China Price Index: Identifying Inflection Points for Chinese Agrochemical Prices

Editor’s note: Contributing writer David Li offers a snapshot of current price trends for key herbicides, fungicides, and insecticides in the Chinese agrochemical market in his monthly China Price Index. Below he provides insight into why sensitivity to inflection points is so important when predicting product trends.

Cost is the biggest price forgone.

I am not an economist. Nor am I a critic of the field. Yet, after reading a lot of economic analyses, I recognize how difficult it is for even professionals to predict the future movement of markets based solely on these analyses. For those analysts able to successfully predict market direction and inflection points, it is algorithms, based on different dimensions of information, that are the key to those predictions.

Being involved in China’s agrochemical industry for more than a decade, I’ve searched for a model that accurately predicts product trends. Purchasing teams generally look at raw material prices, capacity, and supply status to determine the likely future price trend of a given agrochemical product, and to make decisions about their purchasing plans. But this simple “triadic structure” seems to contradict a basic economic concept related to cost. That is, supply and demand determine the price of a commodity, and the price of that commodity determines the cost of a resource. Glyphosate, a single product in a perfectly competitive market, is the best example to understand this concept.

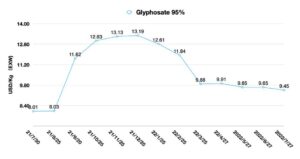

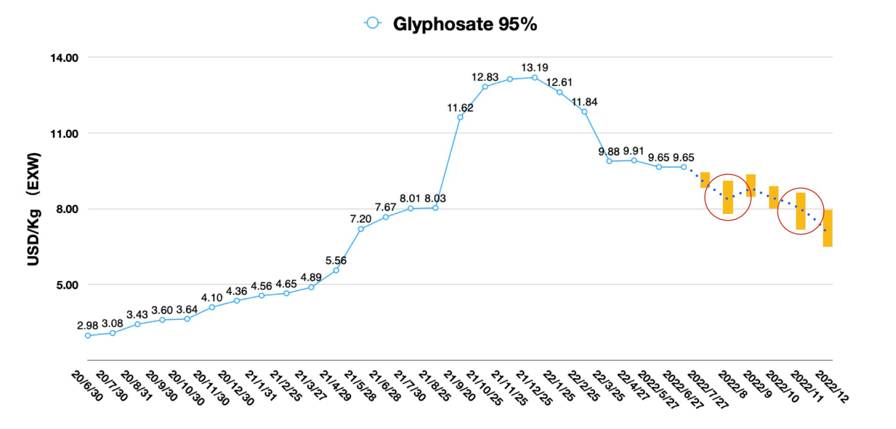

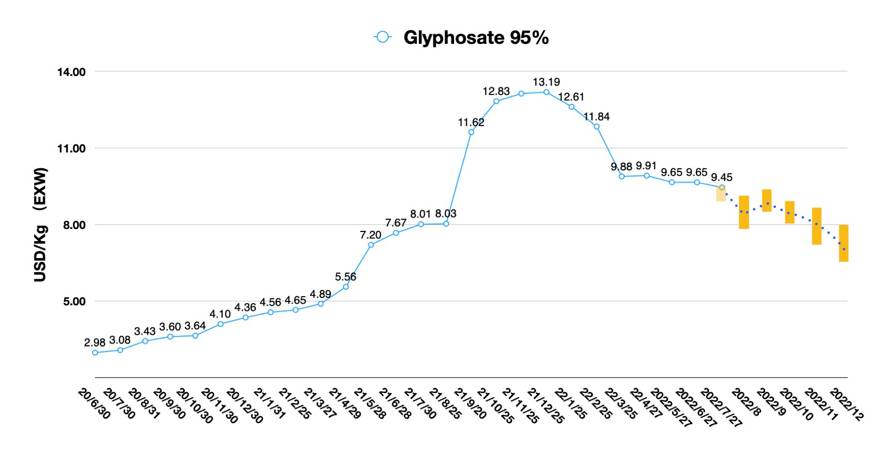

In September 2021, China’s double control policy had a huge impact on glyphosate manufacturers’ operations leading to a brief period of extremely reduced capacity. That resulted in a huge disruption to China’s glyphosate availability, during which prices soared from U.S. $8/kg EXW to more than U.S. $10/kg in just a few weeks. That, in turn, led to two worries: 1) the supply would not recover quickly in the short term, and 2) that prices would continue to increase too quickly. If purchasing decisions were not made at a right moment, then the procurement teams risked increasing their raw material spend as prices moved higher. Due to cautious risk-taking and perception that demand for glyphosate in overseas markets would increase, the price of glyphosate went up as expected. However, at the end of last year, it went unnoticed by many that the basis for price firmness began to shake, that is, end demand was waning.

Whenever one side of the supply and demand equation is affected by a black swan event, it will influence product price trends. Thus, even with full knowledge of raw material prices and producer margins, it is impossible to control product prices. While counterintuitive, it is consistent with the facts. Therefore, a deep understanding of global economic trends and consideration of multiple factors affecting farmers’ consumption of agrochemical products, is the key to predicting future trends.

When predicting product trends, understanding overall societal trends can be very important, but more important is the sensitivity to inflection points. There is a trap in perceiving inflection points, and that is to find the results and then look for the causes, which is putting the cart before the horse. Laurence J. Peter, a management expert and author of The Peter Principle, offered a dark, yet humorous comment about the hindsight of economists when he said, “An economist is an expert who will know tomorrow why the things he predicted yesterday didn’t happen today.” That’s why intelligent leaders should focus more on people with industry intuition than on the so-called “experienced people” who simply list data, stack it up, and call it a platform.

According to the Chinese lunar calendar, we are at about the halfway point of the year. So, it is a good time to consider the future of key products by using our prediction mindset.

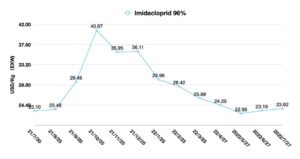

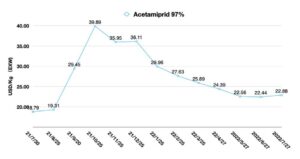

According to the data released by ICAMA (Institute Control of Agrochemical), the overall trend of China’s pesticide export volume from January to May 2022 trended up. February is the traditional weak season and also the Chinese New Year period. As such, 11.91% fewer pesticide products were exported in February 2022 compared with the same period last year, but the export value of pesticide products increased by 205.86% YOY. This also indicated that after the significant price increases in 2021, the price had a certain inhibiting effect on demand. Conversely, the decrease in demand was also the inflection point for lower prices.

In April 2022, pesticide export volume and export value both bottomed out due to COVID-19 controls in Shanghai, which led to logistics delays. Unlike the positive correlation between China’s pesticide export volume and export value from early 2020 to the present, the export volume of Chinese pesticide products in May 2022 reached 308.9 mt million, an increase of 43.81% compared to the same period last year. But surprisingly, the value of China’s pesticide exports in May 2022 only increased by 8.23% YOY 2021, reaching $2.486 billion U.S. It can be said that from May 2022, the correlation between the volume and price curves began to diverge, which is a sign of concern. At this point we need to ponder the question, is demand starting to be lower than expectations?

With the policy of double control of energy consumption gradually shifting to double control of carbon, the sudden energy shortage in 2022 will probably not happen in China. As part of the major capacity of glyphosate comes from Sichuan province, the flood season (August-September) in previous years has been a critical period for flood control. And under extreme weather conditions this year, the possibility of flooding in southwest China cannot be ruled out.

However, the disruptive factors could have a smaller impact compared to the overall stable supply of glyphosate in China. China’s glyphosate cost space is likely to peak in August due to the lower raw material price and weaker global demand, which also leaves room for price concessions to attract long-term, large-scale purchase orders. Due to higher overseas inventory, it is likely that individual large purchase orders from overseas will not flood into the Chinese market at once. Multiple purchases and continuous price watch should be the main strategy for industry purchases. Therefore, we expect that the price of glyphosate is likely to bottom out in August.

The Predicted Price Trend of Glyphosate 95% AI on July 3

The Predicted Price Trend of Glyphosate 95% AI on August 4

In the long run, even though overseas single large orders might be rare by the end of 2022, market demand still exists. Overseas buyers should be very sensitive to the price of glyphosate from China during the 2022 peak season. Once the order amount is less than Chinese suppliers’ expectations, price declines could become mainstream in the fourth quarter. Due to the major Chinese producers’ control over the upstream phosphate mines and the possession of sufficient cash flow, companies are not strongly willing to cut prices. A new balance will be revealed in November.

Another thing to pay extra attention to is the strategy of overseas capacity. Bayer has more than 370,000 tons of glyphosate capacity. In addition to meeting the demand for its own branded products, maintaining profit margins is likely to be a key strategy for Bayer third-party sales in 2022/2023 growing season.

The U.S. Consumer Price Index reached 9.1% in June, the biggest gain since the end of 1981, according to a Bloomberg report. With channel costs gradually increasing including high gasoline prices and labor costs, trimming AI procurement costs will be the key to maintaining overall profit levels for multinationals and key distributors. Therefore, it is very important for buyers to control the timing of purchases and the number of a single orders.

Overall, weak overseas demand and lower consumption rates would be not conducive for distributors expecting higher 2023 sales growth plans. Chinese companies would probably also offer prices that are as stable as possible. The game between the two sides from October to November 2022 will anchor the global glyphosate market trend.

We all once thought that 2020 would be the toughest year for the agrochemical industry. After a brief recovery in 2021, it’s as if a recession is happening. The outlook for the 2023 growing season has also become more cautious due to high channel inventories. To face the challenges ahead and seize the fleeting opportunities, the Agribusiness Global LATAM Conference and Summit, which was held in Panama in early August, provided forward-looking insights and analysis of trends for those involved in the global insurance industry. Our team also provided an analysis of the future price trends for glyphosate as previously described. With the Americas as the most important target market for Chinese pesticides, a multi-faceted analysis of Chinese supply would be beneficial to the global agrochemical industry.

What’s even more remarkable was that Agribusiness Global’s parent company, Meister Media Worldwide, has also launched the Global Ag Tech InitiativeSM. As we have always believed, all business decisions are human decisions, and it is foreseeable that the Global Ag Tech Initiative will bring together the best people of the agricultural industry, of which forecasting is only one, and more importantly, those with the experience and industry wisdom to create the future together. To be honest, it is not important to predict the future, because we ourselves are the future.