China Price Index: How Major Chinese Manufacturers Are Responsibly Scaling Production for Glyphosate, Other Agrochemicals

Editor’s note: Contributing writer David Li offers a snapshot of current price trends for key herbicides, fungicides, and insecticides in the Chinese agrochemical market in his monthly China Price Index. He also provides insight on how China’s leading manufacturers still view glyphosate as a profitable product, amid the background of global inflation, crisis in Eastern Europe, and the ongoing epidemic in China.

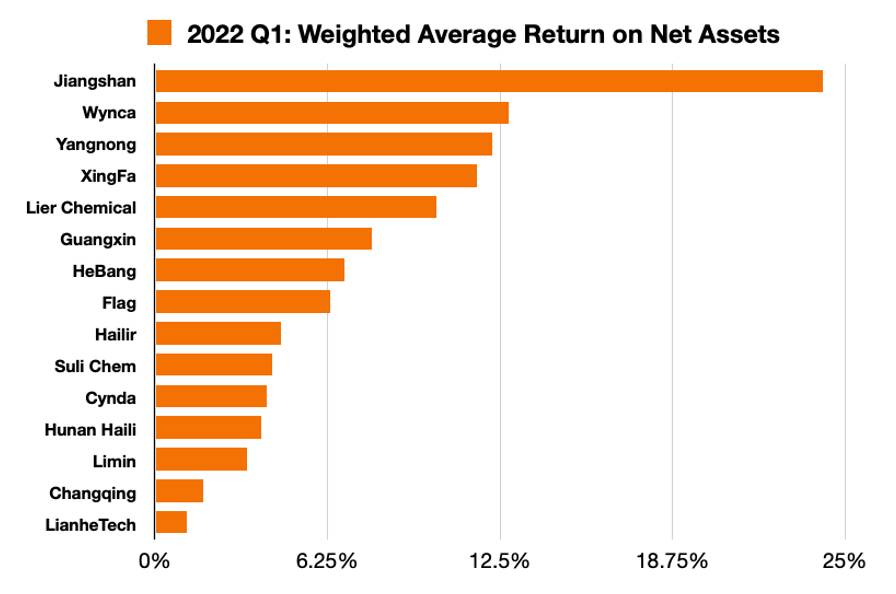

With the disclosure of the 2022 Q1 financial report of all major China stock listed pesticide manufacturers, the operation situation of China’s pesticide industry has been revealed. Under the background of global inflation, crisis in Eastern Europe, and epidemic prevention and control in China, Chinese pesticide enterprises still take glyphosate, the key burndown herbicide, as the main profit contributing product.

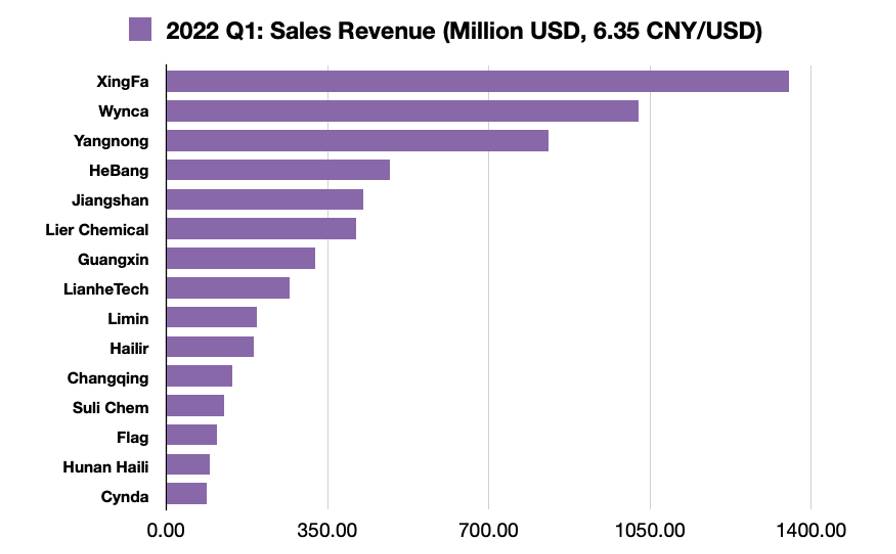

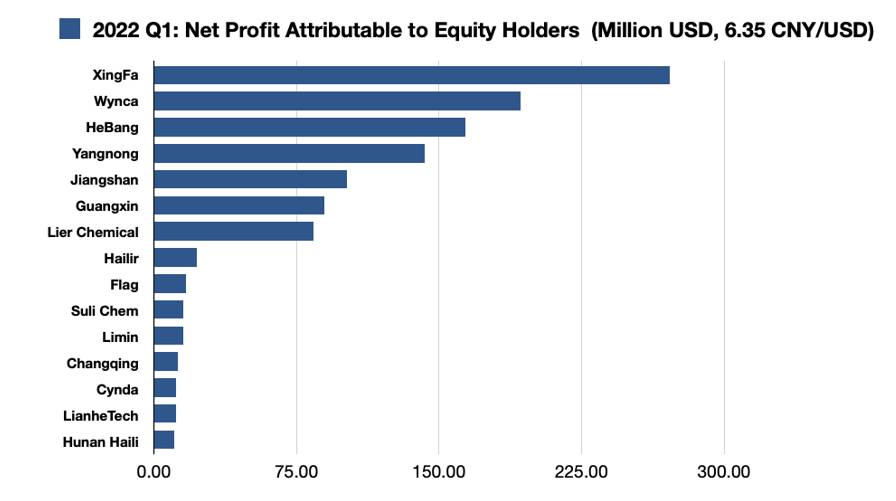

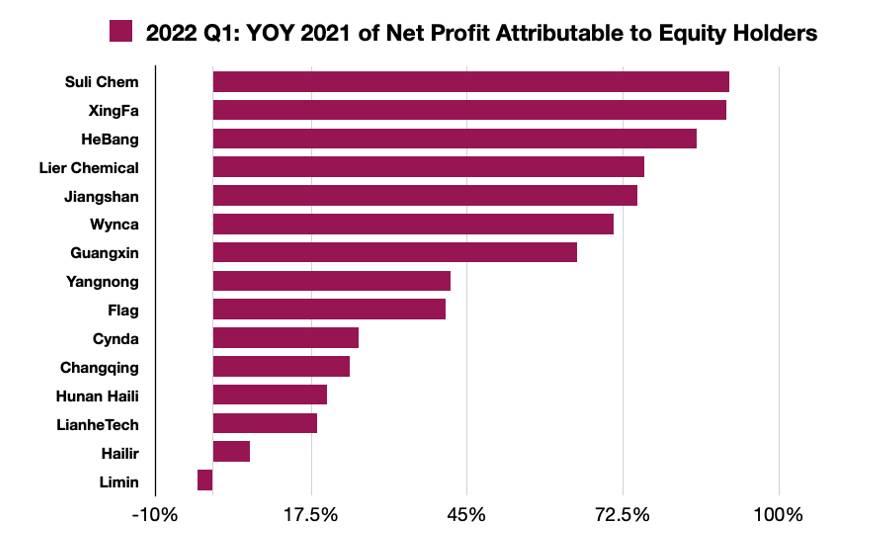

In the first quarter, sales revenue of major glyphosate producers, such as Xingfa Group, Wynca, Hebang Biotechnology, and Nantong Jiangshan, were far ahead of the entire China agrochemical industry. Sales volume and net profits for equity holders were at an outstanding high. It is worth noting that many companies’ Q1 financial results were also the result of the delay of December 2021 backlog orders to the first quarter of 2022. In addition, the epidemic in the Yangtze River Delta region is still a concern, and the uncertainty of raw material supply and shipment logistics is a point for overseas buyers to organize purchase orders in advance.

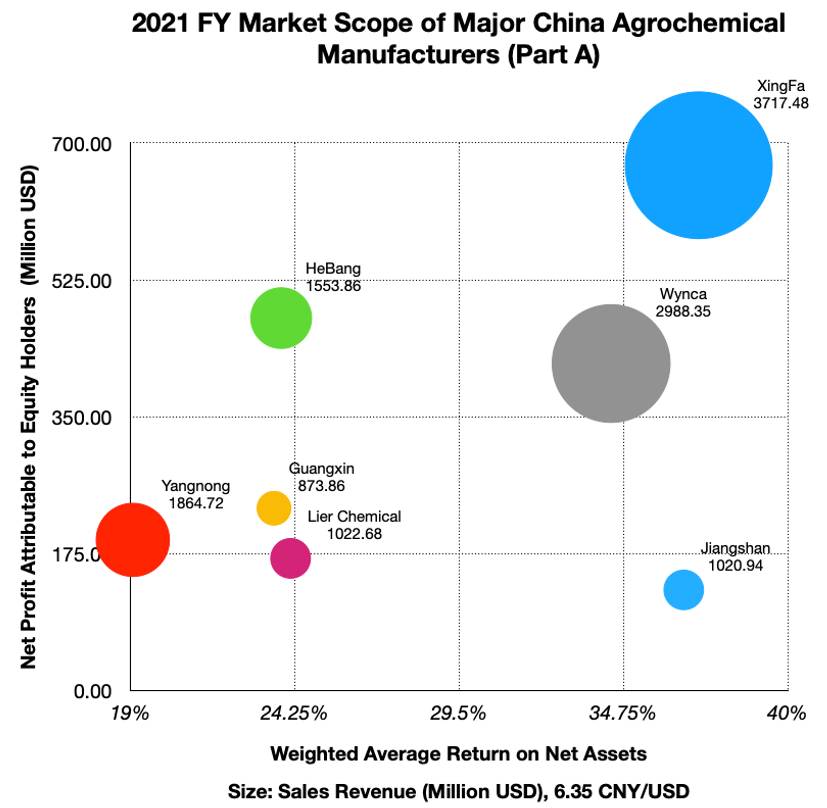

For glyphosate, a resource-intense product, Chinese manufacturers remain the main suppliers to meet the early procurement demand for generic active ingredients (AIs). Reviewing the 2021 annual reports of listed pesticide companies, the advantages of Xingfa and Hebang in phosphate mineral resources enable the profitability of the enterprise to continue to move toward scale effect and high-profit margin because of the 2021 global inflation and high pricing. The strong demand for glyphosate in recent years has led to a gradual increase in assets for Hebang. A similar glyphosate enterprise, Nantong Jiangshan, is stagnant due to limited asset growth. The future development of Hebang and Jiangshan will be influenced by the expansion of business scale and growth of Hebang Bio. Due to its high net profit and large business scale, Wynca is rich in cash. In the future, investment in China’s pesticide industry and other chemical-related industries will be Wynca’s M&A strategy focus, and the whole industry value chain related to halogen may be the focus of its future strategic layout.

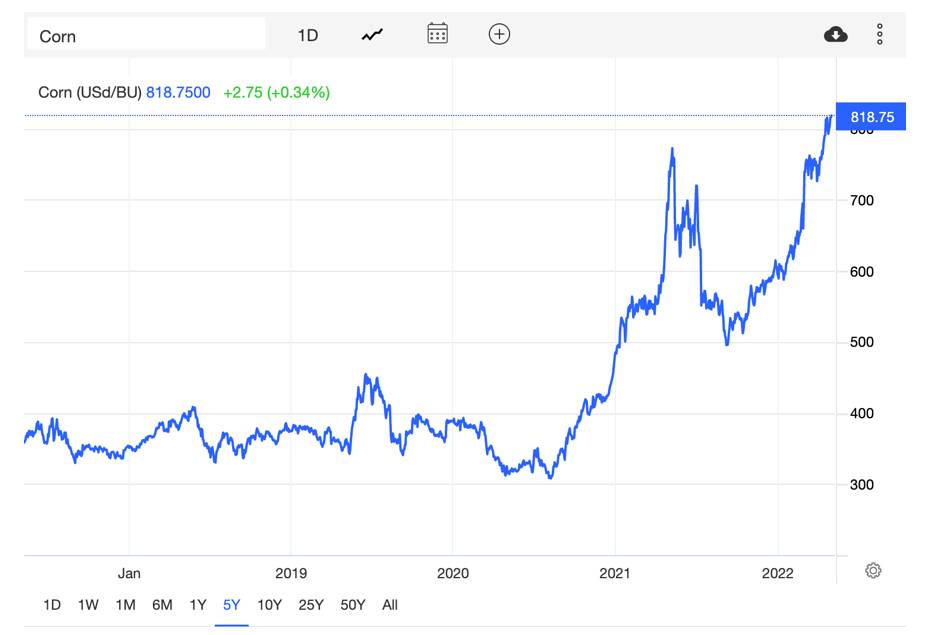

Even though glyphosate as a single product has brought prosperity to the entire industry. The consequences of the herbicide’s high price are also significant and far-reaching. When the price of agricultural inputs increases substantially, the demand from farmers for low-level products increases. When global inflation became a key risk, the consumer’s purchasing habit to buy “lower value” portfolios such as milk, eggs, and wheat flour increases. The early and strong demand for glyphosate from multinational companies and distributors in 2021 is a case in point.

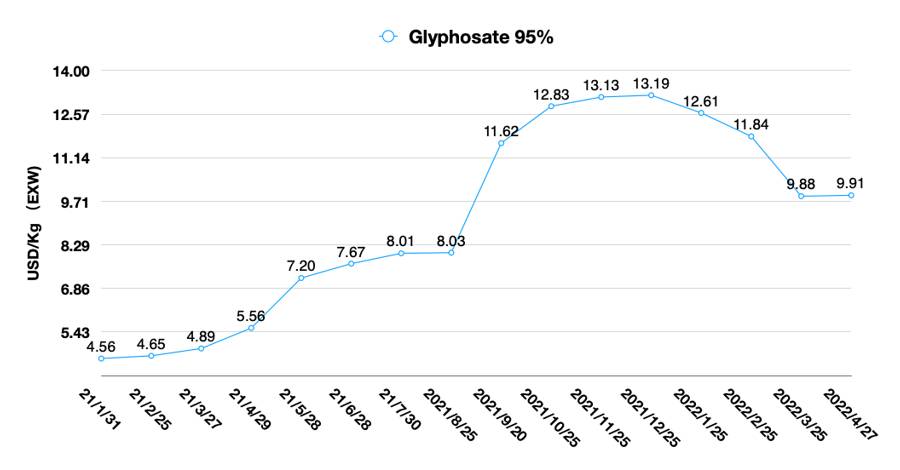

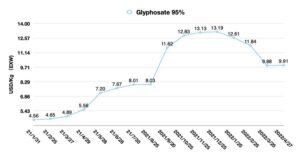

Due to the increase in the price of raw materials, the price of glyphosate gradually climbed beginning in March 2021. The double control policy was the trigger for the price surge. This has undoubtedly increased farmers’ anxiety about future income after the pipeline was stuffed with high-priced glyphosate product lines from the end of 2021 to the beginning of 2022. High food prices are likely to erode farmers’ profits due to higher total “cost of goods sold” (COGS), which discourages farmers from investing, and potentially leads to reduced production, and maybe a crisis in the food supply. Given the potential global food shortage caused by the Russia and Ukraine war, this secondary inflationary crisis will be of particular concern to the global agricultural industry in 2022.

Secondly, the high price of glyphosate, as well as the high stock of glyphosate in the channel, will make it a potential risk again. The last time this happened was 2012 to 2013. Multinational companies are actively urging distributors to hoard safety inventory. The sales execution can support multinational companies’ sales team to achieve sales targets. On the other hand, it can occupy the cash flow on the channel, and organize channel suppliers to obtain products from other competitors. Channel competition will become a battlefield when the global economy faces pressure of stagflation.

As for the China supply side, the high profits of glyphosate also attracted investors in China’s domestic secondary market for investment on large-scale production enterprises of glyphosate. For such resource-intensive products, upstream mineral resources become the key support point for enterprises to achieve scale effect and improve profit margin. With the release of the 14th Five-Year Plan of China pesticide industry, the performance of China’s listed pesticide companies has gradually become polarized under the trend of increasing consolidation, which will go deep into 2022. With the fluctuation of global demand, enterprises with large cash flow are proceeding with M&A of low-growth, China agrochemical companies.

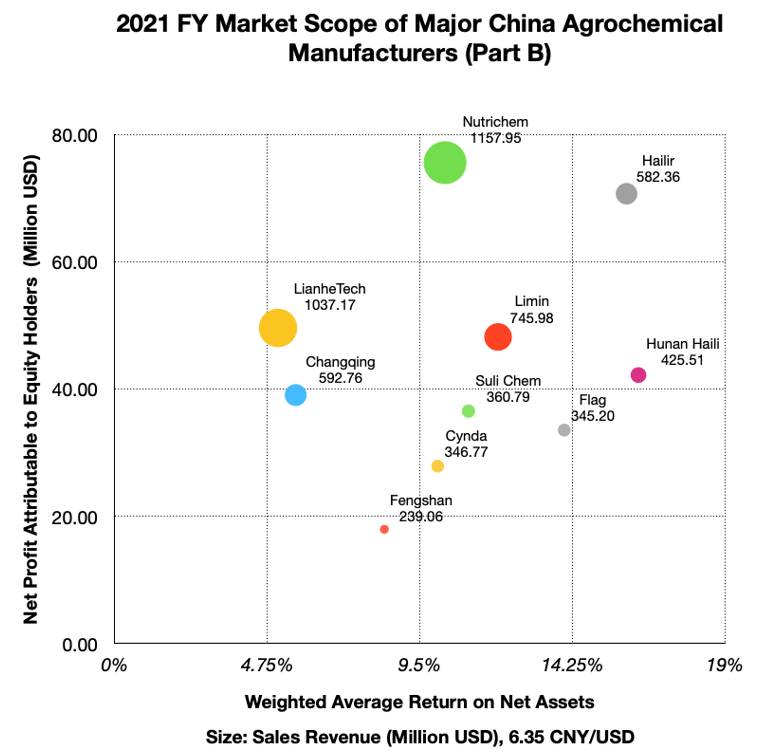

The market scope chart of major China pesticide manufacturers shows the distribution of net profit attributable to equity holders of the company and weighted average return on net assets based on their recently announced 2021 financial results. The size of the bubble represents the company’s sales revenue in 2021. The larger the area, the higher the total sales show up. Companies in the upper right area of the market scope have advantages both on scale effect and high profitability. Glyphosate enterprises are concentrated in this area. The enterprises on the lower right, although relatively outstanding in return of investment (ROI), still need to improve on scale effect and asset accumulation by furthering financial support on investment, regardless of upstream resource control or new production line expansion. The enterprises in the upper left are those with the highest asset establishment and higher profitability, their target is to enlarge the sales revenue to increase the return of investment. The enterprises in the lower left have certain profitability, they might be focusing on niche markets. The lower business volume, but high profit AIs and contact made intermediates, are their future strategy.

Besides the leading glyphosate manufacturers, innovative companies that continue to invest in niche portfolios face several challenges. Lier’s advantage is novel process development. For expanding business scale, they might be seeking the expansion of business scope. L-glufosinate will be a core development area of Lier Chemical in the future. Flumioxazin and chlorantraniliprole will be Lier’s new attributable point of profit. The suspension of Lier’s production in 2021 impacted their net profit performance, otherwise Lier would have been in the high-growth, upper left of the market scope.

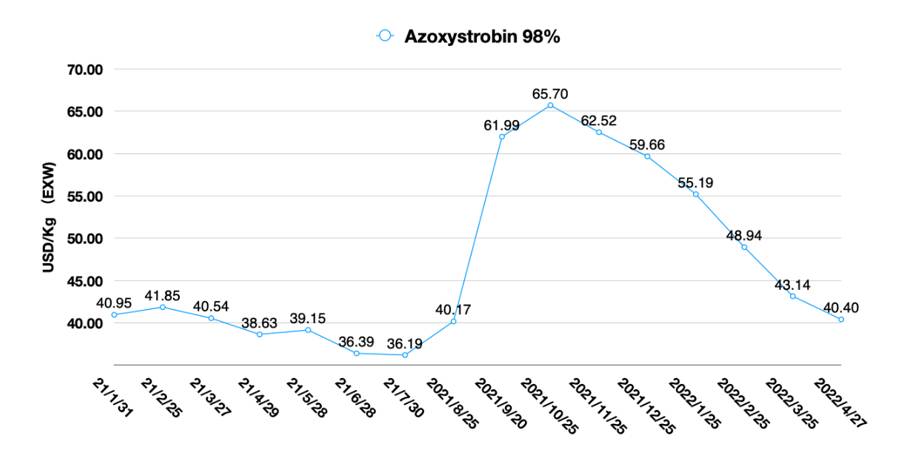

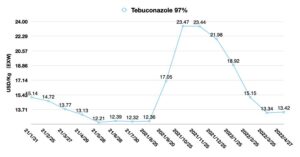

From Part B of the China market scope, it shows the progress of pursuing producers. Sales ranking can tell us something about a company, but it can’t explain the essence of company growth. Although Nutrichem production is based in Jiangsu province, it was forced to stop production due to the accident in Xiangshui area. Its business scale is still considerable, and cooperation with key accounts is stable. After introducing Wynca as a strategic investor, the future cooperation between the two parties will become exciting as a case of complementary advantages in the China pesticide industry. Nutrichem will build new production capacities with an annual output of 4,000 Mt of mesotrione, and annual output of 1,000 Mt of oxifluorfen, both of which are expected to reach operation in 2022-2023. At the same time, the newly built projects with annual output of 4,000 Mt of azoxystrobin and 3,000 Mt of tebuconazole are expected to start production in 2023-2024. In the next three years, Nutrichem needs continuing financial support to overcome the loss of its production base in Yancheng South, and building new capacity will be key to its business growth.

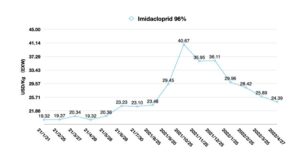

On the basis of the improvement in the yield, quality and cost of dichloride intermediates, imidacloprid, acetamiprid, and other generic AIs, Hailir has entered into trial production of the second generation of nicotinoid insecticides like thiamethoxam and clothianidin in June 2020. And prothioconazole has entered into trial production in September 2020. Hailir has penetrated overseas market by professionals in the global B2B agrochemical business layout. In the field of marketing, Hailir has gradually developed from a traditional agrochemical manufacturing enterprise to a global agrochemical business. Prothioconazole will be seen as the basis of Hailir’s entrepreneurial spirit in future.

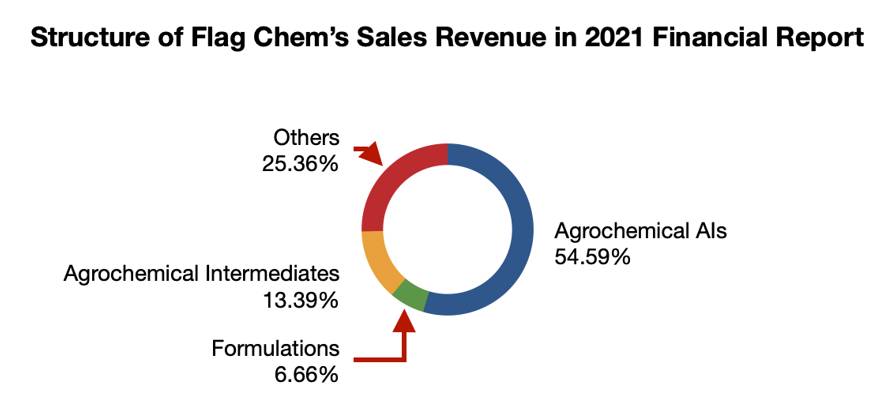

Flag Chem is a key supplier that cannot be ignored for enterprises, which are both in assets growth and the improvement of profit margin. In 2021, the net profit attributable to equity holders of Flag Chem increased by 8.88% compared with that of 2020, while its weighted average return on net assets decreased by 0.38% compared with the same period of 2020.

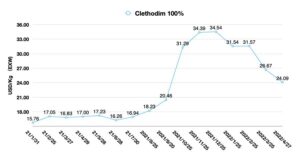

In July 2020, Flag Chem set up a holding subsidiary Anhui Ningyitai Technology, located in Anhui (Huaibei) Novel Coal Chemical Synthetic Material Base. Flag Chem built a new chemical production facility with an annual output of 15,500 Mt of novel AIs and supporting intermediates. New infrastructure investment should be the main reason for Flag Chem’s low return on assets. Flag Chem’s portfolio structure included sales of AIs, which was approximately 1.197 billion CNY, pesticide formulation of 146 million CNY, and pesticide intermediates of 294 million CNY (see figures below). The business growth of pesticide intermediates had increased by 63.89% year-on-year in 2020, according to their 2021 financial report. The cooperation with core customers like major multinational companies in the field of intermediates should be the sales strategy of Flag Chem in coming years. In the market segment, Flag Chem’s fluroxypyr, clothianidin, lufenuron, and other niche products are in a leading position of China supply market. In the future, gradual expansion of new niche portfolios is the core competitive advantage for such technological innovation-oriented enterprises to maintain long-term growth.

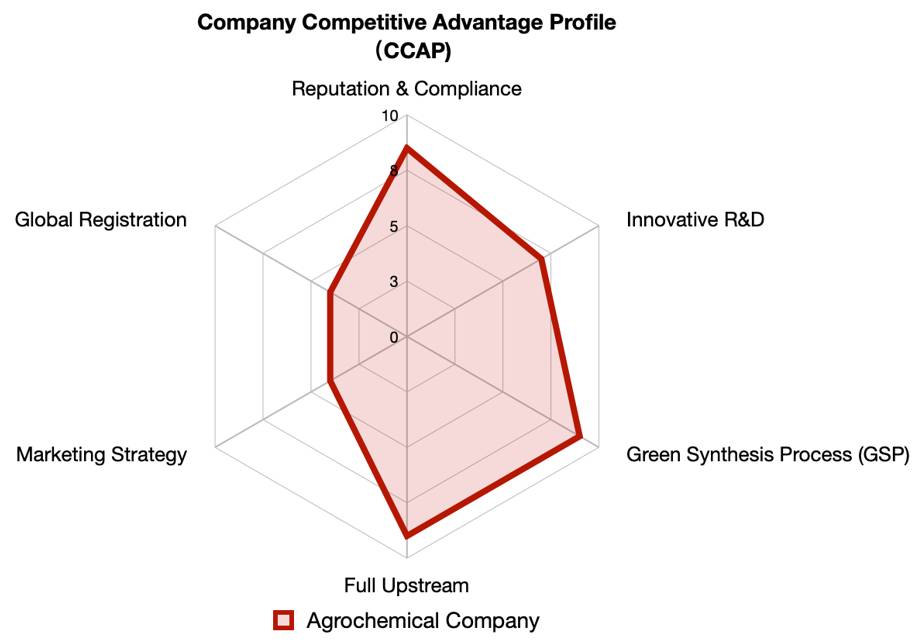

Due to the complexity of history and cooperation with multinational companies and distributors, it is too difficult to capture China agrochemical companies’ future business goals and strategies, which is undoubtedly exposed in the environmental protection storm and the Xiangshui incident. For the analysis of Chinese companies, the method of Company Competitive Advantage Profile (CCAP) had to be introduced to the procurement team, which was created by the SPM to fill the key weakness of SWOT. SWOT is not sufficient to make a decision for top management teams. We combine CCAP analysis of suppliers with CCAP analysis of buyers together to create complementary and synergistic effects that can help deliver value in the supply chain.

Usually, we take the professional ethics and past business behaviors of a suppliers’ management team or person in charge as the quantitative criteria of Reputation & Compliance. For R&D evaluation, the proportion of the company’s annual R&D investment in the company’s sales revenue is an important index, while the third-party alliance initiated by suppliers is a bonus item for their competitiveness in this field. GSP is mainly based on the quality control of enterprises in the field of segmented products, like the controlling of main impurities. Full Upstream is evaluated based on suppliers’ investment in upstream companies. The marketing strategy is a relatively cautious evaluation, which requires an in-depth analysis of suppliers’ way for engaging overseas channel. Relying too much on channels will result in a lack of market control ability compared with having independent teams to operate the pipeline.

Global registration includes three parts: the number of global registrations, the layout of global registrations, and the support for cross-companies. Since 2012, Chinese pesticide manufacturers have aggressively carried out their own overseas registration. While supporting trading enterprises, they also actively contact retailers, which is a kind of proactive marketing strategy for the penetrating into downstream market. Cooperation with multinational companies, to some extent, can prove that the product quality and supply capacity of the supplier meet the multinational companies’ standard. However, for the global layout, we sometimes regard it as a certain unfavorable factor for its independent development, because the strategic autonomy of the enterprise will be limited.

Market Status of Glyphosate and Glufosinate

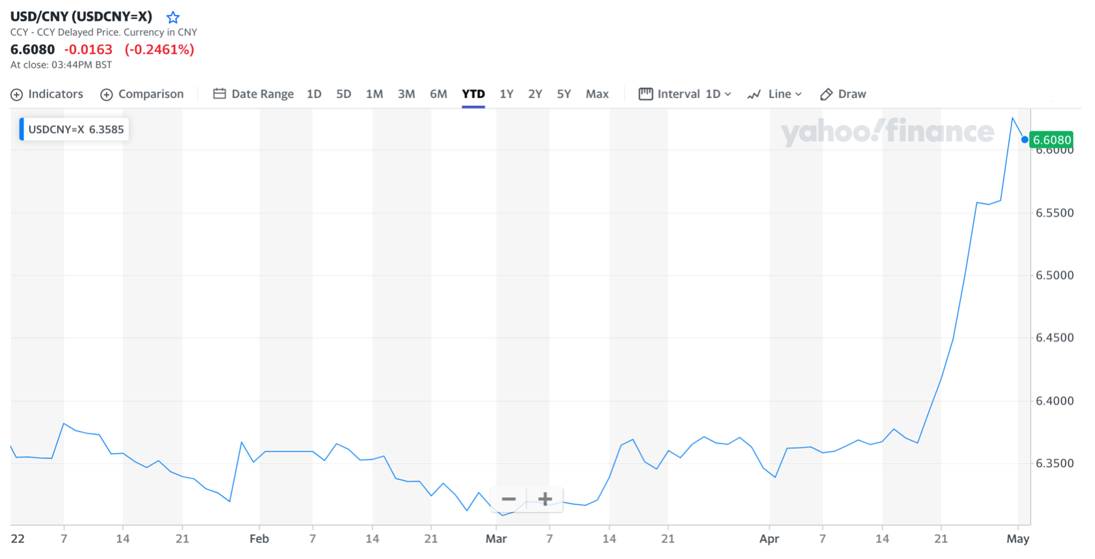

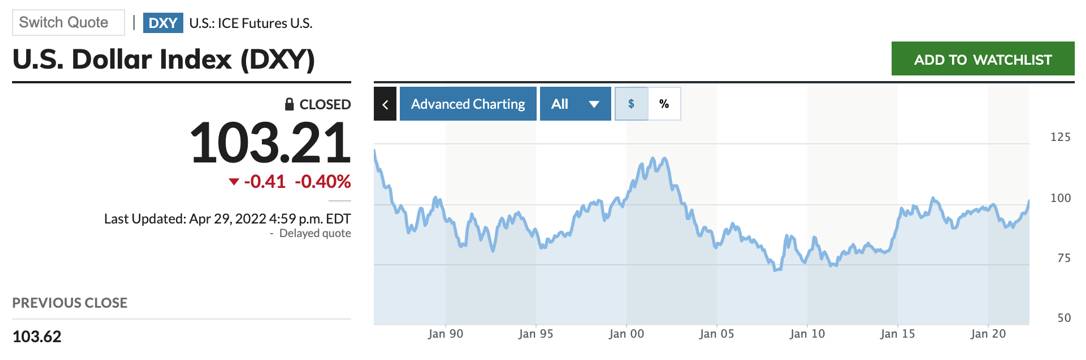

In April, the Japanese Yen tumbled more than 7% against the US dollar. A new round of currency gaming may have begun. The CNY has depreciated by 3.8 % against the US dollar in the past month, entering a period of rapid adjustment, according to China Securities Times. Russia’s war with Ukraine has battered Europe’s economy, weakening the euro and pushing up the dollar. The recent move above 100 on the USD Index reflects a trend of global money flowing back to the US from Europe and emerging markets. Against the backdrop of accelerated tightening of US dollar liquidity in 2022, the possibility of a sustained rise in the future of the USD Index is high. The total value of China’s goods exports in 2021 increased by 26.1% from 2019 due to disruptions in global production following the COVID-19 outbreak in 2020, according to data released by the Customs of China. However, due to the recovery of overseas production in 2022 and the pandemic of Omicron in China, China’s export may fall slightly this year.

Expectations for the global economy are also reflected in glyphosate and glufosinate prices. The overall glyphosate supply market is stable. Despite the crisis in Eastern Europe, the supply of glyphosate raw materials remains at normal prices, and key producers are operating smoothly. Due to the impact of the Omicron pandemic in Shanghai, concerns about the transportation of raw materials and finished products are increasing for global buyers. It is expected that the transportation to Shanghai port in May will generally remain stable. And the land transportation cost from domestic cities to Shanghai port will increase due to the shortage of truck drivers.

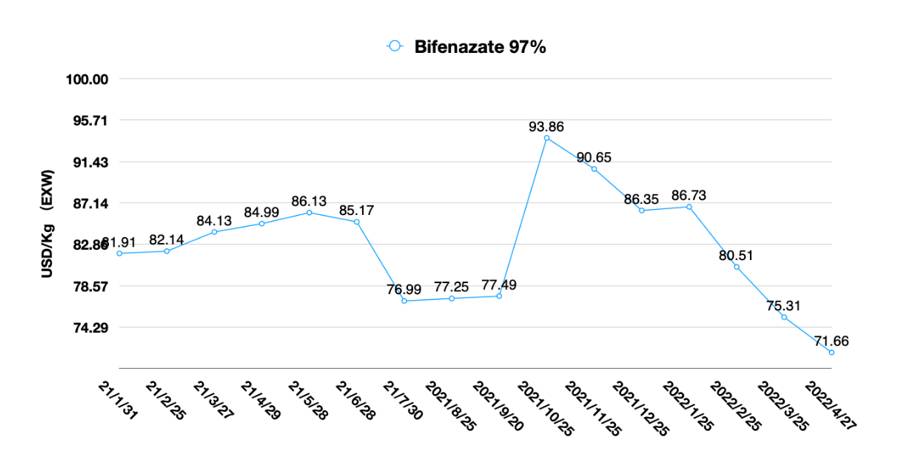

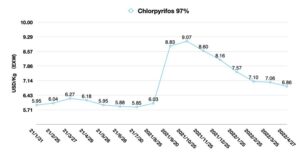

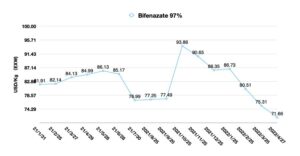

For the overseas market, logistics is still in the stage of high cost, but overseas will gradually relax the control of the epidemic. It will take some time to recover to the pre-pandemic level. Overseas demand should be cautiously optimistic in 2022 as supply gaps persist from 2020 to 2021, and total cost of product sold remain high. Due to short-term CNY exchange rate fluctuations, exchange rate change offset part of the trend of glyphosate price strengthening, resulting in stable price changes in USD of glyphosate AI. At the end of April, the EXW price of 95% glyphosate AI in China remained between 9 USD/Kg and 10 USD/Kg. When the downstream customers get more reliable future demand, the overseas demand for Chinese glyphosate, which generally occurs in Q4, may be coming earlier than China’s expectation. The purchasing team should establish long-term purchasing plan with suppliers in time. As the CNY is likely to maintain a conservative depreciation strategy after Q2 2022 in the long term, the Chinese government’s export stimulus could keep glyphosate prices relatively stable this year. High global inflation may make it hard for glyphosate prices to fall off a cliff in 2022.

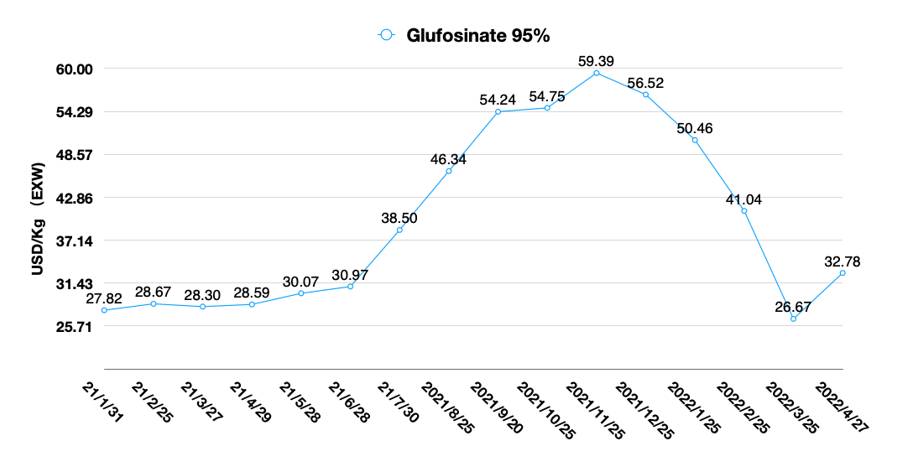

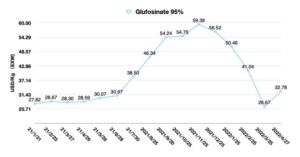

The end of March showed the lowest price of glufosinate AI in China in recent months. The rising price of glufosinate AI is mainly due to the increase of overseas demand, which is gradually showing up in 2022. However, the temporary suspension of key domestic production enterprises has led to the gap existing. The relationship between supply and demand is gradually shifting to supply dominance. Some new glufosinate capacity will be coming out mainly in Q3 2022, so it is difficult to rebuild the supply and demand balance in the near term. At the end of April, the EXW price of 95% glufosinate rose to more than 32 USD/Kg. Due to the longer contracts line, the price of glufosinate AI still has room to rise. Energy supply uncertainty in Europe and emerging supply countries is also likely to drive up the price of glufosinate in China. In 2022, the layout of multinational companies in the promotion of glufosinate resistant crops will further promote the overseas demand. Key glufosinate manufacturers with upstream raw material control capability will be the preferred partner of purchasers.