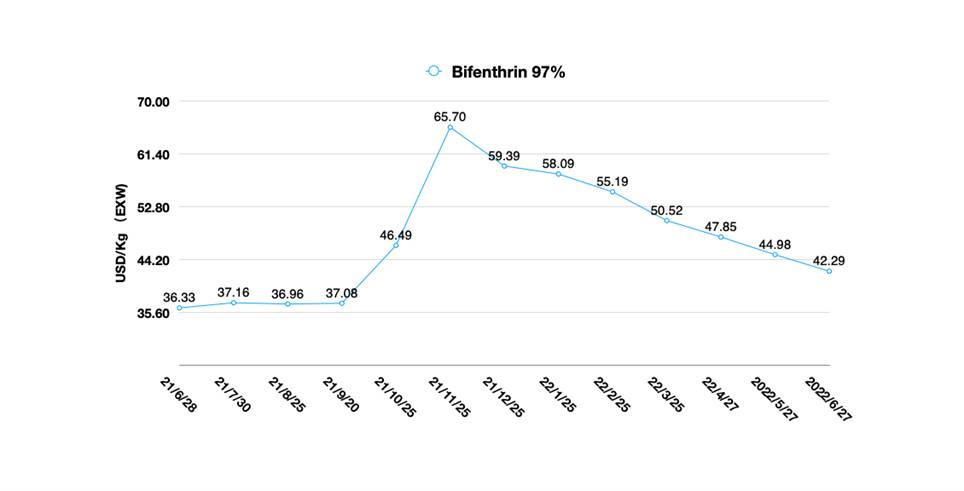

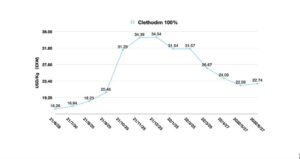

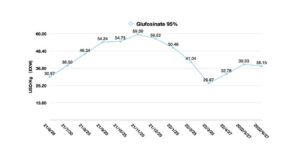

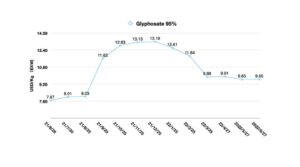

China Price Index: Glufosinate Approaches a ‘Perfectly Competitive Market’ and What It Means for Buyers and Sellers

Editor’s note: Contributing writer David Li offers a snapshot of current price trends for key herbicides, fungicides, and insecticides in the Chinese agrochemical market in his monthly China Price Index. Below he provides insight on how buyers and sellers of glufosinate are expected to respond to the “perfectly competitive market” that the herbicide is approaching.

Perfect competition is the ideal state of market competition in economics. This competitive state is called perfect competition (or perfect market) when the buyers and sellers in the market are equal with each side existing as an established price taker without being able to individually influence the market price.

Because of the nature of perfect competitive market, it is generally not a good idea to be a seller in it. Prices are driven so low it is quite difficult to generate reasonable profits for every position of the business including suppliers and distributors. Consequently, many suppliers seek fewer perfect markets, allowing them to realize higher profit levels. That’s what we call the “innovation to reach high margin portfolio.”

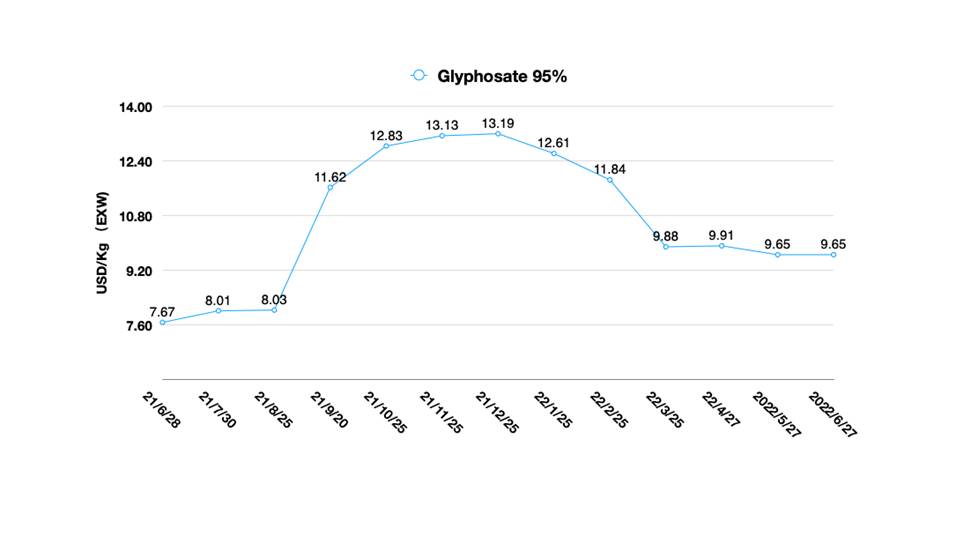

When we look at the supply of pesticides in China with a prudent eye, we find the supply market of generics in China, especially for the categories of agrochemicals required for international bulk agricultural products, such as glyphosate and glufosinate, is gradually approaching a perfect competitive market state. The total global production capacity of glyphosate exceeds 1 million tons, of which nearly 70% is manufactured in China. As the world’s largest burndown herbicide, glyphosate’s fortunes began to take off in 1996.

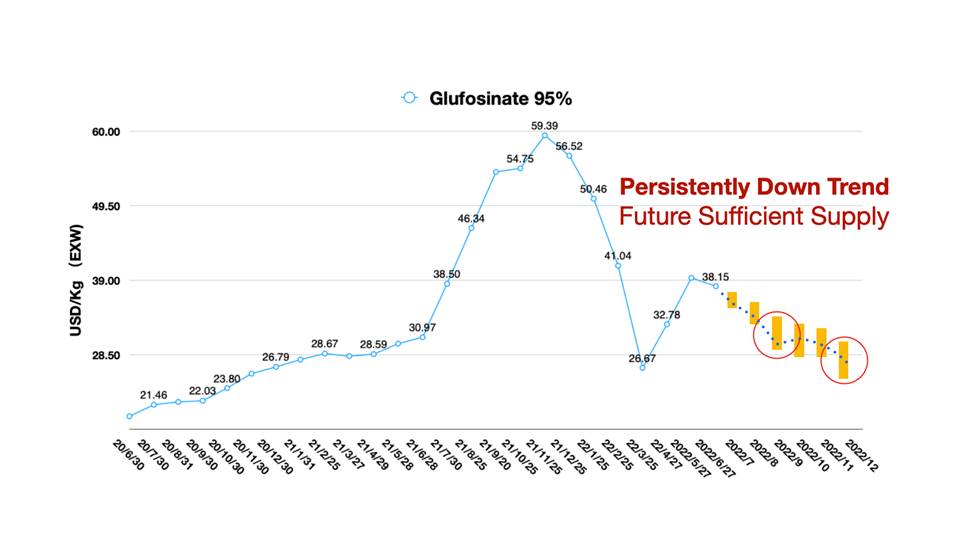

On the other hand, China’s glufosinate active ingredient (AI) capacity is reaching more than 38,000 mt. The estimated capacity under construction has exceeded 90,000 mt. L-glufosinate capacity is at more than 80,000 mt. The only future reasonable margin of production could be with L-glufosinate. Glufosinate capacity expansion in China is partly due to Chinese suppliers having a big-picture view of the global trend toward glufosinate-tolerant crops, and partly because they are expecting the future promotion of genetically modified crops in China.

According to a Certified Commercial Property Inspectors Association (CCPIA) report, construction of Yisheng’s 20,000 mt glufosinate, 10,000 mt L-glufosinate, and 10,000 mt chlorantraniliprole got the approval of a plant in Shandong province in May 2022. Liben’s subsidiary Nei Mongol Shengling Chemical started construction of a facility that can produce “50,000 mt of glufosinate and intermediates” in a La Shan Novel and High-Tech Industry Development District at the same time. And new capacities of glufosinate from Changqing, Binnong, and Wynca will come into the market soon. Traditional Chinese glufosinate giant producer, Lier Chemical, also has a plan to expand additional 50,000 mt of glufosinate capacity to the market in the next two years. In June, Veyong recently signed a technology transfer agreement with Zhejiang University of Technology for the industrialized production of L-glufosinate by the bio-enzymatic method.

Using the synthetic biology and enzyme catalytic technology provided by the Zhejiang University of Technology, Veyong Biochemical will utilize highly efficient enzymes for glufosinate catalysis and convert D-glufosinate into L-glufosinate with high purity and efficiency of the reaction. Combined with the new player, Hebei Chengxin, the supply market of Chinese glufosinate market will be reshaped.

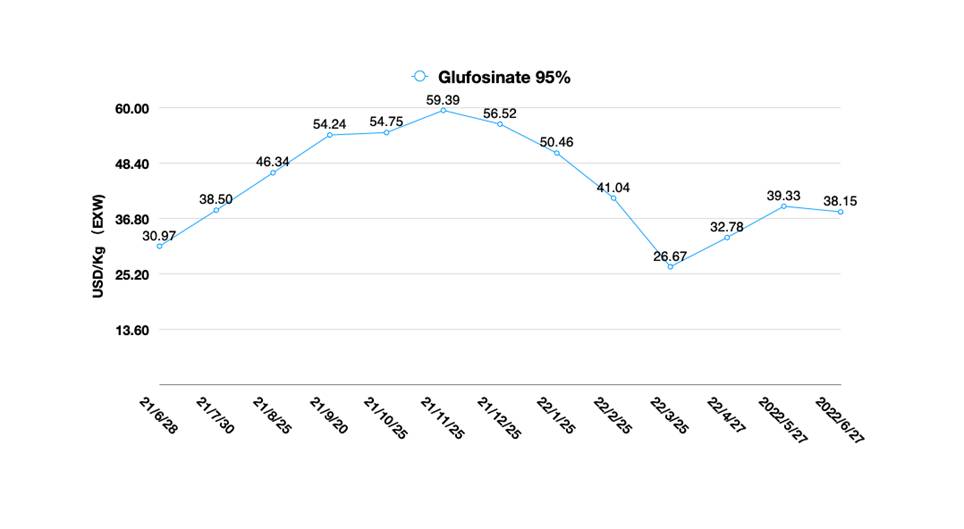

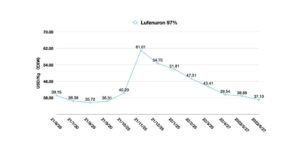

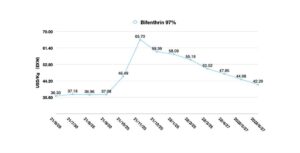

The current glufosinate supply market is very sensitive. The leading producers’ contract line is occupied by key account orders. However, with the gradual delivery of orders, suppliers are gradually focusing on new demand, making the volatility of supply increase. Lower operation rates are common due to the traditional off-season. Low operation rates could offshore the weak demand in a short time, so glufosinate prices will be unlikely to fall significantly.

New capacity is still likely to have an additional impact on the retreating prices in the next six months. As a result, there will be lower prices in the market trying to capture overseas purchasing demand. Market prices will continue to be volatile. Persistently weak overseas demand in the long term might prevent glufosinate prices from holding firm. Additional new capacity releases will also have a dragging effect on forward prices.

For glufosinate, price trends over the next six months, we feel that overseas demand is critical for “first-in, first-out” sales stream due to the challenges facing the economy (high inflation as the purchasing season approaches and farmer field consumption). The most important feature of stagflation is high prices but sluggish economic growth. Continued monetary tightening by the Federal Reserve is increasing the risk of stagflation, especially for the global 2023 growing season, which could create significant financial pressure. Uncertainty over China’s domestic COVID-19 pandemic control will also prompt overseas buyers to seek a “China+1” sourcing strategy. Regardless of the expansion of Chinese supplies and whether the pandemic control will ease or not, the willingness of buyers to hold onto alternative options will become stronger. This is not a crisis for Chinese suppliers, but perhaps we are experiencing a historic inflection point.

If distributors continue to panic stockpile, they will likely be very cautious about purchases for the 2023 growing season, depending on the resilience of their finance level. Demand from multinationals will be relatively stable. This is because for sales of branded products, capital pressure will be passed on to the channel. With the squeeze on channel funding for MNC-branded products, distributors could have to continue to source cheaper-priced raw materials directly from China. At the end of 2022 on the supply side, we will see that leading suppliers will continue to get deeper into consolidation. While industry concentration is increasing, price weakness is likely to be a new norm. If we can exclude the impact of black swan events in 2022, the Chinese agrochemical market will gradually move to a more stable volume and down price trend by the end of 2022.

August 2022 may be the low point for glufosinate prices. As buyers return in September/October and supply stabilizes, cautious sourcing strategies will force Chinese suppliers to offer more room for discounts. And new capacity would possibly release lower-priced products, which are likely to continue to hit the market for capturing market share in 2022. Therefore, it may be difficult for glufosinate prices to lift in the fourth quarter. The 20th Congress of the Chinese Communist Party takes place in October. Major events in China are likely to have a slight impact on production around Beijing but will not have a major impact on the broader fundamentals of economic operation. Moreover, key raw materials and production bases of glufosinate are far away from the economic circle of the capital. Therefore, it is very unlikely that domestic glufosinate prices will be raised by major events.

Although promising, a perfectly competitive market might not be an optimal state for high, upfront investments. The return on investment can become very fragile and untenable in a highly competitive market. For buyers, a fully competitive state for glyphosate and glufosinate is certainly a good cost savings. But we need to know that full competition will trickle down to the farmer field market. For distributors, they are also faced with a homogenized portfolio in burn-down herbicides market.

Nature may teach us a sobering lesson against the backdrop of mass adoption of a single and simplified portfolio. For Ecuador roadside resistant weeds, the application of a combination of high-quality glyphosate and 2,4-D from a multinational company compared to a control using an inferior similar portfolio, both face serious resistance problems. What is predictable is that this is a problem that all market practitioners will face in the field for perhaps the next five to 10 years. There is no optimal solution if we want to simplify the application of burn-down herbicides as much as possible and easily avoid the weed resistance problems that come with it.