2020 AgriBusiness Global State of the Industry: Coronavirus Creates New Normal for Purchasing Terms, Automation

There is nothing normal about 2020, but the current disruptions that are affecting the downstream food value chain likely won’t affect crop input companies until Q4 or 2021. The delay in real product demand is a result of mainly two factors: robust inventory in the value chain and the favorable timing of production cycles in both the Northern and Southern Hemispheres.

The coronavirus disruption is an overwhelming force affecting labor, demand trends, logistics, and spending power for the world’s food, feed, fiber, and fuel. Agriculture industries have been fortunate compared to the hospitality and service sectors. The virus hit the Southern Hemisphere during harvest season, when far fewer products are being applied. In the north, it began around planting season, which means farmers and retailers had already purchased enough seed, fertilizer, and crop protection inputs to buoy production through the summer.

Businesses related to agriculture were deemed essential industries around the world, allowing for continued operations, albeit at a lower capacity amid labor disruptions and a shifting demand outlook that could delay the economic impact on suppliers and distributors around the world.

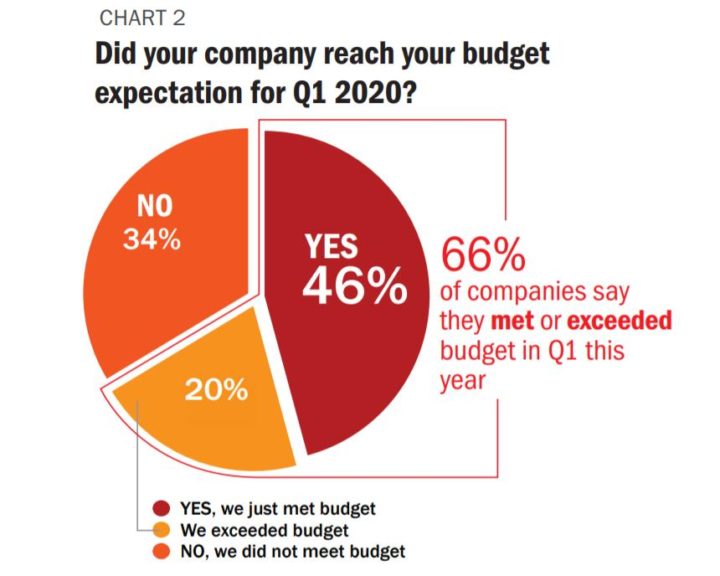

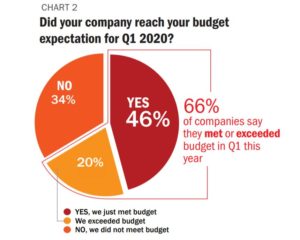

For now, the data is positive: 66% of companies say they met or exceeded budget in Q1 this year (Chart 2), which is consistent to company performance in Q1 2009 during the Great Recession, when 69% of companies met or exceeded their Q1 budget projections. But uncertainty requires precaution, and 45% of companies revised their budgets for the rest of 2020 to be lower than expected, again similar to 2009 when 46% of companies tempered their sales goals.

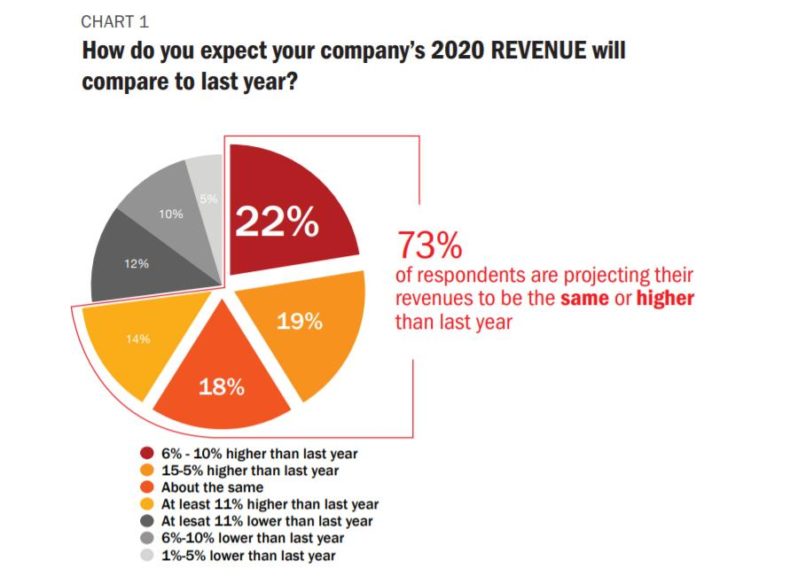

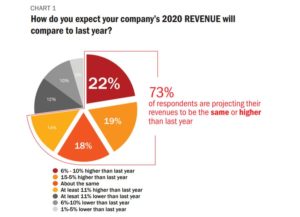

While Q1 numbers weren’t affected, there appears to be a good amount of caution for the rest of the year: 73% of respondents are projecting their revenues to be the same or higher than last year (Chart 1), on par with the 69% of companies who projected the same or higher year-over-year revenues in 2009. Similarly, companies are scaling back their production or responding to diminished capacity that was necessary during worker shortages amid lockdown: 28% of respondents say their output in 2020 will be lower than last year, compared to 20% who planned for lower production in 2009.

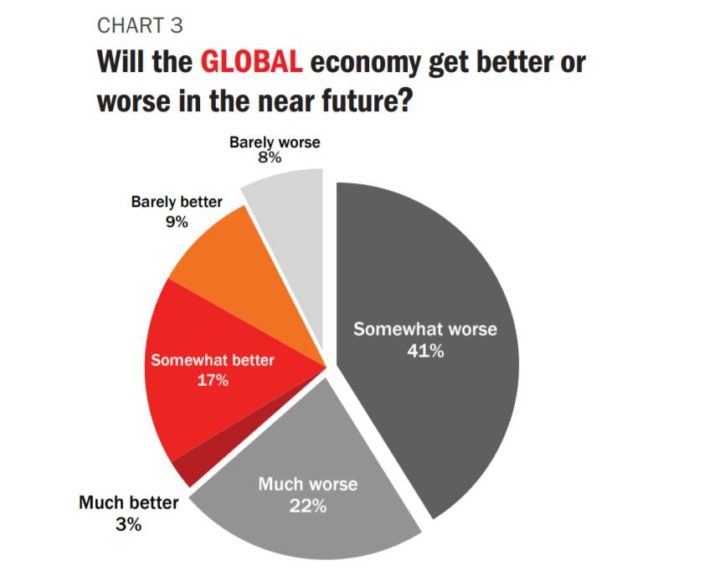

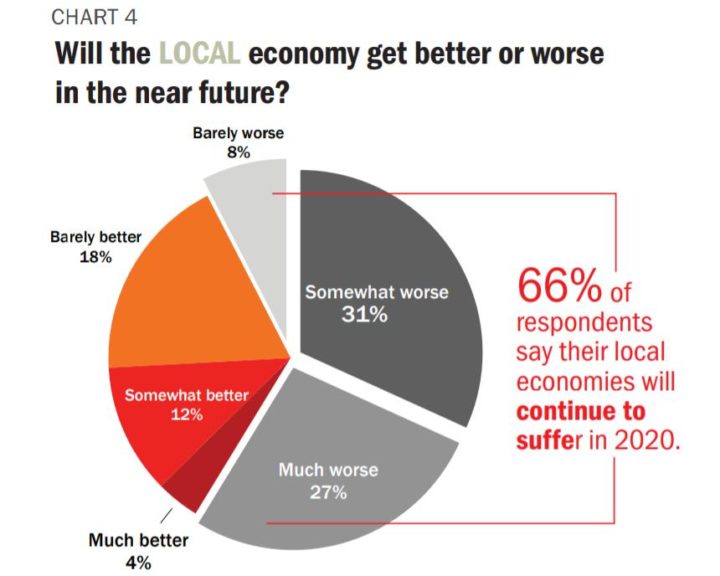

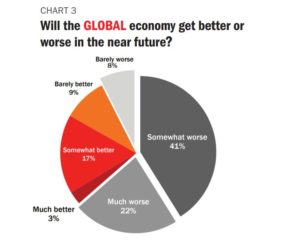

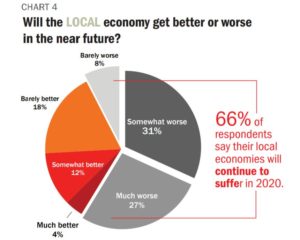

Sentiments about the global economy are more pessimistic than views about individual company performance: 71% of respondents say the global economy will get worse, and almost a quarter say it they are expected it to be much worse. In 2009, just 29% of respondents were pessimistic about the global economy, and 33% were neutral. Domestic sentiment isn’t much better: 66% of respondents say their local economies will continue to suffer in 2020, whereas just 18% of respondents were pessimistic about their local economy in 2009, and 30% were neutral.

But the disparity isn’t surprising, as in 2009 the global economy was showing signs of stronger growth compared to a dismal 2008, whereas the current recession had just begun at the time respondents took the survey this year.

Mergers, Acquisitions, and Expansion

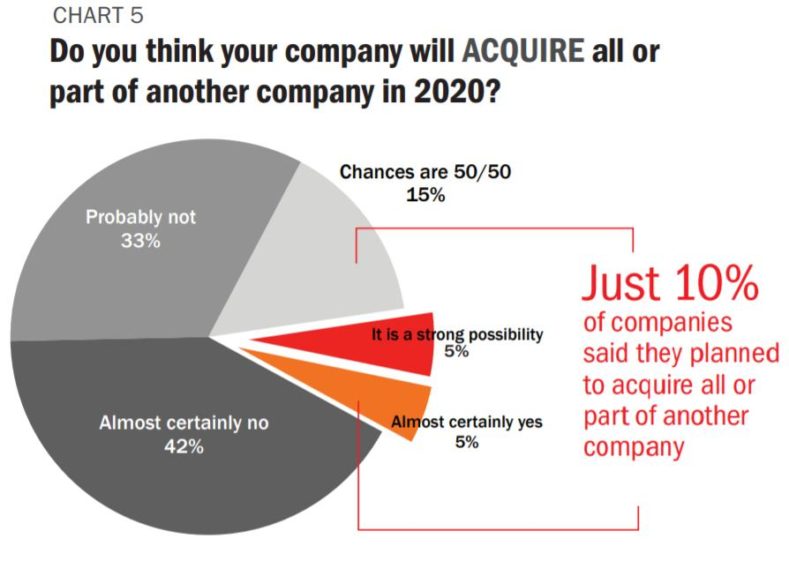

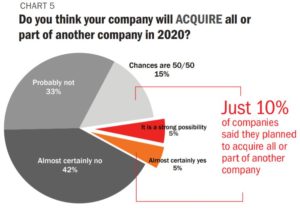

Uncertainty is pervasive in 2020, but companies seem to be sure about one thing: Consolidation can wait, for now. Almost 75% of respondents say they won’t look to make any acquisitions this year. Just 10% say it is a strong possibility or certainty that they will acquire all or part of another company. In 2010, under similar economic pressures, 14% of companies said they planned to acquire all or part of another company (Chart 5).

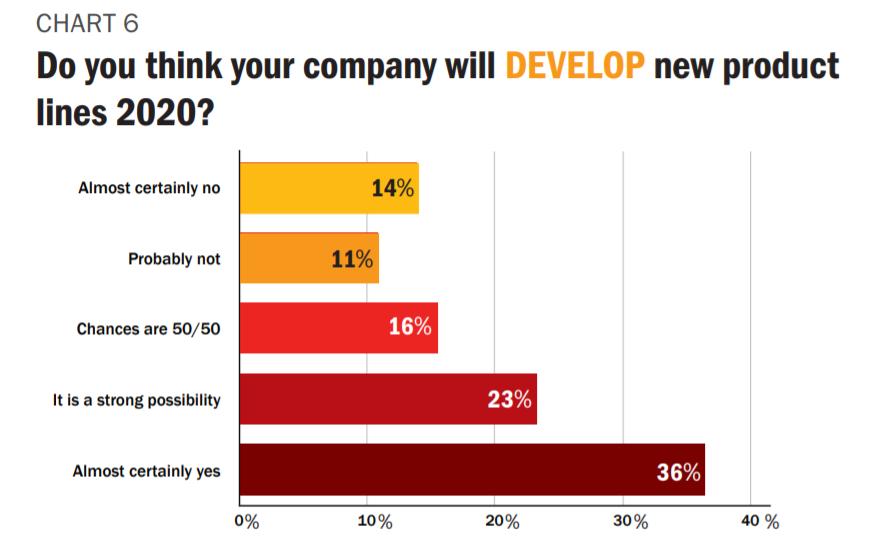

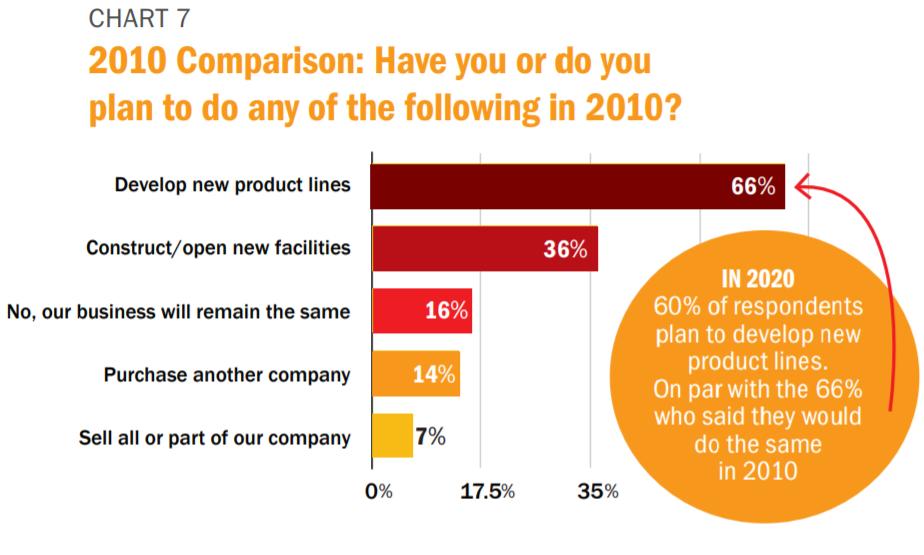

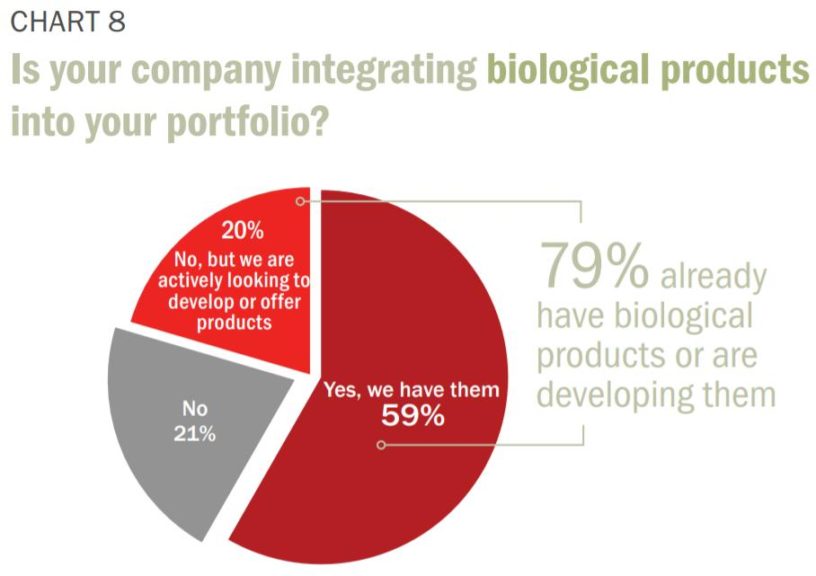

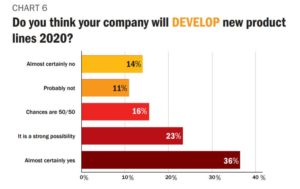

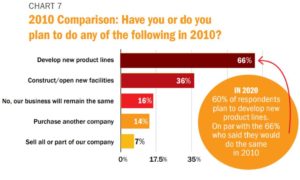

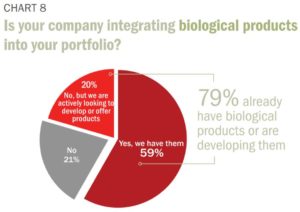

New product development appears to be uninterrupted by macroeconomic factors (Chart 6): 60% of respondents plan to develop new product lines this year, on par with the 66% who said they would do the same in 2010 (Chart 7). Of the companies who are developing new product lines, insecticides led all product categories with 40% of companies exploring development plans, followed by biological pesticides (38%), fungicides (37%), and herbicides. Almost 90% of respondents say they are seeing an increase in demand for biological products, and 79% say they either already have some biological products in their portfolio or are actively looking (Chart 8). Biological products are the fastest-growing crop input segment, and 75% of respondents attribute this to consumer demand for safer foods, a trend that is influencing crop production models like never before.

Supply Chains, Labor, and Automation

Early coronavirus repercussions were isolated to the supply chain in Q1 at a time when companies were already focused on backward integration and just-in-time delivery. Those risk mitigation strategies appear to accelerating and could be part of the new normal as companies work to insulate themselves from supply shortages, risky payment terms, and cash-flow issues while creating more transparency and visibility of their shipments.

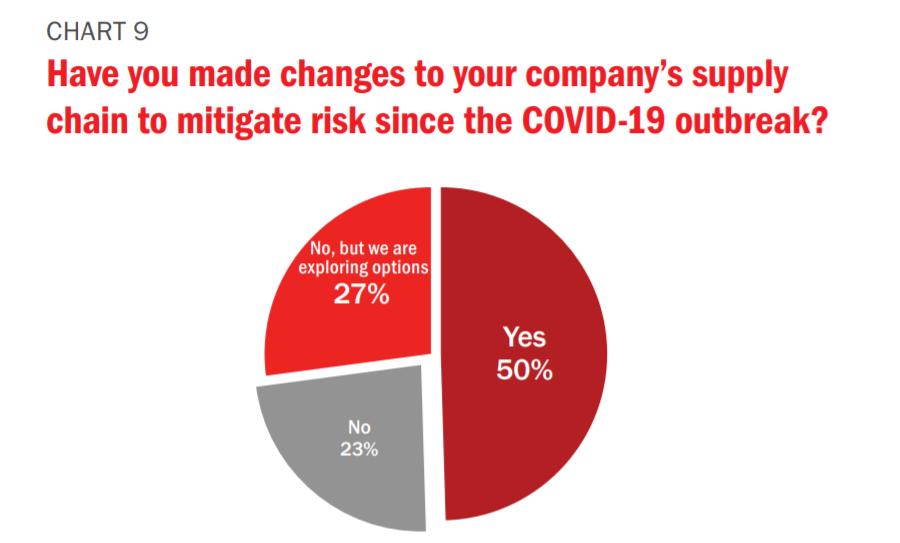

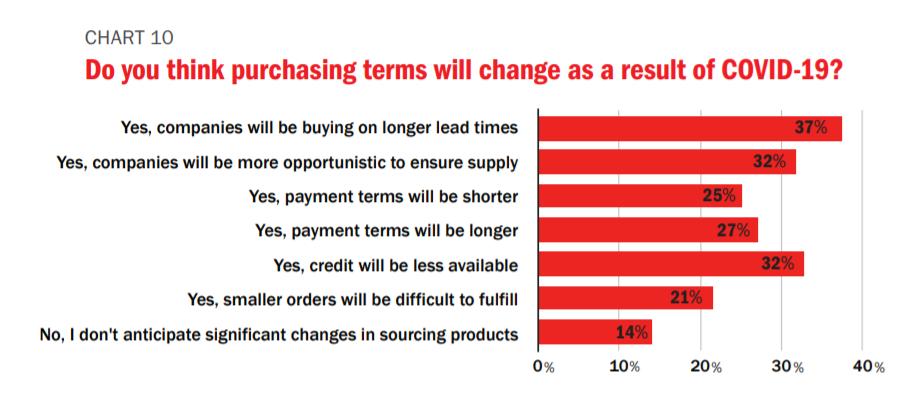

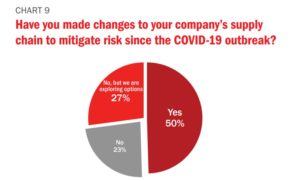

Just 23% of respondents say that they aren’t changing their supply chain strategy in the wake of the coronavirus, and just 14% aren’t expecting any changes to purchasing terms (Charts 9 and 10).

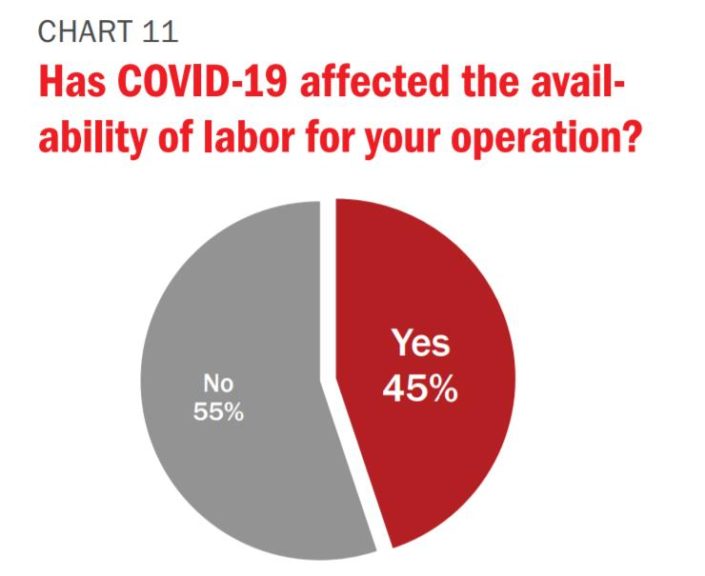

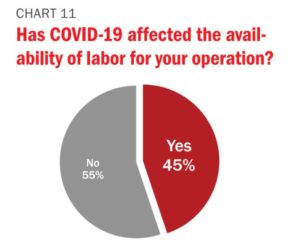

Labor availability was another immediate ramification of lockdowns and sick workers: 45% of companies say their labor was affected by ongoing disruptions and will likely continue to operate in some form of reduced capacity to comply with physical distancing requirements (Chart 11).

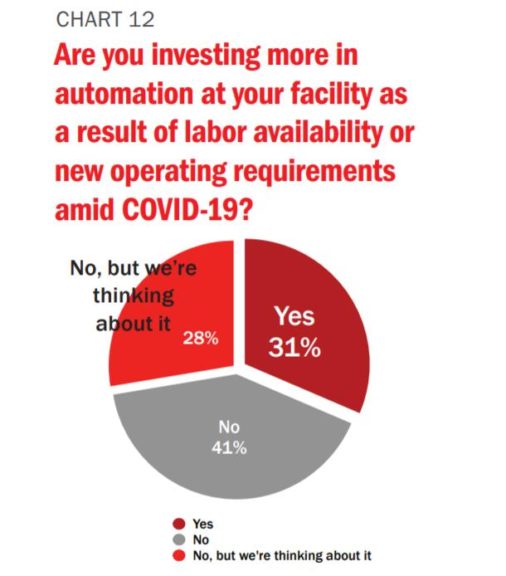

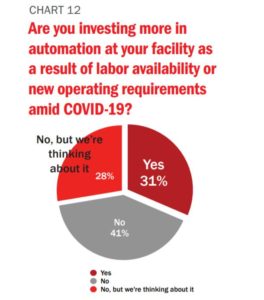

Almost one-third of respondents say they will invest more in automation to help mitigate labor disruptions going forward (Chart 12), and another 28% are looking into how automation can help their business in the future.

Methodology and Demographics

AgriBusiness Global’s™ annual State of the Industry Survey and special report offers readers a biographical snapshot of the health of the industry and the sentiment of the companies that operate in it. The survey was designed by AgriBusiness Global editors and broadcast to our email subscriber base. Email reminders were sent during the four weeks the survey was open May 11-June 8, and an incentive was offered to win a $100 gift card. The survey was taken by 133 respondents in 43 countries, giving the survey a margin of error of ±8.44% with a 95% confidence level.

The survey respondents represent primarily crop protection manufacturers and formulators (55%), distributors and trading companies (27%), and plant health suppliers and distributors (17%). About 42% do not originate any molecules, and 30% do not formulate any products, indicating that trading companies and non-formulating distributors still represent a significant share of the industry.

More than half of responding companies (56%) had gross revenues of less than $25 million in 2019, which is consistent with the past 10 years. However, the number of companies who gross more than $250 million (21%) has doubled since 2009, illustrating consolidation among the largest companies in the industry.

Similarly, the number or registrations per company has increased remarkably in the last 10 years: 34% of companies held at least 50 product registrations in 2019 compared to 8% in 2009. Companies with more than 20 registration rose to 54% compared to 22% in 2010. The number of companies with zero product registrations also rose from 15% in 2010 to 23% this year. This data illustrates consolidation among larger companies and also the difficulty of more stringent and expensive regulatory environments, forcing a share of companies to abandon product registration strategies to focus on pure import/export and distribution business.

For almost 40% of respondents, their respective domestic markets represent at least 75% of their business; 29% of respondents rely on export markets for at least 75% of their businesses.