China Price Index: The Dilemma of Agrochemical Overcapacity Amid a New Era of Customer Transparency

Editor’s note: Contributing writer David Li offers a snapshot of current price trends for key herbicides, fungicides, and insecticides in the Chinese agrochemical market in his monthly China Price Index. Below he also provides insight into how China’s agrochemical market is entering a new era of transparency between buyers and sellers while it faces the challenges of overcapacity.

According to the data released by CCPIA (China Crop Protection Industry Association), China’s pesticide industry revenue (including export and domestic sales) decreased by 17% in 2023 compared to 2022. The total profit dropped by 62%, and export value decreased by 27%. ICAMA reported at the recent CAC Conference in Shanghai that China’s pesticide export value was USD $15 billion in 2023 with a decrease of 34.83% YOY 2022. China’s exports of pesticide products are undergoing rebalancing and demand levels are approaching pre-event levels.

Even though demand in the Southern hemisphere has been unleashed after CAC Shanghai, overcapacity remains a key constraint on the price trend of pesticides in China. According to CCPIA’s data, from January 2021 to September 2023, China’s pesticide industry has invested more than USD $9 billion in production capacity expansion. The new capacity of AI was 560,000 Mt, and the new capacity of intermediates was 1.13 million Mt. Currently, the new capacity is mainly concentrated in provinces of Gansu, Inner Mongolia, Jiangxi, Hubei, and Liaoning.

If we understand the behavior of Chinese entrepreneurs, it’s very hard for them to give up. Especially after the scale effect, if you want them to withdraw from the product category they have already invested in, it is simply impossible. In 2023 December, China’s listed pesticide company Lanfeng Biochemicals transferred 100% of the equity interest in Ningxia Lanfeng Fine Chemical Co. to Hebei Netlink Agricultural Science Co. The wholly owned subsidiary, Ningxia Lanfeng Fine Chemical Co., Ltd., had been in a state of loss for a long period of time and incurred serious loss in 2023 for Lanfeng.

According to the situation, Lanfeng Biochemical made a corresponding provision for impairment of its fixed assets. Therefore, in order to further optimize the overall asset structure of the company, Lanfeng Biochemical divested and disposed of its subsidiaries. For companies that lack competitiveness and internal governance efficiency, complete withdrawal from market competition is often a hopeless end.

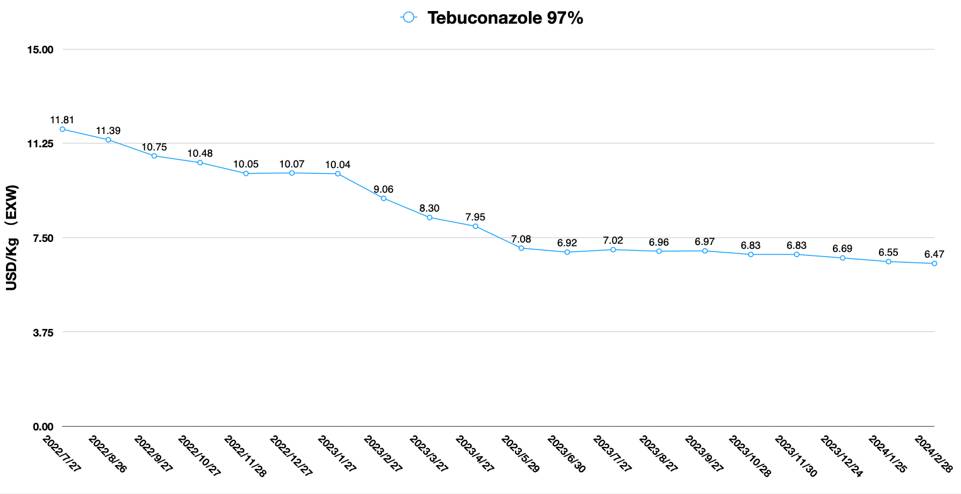

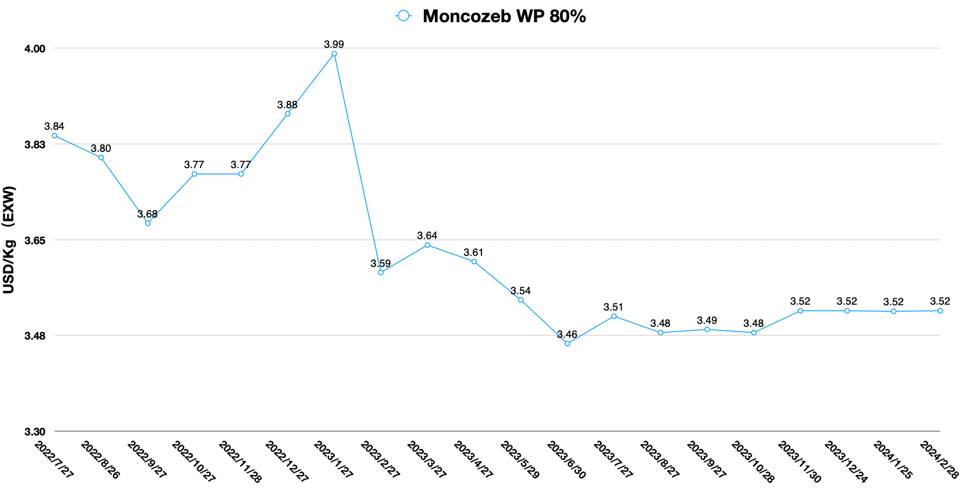

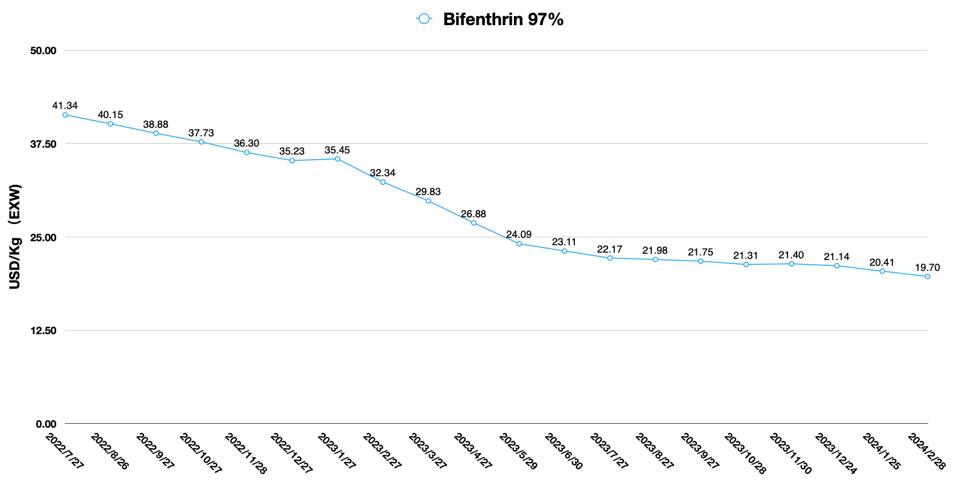

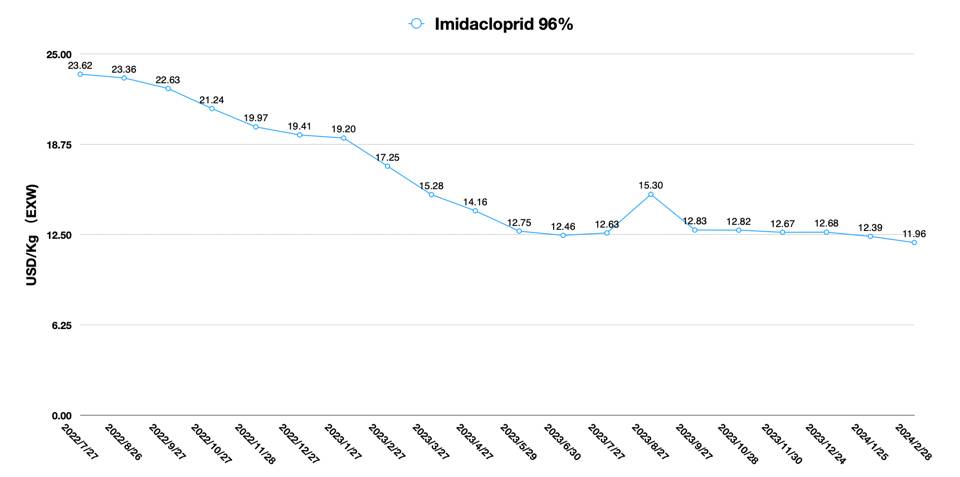

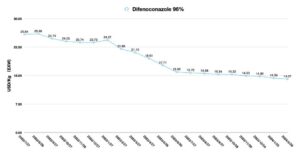

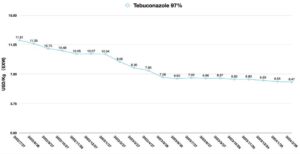

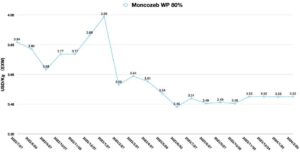

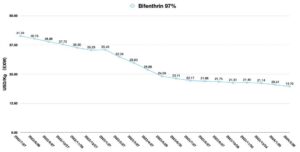

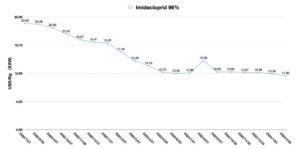

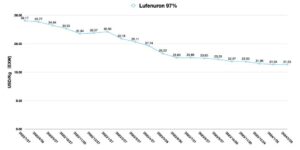

Competition in the Chinese market is becoming more confusing. In anticipation of overcapacity, the EXW price of chlorantraniliprole AI in China is already below 40USD/Kg. Prothioconazole has been priced between 18-22USD/Kg due to increased expectations of capacity release. The market supply price of pyroxasulfone AI, which is about to see a large-scale capacity release, has also seen a rapid decline, with the current price at around USD $77/Kg. In the future, the prices of trifloxystrobin and kresoxim-methyl will also continue to decline due to the emergence of new production capacity.

Chinese agrochemical companies are now looking for other high-growth tracks to expand their profit sources. What they don’t realize is that new competitors have already used the profitability of other tracks to leverage their competitiveness in agrochemicals production. Currently, most of the new competitors in the Chinese market are from the pharmaceutical/cosmetic and fine chemical sectors.

In addition to the advantages of the whole industry value chain, these competitors will also use the advanced experience of other tracks into the production of pesticides. Their diversified business model gives them enough momentum to compete in the supply of agrochemicals. In the company’s overall balance sheet, earnings in other areas can offset the low gross margins brought about by low prices in the agrochemical field. But what these companies are looking for is economies of scale. The full capacity of the whole industry value chain can improve productivity and reduce overall costs. If we look at their business, the first to open up the product category track could be the competitor rather than the conservative agrochemical companies. As the popular Chinese novel “Three Bodies” tells us, the innovators must exterminate the laggards who are unable to innovate themselves.

Indeed, the essence of profitability in the chemical industry is the sale of key accounts. New competitors may need time to understand and familiarize themselves with the agrochemical industry. Global registration in the agrochemical field is also a potential barrier. But this moat is not that wide and deep. For new competitors, global registrations and market entry tactics are relatively easy to obtain if they can offer a high enough price at the key point and key person.

In addition, the new competitors are on top of the advantages of the whole industry chain, and they are on the cutting edge of synthesis process development. They have optimized synthesis routes. This allows the new competitor to not have to worry about investing too much in R&D. At the same time, they can achieve high AI purity and low content of impurities with a highly optimized synthetic route. The improvement in atomic utilization puts the new competitor in a more favorable position on the future pricing. This also indicates that some old-school agrochemical companies will be ruthlessly abandoned in the market competition.

Customers will always be profit-seeking. This does not contain any pejorative connotations. If I am faced with fierce competition in the end farmer market, I will also choose to utilize the new supplier with the largest capacity as well as the lowest price to balance the offers of other alternative suppliers. The sustainability of the supply of the new competitors cannot be questioned. This is because they have also served the leading multinationals in their field over the past decades of business development. But its business-to-business cooperation is limited by corporate culture. A zero-sum game is bound to arise between the strong contract terms of the crop protection multinationals and the low-priced new Chinese suppliers. But any business can be optimally balanced through negotiation. The clash of cultures will not prevent key customers from making the right decision. Therefore, the new competitor’s advantage will be long-lasting. Competition in the industry will increase. This might be the dilemma that overcapacity poses for entrepreneurs in China’s pesticide industry.

In the current Chinese pesticide supply market, there is no one who doesn’t care about PPO herbicides, no one who isn’t keen on the development of SDHI fungicides, and no one who doesn’t know about patent compounds that are about to expire in the next decade. Segmenting the global market value of an AI means nothing to a company’s strategic decision-making. Instead, who will our customers choose to work with in depth? That’s the question we should ask in the internal strategy meeting.

In fact, Chinese pesticide companies have long been transformed from an entrepreneur to a professional manager model. In Chinese history, any time a dynasty falls, and the rise of a new dynasty was implicit in the essence of the regrettable reason, that is, the redundant bureaucracy. The leaders of the new dynasties are the absolute best, selected through competition in the “mysterious jungle” under the constraints of natural law. For example, in the Chu-Han rivalry in Chinese history, Liu Bang, the founding emperor of the Han Dynasty, had three great skills: first, he was a great learner; second, he knew how to employ people; and third, he knew how to correct mistakes. This makes this ancient Chinese monarch surrounded by a group of extremely capable team. If we look at the current Chinese pesticide companies, such leaders are extremely rare.

In addition, the founders of China’s core agrochemical companies are aging. The erosion of time has forced them to train their successors. However, the greatest weakness of these heirs is that they have not experienced the pain that their fathers experienced. So, as the industry becomes more competitive, these heirs are forced to compete with new competitors. The new competitors, who have gradually emerged from the bottom of a pain-filled industry, will be the biggest obstacle for the heirs of traditional agrochemical companies in the coming era.

Rather than the history of the industry’s rise and fall, this is the history of the rise and fall of people and teams. The key is how long we interpret this history. It is very difficult to experience the rise and fall and continue the business for a hundred years. For China’s first pesticide entrepreneurs since the reform and opening up, thinking about the future may have just begun. The era of focusing on production and ignoring the link to the customer can be worry-free and profitable is over. The era of artificially created information asymmetry is also over. Starting from 2024, it will be the era that China’s agrochemical industry will be more transparent to global customers. The most important thing in this era is to link with customers in a brighter way with the philosophy of integrity thinking and grow together with customers. For Chinese agrochemical companies, an important question is in front of us, are you ready for the new era?