China Price Index: The Impact of Sichuan’s Power Restriction and Historical High Temperature on Glyphosate, Glufosinate

Editor’s note: Contributing writer David Li offers a snapshot of current price trends for key herbicides, fungicides, and insecticides in the Chinese agrochemical market in his monthly China Price Index. Below he provides insight on how the short-term power supply restriction due to recent high temperatures will impact the country’s overall capacity and pricing for key agrochemicals.

The supply chain departments of multinational companies were updated almost weekly during the COVID-19 pandemic in 2020, in an effort to ensure the supply of raw materials from China. BASF and UPL are actively recruiting sourcing talent in an effort to form agrochemical supply information teams in China. The need for agrochemical intelligence in China is deepening for both multinational and generic companies. But opportunities always come with challenges. The sufficient information available to multinational companies may be a constraint to their decision making — the more information a company gets, the more noise it contains. The key is to filter out the noise leaving useful information to help form the right decision.

Price trends can, at times, be very important. For small and medium-sized buyers, price trends can help them estimate budgets for the next sales season. At the same time, price trends are of limited value to small and medium-sized teams because they do not provide fundamental cost savings by influencing their purchasing strategy. For MNCs (multinational companies), there is no shortage of price information for the intelligence teams, as sales from Chinese suppliers will be the first to provide those larger organizations with the latest prices with the hope of additional purchase orders.

So, what is at the heart of strategic analysis? To answer this question, it depends on how long the team is making strategic judgments with a strategic interest in mind. If we look at strategy in terms of the company’s earnings over the next six months, then our judgment of the supply chain and market trends need only be on the “best timing” of purchases and the prediction of a reasonable price range. But if we consider the long-term strategy for the future, say five to 10 years. Then the analysis team should consider the competitive advantage of the supply side as a whole and make a comprehensive analysis of the political, economic, humanistic, efficiency, and innovation environment in which the supply side is located.

More importantly, it should also anticipate the possible decisions of each stakeholder that are manifested in the integrated environment. This anticipation of the decisions of the practitioners in the environment is something that information teams need experience and time to build and cultivate. It is critical for the company to gain a competitive advantage on the supply side. Based on this, the company can further strengthen its competitive defenses and maintain an optimal posture in the target market for the long term.

Power Play

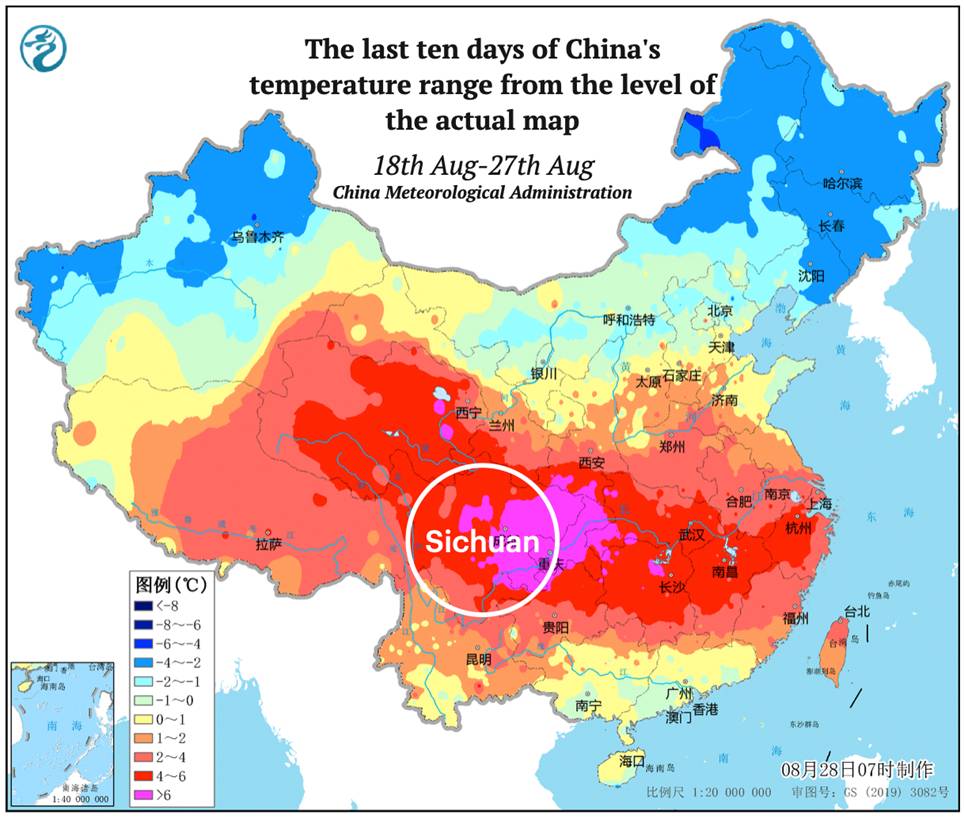

The impact of the recent power restriction in Sichuan may provide some inspiration to the local intelligence teams.

On August 14, Sichuan Electric Power issued a notice, that in order to face the hot weather, all industrial power users on the Sichuan power grid were required to shut down production from 15 August to 20 August. The Sichuan local electric power suggested the manufacturers have high-temperature days off, so that they can provide electricity to the people.

On 22 August, Lier Chemical, the leading Chinese glufosinate producer, announced the production sites in Mianyang City and Guang’an City, Sichuan Province, received a notice of production power restriction. Due to the tight power supply, the two production bases have adhered to the relevant policy of the local government and started to shut down production on 15 August (only the security load was retained). The two bases were later notified of an extension of the power restriction (security load only) until 25 August. Production bases outside Sichuan province were generally less affected by the power restrictions. In view of the large-scale production restrictions at the Mianyang and Guang’an bases, the total period of the restrictions reached 11 days. It is expected to have a negative impact on the company’s operating results.

Different from other restrictions, Sichuan Power’s regional policy is obviously because of necessity. The drought brought by the high temperatures has put a huge strain on Sichuan’s power system, as Sichuan mainly uses its abundant hydropower resources to power production in the province. Continued high temperatures turned the power supply and demand situation in Sichuan Province from a “shortage” in the July peak period to a “double shortage” of a whole day without power and electricity. According to Chuan Guan News reports, the Sichuan province’s maximum electricity load was expected to increase by 25% over the same period last year. Sichuan Power noted the load of the Sichuan power grid increased 14% compared to the same period last year. The average daily electricity consumption of residents YOY 2021 increased by 93%. At present, Sichuan province residents account for about 30% of electricity consumption. Industrial enterprises account for about 60%.

As the ancient Chinese used to say, things always turn to their opposite. August 23 was “the end day of high humidity and high temperature weather” in the Chinese lunar calendar. From this day forward, most of northern China enters a period gradually dissipating heat. Daytime electricity loads for residents in northern areas would be immediately reduced, which allows energy suppliers to provide power needed in Sichuan. The hot weather in the region started to ease 23 August. The average temperature in key Sichuan cities has dropped to about 30 degrees Celsius (86 degrees Fahrenheit). Chongqing has always been known as “furnace,” so, high temperatures in Chongqing are expected to continue. From 29 August, the Sichuan region expects cooler air from the north of China. The temperature will further decline accordingly.

Weather Effects

Even though the extreme hot weather is short-lived, the power restrictions will certainly have an impact on upstream, high-energy-consuming yellow phosphorus and chemical production. A lower operation rate is the most direct impact. But view of the overall phosphorus chemical upstream and downstream should be monitored from a broader perspective. July and August are the traditional low season for agrochemical production. Overseas demand and peak production will come into China’s supply market between September and October. And August was also a common practice for suppliers to reduce their operating rates to overhaul and maintain equipment during the off-season. Moreover, it is worth noting that the overall demand for glyphosate and glufosinate could be weak in the second half of 2022. The short-term power supply is not expected to impact the country’s overall capacity.

On the other hand, from traditional farming experience, a bad drought is sometimes followed by a bad flood. From the end of August to the end of September, the possibility of flood in Sichuan remains high. Possible future floods could hit Sichuan production harder than the power restrictions did. Moreover, extreme droughts due to climate change are also likely to cause extreme cold in the winter, especially in the spring of 2023 when the risk of cold snaps increase. A future freeze brings high uncertainty into the mix for chemical production in early next year.

In addition to weather challenges, local policies issued by the local electric grid, will certainly be designed to protect local tax from key enterprises in the policy implementation process, especially related to increasing fiscal deficits in various provinces and cities of China. Sichuan’s local government is trying to ensure energy supply, rather than the total cut-off of power.

Sichuan increased its daily supply of coal for electricity production. CHN Energy Group also continues to supply coal to Sichuan, thus increasing the capacity of thermal power generation in Sichuan. In addition, the State Grid Corporation of China is also supporting Sichuan’s power resource allocation by increasing cross-provincial power transmission. Sichuan’s main sources of electricity from other provinces are currently Shaanxi and Gansu. As the current northern power load continues to operate below peak capacity, Sichuan’s power supply will be greatly relieved soon. The negative impact on production supply and industry will also end.

Affects on Pricing

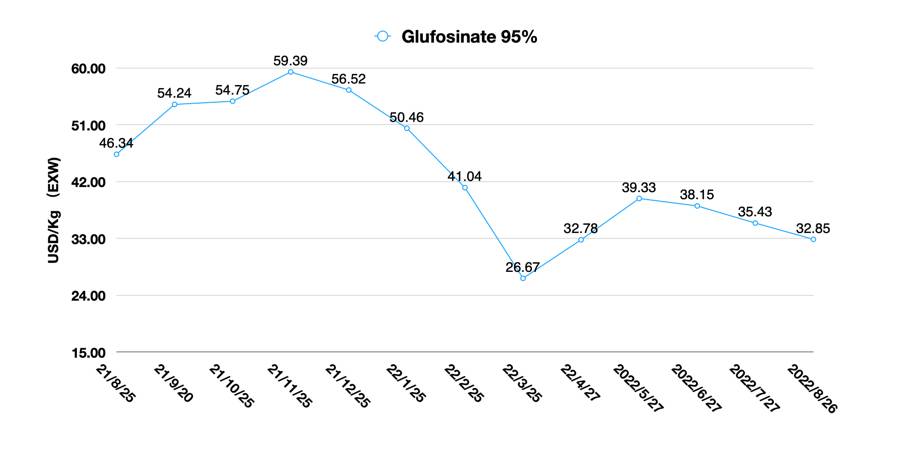

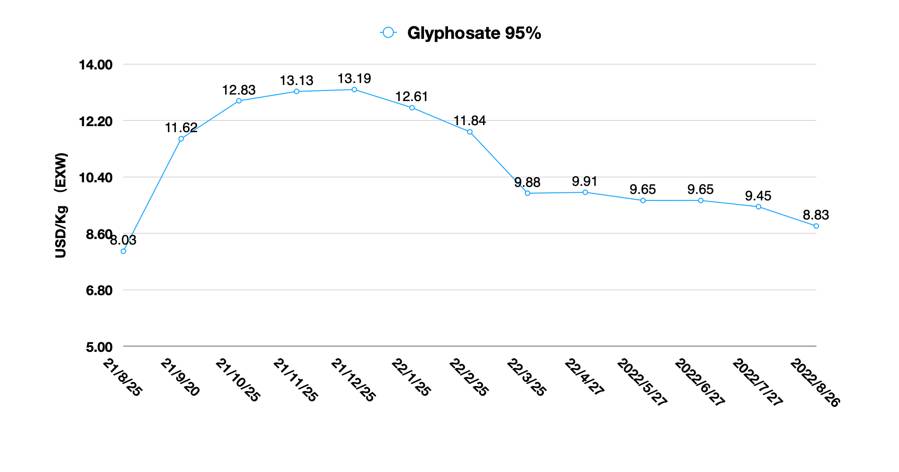

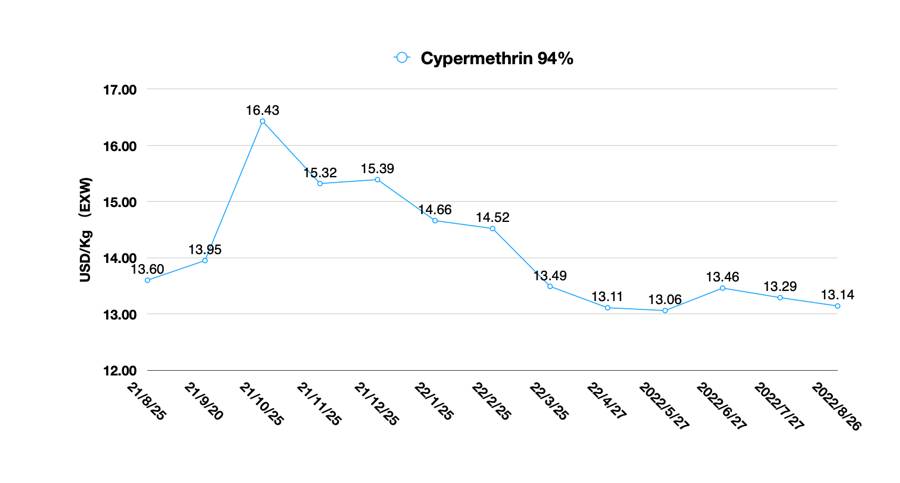

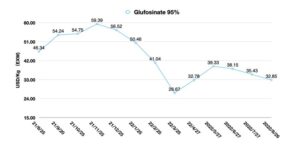

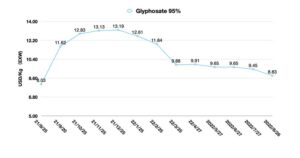

To verify the previous judgment, a deeper look at the recent price fluctuations of glyphosate and glufosinate is also needed. For now, this negative factor has limited impact on the overall phosphorus chemical industry. Yellow phosphorus prices rose by about 17% from mid-August compared to early August due to power restrictions in Sichuan and insufficient production operation in Yunnan and Guizhou. However, due to the weak demand for glyphosate, the brief rise in yellow phosphorus prices has not yet been passed downstream. There are still certain stocks of glyphosate in the supply market. Therefore, even the low operation rate and the power restriction in Sichuan did not boost the declining price of glyphosate. The EXW price of glyphosate 95% AI dropped to US $8.83/Kg in August, which was the first time below US $9/Kg in the last 12 months. According to our previous forecast for glyphosate, the price trend is still within the forecast range. For the supply of glufosinate, Sichuan production capacity has been affected to some extent. However, the overall market supply/demand balance did not deviate seriously, and the extent of this short-term negative impact was limited. Glufosinate 95% AI EXW price continued to drop to US $32.85/Kg in August.

Good news arrived with the cold air and rainfall. According to the State Grid Corporation of China, all general commercial and industrial electricity consumption in Sichuan Province returned to normal at noon on 28 August. Except for high energy-carrying industries, electricity consumption for large industries is being gradually restored. After the continued improvement of hydropower, all large industrial electricity consumption will be converted to normal soon.

Such extreme weather conditions may become more frequent due to climate change. As a result, local industrial policies related to energy consumption in Sichuan are willing to be further optimized. Predictably, Sichuan is likely to increase investment in photovoltaics, wind, and other power sources in the future to ensure a diversified power supply. At the same time, there will be some restrictions on traditional energy-intensive mining and chemical production. Local enterprises will also pay more attention to the improvement of traditional energy-intensive processes under the impact of power restrictions. This is also the goal of China’s pesticide industry during the 14th Five-Year Plan period. After upgrading processes in accordance with environmental emission requirements, process improvements aimed at reducing energy consumption is becoming a new focus for the whole of China’s agrochemical industry.

It is also worth mentioning that the measures taken by China to address regional emergent risks and the efficiency of implementing them. As a major global pesticide producer, China’s actions in response to the extreme drought and persistent heat in Sichuan provide another perspective for global buyers to assess China’s willingness to ensure sustainable supply and its determination to implement actions. For global intelligence teams, it could be a good time to upgrading the analysis model of drivers and impact from a relative longer beneficiary of the company strategy like Chinese ancestors did. Chinese ancestors “looked” 700 years into the future. We are considering the next 70 years.