India: A Bright Spot in a Sputtering Crop Protection Industry

Figures released in early July 2020 show that the Global Crop Protection market in 2019 increased over 2018 at a rate of just 0.72% in nominal U.S. dollar terms.

While remaining positive, it is a disappointing result for a year that started so well and when compared with the 2% increase seen in both 2018 and 2017. Taking these modest growths into account the market for crop protection products in 2019 — when measured at ex-manufacturer level and using average year exchange rates throughout — comes in at U.S. $55.65 billion while it stood at U.S. $55.25 billion in 2018.

Once again it is not the magnitude of growth that is important — after all a 0.7% growth is “neither here nor there” — but the simple fact that given all the challenges faced, that there was any growth at all. Those challenges in 2019 included the spring floods in the U.S., the constant regulatory pressure, and the failure of commodity prices to rebound. 2020 will have its fair share of challenges as well. The spring floods of 2019 have been replaced by the 2020 autumn ones in China. COVID-19 has created its own unique set of challenges including the impact it has had on currency movements globally. The regulatory challenges also continue, but once seen as an EU problem, they are now essentially a global one. Brazil, Mexico, Thailand, the U.S., and of course, India to list a few countries where clearly unchallenged public opinion drives political decisions.

The EU, meanwhile, not to be left behind in the regulatory stakes, has tabled the “Farm to Fork” strategy, which amongst other goals aims to see a 50% reduction in the “use and risks” of pesticides by 2030. Asides the terminology of “use and risks” being especially vague (even by EU standards) there is a significant contradiction between the “Farm to Fork” strategy and the overarching policy objective of the EU Green Deal; which aims to make Europe Carbon Neutral by 2050. As a response to this and to other political, social, and regulatory challenges the industry needs to “weather the storm” and at the same time present “a unified strong and positive message” on the benefits of crop protection to both the global economy and the Global Carbon Footprint.

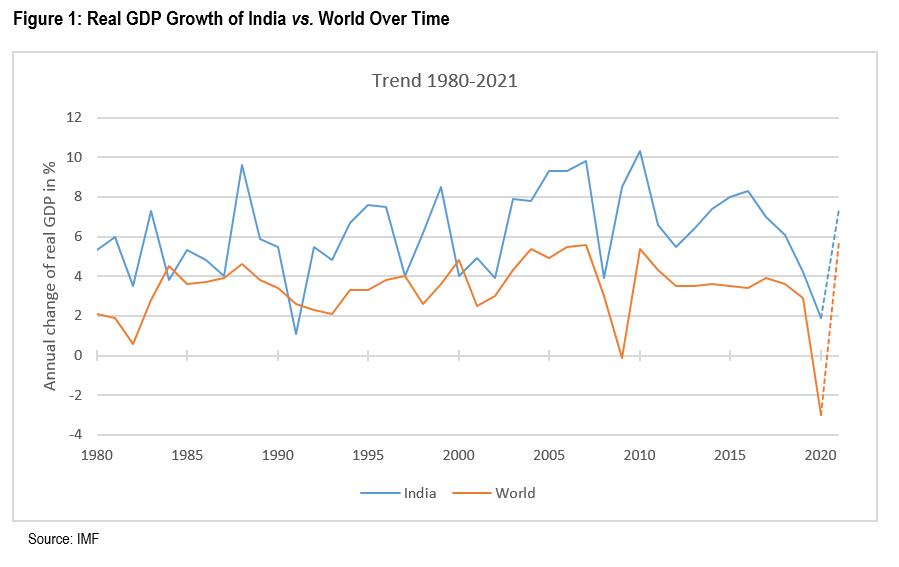

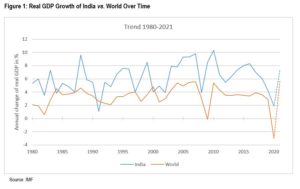

In looking for a first positive message for the global crop protection industry one need to look no further than India. India is often reported as the fastest growing “world” economy and even taking into the account the significant impact of COVID-19 on the economy the latest comparable IMF figures show that the India since 2020 has on average outpaced the global world economy by over 3 percentage points in terms of GDP growth annually (Figure 1; view all Figures in the slideshow above).

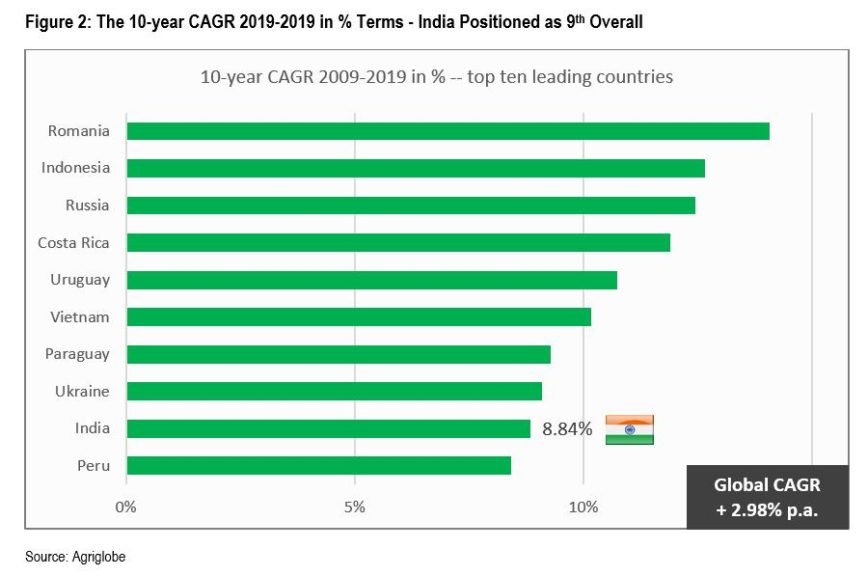

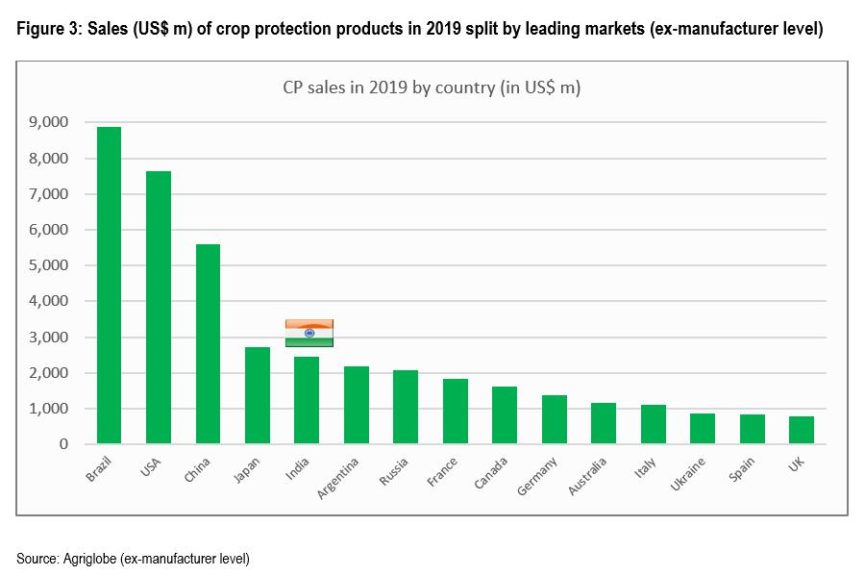

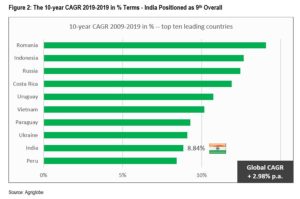

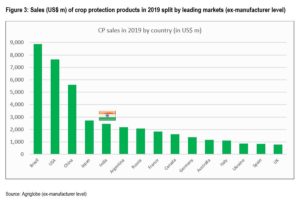

The same growth dynamics can be said to be true for the crop protection market in India. While India is not the fastest growing market over the last 10 years (that particular tag goes to Romania), India is the fastest growing market of significant size. This can best be visualized with reference to Figure 2 and Figure 3.

While 9th rank is not necessarily first tier, the sheer size of the Indian market (fifth largest globally) if taken into account makes it clear that, as with overall economics, India can be considered the fastest growing global crop protection market of significance.

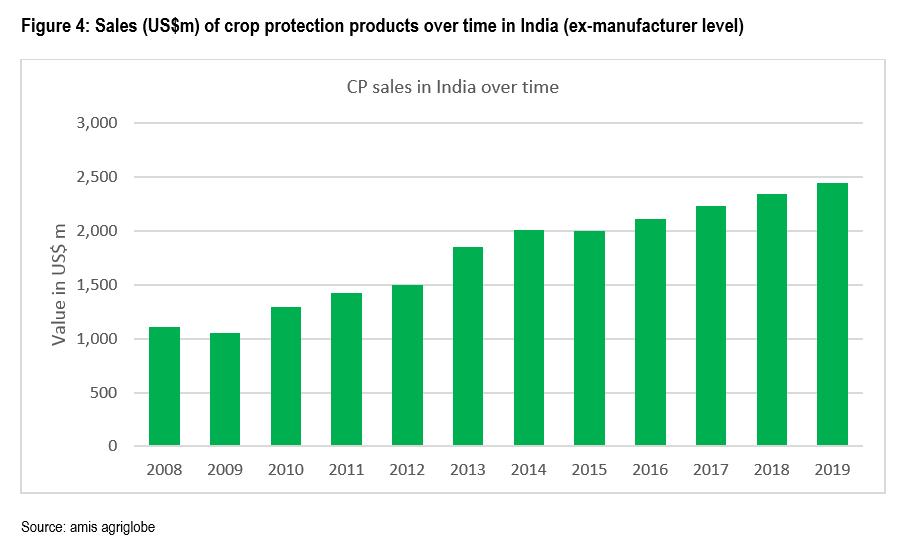

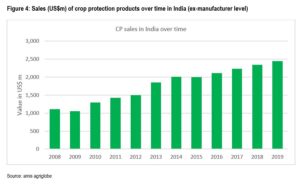

India, like most markets, suffered a decline in 2009 as a result of the financial crisis, and then once again in 2015 — when among other factors a marked decline in commodity prices took place. India, however, suffered less than most markets and came out of this 2015 decline in 2016 rather than 2017, a testament to the resilience of the Indian market (Figure 4). Further in 2018 and 2019, it continues that growth pattern, which as of this point remains likely for 2020.

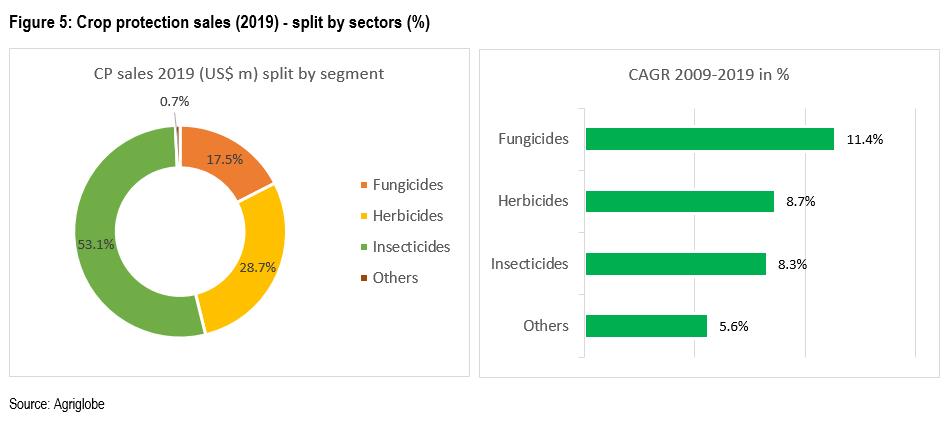

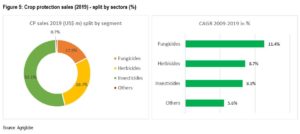

That the Indian market is growing is of little doubt when looking at Figure 4. However, how much the market is developing is a more challenging question. If we look at the splits between the sectors in 2019, more than half of the market remains as insecticides. Insecticides have grown at a rate of 8% per annum over the last 10 years, and while herbicides and fungicides have grown faster, it has not been fast enough to reduce the insecticide dominance to below 50% (Figure 5). When you consider the impact of Bt cotton, reducing the insecticide market potential, it is surprising that herbicides and in particular higher value fungicides don’t represent larger proportions of the total market.

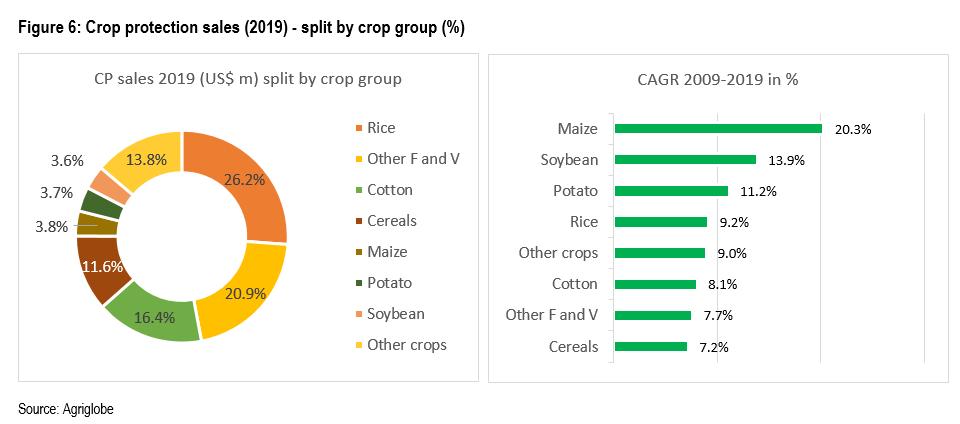

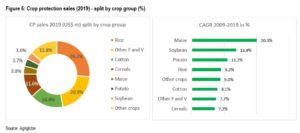

If we look at the CP spend by crop groups in 2019, we find that the market is dominated by rice, other F&V, and cotton, which collectively account for more than half of the CP market value (Figure 6). As a measure of some success in developing the market the fastest growing crop groups over the last 10 years have been maize, soybean, and potato, although their market share remains relatively small with less than 4% each. The reduced dominance of rice at some 29% of the market in 2018 is a testament to the success of “rice reduction programs” as has been seen in other Asian markets.

Outlook for 2020

Indian agriculture, and in turn the crop protection market, is heavily dependent on the South-West monsoon. Its arrival and spatial distribution in the Kharif season (from June to October) largely decides the fate of the market. For the current 2020 Kharif season, the monsoon rainfalls were initially strong but various reports suggest that in August they started to grow somewhat uneven in distribution at what was a critical time. Despite that the estimates from the Indian Agricultural Ministry as of 28 August 2020 were that overall actual rainfall received June-August period was “normal” at 447.1 mm with “good” distribution. Looking forward the India Meteorological Department (IMD) recently issued its long-range forecast for rainfall during the second half (August–September) of the 2020 Southwest Monsoon at an estimated 104% of the long period average; or in IMD terms; normal.

The area of Kharif crop planting 2020 also remains well ahead of that planted in 2019 and as of the end of July around 88.2 million ha of land has been sowed some 120% of that planted in 2019. Rice sowing is up 19% with cotton planting up 11.3%. Pulses sowing has increased by 19.3% as compared to 2019. Coarse cereals acreage rose 6.5% with corn acreage up 2.4%. Oilseed area rose by 16.8% and soybean area rose by 8.2% to 11.64 million ha. In short, all Kharif 2020 cropping is up with good indications that the Rabi season (from October 2020 to March 2021) crop area will also be higher on the back of good water availability and stable commodity prices.

Asides the Monsoon the Fall Armyworm (Spodoptera frugiperda) attack remains a significant driver in India as do locusts. Both insect pests as well as growing resistance challenges within the weed population and what should be a favorable disease environment on increased area and high rainfall all offer good opportunities for the remainder of the 2020 season. On balance “India 2020” should be as good as, if not better than, “India 2019” when measured in terms of growth even taking into account the negative impact of COVID-19.