China Price Index: Glufosinate’s Shift from Overcapacity to Product Innovation

Editor’s note: Contributing writer David Li offers a snapshot of current price trends for key herbicides, fungicides, and insecticides in the Chinese agrochemical market in his monthly China Price Index. Below he also provides key insight into the current state of the glufosinate market and the challenges manufacturers face in an oversaturated market.

“Potential is to make power because of profitability.”

Strategies must start with assumptions and be based on facts. Executives weigh the pros and cons and carry out actions based on competitors and market trends to create beneficiary potential. Chinese enterprises often develop different strategic positioning, and MNCs (Multinational companies) may be both partners and potential competitors for some Chinese suppliers. Weighing the pros and cons is crucial for enterprises to invest in product capacity in the early stage. The so-called upstream industry chain is not a one-step process but is built gradually according to customer demand and clients’ sourcing strategies.

The launch of innovative products from multinational companies will definitely affect the market landscape. In time, the ripples of change in market patterns lead to shifts in the center of gravity of the upstream industry, followed by rebalancing.

According to Agribusiness Global on 25 August 2023, BASF Agricultural Solutions delivered the first trait-enabled, resolved isomeric postemergence herbicide with its introduction of Liberty ULTRA herbicide powered by Glu-LTM Technology, to the U.S. marketplace. Liberty ULTRA herbicide will effectively control grasses and tough broadleaf weeds like waterhemp, palmer amaranth, giant ragweed, and kochia in glufosinate-tolerant soybeans, cotton, canola, and corn. Registration is anticipated in late 2023, enabling a targeted launch in 2024 and a full launch in 2025.

The launch of BASF’s innovative L-Glu can not only extends the market boundary of burndown herbicides, but also provide a new profit growth point. In addition, the herbicide can drive the market expansion of “inferior” glufosinate products. BASF’s delivery of L-Glu products can be a potential growth engine for the entire glufosinate market. Considering the fact that both prices and demand for glufosinate are weak, only innovation can lead the company from the red sea to the blue ocean.

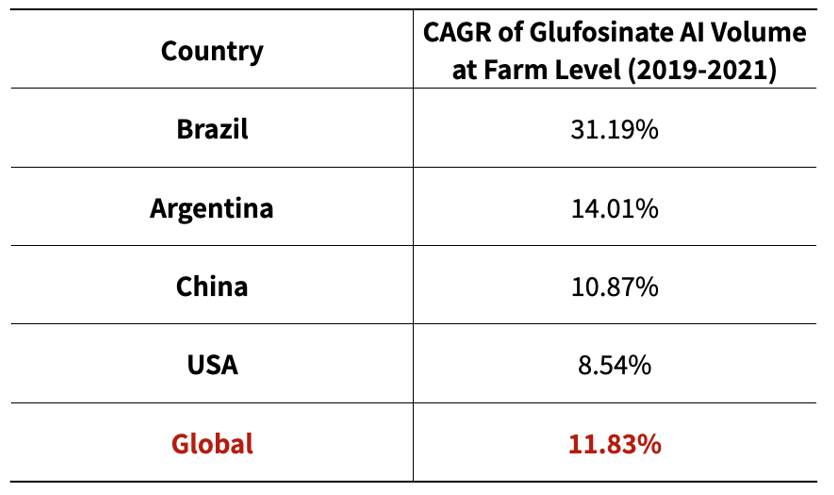

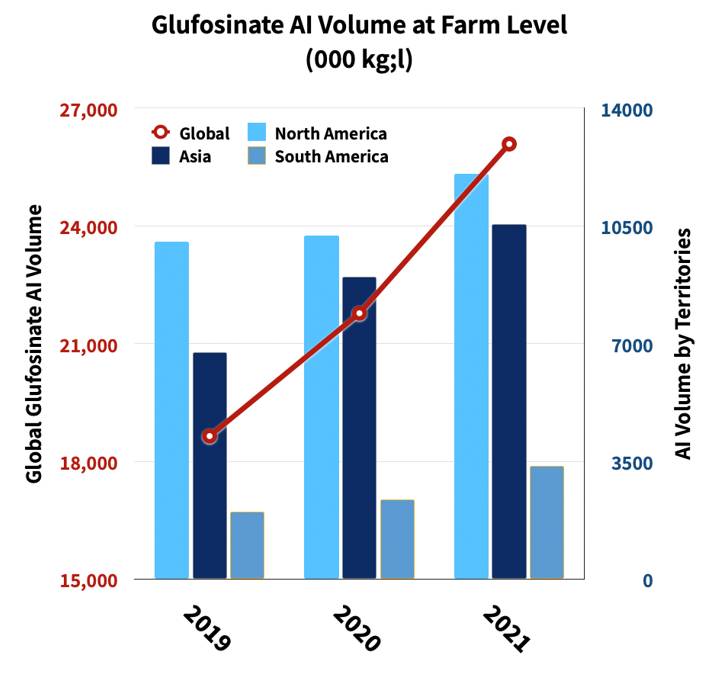

According to Kynetec, the global glufosinate AI volume at the farm level experienced a compound annual growth rate (CAGR) of 11.83% from 2019 to 2021. The fastest growing market was Brazil with a CAGR of 31.19%. In the APAC market, China experienced a CAGR of 10.87%. The main contribution to the growth of glufosinate AI volume in North America came from the United States. Along with the rapid growth of the market size, the glufosinate AI volume at farm level reached around 26,087 metric tons (Mt) in 2021. According to the estimation of SPM INSIGHTS, glufosinate AI volume at farm level will reach about 36,000 Mt in 2023.

Source: Kynetec

Source: Kynetec

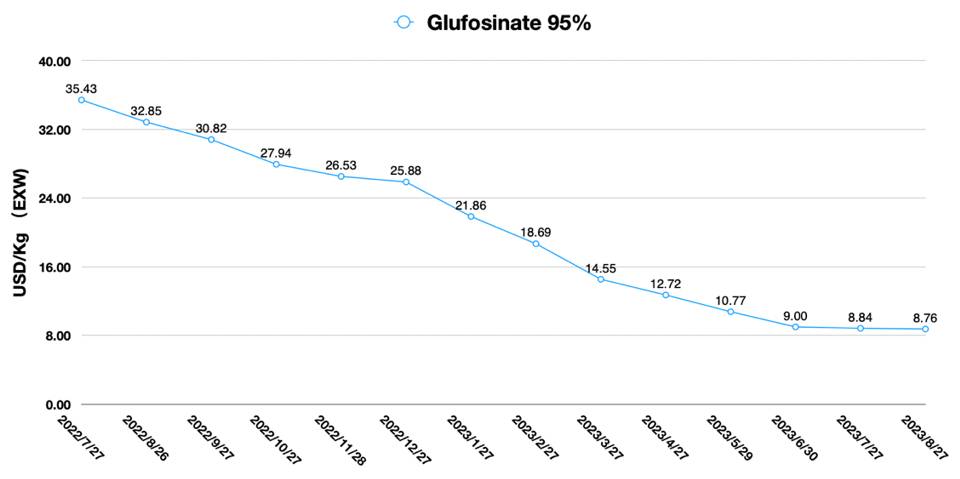

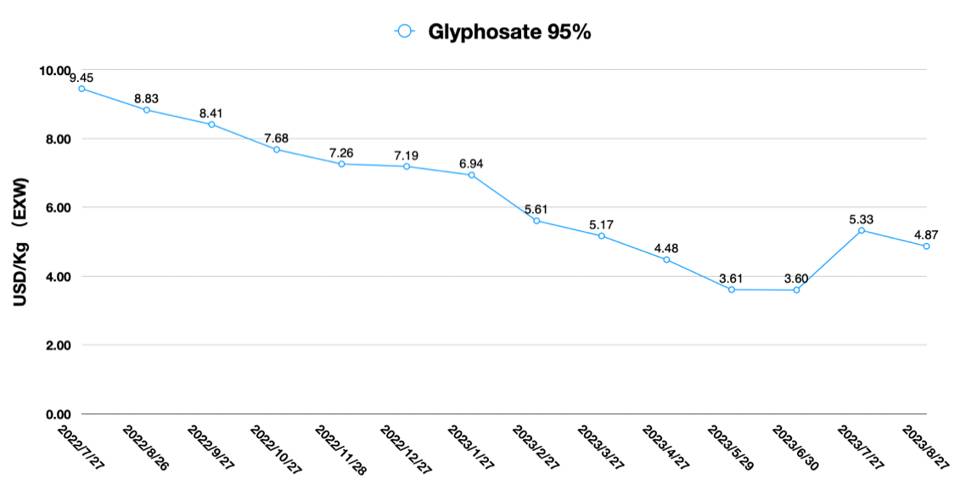

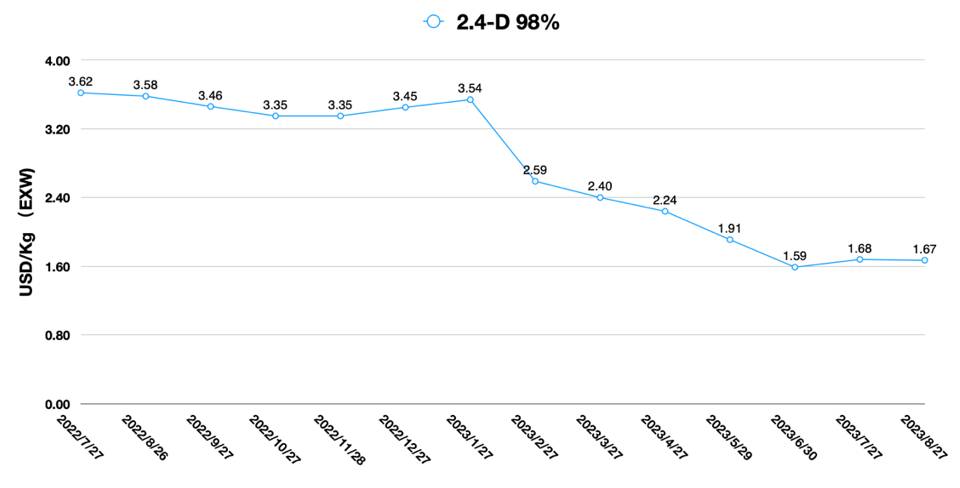

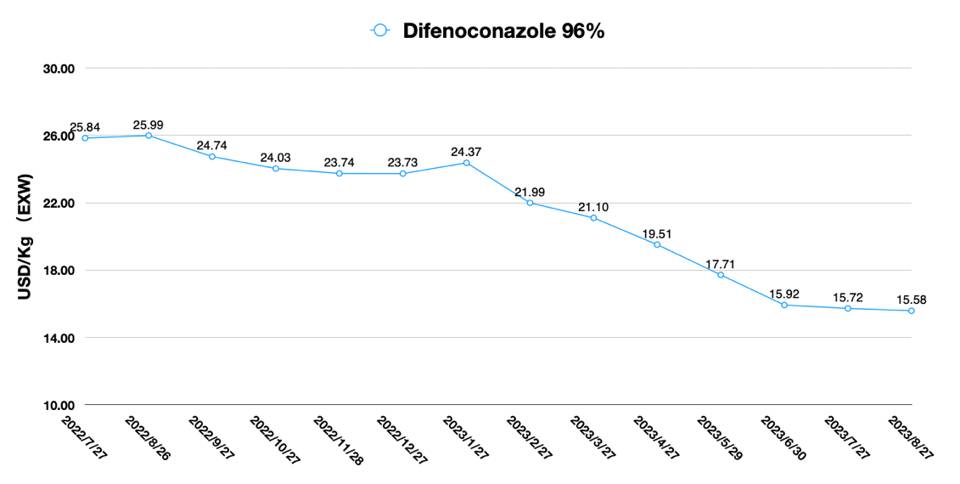

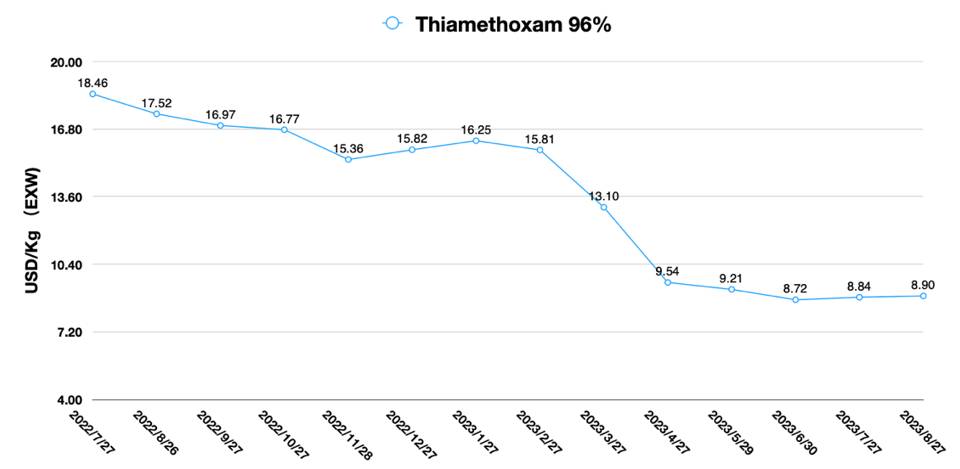

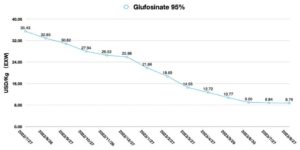

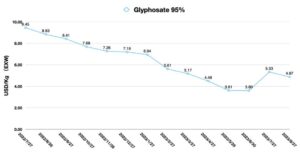

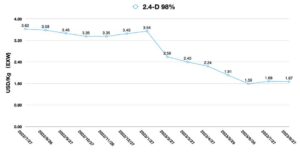

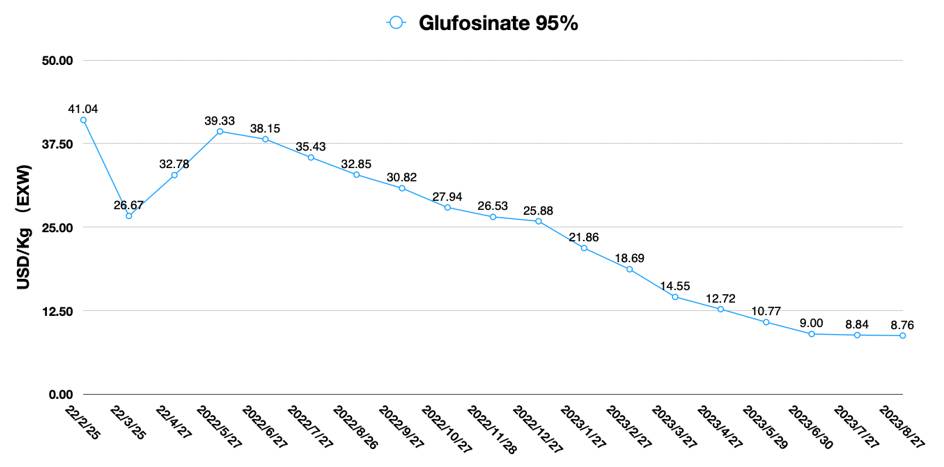

Global demand for glufosinate continues to grow. China, the country with the largest glufosinate AI production capacity in the world, is also continuing to increase its investment in glufosinate AI capacity. Sufficient supply and the maturing of the demand market for glufosinate have led to the emergence of super-sized glufosinate AI producers. The situation does not end there, as the pricing strategy of the supply markets with mega-capacity has led to a significant drop in the price of the product. The trough prices are no longer sufficient to allow producers without the advantages of scale to remain reasonably profitable. Super-sized glufosinate AI producers have been able to dominate the market by driving down prices and nipping potential new-entrance production capacity in the bud.

Through BASF, UPL, Lier Chemical, Seven Continents, and Hebei Chengxin, the global supply of glufosinate AI is now solidifying. Super-capacity and undifferentiated price wars have dragged glufosinate directly into the long-tail stage of the product life cycle in just one year from the beginning of 2022 to the middle of 2023. Unless an unforeseen accident occurs, the glufosinate supply will continue to exceed demand.

Source: SPM INSIGHTS

It is human nature to seek the best use of resources and to maximize efficiency at all times.

The price of glufosinate AI continues to run low, and profit margins continue to be squeezed by emerging production capacity. This may lead to two consequences. First, both previously medium-sized glufosinate AI producers, as well as multinational companies, may consider outsourcing glufosinate AI from Chinese super-capacity suppliers. When their own production does not have the cost advantage of scale effects, outsourcing may be the optimal solution in the short term. Second, glufosinate players that do not have a cost advantage must extend further downstream. They need to reach customers more deeply and shorten the length of the value chain between producers and farmers. At the same time, placing themselves in the production of L-glufosinate, which has a much lower dosage in the field, is their primary strategy.

Overall, the price of glufosinate AI is depressed, which provides suitable conditions for the supply of L-glufosinate. Red Sun and Luba Chem chose to invest directly in the technology development and production of L-glufosinate. Since 2009, Yongnong Bio cooperated with Meiji to take the lead in the R&D of industrial production of L-glufosinate. After 10 years of technical development, it was successfully developed and put into industrialized production in 2020. In early May 2023, Veyong, a subsidiary of Limin Group, obtained the authorization of the investment project of 10,000 Mt L-glufosinate. The project construction was started to fully launch.

At present, Limin Group’s L-glufosinate equipment installation has reached 50% and is expected to have 2,000 Mt capacity by the end of 2023. Limin Group has the capacity to produce glufosinate AI as a “raw material” of L-glufosinate and produces key intermediates in-house. The company’s process enhancement enables Limin Group to reduce the cost of L-glufosinate production through a continuous reaction. This also supports the continuous cost reduction of L-glufosinate as raw material after the scale effect of glufosinate is shown up.

In conclusion, the super capacity of glufosinate AI has been gradually transformed into the key “raw material” of L-glufosinate. The producers of glufosinate AI, with a full industrial chain combined with the production of L-glufosinate with a biocatalytic green process, will be in a favorable position. There is a new trend in front of the burndown herbicide market. Assuming that BASF’s Liberty ULTRA herbicide occupies a high-margin and high-growth position in the market, and at the same time the listing of generic companies’ L-glufosinate is in progress, then the timing of the overseas layout of the L-glufosinate from Chinese enterprises will be the core competitiveness to determine the profitability in the future. As China’s overcapacity will continue for some time, the ability to respond “quickly” to market changes could determine the life and death of enterprises.