China Price Index: Why Supplier Diversification Is Key in the Chinese Agrochemical Market

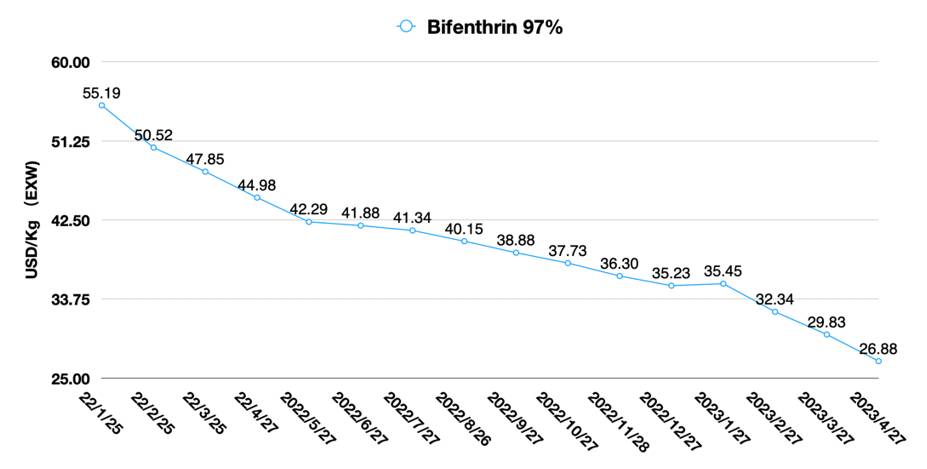

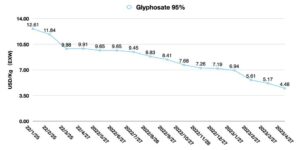

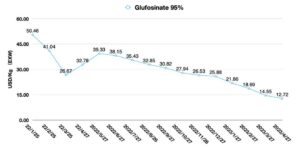

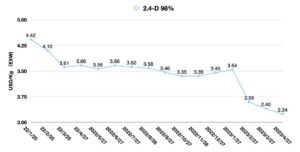

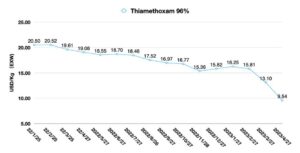

Editor’s note: Contributing writer David Li offers a snapshot of current price trends for key herbicides, fungicides, and insecticides in the Chinese agrochemical market in his monthly China Price Index. Below he also examines why current adversity in the global crop protection industry is forcing Chinese agrochemical companies to explore new business tracks.

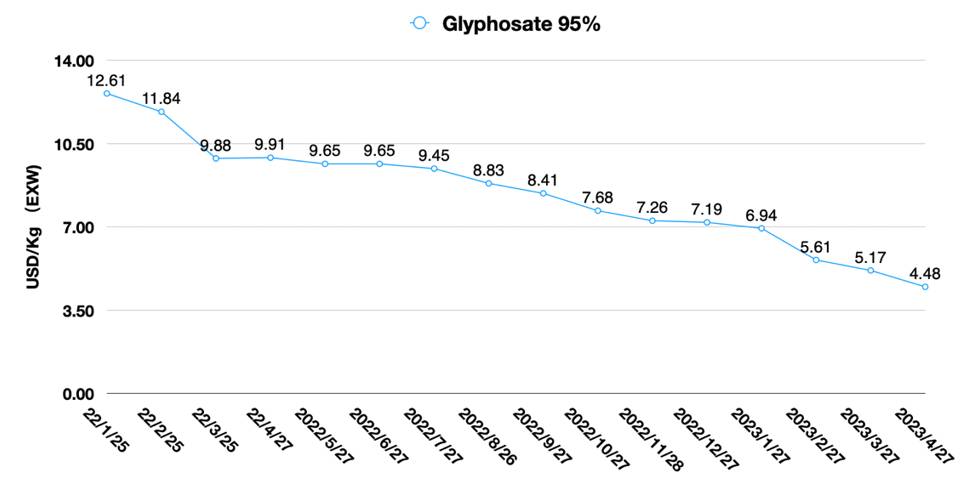

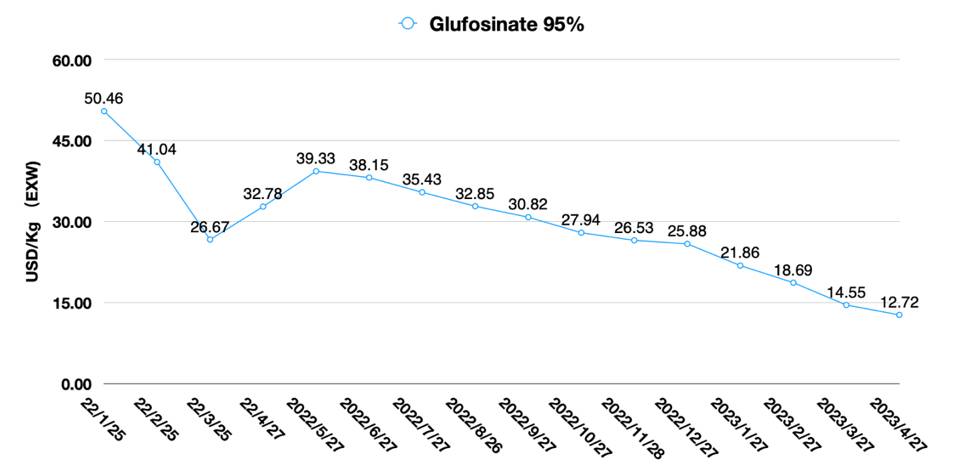

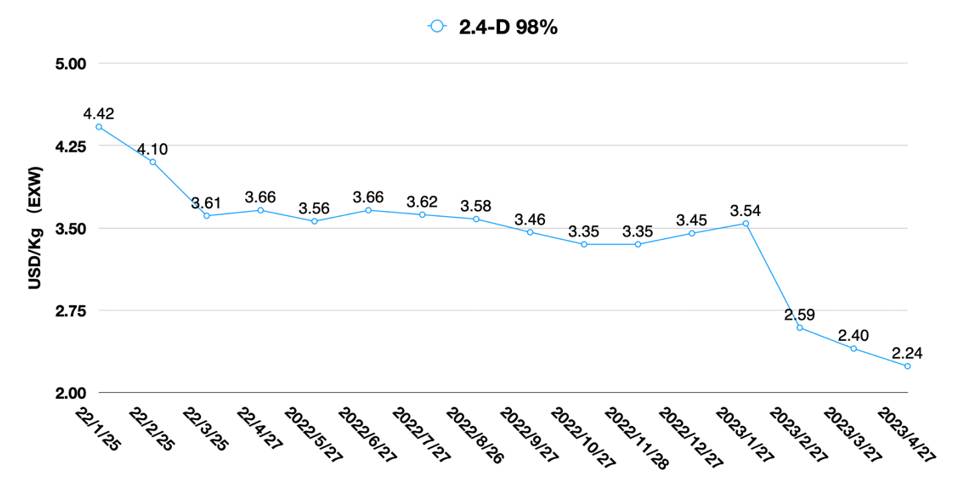

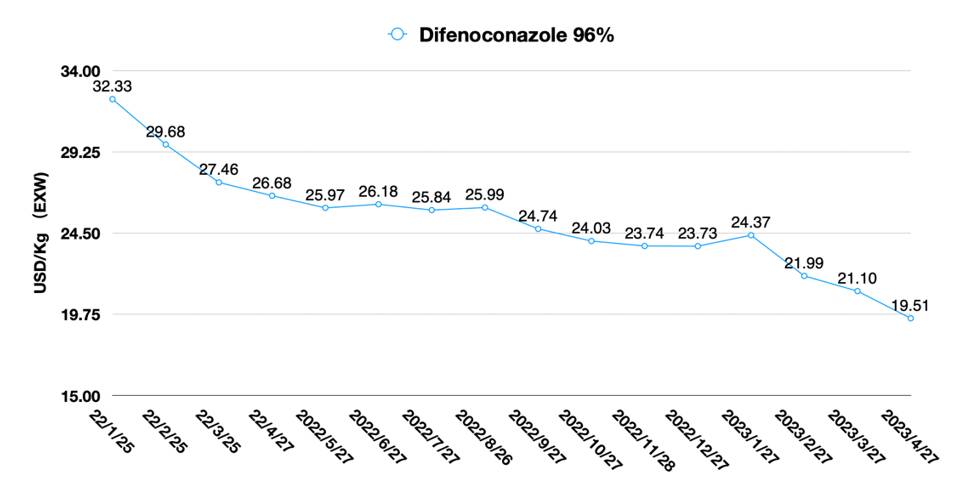

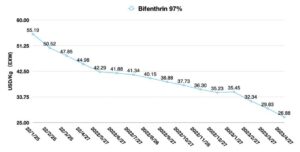

The first quarter results for two leading Chinese agrochemical companies that provide burn-down herbicides amply illustrate that weak demand in overseas markets and oversized capacity in China have led to further red sea competition in the Chinese supply market, as well as in overseas distribution channels. Red sea competition leads to weak prices. Often price declines can lead to a boost in demand, but this has not been the case, so far. This negative reaction put intense pressure on the stock prices of China’s leading agrochemical companies.

Until now, it has been too difficult to disrupt the negative reaction to form positive feedback in the country’s agrochemical supply market.

Until now, it has been too difficult to disrupt the negative reaction to form positive feedback in the country’s agrochemical supply market.

Lier Chemical, a leading glufosinate producer in China, reported revenue of CNY 2.4 billion (US $364 million) for the first quarter of 2023, a decrease of 6.53% compared to the same period in 2022. Net profit attributable to equity holders was CNY 270 million (US $40 million), a decrease of 48.58% YOY 2022. On the other hand, Xingfa Group, a leading glyphosate producer in China, reported revenue of CNY 6.57 billion (US $980 million) in the first quarter, a decrease of 25.02% YOY 2022. Net profit attributable to equity holders was RMB 449 million, a decrease of 74.21% compared to the same period last year.

To face the weak demand, Chinese agrochemical companies normally choose a two-pronged action to face the challenge. Cutting prices helps them gain market share through a price war. The second approach is to limit output, which can boost prices and allow for the digestion of channel inventories including those at the distribution and farm field levels. Since January 2023, it’s clear that these approaches to stimulating demand have not been working.

It is very risky to leverage companies’ resources to capture market share as much as they can when a completely competitive market is formed. Because the low, unsustainable “price moat” could easily collapse at any time. This “market share” would be meaningless because the opportunity cost of customer switching is almost zero. The reshuffling of China’s agrochemical industry is expected to follow after companies’ resources are soon exhausted.

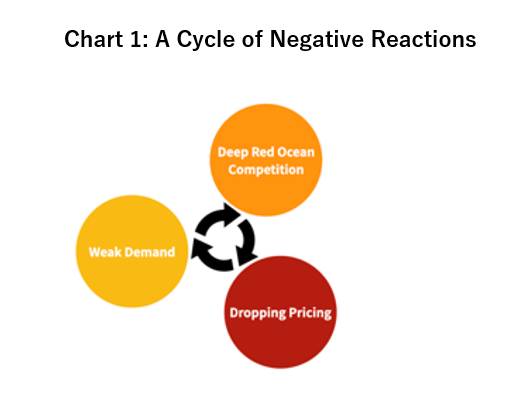

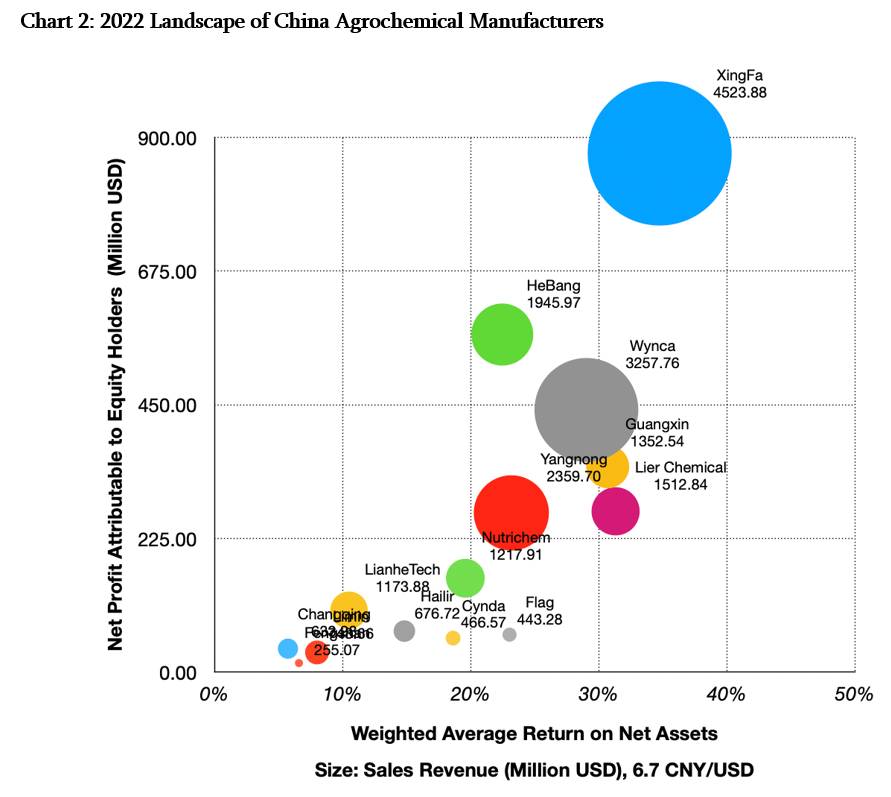

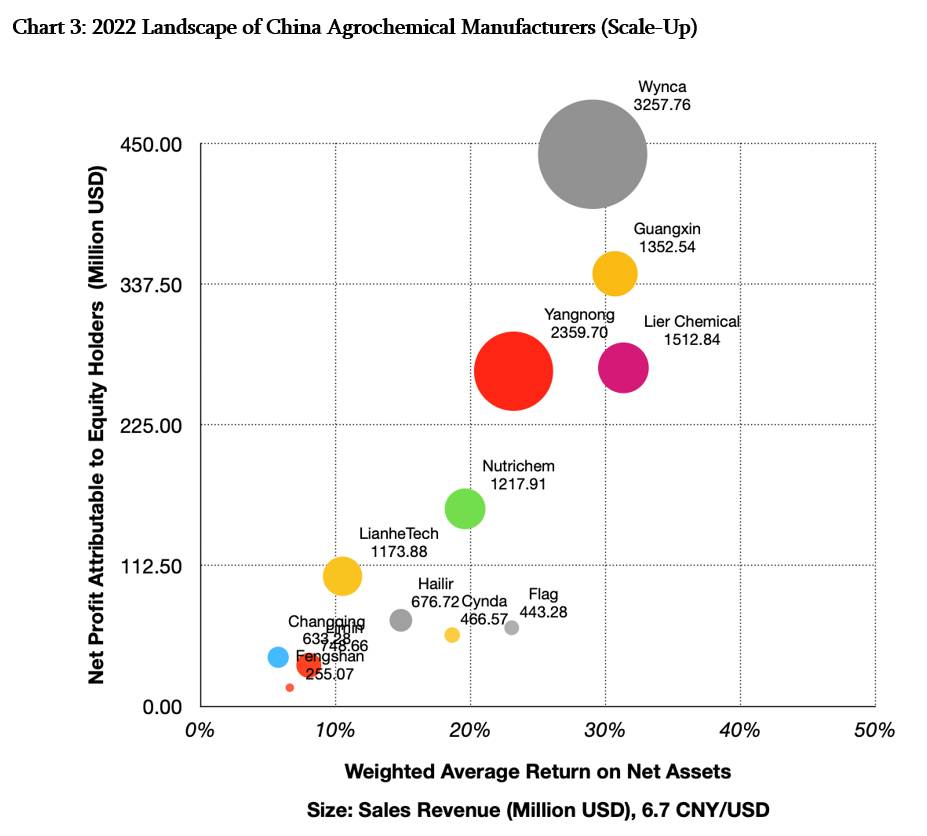

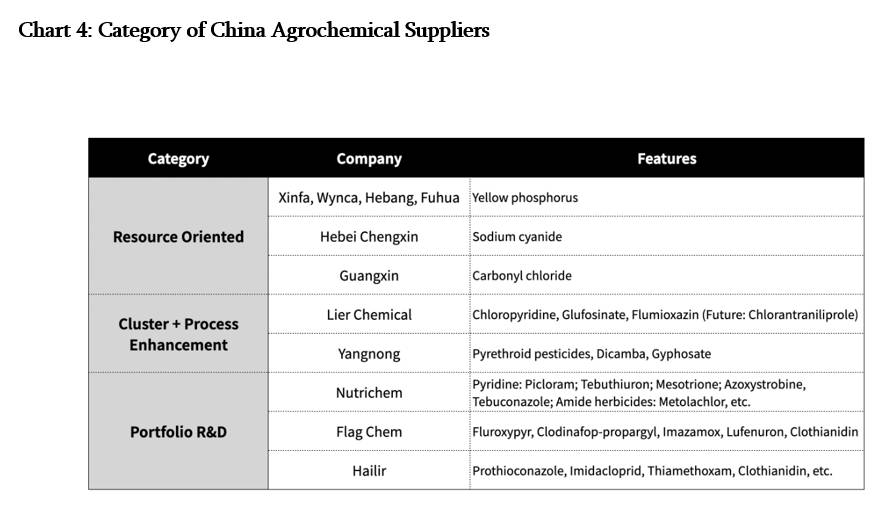

Reviewing the market landscape of China’s agrochemical industry in 2022, the overall Chinese agrochemical supply landscape was still dominated by resource-based companies. Glyphosate producers are still in the leading position. They were closely followed by companies whose key advantages will be cluster and process optimization, which are represented by Lier, Guangxin, and Yangnong.

These two types of companies are at the top segments of entire industry, which is consistent with the economic development model of the past two decades during which China engaged in raw material processing to drive processed product exports. The biggest potential risk for these companies is having single product lines. Companies have invested heavily in manufacturing facilities, resulting in huge, fixed asset investments that have been the growth drivers for them. In the short term, this protective moat of the company is solid. However, once the market for a single product fluctuates, the lack of flexibility will also cause huge fluctuations in business performance.

The most dynamic Chinese agrochemical manufacturers are innovative companies like Nutrichem and Flag Chem, which are driven by varied portfolios and R&D. Product development leads to a long-term technology and process protection moat. If they can be viewed from long-term value creation, such companies’ moats must be elastic. Moreover, these companies have the flexibility to choose their investments in manufacturing infrastructure combined with the advantageous resources of chemical parks to form new clusters. They have a wide range of options. R&D is the driving force for them.

As for Hailir, Cynda, Changqing, and Fengshan, although the companies also have product line development, their market competition to break through the sales dilemma still lacks motivation. The dilemma brought by lower sales amounts make the companies unable to effectively form deep influence on the market. Therefore, they are basically in the role of responding to changes in corporate strategy.

“The greatest danger in turbulent times is not uncertainty, but continuing to act according to yesterday’s logic,” wrote Frederick Laloux in his book, “Reinventing Organizations.” It is foreseeable in 2023 that glyphosate manufactures will continue to dominate the landscape of China’s pesticide industry. But if we take a closer look at the landscape of China’s agrochemical industry, we find that cross-industry competitors and innovators who are disrupting the traditional agrochemical industry through innovative technologies have quietly emerged.

New players’ emergence represented by Hebei Chengxin will be inevitable because of its core competitive advantages like sodium cyanide. The new players will gradually squeeze out the seemingly solid position of lagging companies in the traditional Chinese agrochemical industry in coming years. Only companies that have solid protective moats and competitive advantages can survive. After using the price war to capture the market share as much as they can, the competitive companies need to investigate deeply on how much long-term value they can create for the global partners.

Looking at the short term, it could be very difficult to break out of the negative-reaction loop in 2023. Since the global channel inventory looks like a fully loaded heavy shipment. However, like Nike (Co-founder and Chairman Emeritus) Phil Knights’ 1980 company manifesto: Business is changing, and we’re on offense, all the time. Business is an innovative process to create value. Organizations need to break the “rules” and do the right thing. Some agrochemical companies have now started to actively lay out new tracks.

For Chinese agrochemical companies, many of them are laying out new energy tracks. There are some limitations to the new energy business that agrochemical companies can participate in. At present, the only options available to Chinese agrochemical companies are in the electrolyte and positive and negative electrode materials business.

In 2022, Limin Group’s subsidiary intended to invest in the construction of electrolyte salts, functional additives, and electrolytes for new energy batteries. This includes an annual production capacity of 20,000 tons of lithium bis(fluorosulfonyl)imide (LiFSI). On 21 March 2023, Xingfa Group released its annual report for 2022. According to the report, Xingfa Group is laying out new lithium materials business and plans to build iron phosphate and lithium iron phosphate projects. In January of this year, Wynca issued an announcement that the company will accelerate the strategic layout of the new energy track through M&A and to expand the application R&D and industrialization capacity of negative electrode materials.

As the start of a quote goes: “Tough times create strong man.” The current adversity in the global crop protection industry is forcing Chinese agrochemical companies to explore new business tracks like those that global chemical companies have mapped out over the past 100 years, that is, diversification. In 1865, BASF was founded in Ludwigshafen, Germany, across the Rhine River. In its 150-year history, BASF has gone through several development stages, including the dye era and the ammonia era, and has gradually grown into a premier global chemical giant. Bayer, DuPont, and other multinational companies have similar experiences. Chinese agrochemical companies may also be in an era of kinetic transformation. Perhaps in front of them is a new future with both opportunities and challenges.