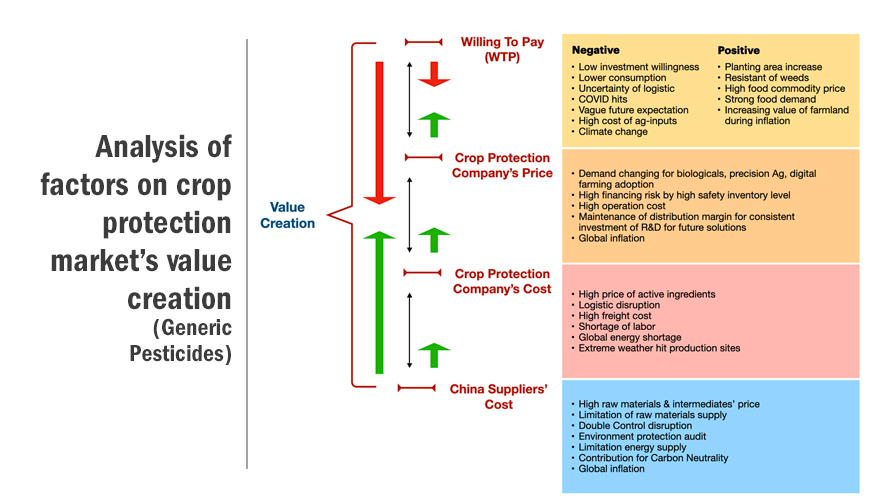

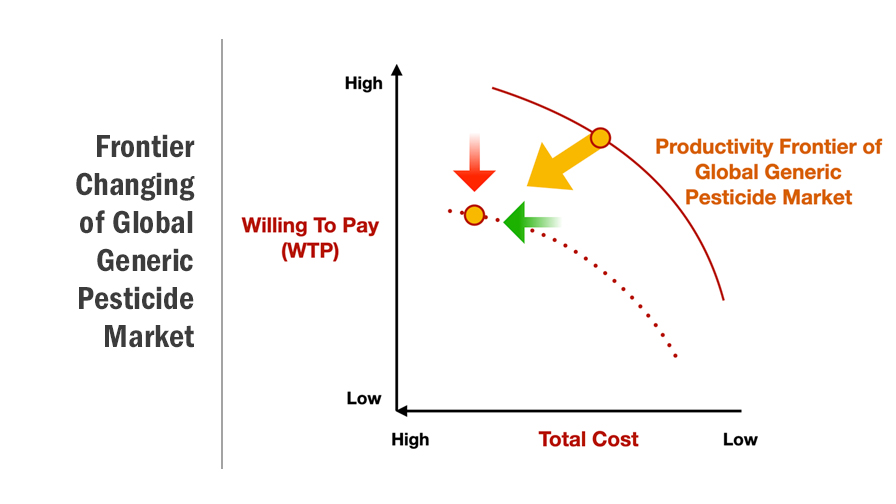

The low investment willingness of farmers would decrease the Willing to Pay (WTP) on generic pesticides from the farmer side (see chart below). And the high cost of inputs would increase the price of agrochemicals and increase the pressure of investment risk, so farmers would choose to save the dosage as much as they can or try to find alternative solutions. Both factors have squeezed the value in which crop protection companies promise to create for farmers.

Moreover, global crop protection companies need to maintain the profit margin for R&D and operation. So, they were forced to increase the distribution price along with the higher cost of operation and higher price of raw materials from suppliers. The entire generic crop protection market in total would decrease accordingly (see chart). There might be lower value for chemical crop protection solutions. The market demand might transition more to biologicals, precision ag, digital farming, etc. The total crop protection market of generic pesticides would likely decrease in 2022 YOY 2021. From 2022 to 2024, the future key question for multinational crop protection companies would be how to stimulate product consumption and deal with portfolio returns.

In 2021, the biggest impact for global agrochemical supply was China’s “double control” policy. The suspension of production froze China agrochemical exports from the end of September to November 2021, which was the annual hot season for agrochemical exporting. From December 8 to 10, China’s annual Central Economic Work Conference released the principle of “Double Control Policy”, which mentioned that “renewable energy and raw material energy, which is for production (not for fuel or power), are not included in the total energy consumption control.” The clarification supported diminishing the impact of the “Double Control Policy” on ordinary industry operations in 2022. Not only are raw material producers slowly back to normal, but also the upstream manufacturers, especially intermediate producers, can plan for consistent supply for the new season.

In 2021, the biggest impact for global agrochemical supply was China’s “double control” policy. The suspension of production froze China agrochemical exports from the end of September to November 2021, which was the annual hot season for agrochemical exporting. From December 8 to 10, China’s annual Central Economic Work Conference released the principle of “Double Control Policy”, which mentioned that “renewable energy and raw material energy, which is for production (not for fuel or power), are not included in the total energy consumption control.” The clarification supported diminishing the impact of the “Double Control Policy” on ordinary industry operations in 2022. Not only are raw material producers slowly back to normal, but also the upstream manufacturers, especially intermediate producers, can plan for consistent supply for the new season.

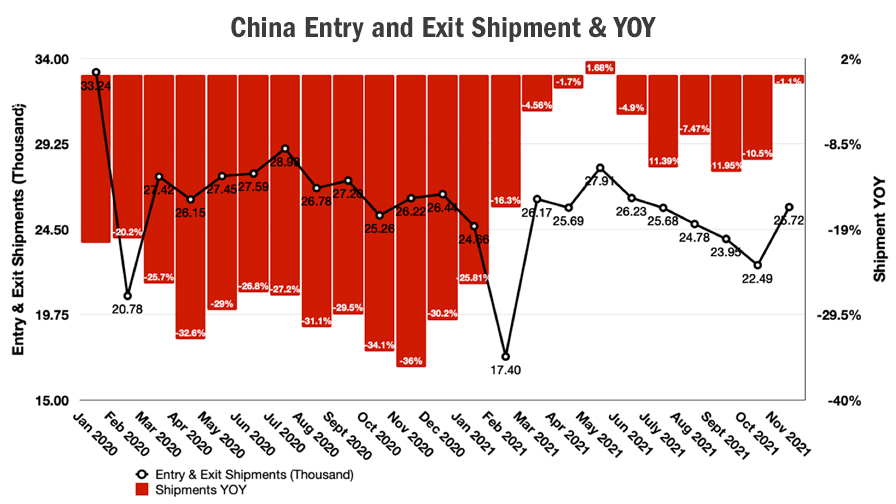

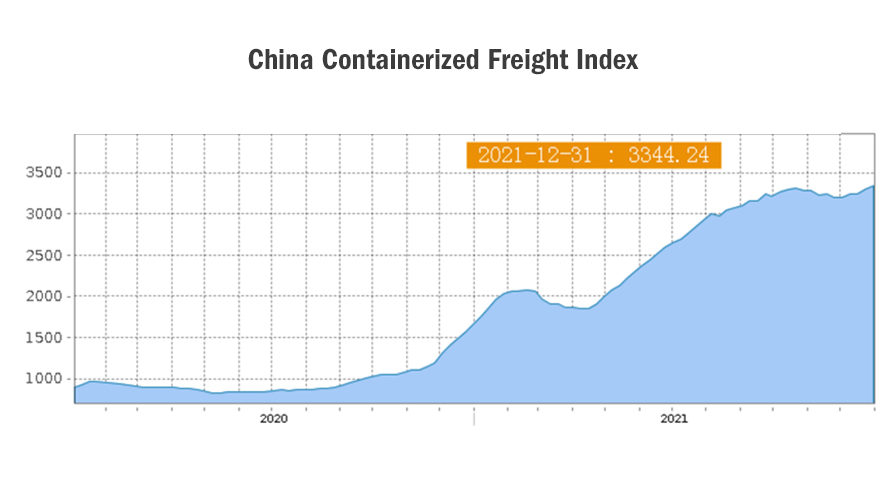

At the same time, global logistics bottlenecks have not been effectively improved. The total China commodity export quantity from January to November 2021 increased 7.61% YOY 2020. And the China Entry and Exit Shipment from January to November dropped by 8.88% YOY 2020. The average level of China Entry and Exit Shipment is still under lower levels than pre-COVID. The strong global demand is still facing a shortage of shipments. According to the China Containerized Freight Index (CCFI), the China freight cost is still at a high level, which reached 3,344 points. In 2022, the shipment shortage could be a continuous issue for global purchasing teams.

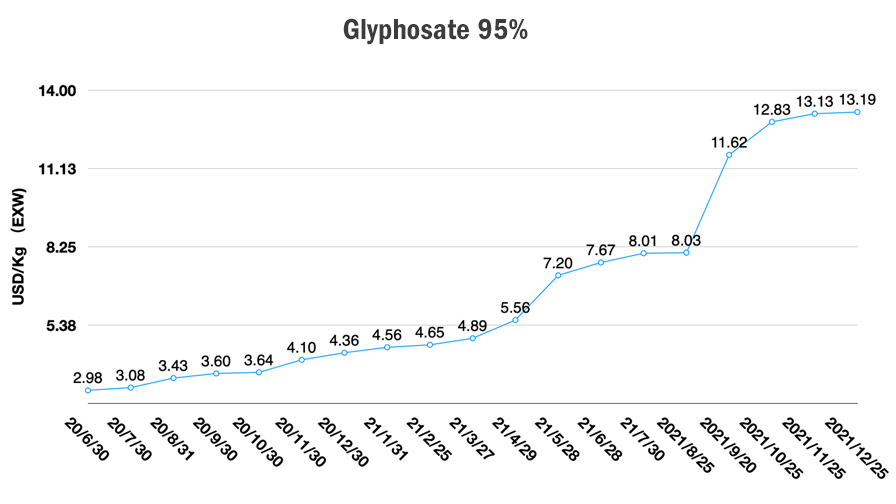

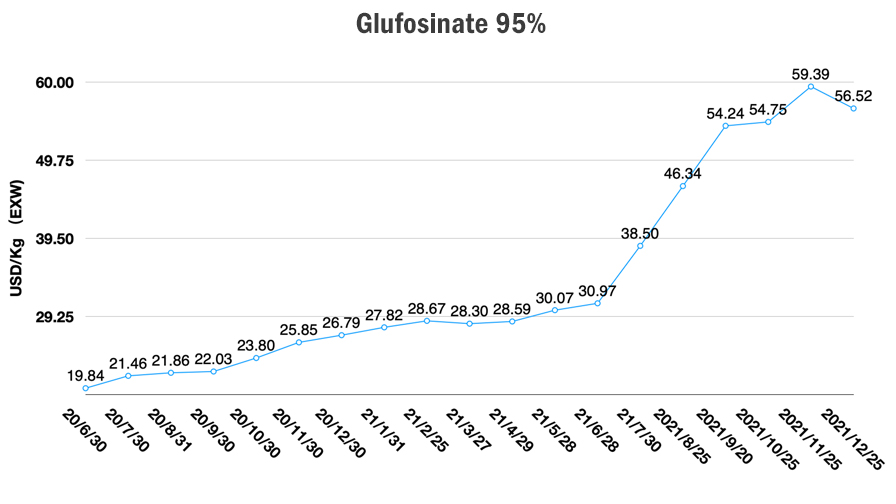

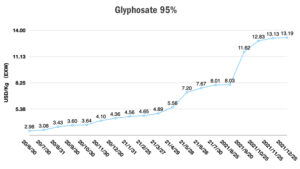

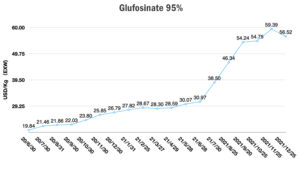

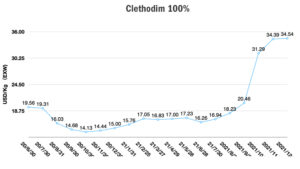

Not only are freight costs at a high point, the key burndown herbicides are still at a robust pricing level. The high price started in March to April 2021 due to the incredible increase of raw material prices in China. Along with the high raw material price, the early global demand was pouring into the China market, which stimulated the supply market to overreact to build a new balance between supply and demand.

Not only are freight costs at a high point, the key burndown herbicides are still at a robust pricing level. The high price started in March to April 2021 due to the incredible increase of raw material prices in China. Along with the high raw material price, the early global demand was pouring into the China market, which stimulated the supply market to overreact to build a new balance between supply and demand.

Meanwhile, the disruption of international transportation also pushed procurement teams to conduct the strategy to increase safety inventory, which was mainly for meeting the lead time to farmers’ planting. These interrelated dynamics in 2021 helped push the price for burndown herbicides, especially for glyphosate, significantly upward, almost at the same pricing level as 2008, the year of the global financing crisis.

In the first quarter of 2022, there will be some impact from environment protection audits and a national event in the China agrochemical industry. But the diminishing impact of the “Double Control Policy” will support China’s agrochemical operation rate from March 2022. Different from 2021, the global procurement strategy could be more conservative in 2022 since the new demand would be back to the normal consumption at farm level. Even though the growth of global planting must be considered, the calming down of demand could be a high possibility in 2022.

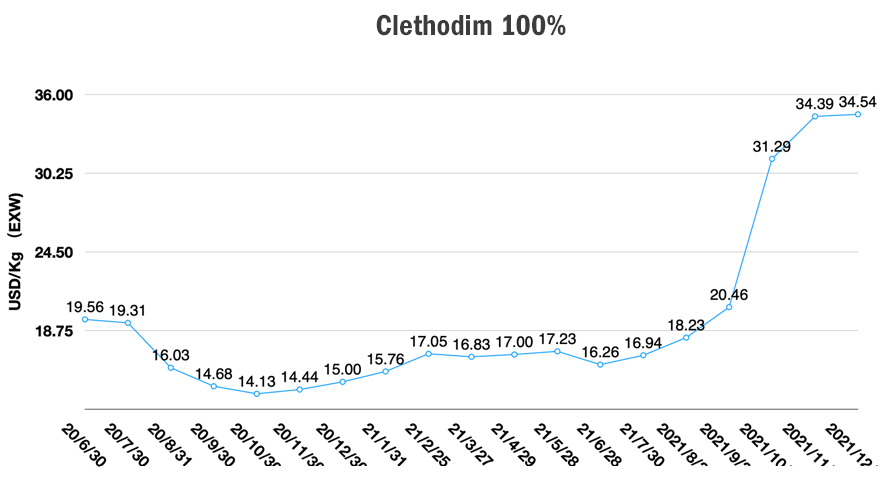

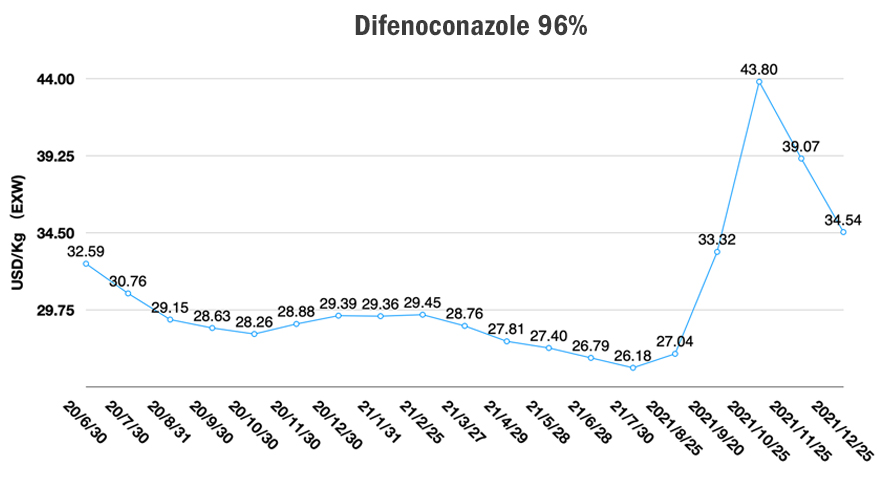

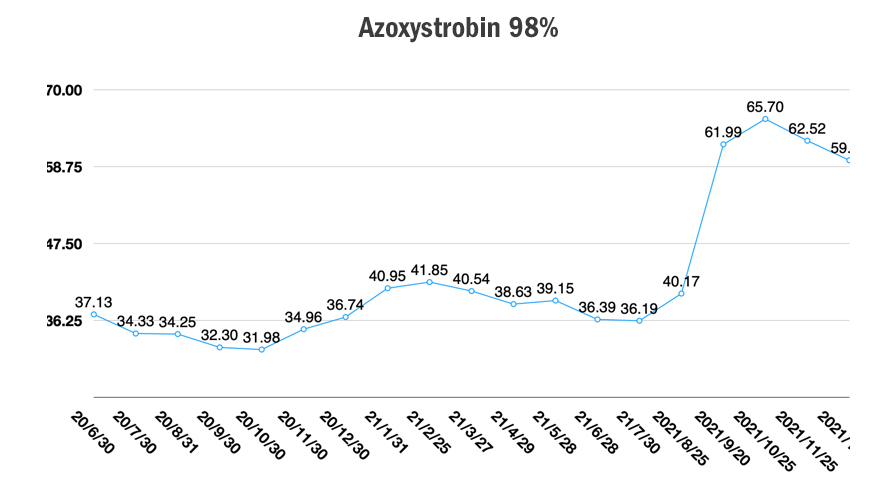

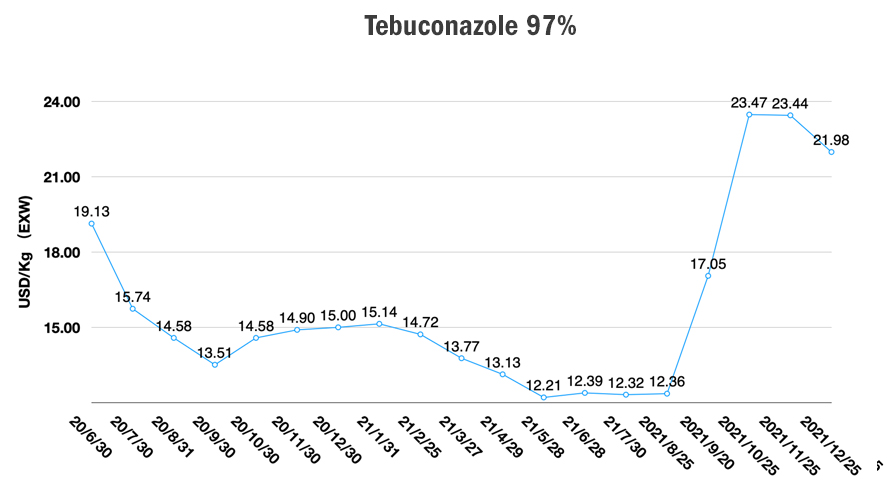

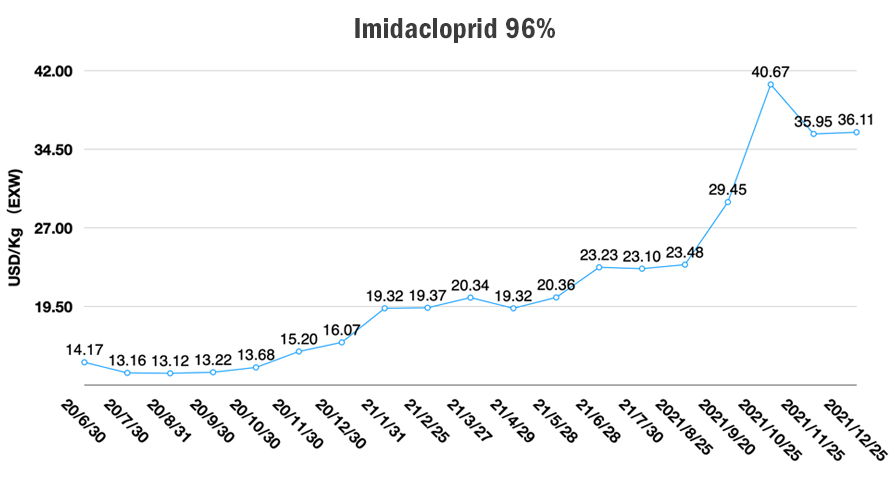

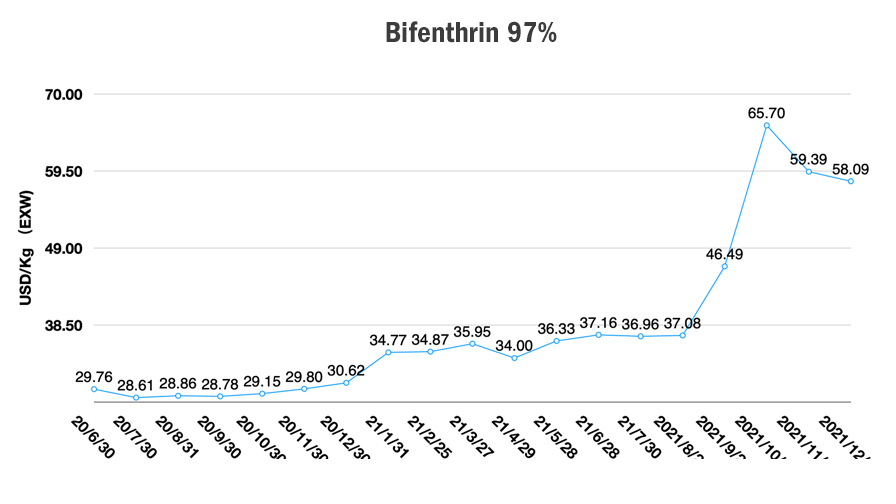

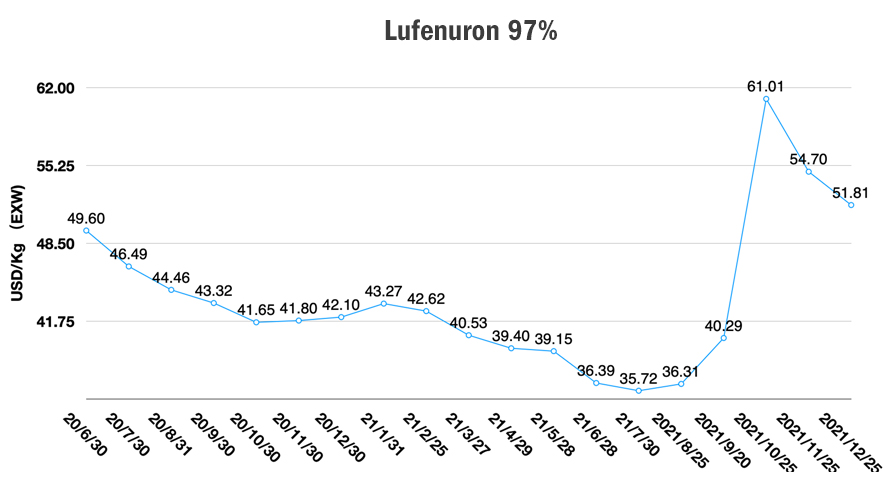

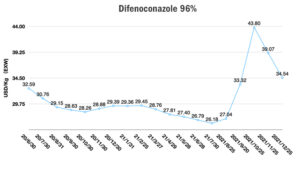

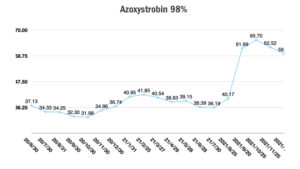

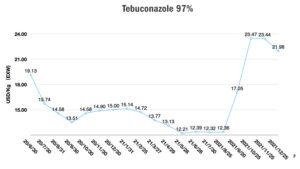

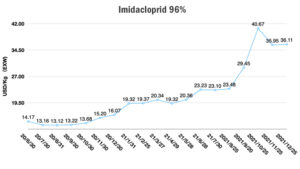

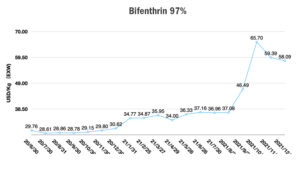

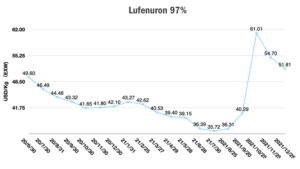

China glyphosate producers might not be ready for the future soft landing of demand. The game between quoting and procurement will be on-going before the Chinese Spring Festival and Beijing Winter Olympic Games. The glyphosate price is currently stable at around EXW 13 USD/Kg. The glufosinate price has dropped from EXW 59 USD/Kg to EXW 55 USD/Kg. Burndown herbicide prices are slacking due to the trader’s behavior. The cheaper inventories are pouring into the market for cash back before the Chinese Spring Festival. On the other hand, prices for Chinese fungicides and insecticides prices are at a stable level after reaching a tipping point.

In the first quarter of 2022, the best choice could be cautious optimism. La Nina could bring unexpected impact to global agriculture growth during the spring of 2022. Extreme weather, like an ice storm, could hit the U.S. again. And the drought in Brazil might cause a serious problem for its farmers. Plant nutrients and biological solutions will take on more weight in farmers’ product investments, along with rising adoption of precision ag and digital farming.

Like mentioned before, the value creation in global crop protection industry needs the contribution from multinational companies and Chinese agrochemical suppliers together. The more value space left to farmers, the more sustainability there is for the whole crop protection industry. This will also extend the life value of precious molecules, since there is limited new molecules available on agronomists’ portfolio list.