China Price Index: Innovation Is Key to Long-Term Sustainability in China’s Fragile Agrochemical Market

Editor’s note: Contributing writer David Li offers a snapshot of current price trends for key herbicides, fungicides, and insecticides in the Chinese agrochemical market in his monthly China Price Index. He also provides insight into how China’s double control policy, environmental protection audits, and predictive suspension of production are the filters of adversity for the entire China agrochemical industry, and how disruptive innovation strategy can be a tipping point for long-term sustainable growth.

Data science is the catalyst that accelerates change in ag technology, especially during an era full of incredible moments. Here are some of the latest examples:

Bosch and BASF’s smart farming joint venture received the global green light, according to BASF news. The brand new JV, registered as Bosch BASF Smart Farming (BBSF) GmbH, brings a novel precision spraying solution to global farmers. Its Intelligent Planting Solution is already commercially available in Brazil and Argentina and will use the advanced digital agronomic intelligence of BASF’s xarvio crop optimization platform to enhance zone-based seeding recommendations in Brazil soon.

The most interesting part of the platform is how it provides real-time, automated pre-emergence (green-on-brown) and post-emergence (green-on-green) weed identification and management day and night. Combining Bosch’s high-tech camera sensor technology and software with xarvio’s agronomic intelligence enables Smart Spraying in milliseconds to precisely detect weeds in crop rows and to spot apply herbicide only where needed. Its unique configuration supports a more efficient use of herbicide, with trials showing herbicide volume savings of 70% are achievable.

AMVAC’s SIMPAS Application System offers “prescriptive application” for the world’s farmers. It uses the agronomic analyses from a variety of data sources to develop prescriptions, “precisely where it’s needed.” The system brings an open platform to accommodate in-furrow application of multiple product categories and brands. Their categories includes nematicides, fungicides, insecticides, micronutrients, PGR, and biostimulants. SIMPAS’ benefit to retailers and farmers is to transform the transactional relationship into a partner relationship. This future business model will allow retailers to grow along with the farmers they are serving.

In China, Modern Agriculture Platform’s (MAP) online service area exceeds 148 million mu (9.87 million hectares), accounting for about 7% of the national arable land area, Syngenta Group CEO Erik Fyrwald told Global Times. MAP is focusing on the full agriculture value chain to provide whole life cycle management services. The MAP beSide lifecycle system is a program that helps farmers grow very high quality, traceable crops in a climate-smart way and sell to commercial buyers at premium prices. It also enhances food security and quality for consumers. By building the demo in rural areas like FuNan Anhui province, MAP is leading China’s farmer education on good agrochemical application practice and improving yield for farmers. The digital platform is the point of junction for Syngenta China Group in China.

These global leading innovators are focusing on next-generation farming, but how they are managing that depends on the circumstance. BBSF focuses on the ability to identify weeds, even at night. Its target is big farms. SIMPAS is a simple application that can be taken advantage of where the agriculture industry is more fully developed. Syngenta Group’s MAP is more suitable for territories where small farmers gather and need more education.

All of these innovation leaders have the same goal: to save ag inputs and increase the efficacy of agronomy. If we think logically, future agriculture should be capable of delivering high yield with the lower application and fertilizer consumption. More high-toxic molecules will be phased out during the next five years. And long-tail generics will live longer by sustainable formulation technology development. New molecules and existing molecules with high efficacy will dominate the market in near future.

Agrochemical Update

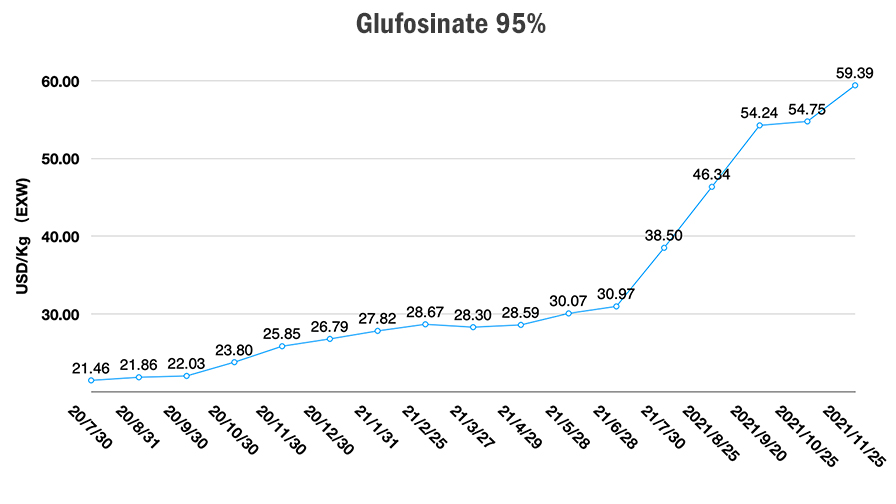

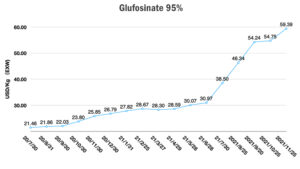

According to an article by Shelby Varner for Kansas State University’s K-State Research and Extension news, when farmers face a shortage of two key herbicides, glyphosate and glufosinate, they need to make sure the herbicides being used are effective. Precision agriculture targets weeds for the effective application of herbicide. This change in farmer behavior will hasten the development of precision agriculture globally.

Moreover, the article discusses ways to take the pressure off the post-emergence products including having a solid pre-emergence herbicide program. The near off-patent molecules like pyroxasulfone could have a bright future since it offers high efficacy with the low dosage in the field, especially as a key pre-emergent herbicide. As I mentioned in the article “Reimagine Strategic Sourcing from the China Agrochemical Industry,” value creation on category management needs to be breeding with suppliers for long-term strategy execution.

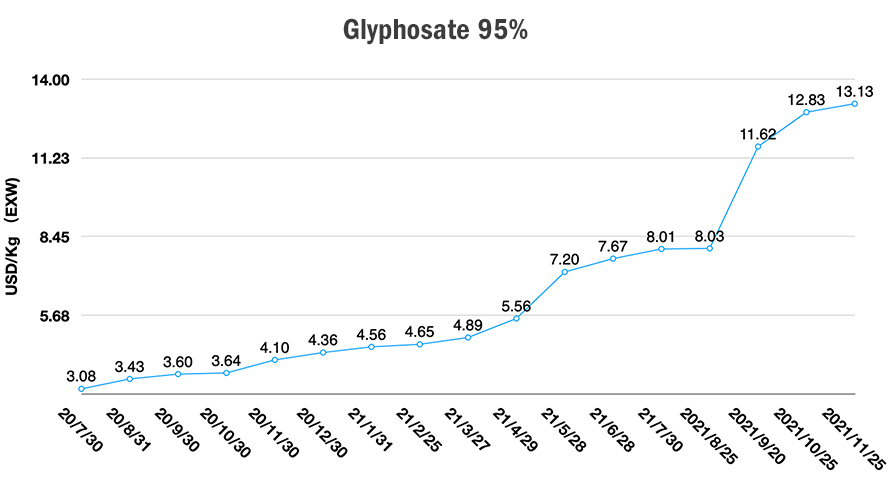

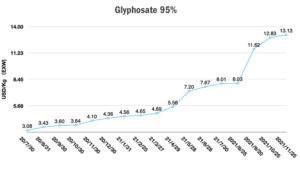

By contrast, common burndown herbicide prices for glyphosate seem to be on a rollercoaster. Since the beginning of 2018, the glyphosate EXW price was decreasing. It dropped from 4.1 USD/Kg in January 2018 to 2.9 USD/Kg in mid-2020. The key reason was the weak price for key food commodities. Beginning in early 2020, global food prices went up, which helped drive the strong demand for glyphosate. Glyphosate prices rebounded hitting 13 USD/Kg with a slowing growth rate a year later.

Future suspension of production for some key manufacturers could be another factor that pushed additional price increases along with the Beijing Winter Olympic Games and winter environment protection audit. Even though there is no serious shortage of raw materials like phosphorus in the Chinese market, key intermediate capacity like PMIDA will be affected due to the key locations where PMIDA is produced ― Hebei and Shandong. Tight supply from China will last to Q2 2022 at least. So the stable high pricing is expected to remain for some time.

According to the global planting trends, farmers around the world are still willing to invest in commodity crops. Corn is expected bring more profit for farmers in the 2022 season. Soybean regions are expected to grow as well. If the prices of corn and soybean stay at high levels, farmers foresee a future return. However, the world economy is on the front edge of a cliff. The global inflation risk is increasing in the EU and U.S. Currency fluctuation is a key factor that could affect the LATAM market in 2022. The uncertainty of food commodity pricing is the most difficult part for farmers to anticipate.

Glypohsate is still a hot topic in the agrochemical market. Since the introduction of genetically modified seeds in the 1990s, farmers have grown accustomed to the easy way to control weeds. It is hard to go back to Twitter if the end-user gets used to TikTok. Moreover, robust global food demand and disruptive supply chains have helped maintain the high pricing for some time. Considering the allocation of world glyphosate capacities, the future continuous supply from world leading capacity will set the future price of glyphosate. Bayer CropScience has recovered from Hurricane Ida. The key accounts for Bayer could have priority on future supply. Tight China supply can let strong pricing continue, but a soft landing in the future will be highly possible for glyphosate.

The current China agrochemical market is in a fragile balance. The market inventory is not sufficient like it was in 2008. So there will be no quick panic if a lower price comes out. It is a good timing for trading companies to sell out as soon as possible for cash back. But the curve of market demand seems to be working. A new deal cannot be very easily closed.

The secret of successful trading is to have frequent transactions. Inventory would only bring high risk of financing management for property hoarding. Looking for the right exit time becomes a top strategy for the dealers. The low price cargo from traders might bring another risk on supply chain management. Quick quality analysis of key impurities by third party or authorized GLP labs becomes more important for quality assurance to guarantee the source of production.

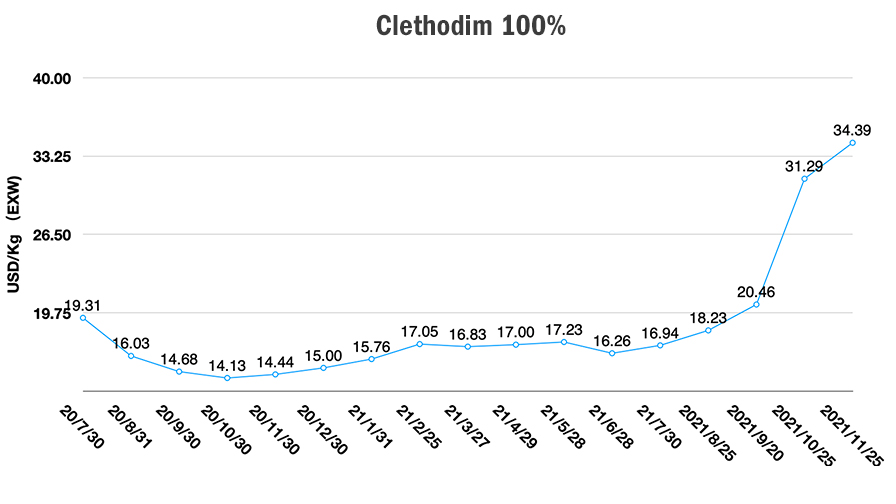

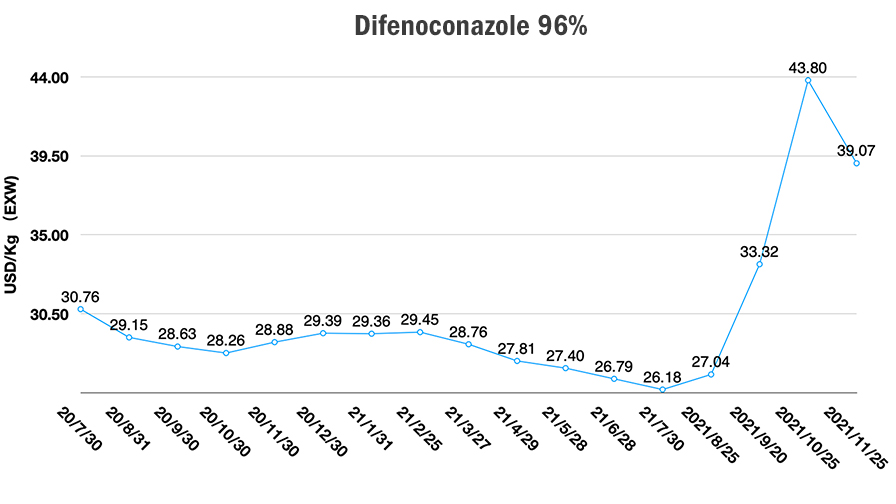

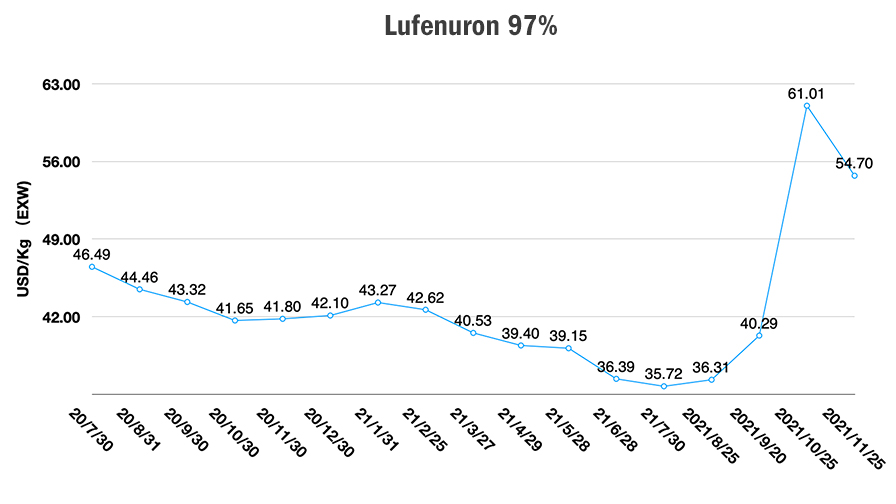

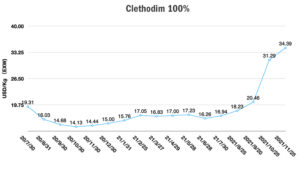

Due to the robust increase in glyphosate prices, most herbicides are still selling at high levels. The real manufacturers are still in low operation rate mode. The alternative to glyphosate has also seen a price increase. Diquat 40% EXW prices rose to 10 USD/Kg in November 2021 from 6 USD/Kg in August 2021. Other herbicides, like Clethodim AI, reached 34 USD/Kg along with low operation rates in November. The whole China herbicide market was almost at its peak in 2021.

Double control policy, routine environmental protection audits, and predictive suspension of production are the filters of adversity for the whole China agrochemical industry. The Chinese manufacturers who are able to control raw material resources, have strong financing capability, advanced process enhancement, sustainable R&D, efficient productivity and a low-cost, high-level of environment protection, competitive energy saving, and regulation compatibility, will have a better chance to survive in the next five years. Future enterprises must be outstanding in line with “the natural law of survival.”

But to be honest, most Chinese agrochemical manufacturers’ management teams are far away from agriculture. Almost 70% of China’s agrochemical production is supplied globally. Only some people from the management team have had the chance to visit global farmers to listen to their demands. And just a few people would like to invest in branding and field application technology to bring innovative solutions to real consumers.

Global trends are made not only by the suppliers, they are created and affected by the key leaders. Like Bosch and BASF, AMVAC, and Syngenta’s MAP, their disruptive innovation strategy can be a tipping point for long-term sustainable growth. How could Chinese suppliers follow the global leader’s strategy? Practical field investments and a mindset for co-development with global agriculture will be key to success.