Rabobank: Tighter Margins for Field Crops in 2024

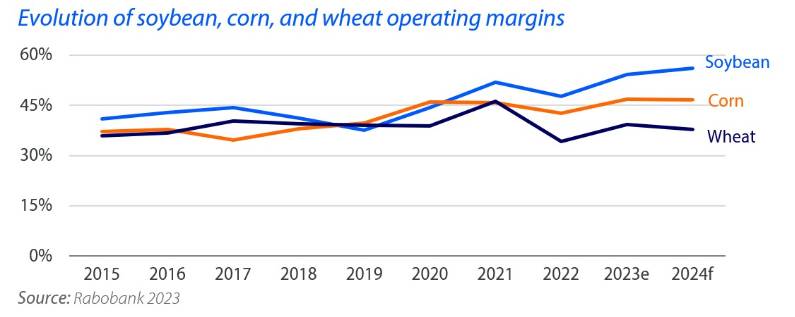

Global farmers faced rising production costs due to disruptions in molecule production during Covid-19 lockdowns and increased crop protection costs. The war in Ukraine further spiked fertilizer prices to record highs. While operating margins slightly decreased, favorable commodity prices buffered the impact in 2022. Rabobank estimates suggest contracted margins persisted in 2023 and will continue into 2024 despite recent decreases in key operating costs.

The outlook is still good for soybean farmers, not so much for corn and wheat

Soybean farmers are likely to achieve good margins in the coming season. However, corn farmers will feel their margins pressured by ample supply, while wheat farmers are unlikely to see improved margins despite declining costs.

Markets are at a crossroads and prices could move in either direction

In the third quarter of 2023, grain and oilseed prices began to decline. This followed the confirmation of record soybean and corn production in Brazil, coupled with reasonable assurances of a satisfactory crop in the US for 2023, preventing further stock decline. Despite fundamental factors favoring a price decrease, notably the increased corn and soybean stocks, market trends indicate a pivotal point.

Uncertainty arises from factors such as record crops in Brazil, “adequate” crops in the US and Europe, and expectations of another record Brazilian crop in 2024. Global domestic demand for key crops declined for the third time since 1980/81, pointing to building stocks and decreasing prices. Corn and soybean stocks increased, while wheat and rice stocks continue declining. Weather challenges and geopolitical instability coupled with economic uncertainty prompt consideration of a risk premium in the market.

The Black Sea region emerges as a notable market risk

Despite Ukraine’s comparable or improved corn and wheat crops, the discontinuation of the Black Sea Grain Initiative has cut off a crucial export gateway. Ukraine, once heavily reliant on Black Sea ports, has diligently diversified, now dispatching around 60% of its commodities via seaports. Despite ongoing challenges from war, Ukraine’s agricultural exports face impediments, with bans from Poland, Slovakia, and Hungary persisting despite the EU lifting restrictions on September 15.

The only certainty is price volatility

In terms of price risk, the corn market exhibits the least upside potential, with wheat presenting the highest. Soybeans fall in between, indicating an equal likelihood of upside and downside risk. The prevailing market uncertainty ensures that price volatility is an inevitable certainty.

To read Rabobank’s “Field Crop Margin Outlook 2024” report, click here.