China Price Index: Is Glyphosate Market at a Tipping Point with Continued High Pricing Levels?

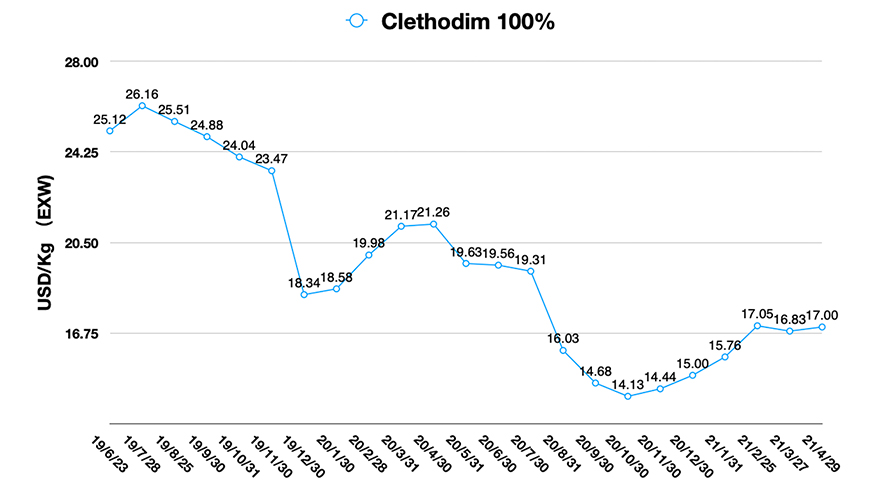

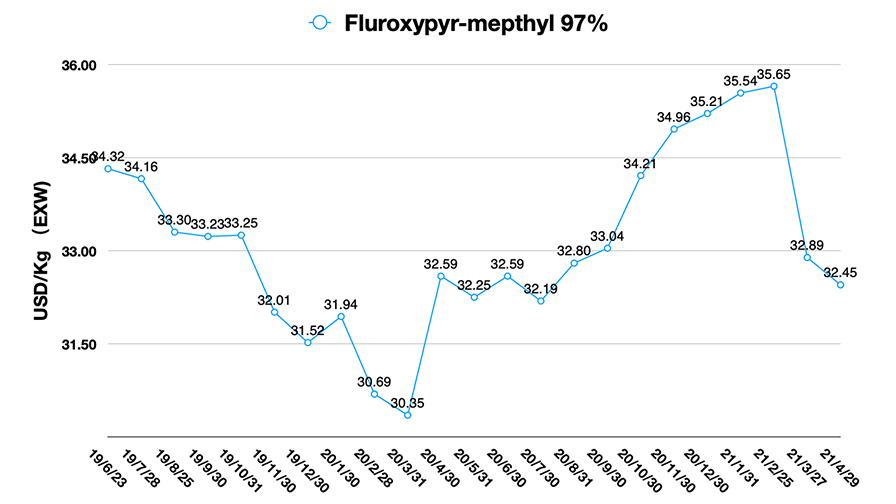

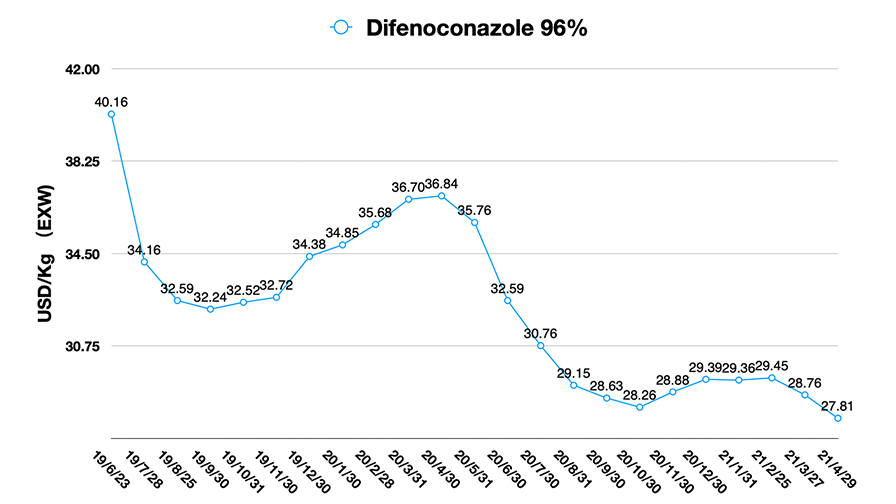

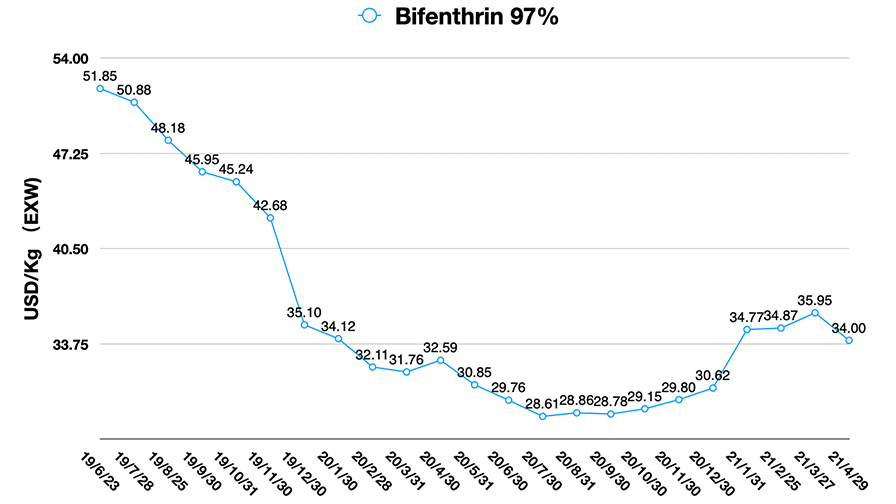

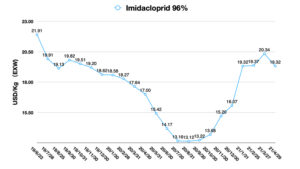

Editor’s note: Contributing writer David Li offers a snapshot of current price trends for key herbicides, fungicides, and insecticides in the Chinese agrochemical market in his monthly China Price Index above. Below he provides insight into key factors that have brought the glyphosate market to a potential tipping point.

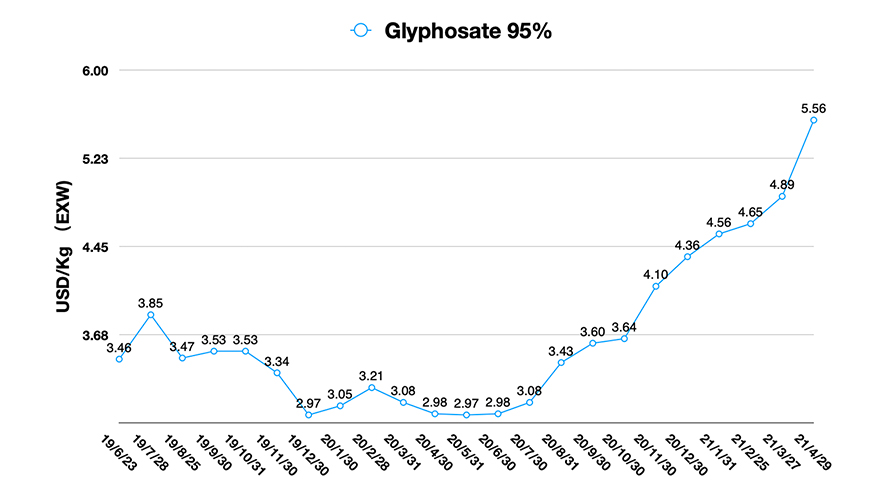

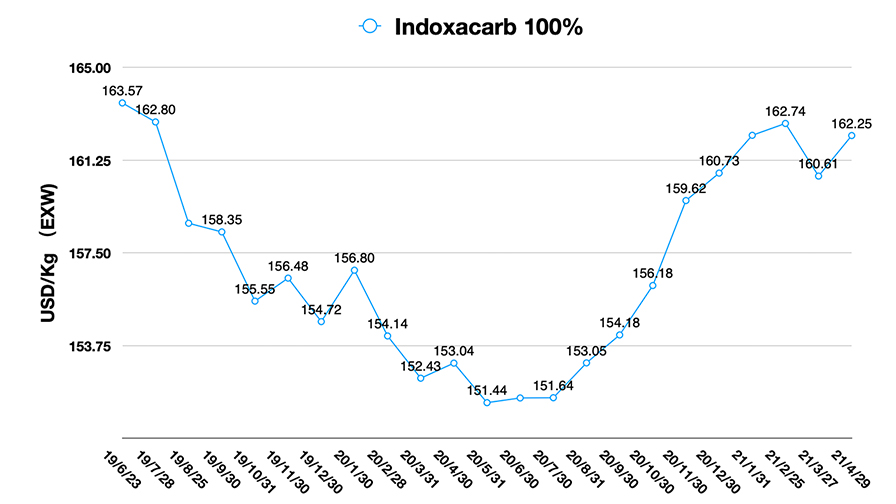

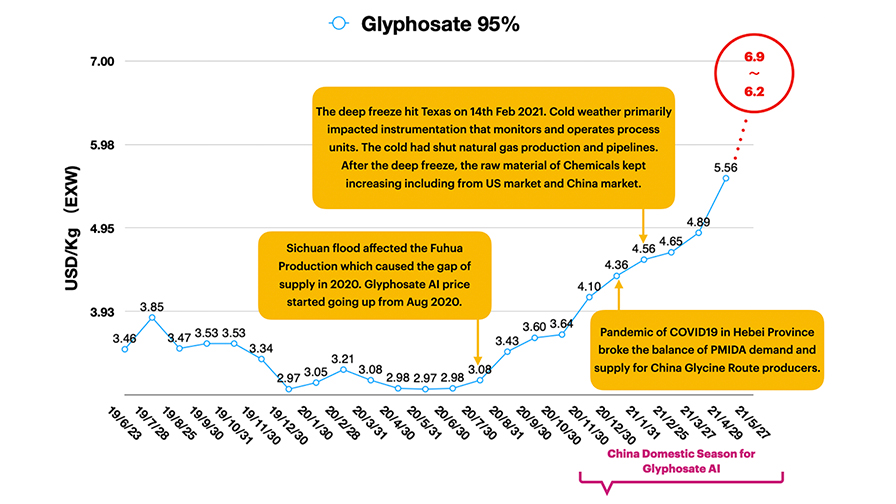

The glyphosate market has not seen a pricing level this high in the past three years. According to our monitoring, the glyphosate AI EXW price shall reach up to 6.2-6.9 USD/Kg in May. By the end of April, the EXW price of glyphosate 95% AI was around 5.56 USD/Kg. And the lead time of glyphosate from key suppliers in China has been delayed to October 2021.

In 2020, the Sichuan flood hit the Fuhua glyphosate production. From August 2020, the glyphosate AI price went up step by step. The suspension of Fuhua’s glyphosate production caused a significant gap in supply, the impact of which has been consistent in 2021.

In 2021, the impact on glyphosate supply has not calmed down. Up to 60% of PIMIDA suppliers are located in Hebei Province and Shandong Province. And 34% of China PIMIDA capacity is in Hebei, where the COVID-19 pandemic was under control by the local government at the beginning of 2021. The sudden disruption of PIMIDA supply broke the balance of demand for glyphosate manufacturers.

Moreover, there was the impact of the deep freeze that hit Texas in the U.S. on 14 February 2021. The extreme cold weather primarily impacted instrumentation that monitors and operates process units. The freeze had shut down natural gas production and pipelines. After the deep freeze, the raw material of chemicals kept increasing from both the U.S. and China markets.

The rising price of key raw materials of glyphosate, like yellow phosphorus, squeezed the margin of glyphosate profit. So new contracts have had to face the “new” cost of glyphosate production, which was driven by the limited production status. Meanwhile, the China domestic demand for glyphosate is also driving the price up. The domestic season normally starts from November to May annually.

To look ahead, LATAM demand shall be mainly in September. There will still be major uncertainty with how high the price of glyphosate will go by the end of 2021. What we are sure of is that the glyphosate price will keep increasing in May from a short-term perspective. Even though early demand for controlling lead time poured into China in the 1st quarter of 2021. When autumn comes, LATAM could push the demand for glyphosate to increase sharply. Will the price of glyphosate get back to the same level as the year 2008? It seems that the market enthusiasm on “crazy glyphosate” has been lighting up, so the market is waiting for a tipping point.

The agrochemical industry is relying on natural resources like crude oil, gasoline, and mineral resources, since they all contribute to the cost-saving. Multinational companies need to control the upstream. Especially during the post-COVID19 period, the global shortage of production keeps pushing the demand jump into the China supply chain.

In April 2021, Syngenta Group China announced the strategic collaboration with Hubei Xingfa Chemicals Group officially. The key advantages of Xingfa are the phosphate resources in China. The reserve of Xingfa’s phosphate is 446 million Mt. The collaboration would aggregate the glyphosate industry value chain from the raw material to downstream. It will provide Syngenta Group China more competitiveness on key generic AI sourcing from China. The impact might be a zero-sum game. The collaboration on glyphosate supply shall also squeeze the supply chain competitiveness of other multinational companies. The support for Syngenta will become a priority of Xingfa’s capacity.

The climbing raw material price interacts with the shortage of commodity supply. And QE (quantitative easing) could become the biggest risk for the global economy which would provide an illusion of economic recovery quickly. The current price of soybeans as of 5 May 2021 is $15.42 per bushel. But the soybean price was around $9 per bushel during pre-COVID19 in 2019. The change of soybean price was growing up 67% during the past two years. On the other hand, glyphosate price has been increasing around 87%. The inflation risk is gradually emerging in 2021.

The financing charts of many agrochemical companies are very strong in the first quarter of 2021. But the rational thinking on the risk control shall be critical when we choose the right timing and pricing level to purchase key agrochemicals for saving costs and keeping the lead time.