China Price Index: Diversity in the Supply Chain Delivers Significant Advantage

Editor’s note: Contributing writer David Li offers a snapshot of current price trends for key herbicides, fungicides, and insecticides in the Chinese agrochemical market in his monthly China Price Index. He also provides an indepth update on the glyphosate and glufosinate markets, as well as insight into how finding alternatives can give companies an edge despite supply chain disruption.

The conflict in Ukraine has led to growing shortages of key components and supply chain disruption in Europe. According to Reuters, the conflict has added to the trade chaos that followed the global economy’s most recent emergence from pandemic lockdowns. Due to the closure of Russian airspace, Asia-Europe trade routes have suffered from acute port congestion and cargo disruption, according to a JPMorgan analysis.

The disruption of the European Union (EU) supply chain has brought a new challenge for the companies focused on production in that region. Traditional supply routes have been so difficult to manage, some companies have even considered using higher priced air freight. The conflict in Eastern Europe is testing supply chain resilience in the wake of the COVD-19 pandemic.

The companies that have been able to localize their supply have advantages in such uncertain circumstances. Localization of supply chain allows a company to meet the target territory demand through local production. Most agrochemical sourcing teams have already built a strategic supply with China’s leading agrochemical manufacturers that are working to ensure generic active ingredients (AI) supply. This approach not only helps meet Chinese demand, but those Chinese manufacturers could also feed inquiries in Asia-Pacific (APAC) and other territories around world.

In 2017, the Chinese governments introduced environmental regulations that disrupted the supply of crop input products. The storm those regulations created in China led to many agrochemical companies looking to incubate alternative supply sources around the world. Because some suppliers were unable to comply with the new environmental laws, the government forced them to suspend production. Like the pandemic, which arrived seemingly overnight, global sourcing teams did not have a sense of the potential risk in advance. So, the consequence was a supply disruption of key portfolios. Simply put, they failed to meet the market demand in time.

While the impact of those environmental regulatory changes forced global companies to reassess where Chinese suppliers fit into their supply chains, it should not have come as a surprise. Actually, the environment protection goal was clearly signaled in China’s national policy in 2016, the starting year of 13th Five Year Plan. The supply chain challenges might have been avoided if global buyers had independent and profound understanding of China’s national policy.

Finding Alternatives

In 2018, some multinational companies tried to diversify their supply chains by developing ties to Indonesia, India, and Japan, among other countries. Patented AI manufacturers that once produced key intermediates in China started using facilities in the United States, Europe, and other locations around the world. The optimization of global agrochemical supply chain led many to source generic AIs mainly from China and India. And key patent AIs are still in the headquarters or by CDMOs (Contract Development and Manufacturing Organizations).

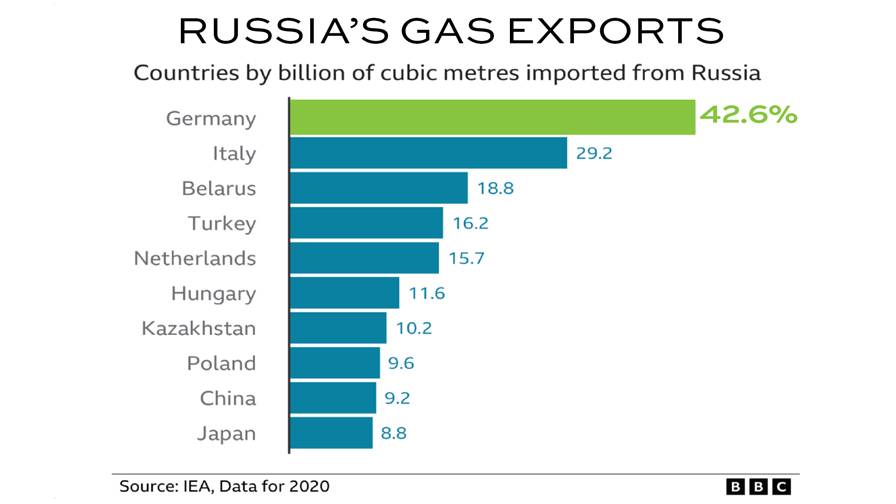

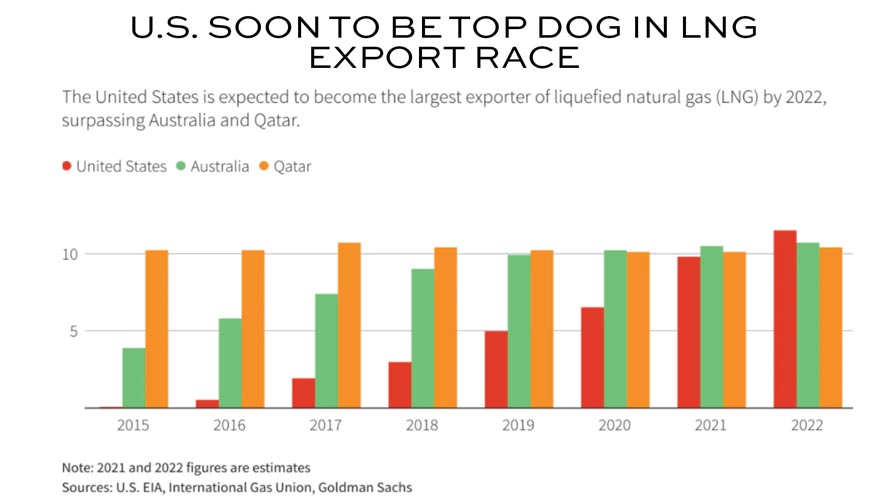

A diversified supply chain supports quick resilience for multinational companies. When COVID-19 hit globally in 2020, the China-centric supply network worked to guarantee global ag-input supply. A healthy profit margin helped ensure the complex supply chain worked smoothly in 2021. However, the conflict in East Europe hit the complex supply chain at the same time as a new COVID-19 variant adding additional challenges. The European Union depends on Russia for about 40% of its natural gas. According to the BBC, Germany, Italy, Netherlands, and Hungary are the top leading buyers on Russia’s natural gas. Based on the sanctions imposed on Russia, the EU plans to slash Russian gas imports by 66% this year, according to CNN. Green energy, such as solar and wind, will not meet the shortfall in demand for natural gas. As a result, it is likely that Europe will continue to import large quantities of LNG (liquid natural gas) from the United States in response to the short-term impact of sanctions against Russia.

Reuters mentioned at the end of 2021, “The U.S. Energy Information Administration projects U.S. LNG exports will reach 11.5 billion cubic feet per day (bcfd) in 2022. That would account for roughly 22% of expected world LNG demand of 53.3 bcfd next year (2022), according to analysts at Goldman Sachs, and would outpace both Australia and Qatar, the two largest exporters at present.” As a natural gas alternative source, U.S. LNG can feed demand from EU countries, which would increase the total production cost for EU manufacturing.

Biological Solutions

From the disruption of production in Europe to the dilemma of supply chain management, will the crisis in Europe increase the weight of strategic patent AI supply from Asia Pacific, again? No one has a clear answer about that, but from China’s agrochemical market point of view, multinational companies’ competition seems to be diving into a deep red ocean. The marketing promotion for patent AIs are more similar to the generics. The serious market competition could bring about a reevaluation of patent AI launching strategies for the top four players.

Not only is agrochemical production affected by such disruption, but the manufacture and distribution of biosolutions are also interrupted due to the uncertain supply chain. Demand for biosolutions from Chinese producers mainly come from European enterprises like Koppert, Biobest, etc. Some biosolutions are more sensitive during transportation since the bumblebees, beneficiary insects, and mites are key portfolios in their IPM (Integrated Pest Management). The disruption of transportation from EU to Asia is affecting biosolution enterprises much more deeply than traditional crop protection multinationals. The markets of Japan and Korea are critical for the biosolutions because of the advanced sustainable agriculture system in those countries. Even though China has big potential, China’s biosolution market still needs time to cultivate. With strong future growth goals, living biosolutions need timely delivery urgently, especially during the growing season.

The reasons for failure are different, but the reasons for success are all similar. According to the Biobest’s China GM, Jun Wang, the key success of Biobest is to a have long-term view of Asia-Pacific market penetration.

“One-day delivery principle is the key concept we believe from the first day I joined Biobest’s global team,” she says. “China is a huge country, we cannot consider China market as only one territory. The flight from Beijing to Guangzhou will take around three hours. However, the flight from Belgium to the United Kingdom takes around one and half hours. What Biobest seeks is to establish provincial distribution centers. The centers will offer a tending function to take care of our valuable biosolutions. And there will be another benefit to expend Biobest’s solutions into ‘One-Day-Delivery’ in China.”

Wang’s strategy is to have provincial tending centers along with developing China agriculture industry. China has a strong flower industry in the southwest. And strawberry growing is popular in northeast of China. Guangxi, Guangdong, and Fujian are focusing on cash crops like tropical fruits. Biobest would follow the planting trends and China’s future consumer market to encourage future growth.

Biobest China launched operations in 2013, opening a facility for the production of bumblebees. So, when the supply chain disruption happened in the EU, Biobest China was ready to take advantage of the opportunities in China and the Asia Pacific (APAC) markets. Currently, Biobest can easily source products from China, Japan, or Korea, which ensures the supply is available to the market. The future capacity of Biobest China would also bring new competitive advantages to supply. The concept of biosolution and IPM is critical. But the in-time delivery and longer shelf life are the true “facilities” the biosolution company can use to bring value to farmers.

Supply chain diversity is becoming more important for global economy growth in such an uncertain era. Well-planned diversification can bring a handsome return for the investment. In addition to diversifying supply, localization is also valuable to meet the rising demand on global agriculture development.

The 4.5 billion population in Asia is not only the “world factory” for key raw materials. The people who live here are also the market with strong demand for better food, a cleaner environment, and a healthier lifestyle. With such a large potential market, should innovative technologies and biological solutions enhance local supply, save costs, and provide better solutions for local farmers in Asia? The answer is yes.

Demand Re-anchors Consumption in 2022

Since the pandemic of Omicron in Shanghai, the lockdown of the Shanghai Pudong area was expected to last until 1 April. And the lockdown of the Puxi was planned for 1-5 April. The pandemic control polices brought some uncertainty to Shanghai’s logistic management. With fewer people moving, there was concern over a lower operation rate. However, Shanghai’s port is operating smoothly. Shanghai International Port (Group) Co., Ltd. is maintaining round-the-clock operations to keep up with the cargo delivery stopping only during extreme inclement weather.

In the first two months of this year, the value of Shanghai’s imports and exports reached 674.5 billion CNY (about 107 billion USD), up 22% from the same period last year, according to Shanghai Customs. Of this, exports reached 279.49 billion CNY (about 44.36 billion USD), up 24.5%. As one of the leading international cities and the center of China’s economy, Shanghai must be back to normal soon.

The Omicron variant in Shanghai has created a “soft lockdown,” which includes staying at home and PCR testing for every citizen. The central government decided to employ the control policy to help protect China’s large population of older people. The policy will impact southern China in the coming one or two months, but the central government also emphasized that the ordinary operation of society must be maintained.

Currently, there is still no solid data to evaluate the lockdown’s impact. Even though there are some cases where transportation of goods has been disrupted, the State Council of China requested the provincial to follow the rules of “Pass Permit.” The Pass Permit for truck drivers will be recognized by all provinces to guarantee the supply chain for key daily necessity cargo delivery, according to the Ministry of Transport.

The policy still needs some time to go into full effect. Truck drivers for cross-provincial transportation could be affected in some time. Even though operations for agrochemical manufacturers is going well, the slowdown of transportation will affect the raw material transportation and final cargo delivery. For the agrochemical product, it is not expected to result in increased inventory for AIs in the short term. The long-term view is less clear with future trends dependent on Shanghai’s pandemic situation.

In addition to the lockdown of Shanghai City, the market must pay more attention to the Eastern European crisis.

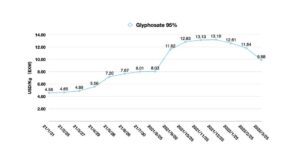

The Glyphosate Market

With the lockdown of Shanghai City, China’s glyphosate market is paying more attention on East Europe crisis. The cliff-like descent in glyphosate demand, uncertain currencies of Ukraine and Russia, and transportation chaos disrupted the continuous expectation of China glyphosate exporting to the region.

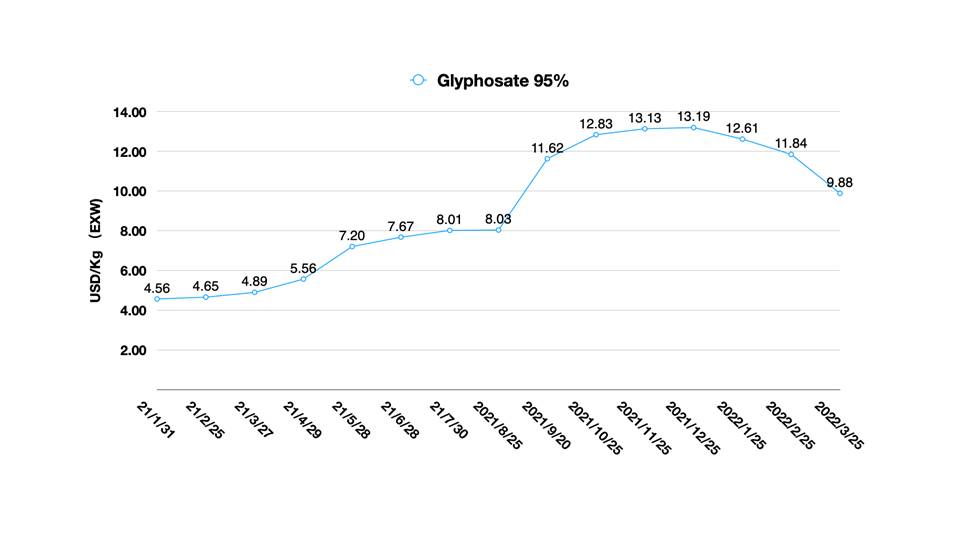

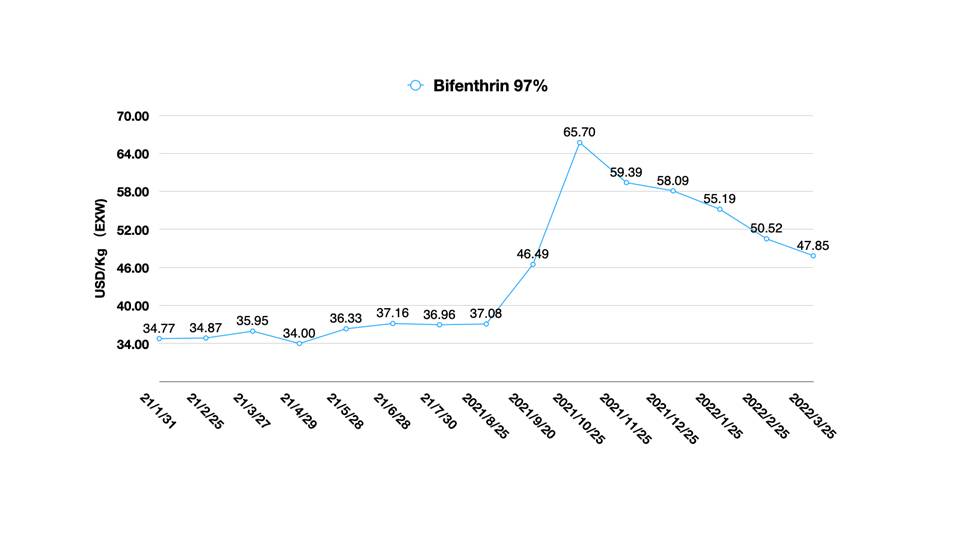

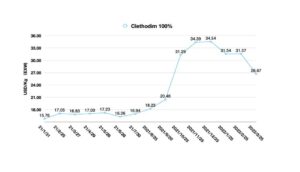

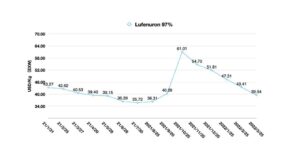

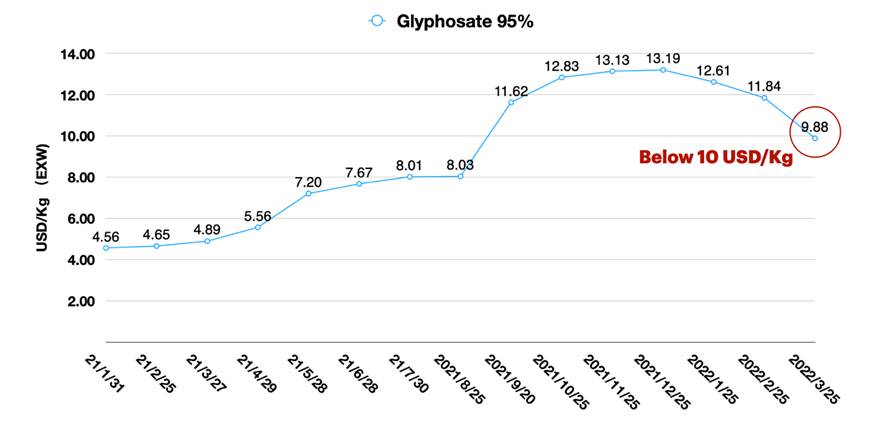

The 2021 China glyphosate AI export to U.S. increased about 40% YOY from 2020. The total 2021 glyphosate AI exports to the U.S. increased about 46% YOY. Sufficient safety inventory in overseas pipelines is driving a further downtrend of prices for Chinese produced glyphosate. Moreover, stable key intermediates supports the smooth operation of China’s glyphosate production. Because most suppliers seem to have good cash flow, the existing demand cannot drag the price up in short term. By the end of March, the glyphosate 95% AI EXW price was down to 9.88 USD/Kg, which is close to the price before the impact of China’s “Double Control” policy set in place in September 2021. The curve is still heading down, but the downtrend rate would be more smooth when the price reaches a level similar to the one it was at in the middle of 2021.

Other Factors

It is worth noting that the global inflation could affect future glyphosate prices. On 17 March 2022, U.S. Federal Reserve officials voted to lift interest rates and penciled in six more increases by year’s end, the most aggressive pace in more than 15 years, in an escalating effort to slow inflation that is running at its highest levels in four decades, according to a Wall Street Journal report. However, China’s Central Bank pledged to use more monetary policy tools to spur the economy and drive credit expansion, sending its clearest signal yet of an easing bias to boost market confidence, which Bloomberg mentioned at beginning of 2022.

Hopefully there will be no more chaos in 2022 related to global economic policy. Though difficult to predict, complications hindering the global economy are expected to last for years. What can be firm is that China’s monetary policy seems to be behind the global economic spur policy. China’s monetary policy could push the key ag-input commodity back to the stable pricing balance between China supply and global “on field” consumption. Looking long-term, the Chinese glyphosate market has a high possibility to be up strongly again in the 2023-24 season, compared to the weak level in 2022. However, glyphosate suppliers from China might be only relying on the autumn demand, which is always hot season for agrochemical exporting.

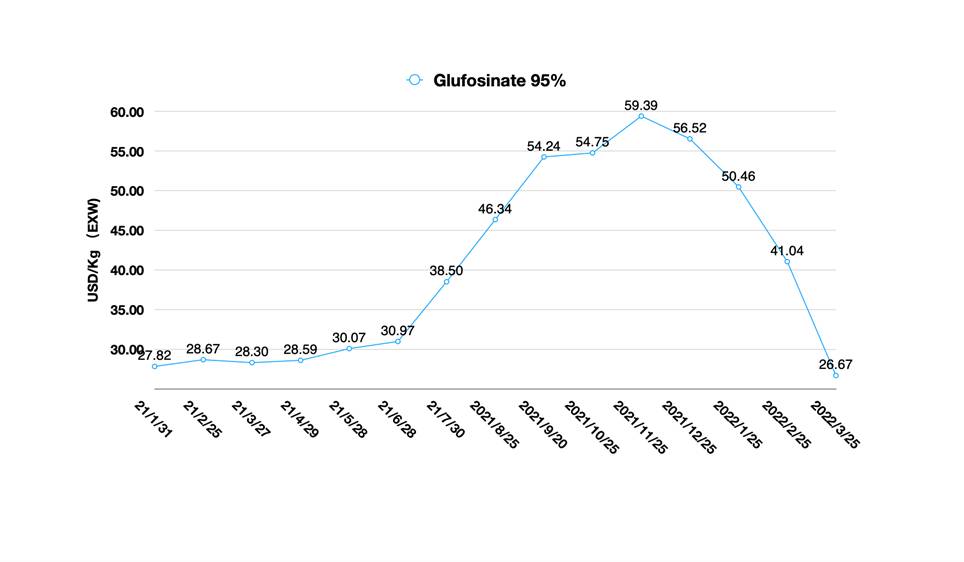

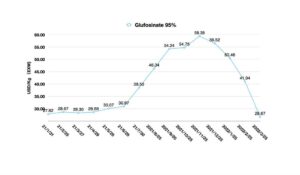

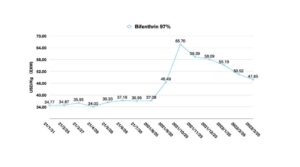

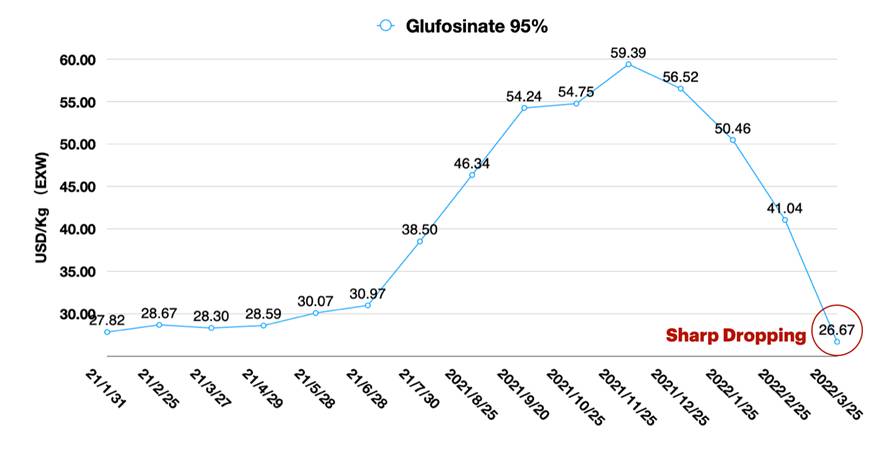

Different from glyphosate, the glufosinate AI market is dominated by the supply. The higher margin attracted more investment to glufosinate inventories in 2021. The high pricing is fragile and without solid fundamentals. When demand becomes stable and new capacity rises, glufosinate AI prices are expected to collapse. The glufosinate 95% AI EXW price went down from 41 USD/Kg to 26.67 USD/Kg within one month. And a rumor spread through the market about the possibility of a much lower price could be expected. High inventory will continuously drag glufosiante AI prices down until Q2. But the low price is not sustainable for an extended time especially with the uncertainty surrounding Europe’s natural gas supply, which is one of the key raw materials and energy sources for European chemical production.

An Uncertain Future

Back to the middle of 2021, when Lier’s production was suspended, other Chinese glufosinate producers had a chance to leverage the strategic partnership by supporting distributors in that urgent time frame. With the sales budgets in mind, Chinese enterprises were more inclined to choose utilitarian short-term profits. Profit-driven decisions are understandable for every enterprise. The similar situation would also happen on global LNG market during the Eastern European crisis. No matter what circumstance we are facing, there are lessons to be learned from the best investors. Only those who are long-term and believe in value creation will thrive in the long-running game. It is critical tip for interested in thriving forever.

There is no right or wrong strategy. Every cause has its effect. That’s a simple and natural rule. The sharp drop of glufosinate AI prices is the consequence. Recently, news circulated about China’s additional glufosinate capacity entering the market. The price typically drops with the addition of additional product. It’s a strategy that has been seen several times when new capacity enters the market. Of course, the lower price always means easy price increasing when future supply becomes tight. It all depends on the sourcing strategy of buyers.

Currently, Lier’s production of glufosinate is on track in 2022. With a deep understanding of global market trends, Lier’s L-glufosinate should be the top priority. The strong financing advantage and process know-how provides the company with a strong outlook for long-term growth in the glufosinate market. By the end of 2022, Yongnong and Veyong will expand their glufosinate AI capacity. Such reliable new capacities will change the glufosinate supply from China.

Leading companies tend to take a long-term order approach to purchasing. The consolidation of Chinese agrochemical manufacturing will bring some challenges for medium and small companies when they want to reach leading companies directly. Key producers will focus on cooperation with multinational companies as their key account strategy. Negotiation options are limited for medium and small buyers. This phenomenon is expected to exist for some time.

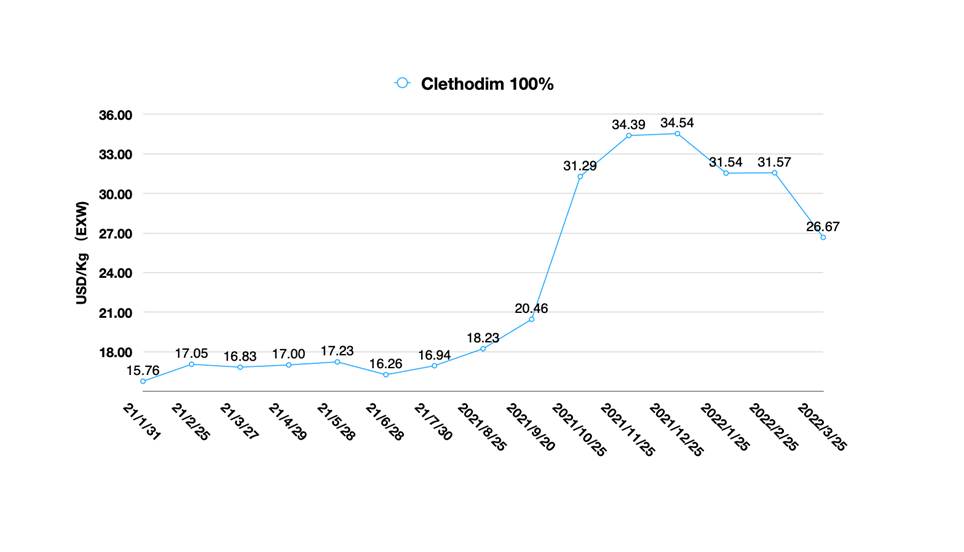

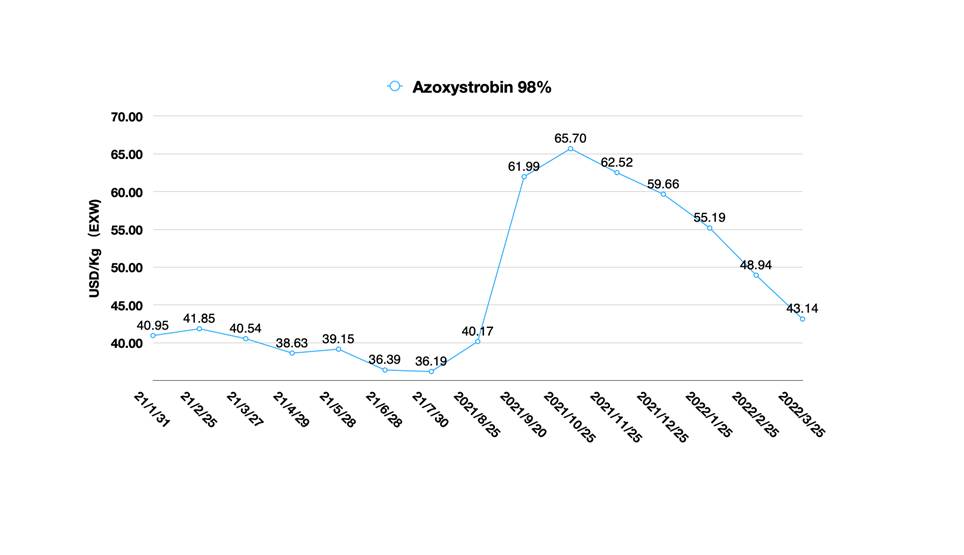

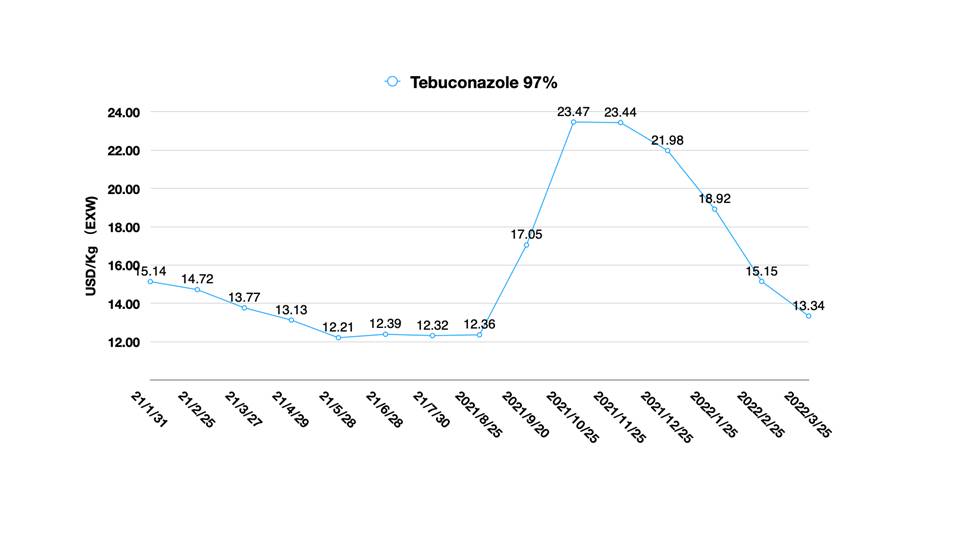

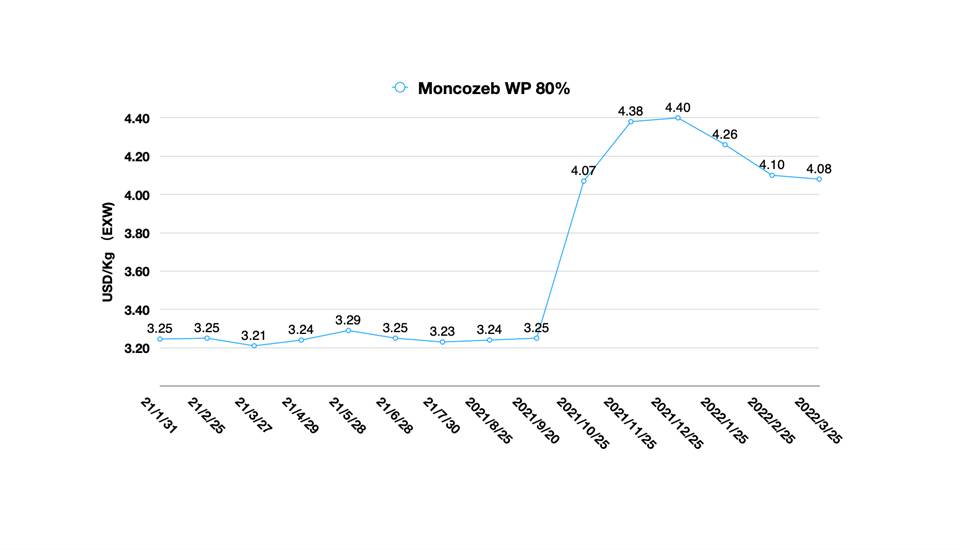

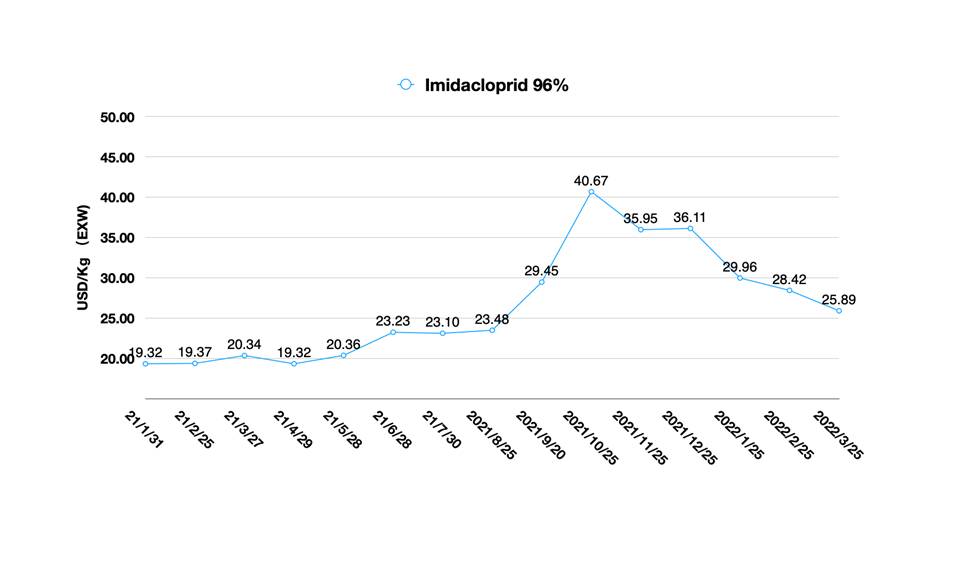

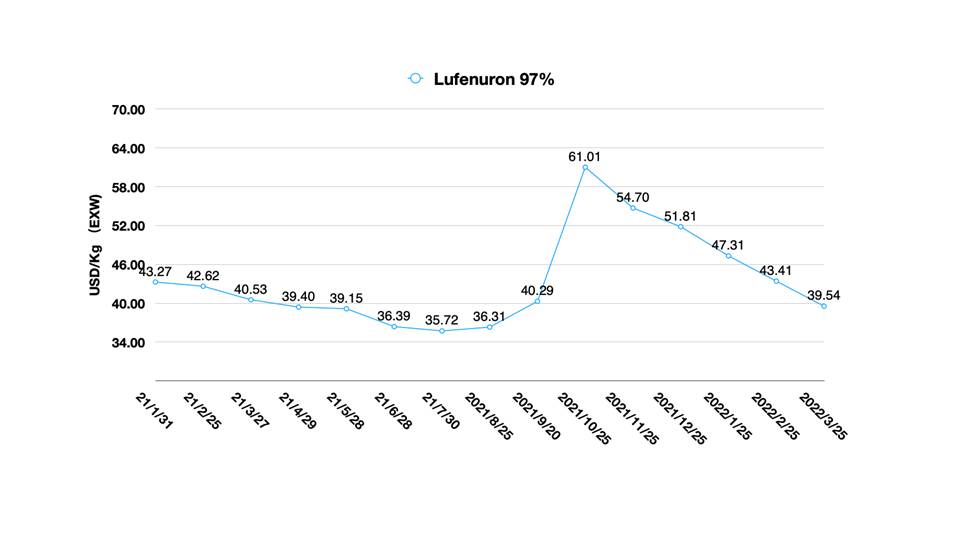

At the start of of 2022, China’s agrochemical suppliers have been sensitive to the slow and low demand from overseas. The over-demand in 2021 was mentioned by me several times in the China Price Index column before. According to the China agrochemical price database, most of monitored Al prices are in a weak position, a clear signal that demand re-anchors consumption in 2022. That’s good news for global sourcing teams. Only when the market demand is weakened, it can give full play to the core functions of the procurement and sourcing team, establish strategic cooperative relations, maximally save procurement costs for organizations, and gain the value from upstream value chain.