China Price Index: Continued Consolidation Expected Within China Agchem Industry’s New Structure

Editor’s note: Contributing writer David Li offers a snapshot of current price trends for key herbicides, fungicides, and insecticides in the Chinese agrochemical market in his monthly China Price Index. Below he provides insight into how recent mergers and acquisitions are impacting the industry, as well as the new structure that leading manufacturers are operating under.

Based on China’s 13th Five-Year Plan, optimizing the structure of mergers and acquisitions was the key goal to aggregate industry resources into the top manufacturers, so that the number of manufacturers would be reduced 20% before 2021. In the 14th Five-Year Plan, M&A will contribute to developing an efficient process for the top manufacturers with the lowest waste output. It will also support China’s clear goal to achieve carbon neutrality by 2060.

Syngenta and Adama

On June 18, 2020, Syngenta Group Co. Ltd. announced the official launch of Syngenta Group, a new global leader in agricultural science and innovation. It unites the strengths of Syngenta AG, ADAMA, and the agricultural businesses of Sinochem. The new entity, headquartered in Switzerland, has 48,000 employees in more than 100 countries, and had sales of $23 billion in 2019, according to Syngenta Group.

The new Syngenta Group was the horn of consolidations in the crop protection industry. ChemChina injected agri-input assets, 100% Syngenta AG, and 74.02% ADAMA equity into the Syngenta Group. Sinochem injected 52.65% Sinofert equity, 39.88% Yangnong equity, and 100% Sinoseed equity into Syngenta Group. The new Syngenta Group emphasized China’s agriculture market growth by establishing the Syngenta Group China, which mainly consolidates the agri-input assets of ChemChina and Sinochem in the Chinese market.

Inside of Syngenta Group, ADAMA completed the acquisition of a majority stake in Huifeng’s crop protection manufacturing facilities on May 31. The acquisition of one of China’s leading crop protection producers will significantly bolster ADAMA’s operations in China and its global product offering. As the key crop protection producer in Jiangsu, ADAMA Huifeng has capacity and potential for growth in the environment of Syngenta Group. Since China’s strengthening of environmental protection regulations, ADAMA Huifeng has a big possibility to become a new symbol of China’s future novel production warehouse within the next 10 years.

Wynca, Hefei Xingyu and Nutrichem

Syngenta Group is not the only company involved in M&A activities. Other leading Chinese agrochemical manufacturers are eager to make moves for sustainable competitiveness as well. The top players are aiming to have raw material resources, a full upstream supply chain, and a broadened portfolio.

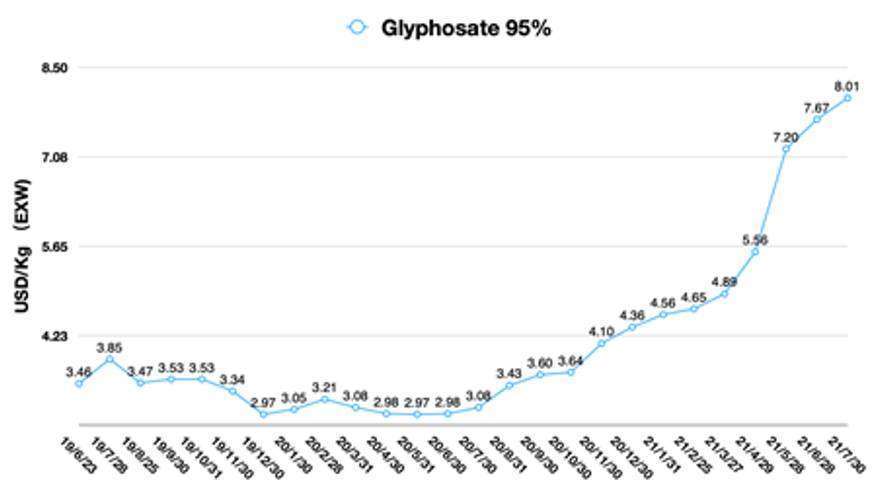

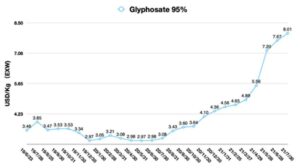

In early 2021, Wynca announced it would acquire a 53.17% stake of Hefei Xingyu for $27.53 million in total. The combination of Wynca and Xingyu would help Wynca to expand into the selective herbicide production and market. It would combine the glyphosate sales pipeline with Hefei Xingyu’s sustainable competitiveness. Currently Xingyu has portfolios including 400 Mt oxadiazon and 300 Mt oxadiargyl. Wynca has around 80 thousand Mt of glyphosate capacity.

On June 9, Nutrichem and Wynca signed an official strategical cooperation agreement. Wynca will be aiming to acquire the share of Nutrichem from Huapont. Wynca would have the potential to become the strategic shareholder of Nutrichem in the future, since Nutrichem has the potential to enhance the core advantages of R&D and global market penetration within the cooperation. Wynca considered diversifying its agrochemical business areas by strengthening its current portfolio as well as new portfolio development with Nutrichem.

Structure of China Agrochemical Industry

The 14th Five-Year Plan of China’s Agrochemical Industry is on the way to publishing. According to the national principle of the 14th Five-Year Plan, deep consolidation of the industry will be moving forward. There will be four Future World-Class Advanced Manufacturing Clusters in China: Jing-Jin-Ji, Yangtze River Delta, Pearl River Delta, and Northwest Central Area. The verbund advantage is to reduce costs with an integrated value chain and utilize green energy.

China’s national policy is guiding the industry. The leading manufacturers have solid capability to invest in R&D, environmental protection infrastructure, process enhancement, and waste treatment. Carbon neutrality by 2060 will be achievable by the sustainable development with new investments. For the future Chinese active ingredient market, the robust manufacturer which has AI-related innovation will lead the development of sustainable competitiveness. There will be only 20% manufacturers to serve 80% of crop protection distributors. Consolidation will continue in the coming 10 years.

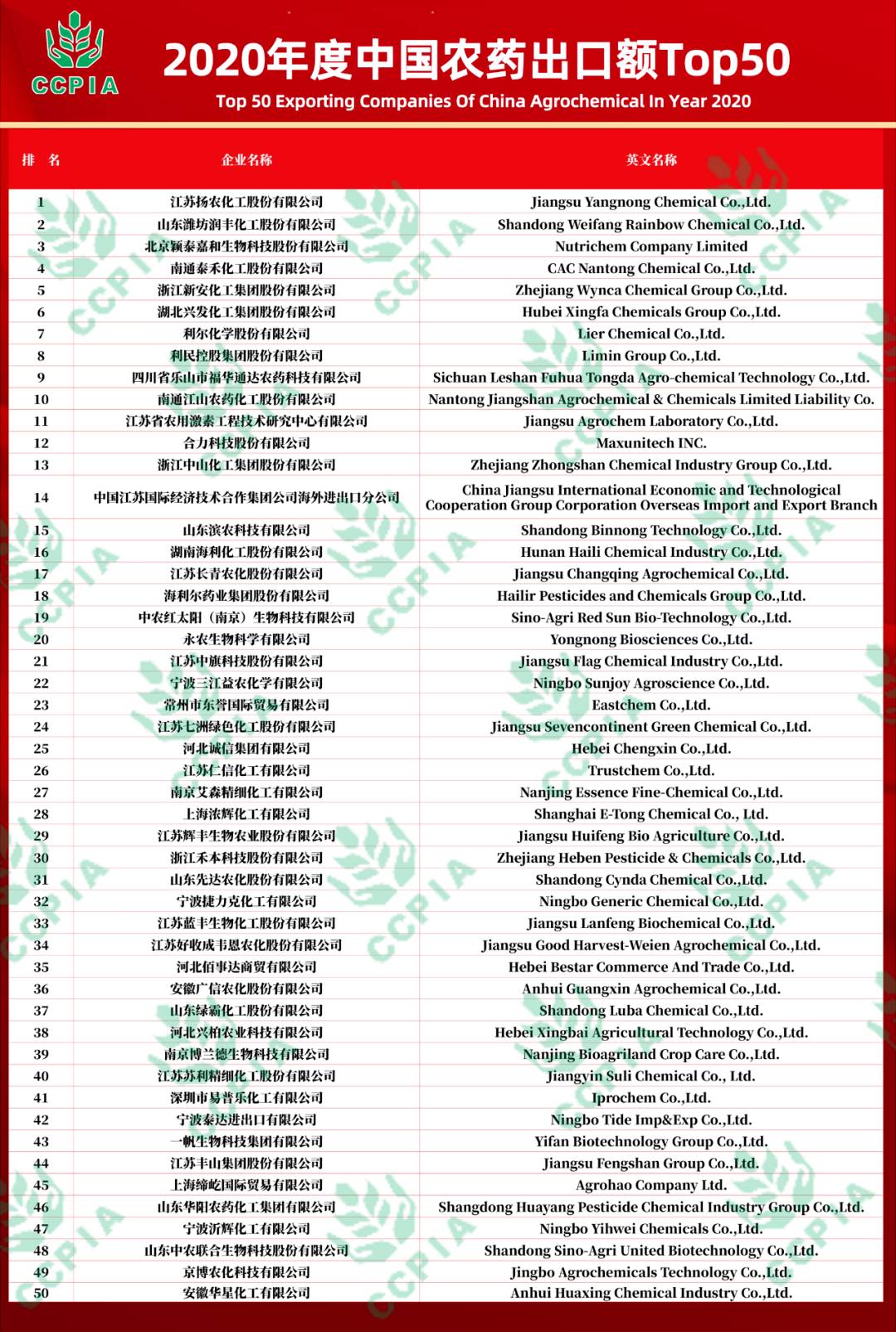

In May 2021, CCPIA published the Top 50 Exporting Companies of China Agrochemical in Year 2020. To investigate the structure of China’s agrochemical industry, manufacturers can be categorized by four types: Product-centric & Process Enhancement, Segment Market-centric, Crossover, and Financing.

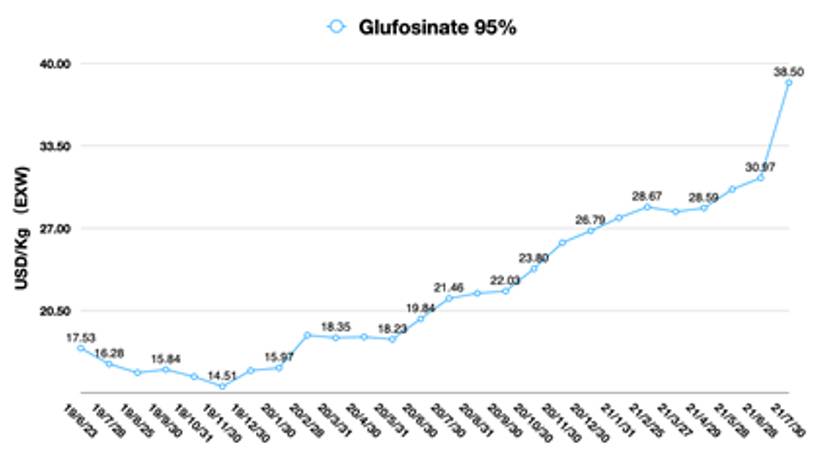

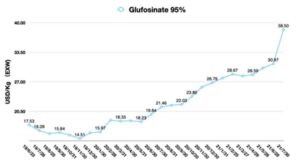

The Product-centric & Process Enhancement means that manufacturers have raw material resources and contributions in solo active ingredient or serious active ingredient with an integrated value chain. Lier, Yangnong, Xingfa and Fuhua, the top glufosinate and glyphosate producers in China, fall into this category. CAC Nantong and Nutrichem have strong capabilities on process enhancement. The process investigation can reduce the total cost of active ingredients and consistently improve profit margins.

The Segment Market-centric means that the company has strong penetration into the selected market. For example, EastChem has a strong presence in the Vietnam rice market. It mainly captures the herbicide’s safener demand and provides an integrated portfolio like insecticides to the local distributors which drives EastChem’s success in the target market.

The Crossover means the company focus on the specialty chemicals, advanced intermediates and fine chemicals. The Zhejiang Yongtai Technology, is typical crossover from pharmaceutical industry to get involved into agrochemicals and key intermediates for AIs. Yongtai Technology is a leading fluorine chemicals manufacturer which invested on Shanghai E-Tong for expansion of AI and key intermediate sales channel.

The China Jiangsu International Economic-Technical Cooperation Group (CJI), Ningbo Sunjoy, and Sino-Agri RedSun have strong financing support which shall be in the types of Financing. The Financing provide them a solid position in China agrochemical exporting business when the raw material price goes up and long-term credit line pressure comes in.

The classification of companies can change dynamically, since some manufacturers have multiple advantages to build a “moat” for their business. Their new investments and new strategic collaborations will absolutely affect the status of company development.

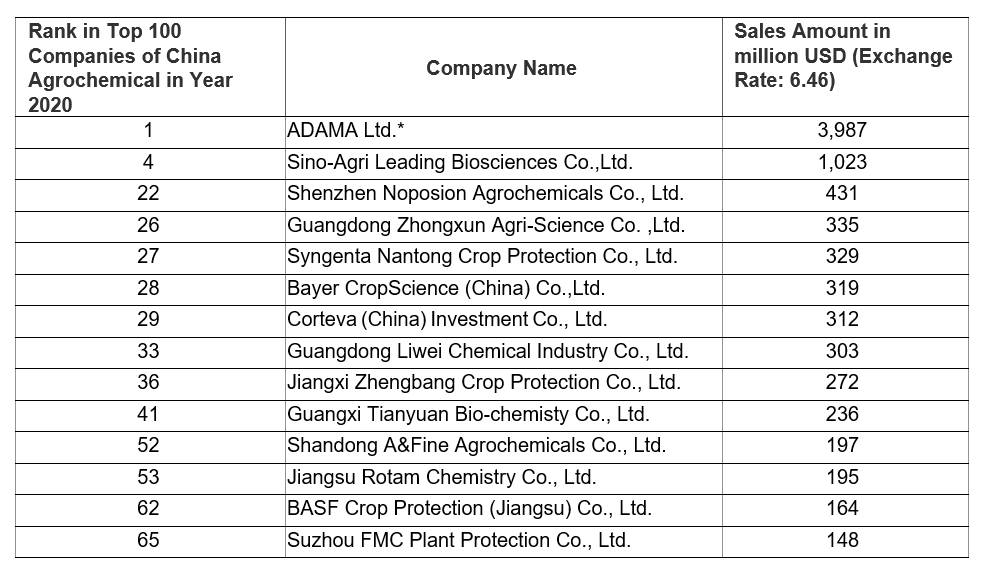

Regarding company sales in China’s domestic market, CCPIA did not provide a ranking. According to Top 100 Companies of China Agrochemical in Year 2020, the key companies with China domestic market can be roughly selected by sales amount as below.

In China’s domestic agrochemical market, the multinational companies, Syngenta Group, Bayer Crop Science, Corteva, BASF, and FMC, are still in the dominant positions. The local agrochemical companies, like Noposion, Guangdong Zhongxun, Guangdong Liwei, Zhengbang, and Tianyuan, are also growing fast.

According to total sales, Chinese local agrochemical companies have become more competitive with multinationals in China. It showed that China crop protection market has always been a red ocean on competition.

Under China 14th Five-Plan Policy, food security is fundamental for future national development. The policy will guide the whole Chinese agriculture industry to enhance integrated production capacity in the coming five years. The security of food production will be stable at level of 650 million Mt/year. Food inventory shall be also guaranteed. China will have a stable food supply chain by robust agri-input supply chain support. Stable food prices like rice, maize, and wheat is a crucial factor for future investment trends in China agriculture industry. Nutrients and fertilizers are the key category to protect yield. In China’s future market, nutrients and fertilizers will be still a strategic segment market to cultivate.

In 2021, the price of cash crops, like mango and apple, etc., are weak, partially due to COVID-19 hitting the international transportation of fruits. So the competition on China field crops has become more serious than ever.

Multinational companies are shorting their distribution channel and decreasing the price of crop protection portfolios in China. Long-tail product price is at a historical low level. When provincial distributors are phased out step by step, the multinationals can leave more profit margins to the end users, the Chinese farmers. They are trying to provide patent-branded product into China’s market quickly and efficiently.

Generic companies always have chosen a deep penetration strategy. They manage their portfolios to meet the market gap with agile pricing. On the other hand, local Chinese formulators are focusing on cost performance. They are eager to invest upstream to control active ingredient costs, which can empower their competitiveness for flexible product development in the future. Moreover, some exporting companies have turned over into domestic market since 2020. The potential growth point in the domestic market is already being scanned by exporting manufacturers.

Drone crop protection area in China reached to 1 billion Mu (around 67 million Ha) in 2020. E-commerce for crop protection products is growing fast when young farmers arise. When traditional agrochemical companies can reach the big farmers and build loyalty, the channel’s function can become a simple payment platform downstream.

The Delta variant is still affecting China in many cities. The extreme weather like flood in Henan province will be unpredictable due to the global climate change. Competition for market share will not stop for the next season in China, the same as the consolidation.