Global Crop Protection Product Trends: An Inside Look at Key Central America Markets

Central America can best be considered as the “land-bridge” or isthmus that separates North America from South America. The land mass makes up most of the isthmus that separates the Pacific Ocean to the west from the Caribbean Sea in the east. It extends some 1,140 miles long from the northwest to the southeast. At its narrowest point the isthmus is approximately just 30 miles wide and that point is also the location of the Panama Canal.

Asides being an important country for agriculture in its own right Panama via the Canal is estimated to provide transit to close to 50% of all U.S. soybean exports in a normal year; as well as a significant proportion of other agricultural crops from both North and South America. In addition, Panama Central America comprises six other countries: El Salvador, Costa Rica, Belize, Guatemala, Honduras, and Nicaragua. The region is also distinct from the Caribbean, which is a much wider geography and includes Cuba.

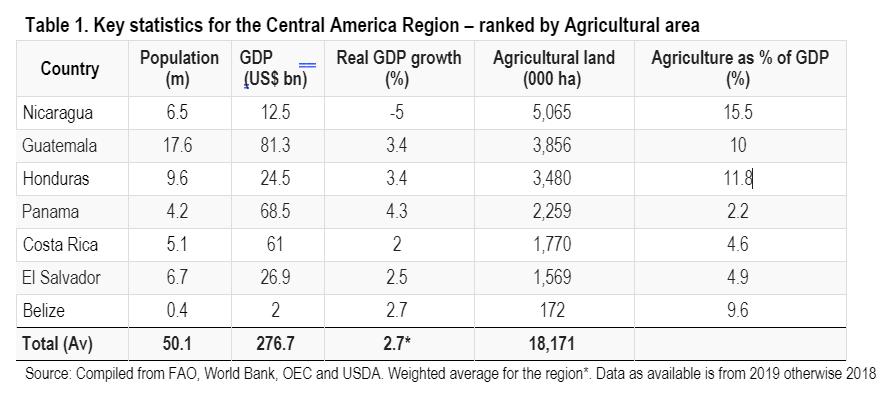

Agriculture in the different Central American countries ranges from export orientated in the case of Guatemala and Costa Rica to that of a more subsistence focus as in Nicaragua. The size of the overall economy of Guatemala and the strong importance of agriculture in that economy makes it the largest agricultural economy in the region by some margin. This is despite it not having the largest agricultural land area as indicated in Table 1. In the case of Guatemala four of the top five export commodities are agricultural with bananas, coffee, raw sugar, and palm accounting for close to US $3 billion of exports. For Costa Rica, bananas and other tropical fruits (mainly pineapples) are the top two exports in value terms accounting for US $3.2 billion. In both cases the U.S. is the largest trading partner for exports.

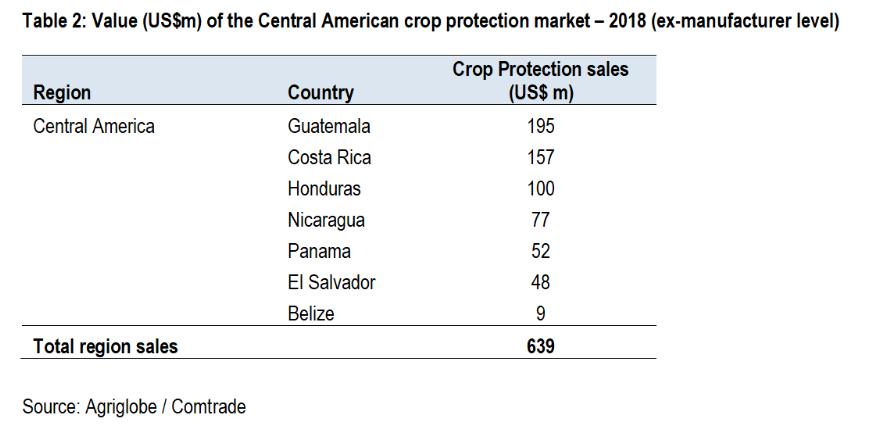

The largely export focused markets of Guatemala and Costa Rica have an increased demand for crop protection products in order to satisfy higher quality demands for produce destined for largely European or North American Markets; resulting in those two countries dominating the region in terms of overall value; as in Table 2.

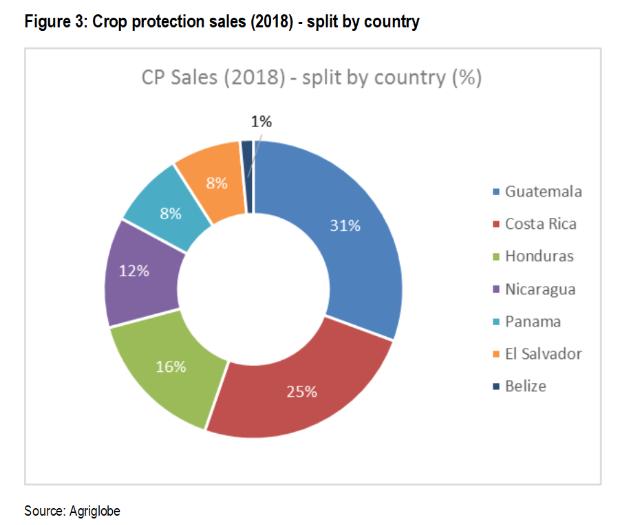

While the two larger markets of Guatemala and Costa Rica account for some 31% and 25% of the total regional sales respectively, the other four markets do provide for significant value contribution. While differences do exist between the countries, the similarity of the crops grown and the agricultural climate overall is such that the region can be considered as broadly quite similar.

Central America: Over Time a Significant Growth Market for Crop Protection Products

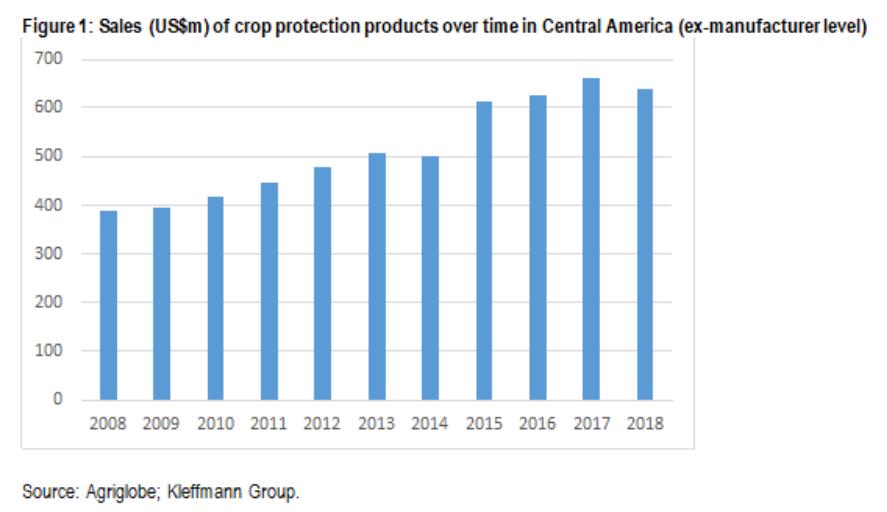

As published in June 2019 the Global Crop Protection market in 2018 increased at a rate of 2% in nominal terms over that of 2017. As a comparative figure the Central American Market fell by close to 4% in 2018 as compared to 2017. Despite this drop in 2018 the region has, however, outperformed the global market with a CAGR of 5.1% per annum over the time period 2008 to 2018 as compared to a more modest CAGR of 2.3% per annum for the global market.

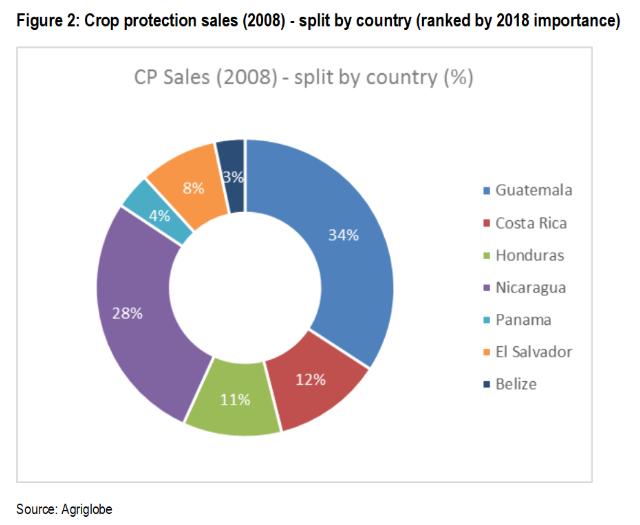

The region overall has, with very few exceptions, seen a year on year increase in overall value. That value increase has also seen significant changes between the individual countries ranking within the region; most notable the relative decline of Nicaragua and to a lesser extent Guatemala; whilst Costa Rica in particular has grown in relative importance (Figures 2 & 3).

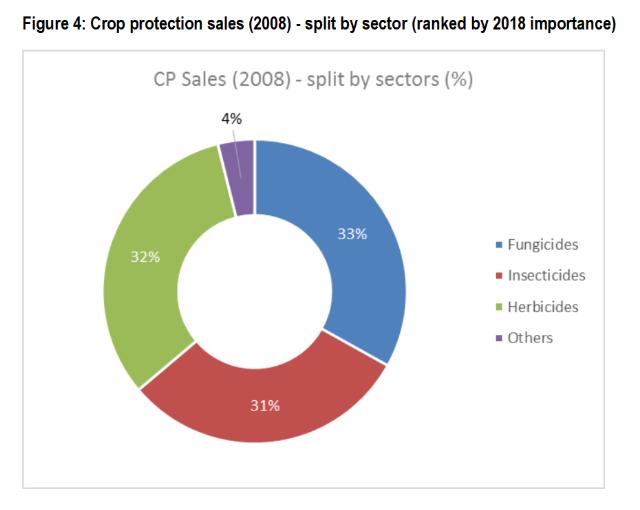

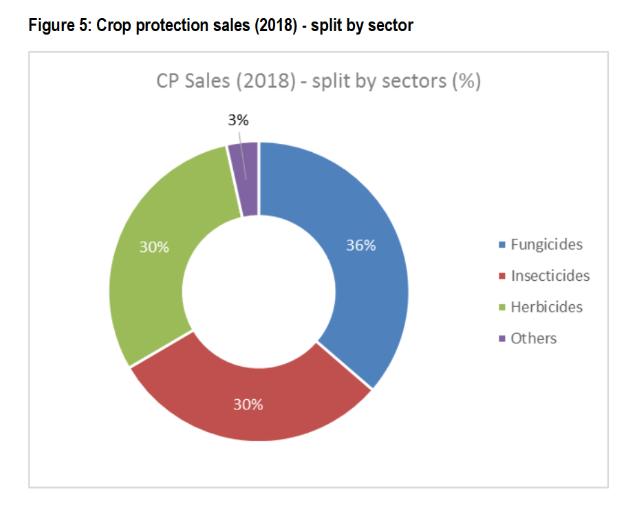

Despite the shift in relative country value throughout the region the overall importance of the different sectors has remained relatively stable although there has been a shift of value from the herbicide sector into that of fungicides over the time period of 2008 to 2018 (Figures 4 & 5).

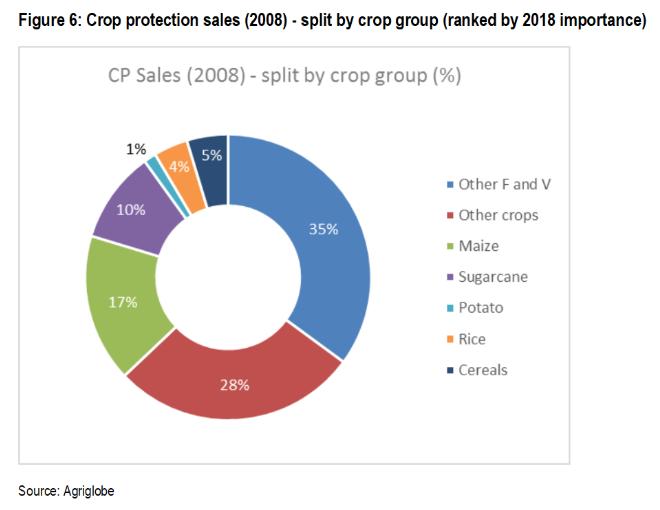

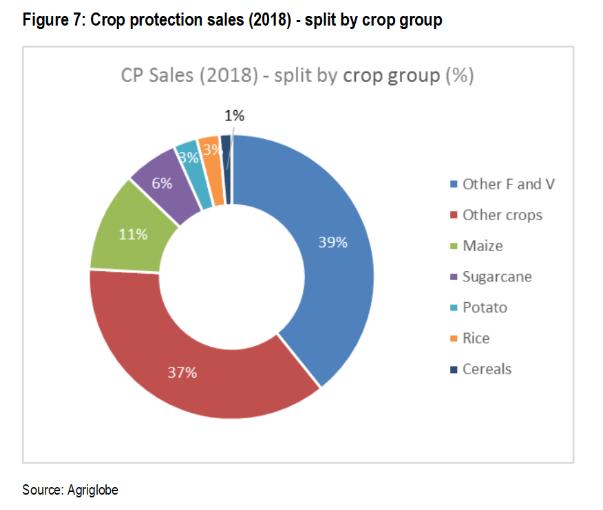

As with sectors the relative split between the different crop groups has remained relatively stable over the time frame 2008 to 2018 although there has been a shift towards the more profitable export crops of fruit and vegetables (for example in Costa Rica with banana and pineapples) and towards the other crops (for example coffee in Guatemala) as indicated in Figures 6 & 7.

Outlook for 2020

At the time of writing the outlook for the global market for crop protection products is heavily influenced by the progression of COVID-19. At the end of 2019 the Kleffmann Agriglobe forecast for 2020 was for a global growth of just over 2.5% in 2020 as compared to 2019. That rate has since been cut by a clear percentage point over concerns of COVID-19 on the global economy as well as the direct impact on the agricultural sector and in-turn crop protection use. On a global basis one area that is likely to see a significant decline in crop protection usage will be the fruit and vegetable sector; as the availability of labor required for the crop will likely be restricted out to Q2 and possible Q3 in many regions. Central America, however, both from the point of relatively low COVID-19 infection rates (again at the time of writing) and the on-the-whole lower dependence on migrant-workers may not, however, suffer such a decline in this important sector for the region and may benefit from an additional increased global demand.

Kleffmann’s analysis is based on data collected from farmer surveys, interviews with distributors in emerging markets, proprietary market trend studies, subject matter experts and open source information. The farmer surveys continue to provide the bulk of the data for our analysis although our program of “trend studies” is becoming more significant. Trend studies allow for a comprehensive examination of many smaller but fast growing markets, particularly those on the African continent. Many “trend study countries” will become the next group of “farmer surveys countries” as companies better understand their growth potential.