Making Connections: An Analysis of Mergers and Acquisitions in the Latin American Agrochemicals Market

All companies search for growth opportunities. One way to find that growth is through merger and acquisition (M&A) activity. Many ag input providers enhance their organic growth by adding a potential partner’s commercial and economic development in given markets, a complementary product portfolio, patent potential, research and development capabilities, access to raw materials, production plants, new developments, and the short- to long-term prospects for profitability.

Mergers and acquisitions are designed to capture synergies — interactions or cooperation that gives rise to a whole that is greater than the simple sum of its parts; that is, the combined company has more value than the separate companies.

The two main objectives of mergers and acquisitions are first to increase revenues and profitability, often achieved through the increase in market share, and second to reduce costs, which occurs mainly when companies use the same resources, in addition to eliminating duplicate functions. In addition, the elimination of duplicate positions and decreases to transportation costs also helps save money.

Active Regions for M&A

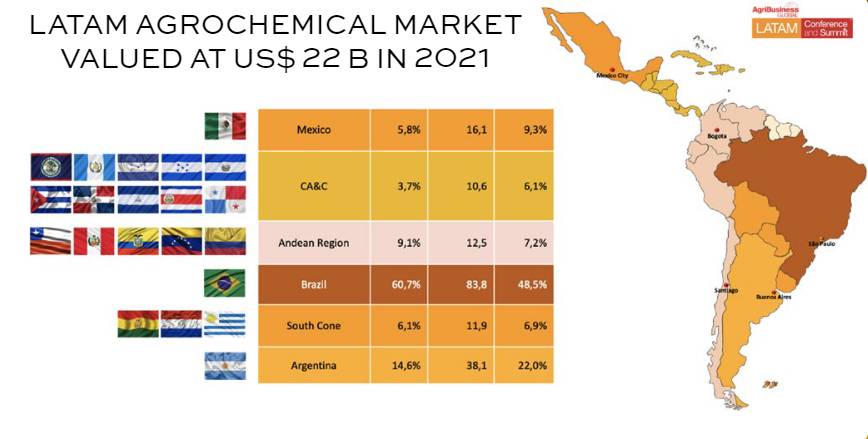

Today, companies fight for a larger piece of the roughly $65 million global agrochemicals market. It is interesting to note the Asia Pacific accounts for a little more than 32% of the global market, followed by Latin America (LATAM), with about 25%. The LATAM region is the focus of a lot of new investment targeting Brazil, Argentina, Mexico, and Colombia along with other Latin American countries. In third place is Europe and rounding out the top five spots are North America and the Middle East and Africa, respectively.

The markets where the largest number of crop inputs are used include fruits and vegetables, followed by cereals, soybeans, corn, and rice.

Another factor to consider is the evolution of the Global Area Planted by Region, with the most important area developments taking place in Africa, which has seen a compound annual growth rate (CAGR) of 2.5%. Right behind that region is Latin America with a CAGR of 1.8% (with planted regions increasing from 120 million hectares in 2000 to 173 million hectares in 2020).

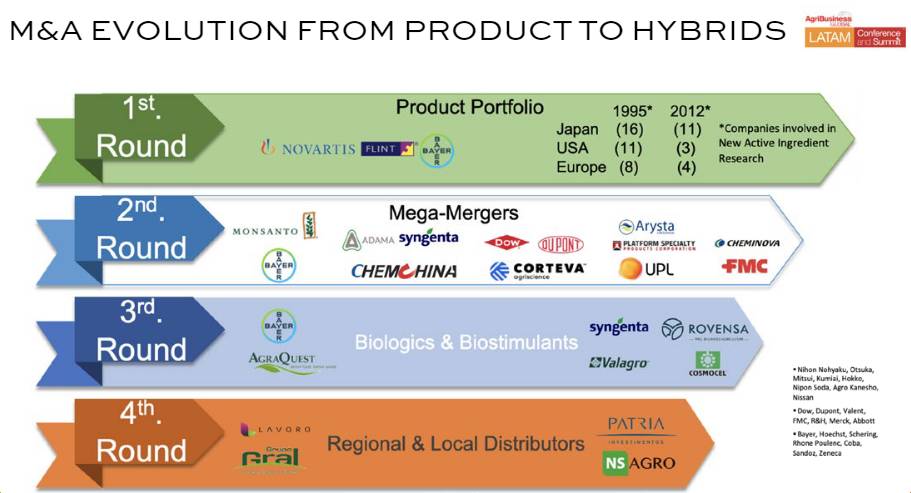

Stages of Global Crop Protection M&A

There have been four stages of M&A activity. During that first stage, one of the most significant acquisitions took place in 2000 when a German company acquired the Flint Strobilurin product line from a Swiss company. The acquisition included global ownership of all associated intellectual property rights, registrations, and trademarks, as well as production and formulation knowhow.

At the same time, there were many companies involved in the R&D of new active ingredients (AIs). Many Japanese organizations like Nihon Nohyaku, Otsuka, Mitsui, Kumiai, Hokko, Nippon Soda, Agro-Kanesho and Nissan; and American companies Dow, Dupont, Valent, FMC, R&H, Merck, Abbott, and the Europeans Bayer, Hoechst, Schering, Rhone Poulenc, Coba, Sandoz, and Zeneca were bringing new products to market to strengthen their portfolios.

A second stage of activity in the 80s saw megamergers, that included six very important multinational companies, integrating leading to the strengthening of not only their crop protection product portfolios, but also the portfolios of biotechnologies that allowed expanded offerings to farmers around the world.

The third round focused on increasing product offerings to accommodate farmers’ varied needs, including the addition of biological and biostimulant products.

The final stage involves the consolidation of distribution companies. Today, at the center of this whole issue are agricultural inputs, the impetus for all action and generation of strategies by the organizations that have them. The importance is so great that Latin America is undergoing a very important business turn since now investment funds, agrochemical companies, food production companies, retail platforms, and merchants are announcing M&A of those distribution companies.

In Latin America there are three levels for the distribution of agrochemicals. The first tier is made up of R&D companies including the six largest companies in the industry that have locations throughout Latin America. On the second level are the post-patent companies, some of which are also found in many countries in the region, and finally the third level (all companies under the Top Local Agrochemical Companies header) comprise local companies that distribute R&D or post-patent products or that do formulation of private label products.

All these companies are working day-by-day to bring growers what they need. This point is very important, because many of these companies are pursuing M&A in different countries to achieve greater participation in local businesses.

A point of reference in Latin America is the value of the agrochemical market, which is around $22 billion, where Brazil and the southern cone handle 80% of the market, with Brazil being the country with the largest market in the region.

North Latin America accounts for the remaining 20%, where the countries of the Andean Region occupy the main part of the market, followed by Mexico and the group of countries of Central America and the Caribbean.

This is a very important indicator for defining how M&A processes will be organized in the region.

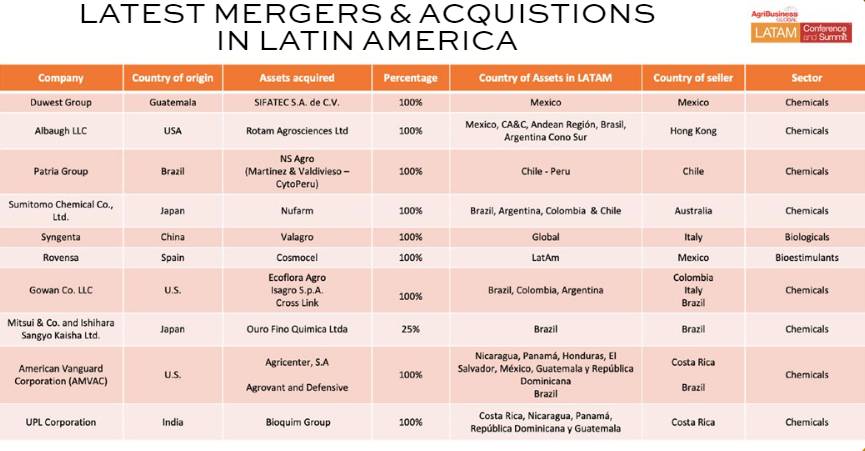

Brazil, today, has very important processes in terms of M&A activity led by investment funds such as the Patria Investments group, a leading alternative investment firm focused in Latin America with more than 30 years of history and managing products across private equity, infrastructure, credit, public equities, and real estate; and Lavoro Group, the largest distributor of agricultural inputs in Latin America, as well as other types of companies that are fighting hard to acquire local distribution organizations.

Linked to this point are the agricultural production systems of Latin America, of which three are very well defined and organized.

- In the first group are the professional grain producers and exporters such as Brazil, Argentina, Bolivia, Paraguay, and Uruguay producing soybeans, corn, and wheat. This group offers great agricultural potential since they are quick adopters of technology, yet they are very sensitive to the costs over the benefits they have.

- The second group comprises professional producers and exporters of high-value crops. They are the so-called specialty crops produced in Chile, Peru, Ecuador, Mexico, Guatemala, Costa Rica, and Colombia. They are intensely professional and work in smaller production areas. They maintain high-quality standards and comply with regulations for the food chain that focus on high-value crops and generate special exports of fruits, table grapes, wine grapes, vegetables, fresh fruits, and coffee.

- The third group, no less important than the previous ones, is found in small-scale local agriculture in Mexico, Central America, and the Andean countries that work crops for domestic or subsistence consumption and are based on traditional small-scale agriculture. Normally these crops are supported by the government and have very low levels of intensification with limited mechanization, which is hindered by the topography of these countries. Corn, beans, rice, and potatoes are planted here.

LATAM’s Primary Drivers

The primary drivers of acquisitions and mergers in Latin America have six factors that have a significant effect on activity in the region.

The first factor is the increase in market share (MS%), which provides a company with higher profit margin, a decreasing purchases-to-sales ratio, a decrease in marketing costs as a percentage of sales, higher quality products, and higher prices.

The second factor is the opportunity to acquire a strong local brand, which promotes and directs its products and services to consumers based on their geographical position.

The third factor is market entry strategy, a planned method of distributing and delivering goods or services to a new target market. With regards to the import and export of services, it usually refers to the creation, establishment, and management of contracts in a foreign country.

The fourth factor is supply chain management, which helps increase logistics service efficiency by minimizing inventory and moving goods efficiently from producers to end users.

The fifth factor is rapid market growth, a stage of market development where competitors scale rapidly to meet growing customer demand.

The latest mergers and acquisitions in Latin America involve companies in Mexico, Central America, the Caribbean, the Andean Region, as well as Brazil, Argentina, and the Southern Cone.

All this activity has a very important objective — to get the companies that have the products to redesign the management scheme of the different phytosanitary problems using both chemical and biological products.

This scheme leads us to use a series of key products and compounds, which together with traditional agrochemicals can be included in the control strategies with basic chemical products such as sulfur and copper. In addition to those, we can include biological fungicides.

Another essential element to include are botanical fungicides, which are made from plants with pesticidal qualities. These materials, while safer for the user and the environment than chemical pest controls, effectively control these problems. We also include biostimulants, which stimulate the natural defense mechanisms of plants, enhancing their resistance to attack by pathogens.

Mergers and acquisitions have a fundamental role in the process of change leading providers to rethink the future of agrochemicals and working to capture value through innovation, resourcefulness, and digital alchemy.

There are a lot of opportunities in today’s agrochemical industry: Feeding the growing world population, protecting against crop loss and increasing yields, growing consumer demand for sustainably produced food, and tackling climate change.

There are also challenges in today’s agrochemical industry, which is experiencing an accelerating pace of change within and in adjacent markets, with reduced government farm subsidies, longer product development cycles, and rising costs combined with increasingly stringent regulatory requirements.