David Li Addresses Glyphosate Oversupply in AgriBusiness Global LIVE! China Update 2024

AgriBusiness Global LIVE! featured David Li, Marketing Director and Chief Analyst for SPM Biosciences, for the China Update 2024 live webinar. Li presented crucial information for understanding China’s crop protection manufacturers strategies for dealing with oversupply in the market. He also answered attendees’ questions about specific active ingredients and markets. You can access the webinar recording and Li’s presentation here.

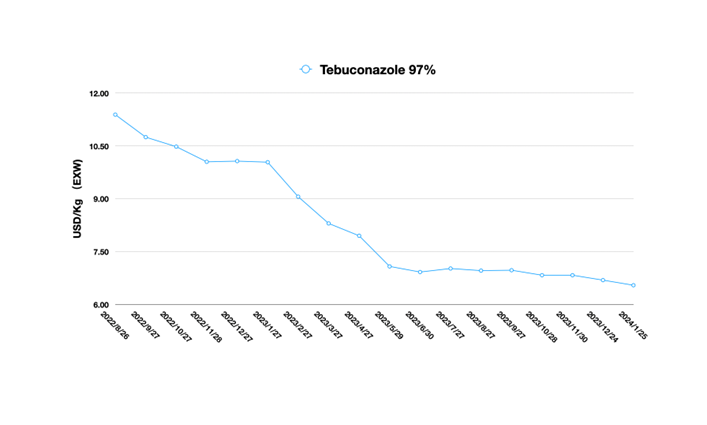

ABG: What is your take on tebuconazole and propiconazole prices? Do you see any correction in them?

David Li: Tebuconazole was mainly affected by the dry climate overseas and the launch of new compound fungicides by multinational companies in past years, which resulted in weak market demand. The situation has not changed fundamentally at present.

The supply of upstream raw materials and the supply of tebuconazole AI in China are stable. The inventory in the supply market remains sufficient. Tebuconazole prices are expected to remain stable and low through the first half of 2024. There is limited room for prices to continue to plummet at present. After the concentrated release of demand in South America, it may bring short-term price fluctuations. However, the space for fluctuation is limited in the long run.

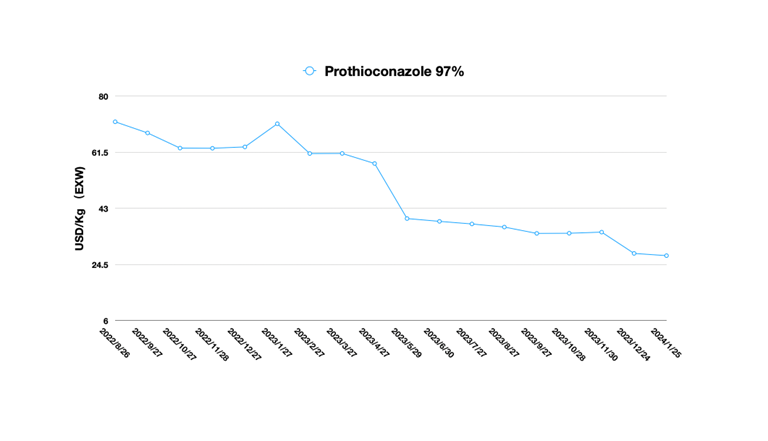

As I mentioned in the webinar, the price of prothioconazole is currently mainly influenced by expectations of future capacity releases. From a long-term perspective, there is still room for the price of prothioconazole. Due to the weak growth in demand for prothioconazole in overseas markets, buyers are more cautious in their purchasing willingness, which makes it difficult for the price of prothioconazole AI to hold up in the long run. The fungicide market as a whole has now been strongly affected by the El Niño climate.

As I mentioned in the webinar, the price of prothioconazole is currently mainly influenced by expectations of future capacity releases. From a long-term perspective, there is still room for the price of prothioconazole. Due to the weak growth in demand for prothioconazole in overseas markets, buyers are more cautious in their purchasing willingness, which makes it difficult for the price of prothioconazole AI to hold up in the long run. The fungicide market as a whole has now been strongly affected by the El Niño climate.

ABG: Is there an overcapacity for cyhalofop and byspribac in China?

DL: The cyhalofop is facing the overcapacity. Currently FlagChem, Fengshan and Weixun Chemical are the key suppliers. In the China supply market there is no byspribac registration available.

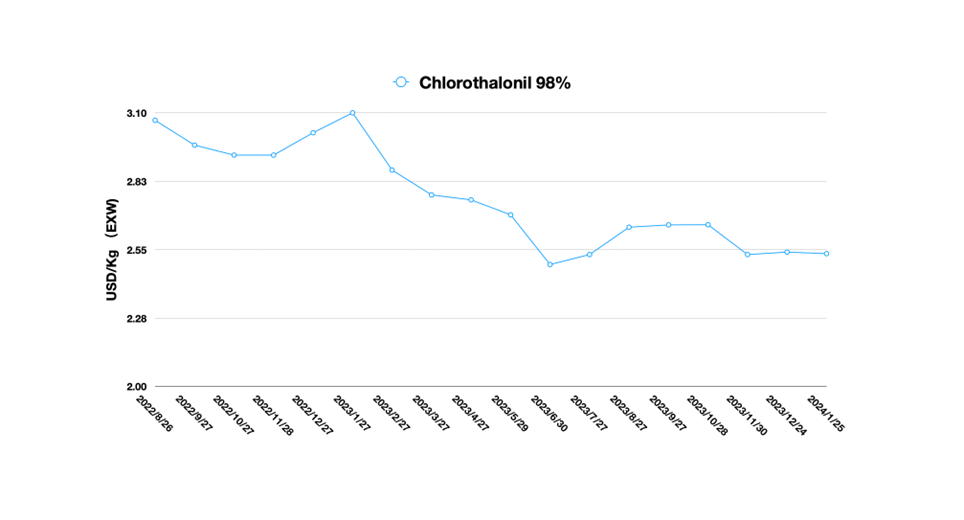

ABG: Can you give us a forecast of prices of chlorothalonil, imidacloprid, and paraquat?

DL: Chlorothalonil is currently in good supply. Capacity utilization rate is relatively stable. The price of some upstream raw materials has been adjusted back, which is mainly due to the lack of end demand to the supply side of raw materials. After adjusting the supply of raw materials, the price adjustment can ensure the profit margin.

However, chlorothalonil AI prices mainly received the impact of sluggish demand. Due to 2024 some regions have relatively abundant rainfall this year. The demand for fungicides would gradually recover. But the demand recovery is not enough to stimulate chlorothalonil prices to a significant correction.

Imidacloprid faced a similar situation, with sluggish demand leading to poor orders from overseas. Market supply is stable. Upstream raw material supply is less volatile. The future is dominated by actual piecemeal orders. However, the climate in key markets may lead to increased pest and weed pressure this year. This could be a positive for the insecticide business.

Imidacloprid faced a similar situation, with sluggish demand leading to poor orders from overseas. Market supply is stable. Upstream raw material supply is less volatile. The future is dominated by actual piecemeal orders. However, the climate in key markets may lead to increased pest and weed pressure this year. This could be a positive for the insecticide business.

ABG: What about new generics this year

DL: This year, the Chinese market is more concerned about the products pyroxasulfone and saflufenacil. Chlorantraniliprole is already in the red sea competition.

ABG: Are there any watch outs on any intermediary molecules like we ran into with MEA a couple years ago that caused shortages of S-Moc?

DL: Chinese suppliers are now focusing heavily on securing the production of key intermediates. Upward integration is a necessary competitive advantage. The advantages of new upstream integration capacity are obvious. For example, China’s MEA production reaches 544,000 Mt in 2022, increase 10.3% YOY 2021. In 2019-2022, the average annual growth rate of capacity was 10.6%, and during the same period, the average annual growth rate of demand was 4.3%.

The slowdown of the growth rate of demand in China’s local market and is much slower than the growth rate of production. And overcapacities in the chemical sector will also contribute to a more solid guarantee of supply in the field of intermediates. Therefore, the supply of upstream raw materials will not fluctuate greatly in 2024. Even if a Black Swan event occurs, this will have limited impact on the overcapacity market.

ABG: What’s the low limit for producer margins? Can this level of glyphosate prices sustain the margin levels?

DL: The current profit margin of glyphosate price is around 10%. Companies with advantages in upstream mineral resources and PMIDA production capacity may have slightly higher profit margins. Glyphosate mainly relies on scale advantage to gain profit. Therefore, the current price fluctuation is very small.

ABG: Is there overcapacity on glyphosate? Will low prices continue throughout 2024?

DL: Glyphosate production capacity is currently in a saturated state. However, if the new production capacity of overseas companies like Hebang once participate in the competition, then it may exacerbate the process of overcapacity, resulting in the price is difficult to firm up.

Moreover, Bayer is executing a low-margin marketing strategy. This undoubtedly makes it impossible for Chinese suppliers to gain room for price increases. Therefore, in 2024, the price of glyphosate may fluctuate slightly, but more time the price will be at a low level unable to rise.

ABG: What is the approximate global capacity of glyphosate?

DL: In 2021, the global production capacity of glyphosate was total 1.13 million Mt, of which China’s production capacity reached 760 thousand Mt, accounting for more than 60%. However, due to the shrinking demand in 2023, the production rate of glyphosate in China was estimated around 60%.

ABG: What is your perception regarding price outcomes in the short and medium term, considering the high inventories of Chinese producers and the current low margin?

DL: Price is only a lagging indicator. This is what I have repeatedly emphasized. Prices of AIs in the Chinese market are basically at historically low levels, and profit margins for products are limited. The current strategy of each manufacturer is to focus on cash flow back as the main sales objective.

Many companies are supplying the market with a certain amount of inventory. But this is a balancing process. After the release of demand in the Americas, a dynamic process of rebalance will happen for the consumption of low-priced inventory.

There will be a key sourcing node here. Before the node will be low prices + reliable supply, after the node will be a short-term price increase and long-term stability + short tight supply but long-term stability.

ABG: Is there an over capacity for tebuthiuron?

DL: The supply market of tebuthiuron AI is relatively stable. At present, the most advantageous company is a producer with the whole industrial chain, Jiangxi Zhonghe. Jiangxi Zhonghe’s current production capacity is 4,500 mt/a, mainly with complete upstream intermediates supporting production. The main features are stable supply and controllable cost.

ABG: Would Chinese companies sell below cost to compete and just to be able to stay in the market?

DL: It’s not impossible for this to happen, but few businesses would operate this way. This is because companies will only consider selling at a loss when they are desperate to return cash. The way Chinese companies are currently choosing to do this is to utilize the scale advantage of the upstream supply chain and process improvements to further reduce costs and thus secure profit margins.

ABG: Do you forecast glyphosate will stay at current level till July 2024? Do glyphosate manufacturers still have 10% margin at the moment?

DL: In the current situation, the stabilization of glyphosate’s upstream raw material price and supply can ensure that the profit margin of glyphosate enterprises, around 10%. However, due to the low operation rate, it is not possible to obtain a sufficient profit amount.

Glyphosate supply market is well stocked. It is likely that Chinese companies have prepared for the release of South American demand in March this year. As a result, prices will not be unduly off track. If demand is strong, combined with the release of North American demand, a lengthening of the cargo delivery is likely to happen. Purchases in 2024 should try to avoid confirming deals only at the last minute.

ABG: What do you see as the biggest mistake or mis-step multinational companies are making to get a win/win future relationship with China producers in general?

DL: Win-win future relationship is achievable. In the last decade, MNCs have also gained tremendous supply chain advantages by working with Chinese companies.

If I have to give some mistakes, I would say that MNCs need to identify “who (bosses)” are trustworthy and cooperative?

To be honest, the Chinese have a whole set of criteria for cooperation with each other. We have our own standards of character that we hold in high regard. The Chinese have been measuring their partners against these standards for thousands of years.

That’s what I always say, “Only Chinese people can solve Chinese problems.” But the top management of multinational companies are often not very concerned about this aspect. So that some sourcing directors have had their entire sourcing strategy disrupted because they listened to false information provided by some corporate executives.

In China, if you choose the right leaders to work with, the win-win relationship is halfway there.

ABG: Post-Consumer Recycled usage for plastic packaging, is it a current demand from the ag chem industry to meet sustainability targets? Why?

DL: Post-Consumer Recycled material generally refers to plastics such as PET, PP and HDPE which are widely recycled and then reprocessed into a resin that is used to make new packaging. In both, the Chinese market and the global market, governments and industry associations are actively promoting the reduction of the legacy of plastics in the field. In Europe, regulation of microplastics in soil and water is also being progressively strengthened. The main aim is to promote sustainability in agriculture and the greening of the crop protection industry.

China CCPIA has also issued a group standard in the “Guidelines for Recycling and Disposing of the Obsolete Pesticide Containers” in mid-2023 in cooperation with Chinese pesticide enterprises and multinational companies in China.

ABG: What is your view on the price outcome in the short and medium term, given the high inventories of Chinese producers and the current low margin?

DL: This issue has been covered in my previous answer. What can be added here is that overcapacity in China’s pesticide industry is an inevitable stage. In the future, only enterprises with the full upstream industry value chain/basic raw material resources and the strength of continuous process improvement and R&D can survive. Enterprises that do not have the cost and capital advantages will be gradually withdrawn from the supply market of certain AIs. As a result, the whole supply pattern will be stabilized again.

China’s supply market has already seen a number of companies lowering their production rates and controlling inventory levels as a result of shrinking demand from the second half of 2023 onwards. Some companies are also aggressively investing in R&D and production of products with expiring patent AIs in the future.

The lower margins of Chinese companies are mainly due to two factors, sluggish demand and fierce competition due to overcapacity. In the short term, prices in the Chinese supply market will not fluctuate significantly. In the long term, Chinese companies also need to be sustainable, for example by continuing to invest in carbon neutrality to meet the carbon neutrality targets of multinational companies. Therefore, the stable profitability of Chinese companies is also an important guarantee of a sustainable supply chain strategy for the global crop protection companies and distributors.

ABG: How do the Chinese players get funding for creating these capacities? I mean the kind of capacity creation that we have seen in glyphosate, glufosinate, and CTPR. What is your view on the thought process of Chinese companies before as they decide to put up these capacities?

DL: This is a good question.

The capacity expansion of Chinese companies is mainly supported by local Chinese investment funds. These investment funds are financed through a variety of channels. Some come from local governments wishing to promote the development of industries in their region, and some come from private investment.

Currently in China, environmental assessment and production licenses for pesticide manufacturers are decentralized to local governments. We are seeing a lot of capacity building and investment in the 2020-2023 period as local governments need to promote employment as well as increase regional economic vitality.

In addition, China is currently transforming from its former pillar of real estate and virtual economy to innovative manufacturing as the pillar of economic growth. In the process of transformation, funds that used to be invested in real estate and other areas need to find new targets. So investment areas based on the logic of agriculture and food security have become the new favorites of investment companies.

Profit-seeking is the essence of capital. As the price of glyphosate was high from 2021 to 2022, expanding production capacity also means more profitable returns. For glufosinate, companies are thinking mainly of the vacant market space after paraquat was banned. And the strong demand for resistance management in regions where GM crops are grown globally.

On the other hand, companies like Hebei Chengxin with a great upstream full industry chain and sodium cyanide resources would have a strong cost advantage entering the atrazine production and prothioconazole supply market. In the competition, Chengxin thinks they can beat other competitors. Then their capacity investment is also rational.

Moreover, it is worth noting that, during the process of capacity expansion and new project investment, what Chinese pesticide producers lack most is the prediction of market demand. In the past, Chinese companies focused more on multinational companies and other key accounts demand. They did not pay attention to market research and the establishment of influence and reputation on the global crop protection market. In fact, Chinese companies have not fully entered the global crop protection market. It can be said that purely B2B thinking has constrained the globalization process of Chinese companies. But in a period of overcapacity, Chinese companies must face this shortcoming and learn quickly.