China Price Index: Chinese Suppliers Face Dilemma As Competition Intensifies in Generic Pesticide Market

Editor’s note: Contributing writer David Li offers a snapshot of current price trends for key herbicides, fungicides, and insecticides in the Chinese agrochemical market in his monthly China Price Index. Below he also explains why a red ocean of competition has turned every Chinese generic pesticide supplier into a “prisoner”.

The prisoner’s dilemma is the most representative example of a non-zero-sum game, also known as win-win, in game theory. It is a game between two arrested prisoners that illustrates the difficulty of maintaining cooperation even when it is beneficial to both parties. This theory reflects that the best choice for an individual is not always the best choice for a group. Or that in a group, individuals make rational choices but often lead to collective irrationality.

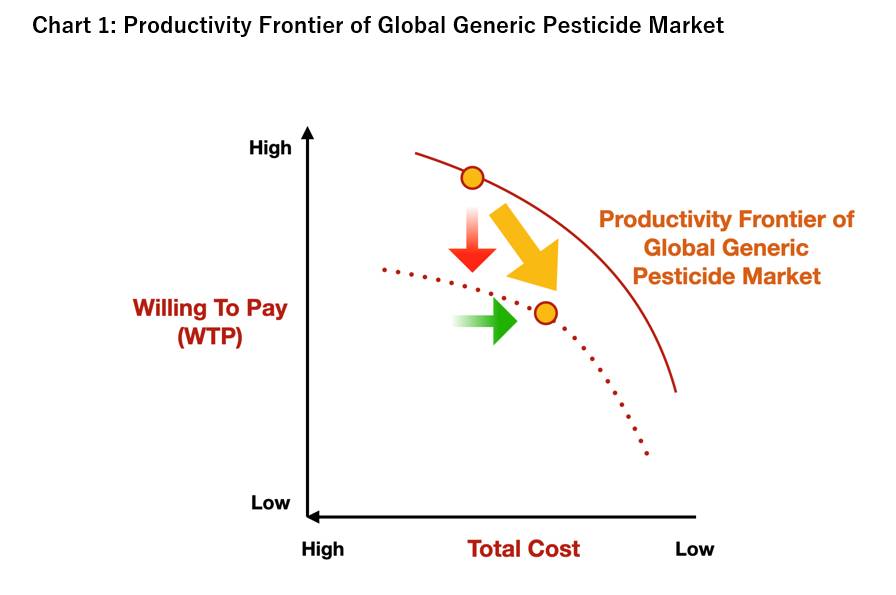

In China’s pesticide supply market, the red ocean of competition has turned every supplier into a “prisoner.” The productivity boundaries of the generic active ingredient (AI) (off-patent pesticide) market are being reshaped as global farmers’ willingness to pay decreases and the price of generic products gradually decreases. At the same time, the field of alternatives to generic pesticide products is also squeezing the overall value of the generic AI market.

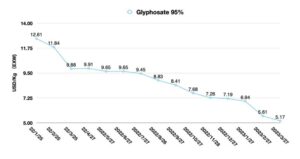

For example, the rise of biopesticides and the rapid growth of the biostimulants market further weakened the farmers’ focus on using generic pesticides. Since the first launch of genetically modified (GM) crop in the world, the market for generic AIs, represented by burn-down herbicides, mainly benefits from the promotion of GM seed. New products with multiple model action, as well as resistance traits, are emerging as new favorites in the GM seed market.

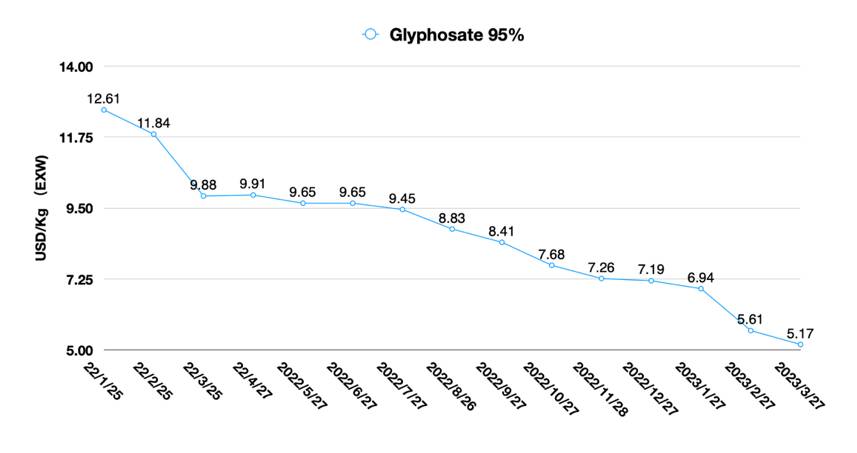

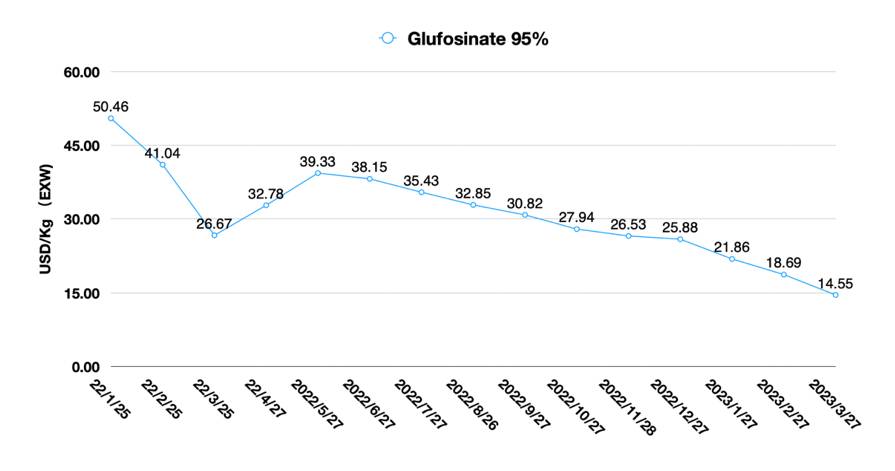

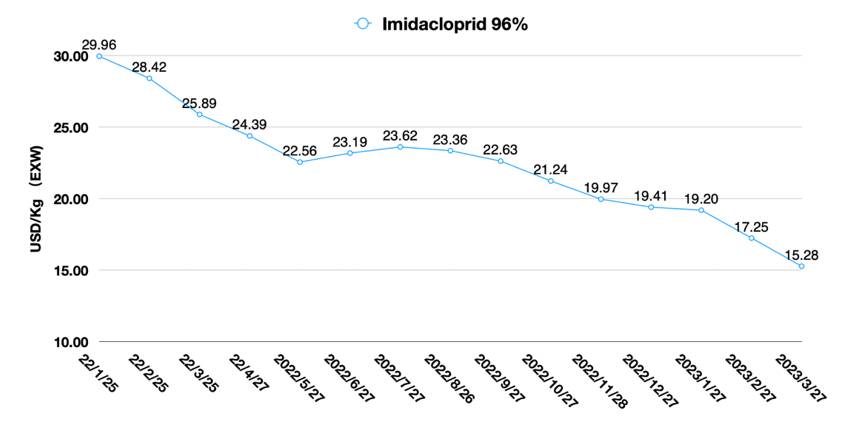

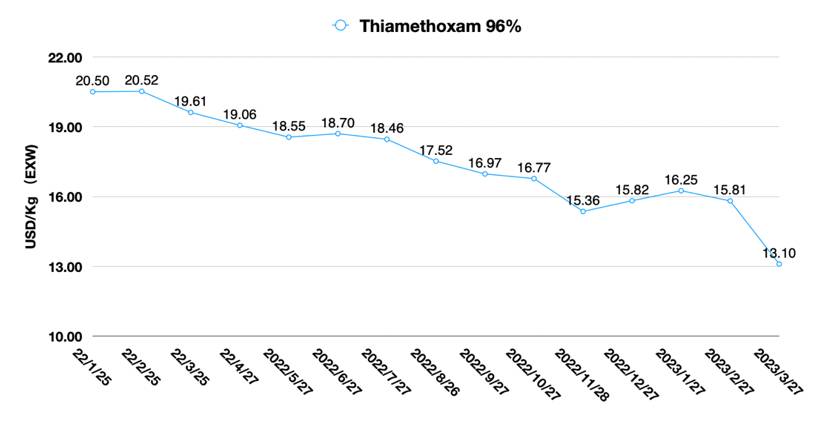

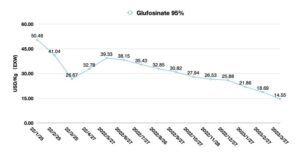

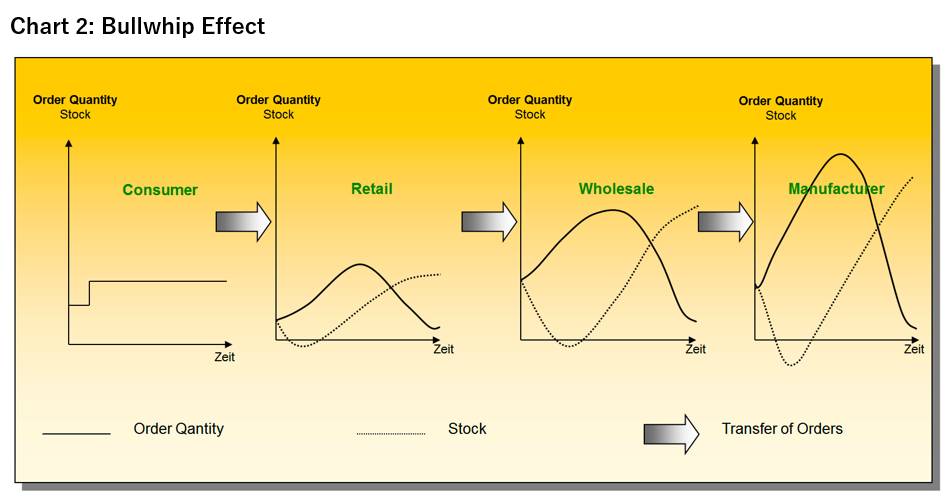

On the other hand, during the COVID-19 pandemic, the price of generic AIs in China skyrocketed. End-consumers (farmers) were in a difficult situation, which led to additional demand for the relatively low-priced burndown herbicide like glyphosate. The “early demand” and “excessive safety stocks” had a “bullwhip effect” on the entire upstream supply chain. Chinese suppliers are lagging behind the channel’s perception. Until Q3 2022, the end-market bullwhip effect is transmitted to the upstream supply chain. Starting in Q4 2022, companies will start to feel the pressure of sluggish demand.

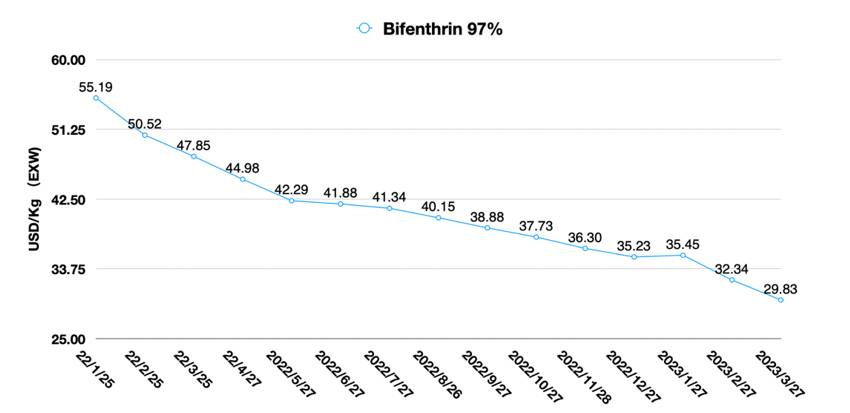

In the sandbox of generic AI, with shrinking productivity boundaries, suppliers have no other choice but to engage in a lose-lose price war. This depends largely on the business-to-business model of generic AIs, where standardized products are easy to scale, but do not capture the additional value premiums that come with differentiation. The nuances of most suppliers’ AIs are insufficient to convey the company’s technical and technological advantages. As fewer and fewer new patent compounds come to market, scale is almost only fundamental to a company’s survival, as scale determines cost, and cost determines profit margin. While scale expansion is a rational choice for a particular agrochemical company, it is an irrational overall outcome for the Chinese agrochemical industry as a whole, with individual manufacturers competing to invest in capacity expansion. What Chinese suppliers are facing is not just a prisoner’s dilemma, but in fact a prisoner’s dilemma in a red ocean competitive environment. This is even worse than the dilemma itself.

If we take away the capacity hype from Chinese suppliers, there are currently more than 20 Chinese generic compounds with far more capacity than the global market needs. In addition, the value of Chinese AI exports has shrunk further as a result of the “China+1” strategy. This has led to a deep competitive phase in the Chinese AI supply market, which would lead to another round of merger and acquisition in the China agrochemical industry in the coming five years.

In the past three years, the global supply chain has experienced a total of three supply chain disruptions:

- the first being the global outbreak of the COVID-19 in early 2020;

- the second being the global supply chain disruption in 2021 and China’s double control in late 2021; and

- the third being the impact of the Zero-Covid policy in early 2022.

Against the backdrop of a high probability of global recession, Chinese investment institutions are almost unanimously bullish on the development of global agribusiness. Food security is the anchor of global economic development as a predictive point of view. Therefore, as pesticides are the only agriculture-related advanced chemical segment, it attracts great attention from investment institutions. Local governments in China are also considering the downstream layout of cutting-edge chemicals in the construction of parks in the chemical industry chain, thus forming integrated chemical clusters in different regions.

China has been well equipped to handle pollution since the environmental protection storm in 2017. Under the high-pressure environmental protection audit, Chinese chemical companies have been able to achieve compliant emissions of key wastes. After the double control of energy consumption in 2021, the Chinese government conducted energy consumption assessment for pesticide companies. If we look at the global agrochemical industry from the perspective of the next 10 to 20 years, the regulations of each country for compliance, green, environmental protection, and carbon peak will bring opportunities for Chinese companies for a long-term strategy.

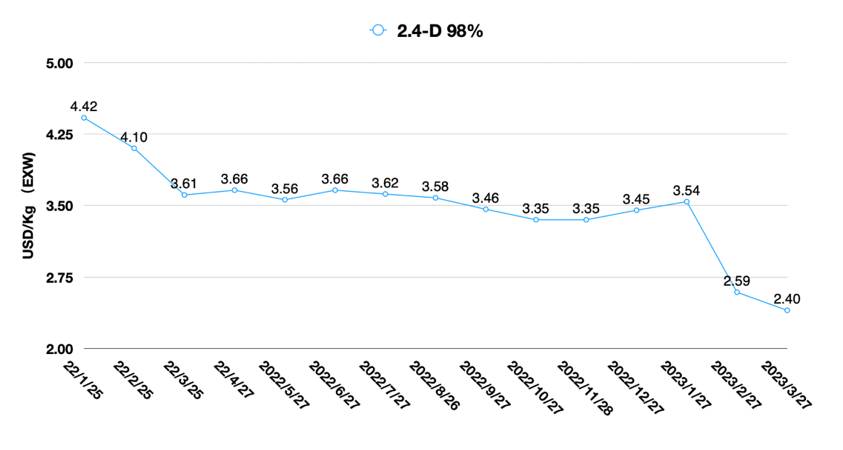

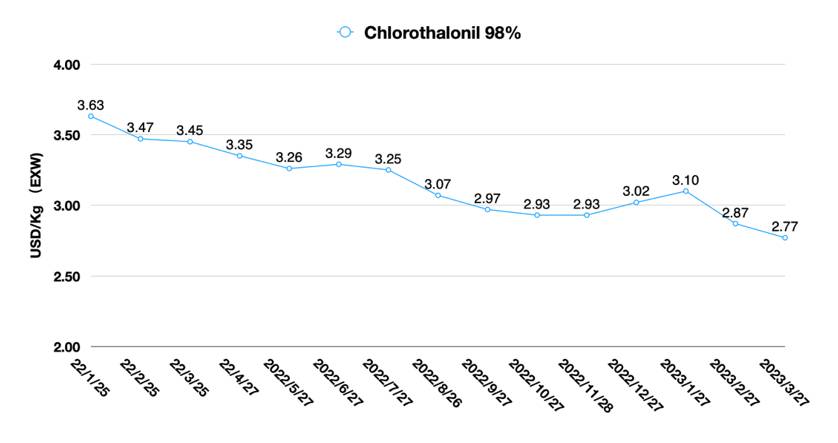

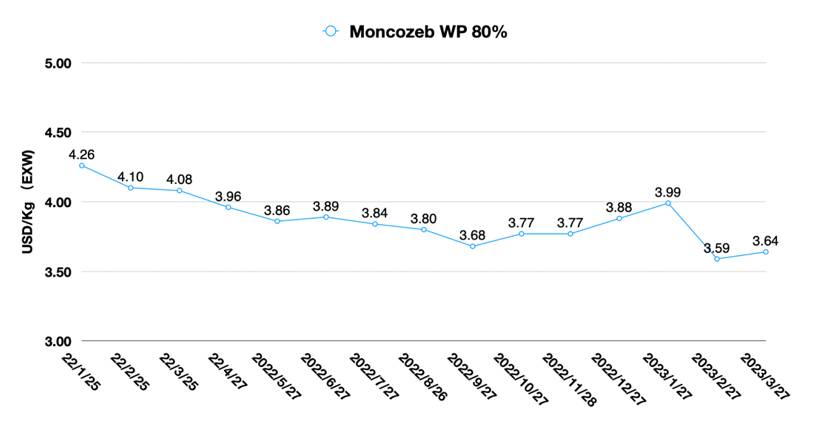

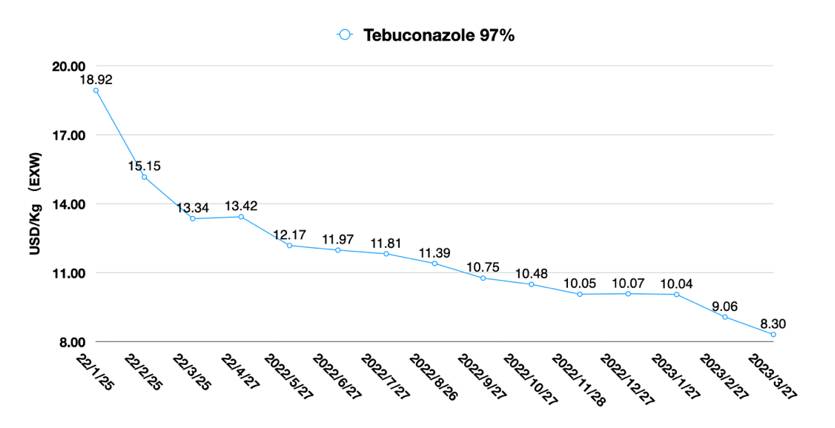

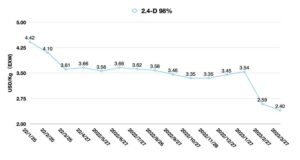

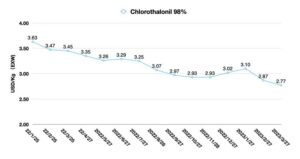

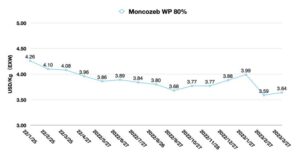

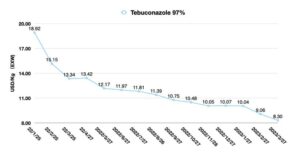

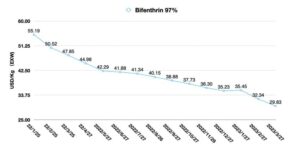

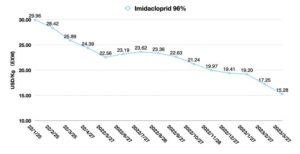

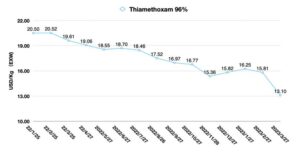

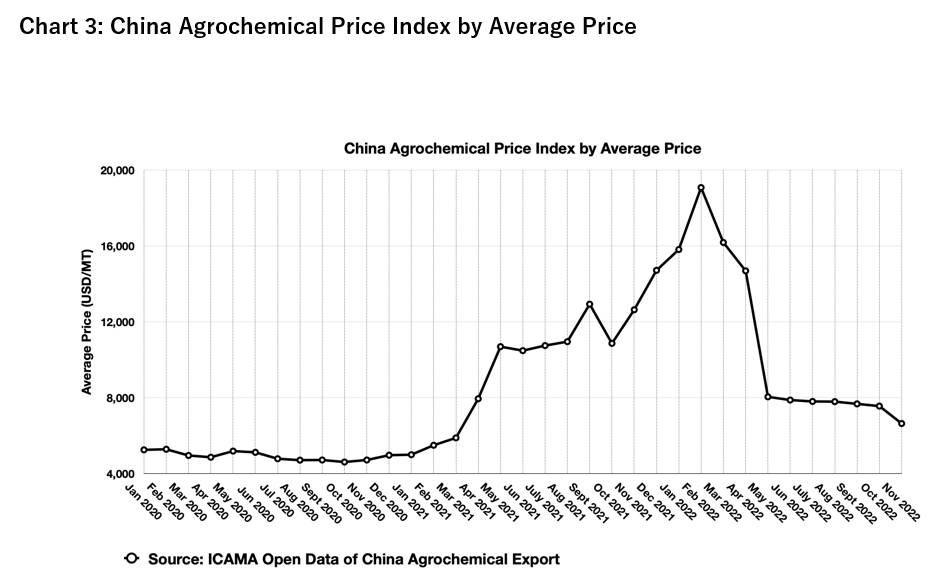

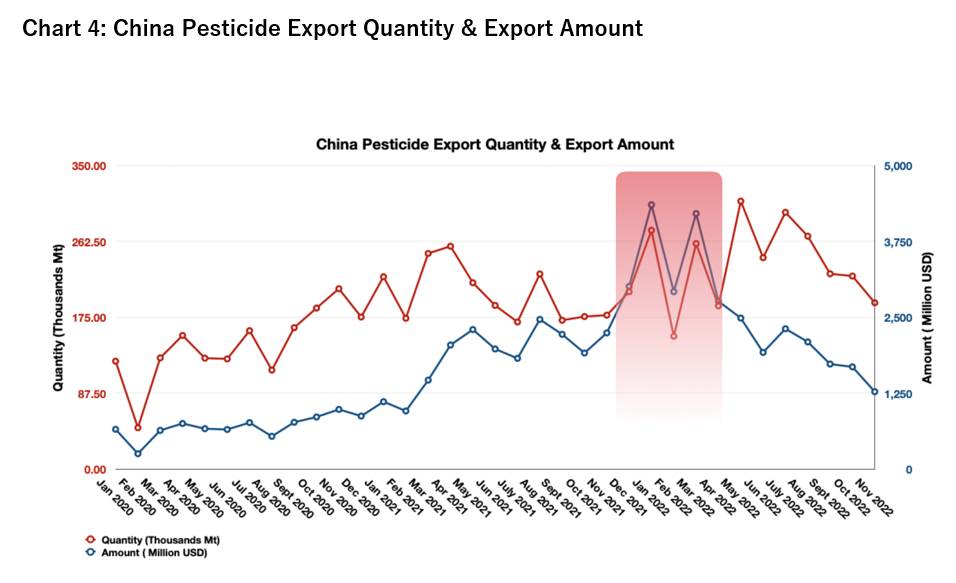

The price trend for pesticides in China initially rises in early 2020 and peaks in 2021 due to the double control policy, and the bullwhip effect in the supply chain in the first half of 2022 forces procurement teams to prepare for another supply shortage for supply chain risk control. However, this next supply shortage did not occur. High inventories in the global agrochemical market make it impossible for all players to be spared. In particular, three consecutive years of high growth for multinational companies’ sales also signals channel pressure. Since November 2022, the new supply-demand relationship shown by prices has gradually emerged. The price index of China’s export pesticides (including pesticide AIs and formulations) in November 2022 was sharply lower by 12% compared to the beginning of October, which was the trigger point for Chinese pesticide prices to step into atrophy.

According to the comparison of the export volume and export value of China pesticides, the prices of purchase orders in the fourth quarter of 2021 and the first quarter of 2022 are almost perfectly stepped at the historical high level. The supply shortage in 2022 advocated in the market at the end of 2021 was not realistic under the weakening demand and high inventory pressure. The beginning of 2022 shall be good timing for agrochemical companies and distributors to adjust, but the procurement strategies were not updated in a timely manner according to the changes in market supply. Many enterprises’ supply chain value transfer faced obstacles while risk management also encountered great challenges.

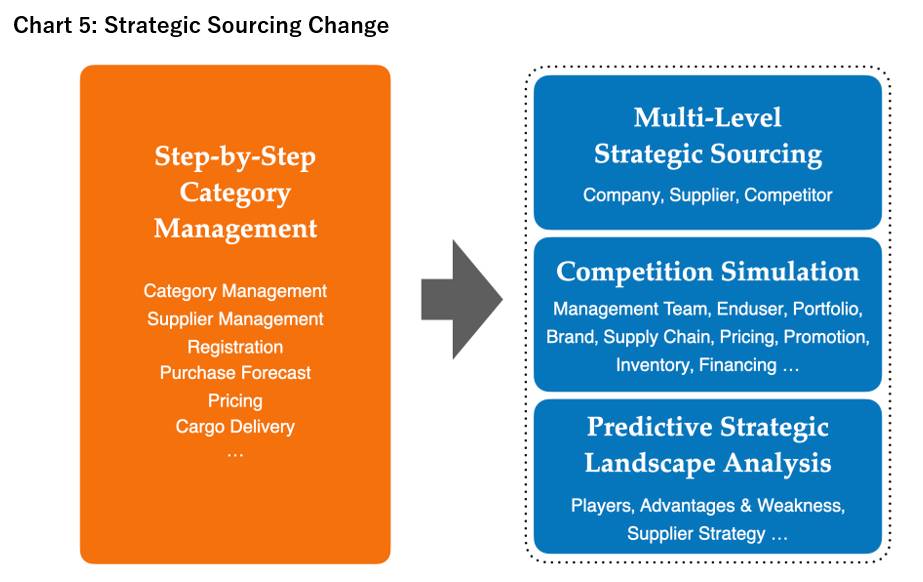

In 2023, competition in the downstream market will be also reconfiguring the customer structure of Chinese pesticide companies due to the deep red ocean competitive environment faced by the upstream supply chain. The customer structure of Chinese companies is changing from one dominated by multinational companies and complemented by national distributors to one dominated by multinational companies and complemented by de-channelized competition. The production transfer of the chemical industry led by multinational companies from 2000 onwards is basically over. The step-by-step category management followed by supply chain management teams in the past decades has also come to an end. And the Chinese supply value chain is rapidly changing toward multi-level strategic sourcing, business simulation and predictive strategic landscape analysis. As the global crop protection market becomes more competitive, the value delivery of the upstream supply chain will directly determine the ability of distributors to develop forward-thinking strategies in their local markets. Suppliers not only need to achieve compliance, environmental protection, energy savings, they also need to support overseas distribution companies in future category expansion, technology investment, capacity layout, registration support, and marketing support on multiple points to compete in the market. If I had to give a definition of this situation, I would say that it is a war.