Global Agrochemical Trade: Glyphosate, Duty Suspensions Among Key Topics Discussed at Trade Summit Session

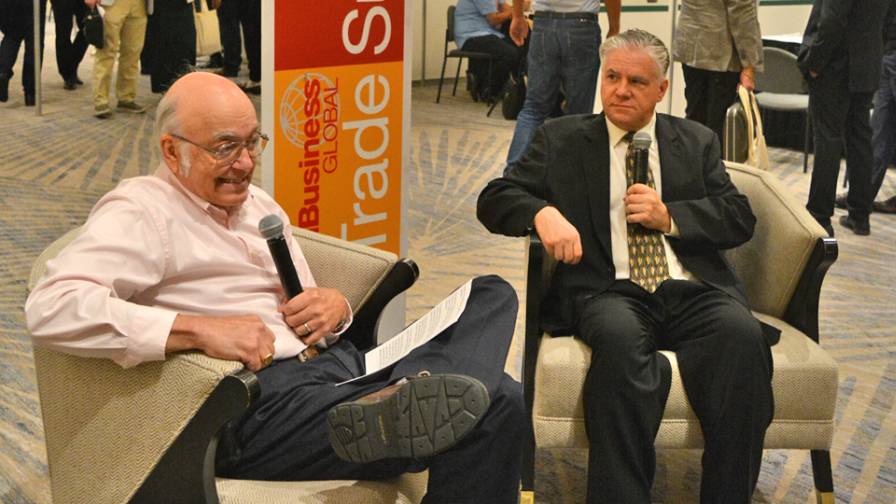

Fanwood Chemical’s Jim DeLisi (left) addressed the state of global agrochemical trade with AgriBusiness Global Editor Eric Sfiligoj at the Trade Summit.

In the case of glyphosate and glufosinate, there’s probably enough inventory to last into 2024 already here,” said Jim DeLisi, Owner, Fanwood Chemical, at the AgriBusiness Global Trade Summit in early August. “Last year, there’s no doubt, there was a bubble in herbicides. A lot of it was caused by people who were really concerned glyphosate was not going to be there.

“Prices ran up pretty high through January then they started to crash,” DeLisi continued. “There are an awful lot of folks sitting on an awful lot of expensive inventory.”

For glyphosate and glufosinate, DeLisi doesn’t expect the inventories to return to more normal levels until 2024. For other herbicide products many import companies “hit the brakes hard in April and May, and they may have hit them harder than they needed to be hit.”

Later in the year they might need to be restock, and that could be difficult and expensive, he says. “Everybody needs to watch their inventories, watch their markets, stay close to their customers. The other piece of it, for those of us that are not gigantic companies – we’ve all seen the numbers for the last quarter out of the big players in this market – when big companies panic, they can do some things that can trample a small company. Just make sure you don’t get stepped on by an elephant.”

This is relatively new territory for the industry.

“The only parallel is 2008,” DeLisi said. “But in 2008 you had the added problem of a banking crisis, which thankfully we don’t have right now. Interest rates are another concern for the young adult generation he continues. They grew up in an era with very low interest rates. This younger generation is people who don’t know how to make decisions with 5%-6% interest rates. It will be a difficult time for the next few months, and there’s not a whole lot anybody can do about it.”

There could be some challenges with regards to a major crop, DeLisi says. “People are putting their head in the sand with corn.”

Basically, DeLisi says, there is a disconnect between the current government’s stance on growing corn that gets turned into ethanol and plans for the future of gasoline powered automobiles.

The Biden administration is looking to end the sale of gasoline-powered vehicles by 2032, DeLisi says. “Two or three weeks ago, they published the amount of ethanol the fuel companies have to take in order to be in compliance it’s just inconceivable.

“You can’t put in more than 10% ethanol in gasoline or most cars aren’t going to run,” he continues. “The reality of a reduction in the gasoline requirements is not going to force a slowdown in the amount of ethanol that is being produced, and yet, they’re still convincing people to grow more corn and make more ethanol. There has to be a dramatic slowdown in the amount of gasoline that’s used if this administration stays on its current kick. There needs to be a discussion on this topic, and so far there is no discussion.”

When asked about duty suspension and GSP (generalized system of preferences) he commented: “It’s been a general disappointment. All the temporary duty suspensions that impact this industry, and in fact, our entire country expired on the 31st of December 2020. There was a bill in Congress to renew those that was all ready to go, and for whatever set of reasons never got acted upon. Buried in that bill were directions for the ITC (International Trade Commission) to open up the window to accept new duty suspensions requests and renewals.”

Had that bill been passed the duty suspensions would have started in October 2022. “We’re in no man’s land right now,” DeLisi says. “If they passed the duty suspension bill today, it would expire it would expire on 12/31/23. You might say, why can’t they just cross out ’23 and write in ’24 or ’25? They can’t do that because they would be shooting in the dark as to what the cost of that would be.”

In addition, the U.S. major parties each want to attach issues to the bill that the other side finds untenable.

“It’s a mess,” DeLisi said. “It would take a miracle for something to happen between now and the end of the year. Hopefully, early next year they’ll do something about these two programs and reinvigorate the ability to apply for duty suspensions, which means you would not see one before the first of January ’25.”

When this ultimately does happen, the companies that have followed the proper procedures could receive a “nice check,” DeLisi said. And India will most likely return to the program, which is “really important for this industry because dicamba, glufosinate, and 2-4,D, which are all GSP beneficiary products and are about one-third of the benefit in Chapter 29 (of the GSP legislation). There’s a lot of money potentially with GSP). I think it could happen because of the way Indian Trade Authority have played their cards.”