China Price Index: China’s Persistent Energy Crisis to Disrupt Agrochemical Production Into 2022

Editor’s note: Contributing writer David Li offers a snapshot of current price trends for key herbicides, fungicides, and insecticides in the Chinese agrochemical market in his monthly China Price Index. He also provides insight into the energy crisis in China and beyond and the impact it will have long-term on the agrochemical supply chain.

On October 8, Premier Li Keqiang presided over an executive meeting of The State Council, making further plans to ensure the supply of electricity and coal in 2021 winter and 2022 spring to ensure the basic livelihood of the people and the smooth operation of the economy.

Winter arrives soon, and China normally starts the central heating system in the middle of November. People’s livelihoods will be the top priority, so the government will first direct the energy supply to the northeast region of China for heating during the winter. Moreover, the Chinese government will also release the capacity of local coal to the market to support the electricity industry. With that coal, the electricity companies also need to keep a reasonable profit margin for easing a shortage of the energy supply. Delayed payment of taxes and making the transportation of coal a priority will support the coal-fired power companies. The final price for electricity is subject to as much as a 20% fluctuation. For a high-energy consumption industry, electricity prices can be formed by market transactions regardless of the 20% fluctuation policy.

According to a people.cn report, China’s electricity consumption from January to August 2021 increased by 13.8% year-on-year, while profits of power and heat enterprises fell by 15.3% according to the public data from National Bureau of Statistics. Based on a report from Reuters, of 10 listed coal-fired power companies, four reported losses and five others saw first-half profits plunge. The dramatic drop in profitability comes amid a surge in domestic thermal coal prices. The price of coal has more than doubled from the 467-Yuan-per-tonne low in 2020.

The comments from China Premier Li instructed the Q4 action of double control. From a central government point of view, the management of energy consumption cannot be executed only by suspension of electricity supply to the enterprises. The detail policy in different provinces could need to be re-evaluated before November 2021.

Not only China, global demand on energy is also strong since the cold winter in 2021. The EU’s future gas prices are soaring, which could bring the crisis across Europe by pushing up inflation, the Financial Times reported on September 21, 2021. In the U.S., the average price of gas climbed to USD 3.17 a gallon. Hurricane Ida temporarily closed most oil production in the Gulf of Mexico and several big refineries. And the global pandemic of a new variant of COVID-19 reversed the resilience of energy supply globally.

Stagnation is a risk for the global economy if the fundamental energy price stays at a high level for an extended time. The high price of raw materials and the energy for production will drive the cost of life necessities higher. Human community with a shared future is a true reality to affect the people’s daily life.

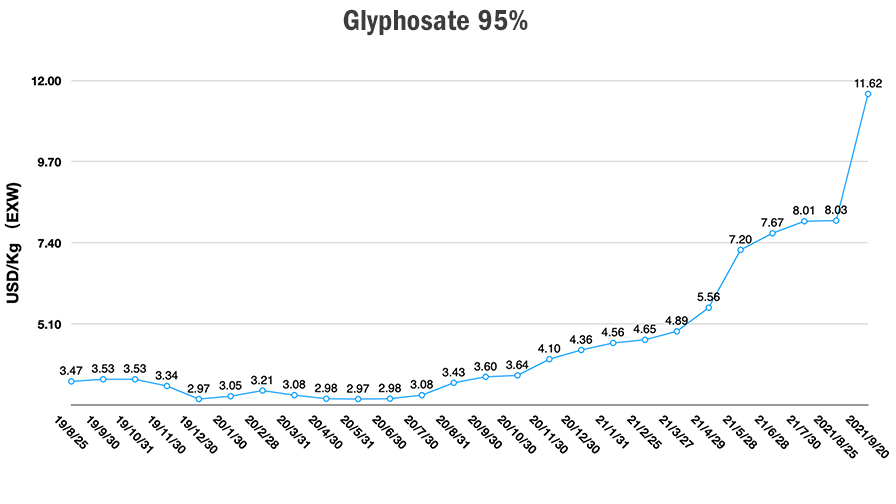

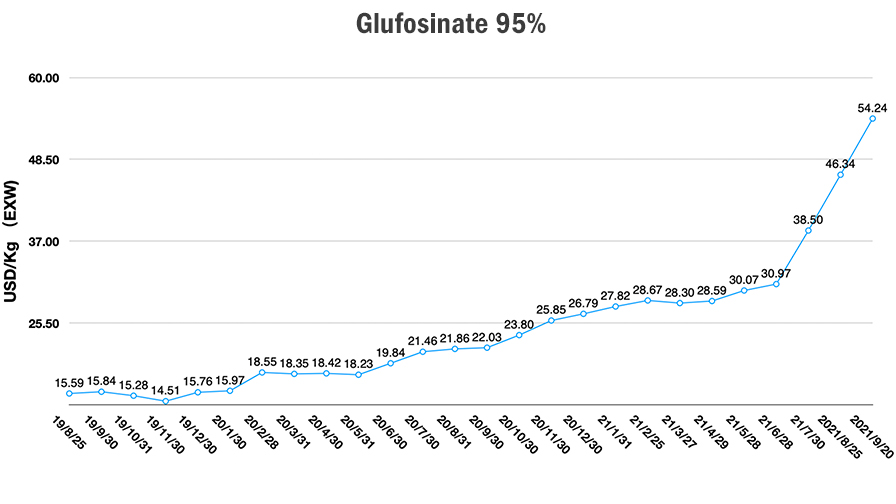

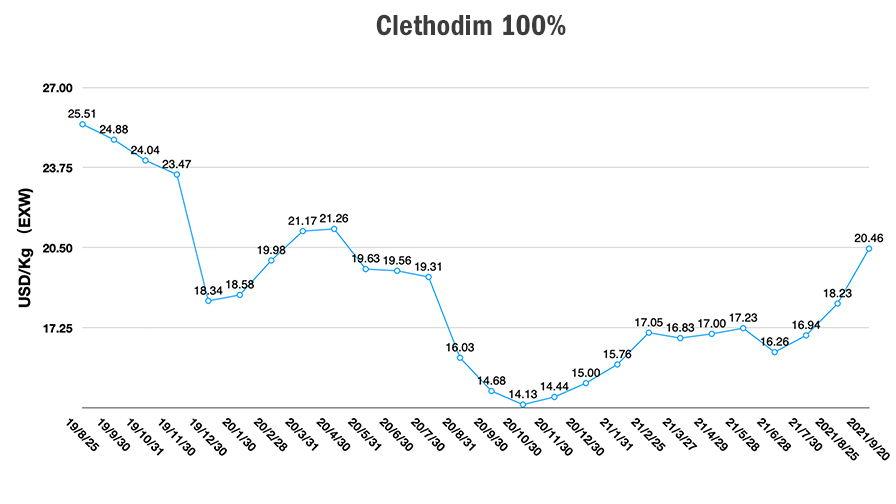

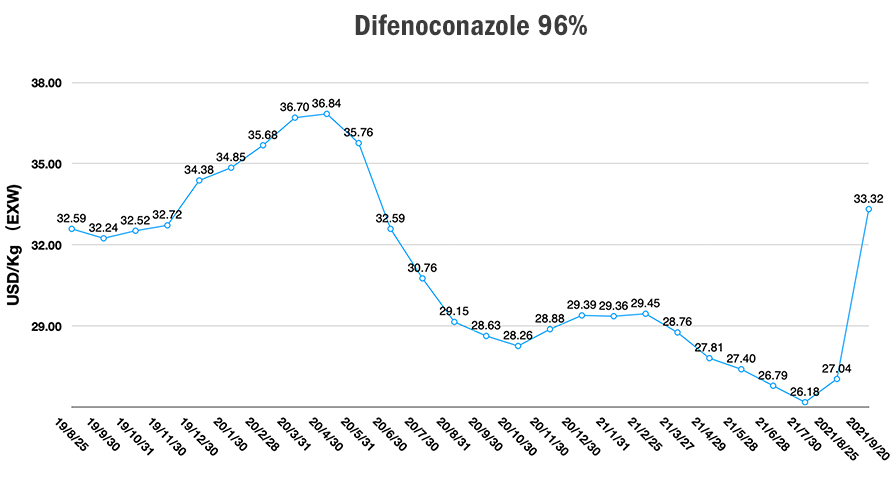

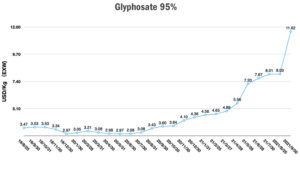

China’s Double Control policy seems like a Black Swan Event to the world’s crop protection market by the end of 2021. No one anticipated the price of glyphosate EXW would reach more than 11 USD/Kg in the past three weeks. And there would be no ETD available for buyers. The shortage of energy-electricity supply in China resulted in an agrochemical raw materials shortage.

Till the end of 2021, Double Control will affect the production rate continuously. The supply capacity will be surely limited. Zhejiang, Shandong, and Jiangsu are backing for agrochemical production. But the future supply shall be only for the key accounts’ demand. Without confirmation of upstream raw material production, no suppliers can quote the solid price to customers because Chinese suppliers do not intend to let cancellation of orders happen again. Even though there is some price from China, there could be no cargo for shipment.

Moreover, the Double Control affection will be combined by the Beijing Winter Olympic Games. The heating demand will be depressing the energy supply to the industry for provinces with Red Alarm Level and especially for northeast agrochemical production. In the north of Yellow River, the heating for people will be the top priority from November 2021 to the March 2022, which will be the routine central heating season every year in China.

Because the energy shortage cannot be resolved in short term. There will be no clear timeline for “normal production.” In late March 2022, there could be a soft landing of such high prices for agrochemicals nor the lack of big volume cargo availability.

From the end of 2020 to the beginning of 2021, the early demand driving China’s agrochemical exporting increased. The key reason was that the national distributors and multinational companies had to increase the volume of safety inventory in the warehouse. The procurement strategy was keeping on purchasing according to the rising price expectation from China’s agrochemical supply. It surely increased the risk of financing for the national distributors and multinationals, but it saved the compensation to purchase lately when the price touched the sky. High safety inventory in national distributors and multinational companies will be along with the high inventory level in farmer’s hand. The global channel could face the low-level inventory since the anxiety of farmers for future disruption of crop protection product supply. Cold winter and drought weather could not simulate the consumption in the coming crop season.

During the financing crisis of 2007-2008, glyphosate prices were up to 13 USD/Kg EXW in September 2008 from 5 USD/Kg EXW in August 2007. And the overcapacity of glyphosate caused the price drop to the 3.5 USD/Kg EXW in 2009. Some buyers spent more than three years to absorb the high price glyphosate in the balance sheet. It dragged the company development deeply. Collecting all this knowledge could help the entrepreneurs avoid the situation in the future, Chinese ancestors said in “Strategies of the Warring States.”